Orchid, Botanic Gardens,, Singapore

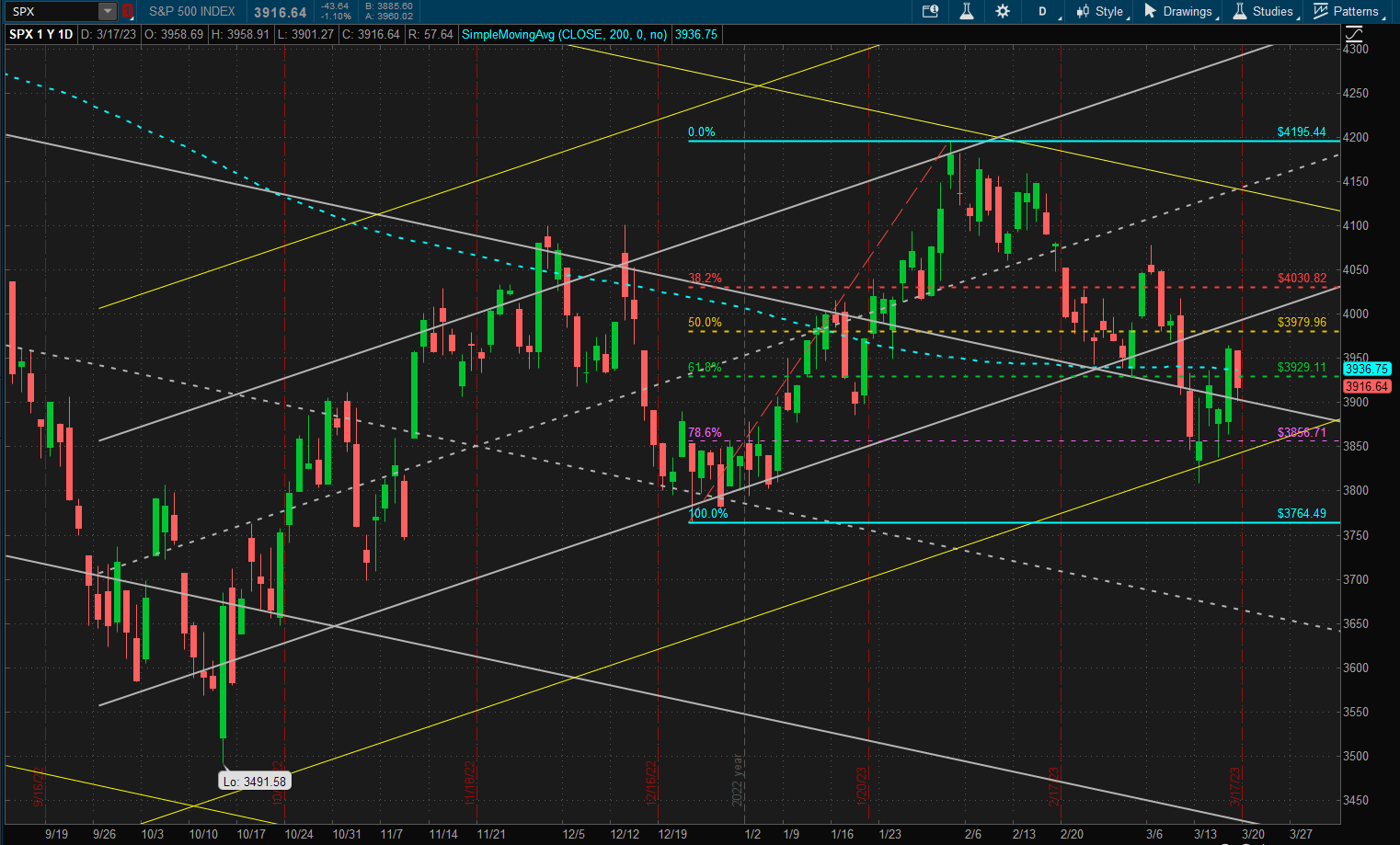

It was a difficult week in the US equity markets with the SPX gaining ~1% in a volatile week of market action:

We are at the bottom of a 2 SD short-term uptrend channel and close to the top of a 2 SD longer term downtrend channel. There is support/resistance in this general area and no clear indication of where we might go from here.

We are at the bottom of a 2 SD short-term uptrend channel and close to the top of a 2 SD longer term downtrend channel. There is support/resistance in this general area and no clear indication of where we might go from here.

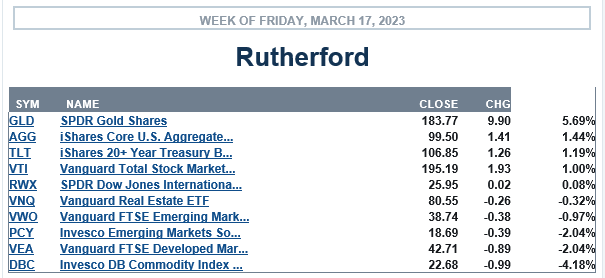

In terms of relative performance US equities performed reasonably well, although losing out to Gold and US Treasuries.

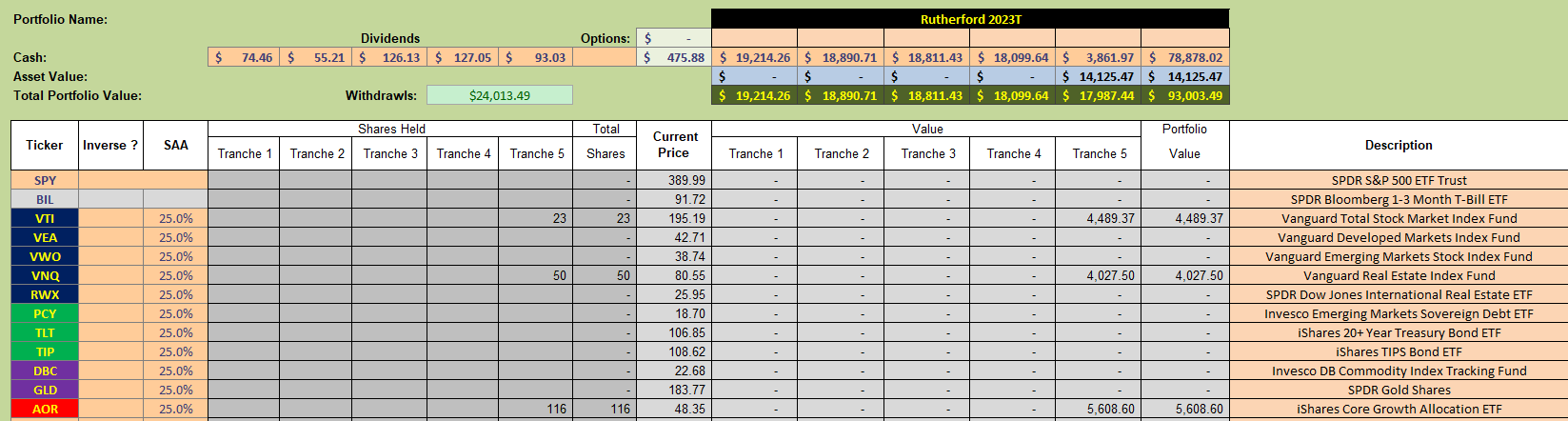

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

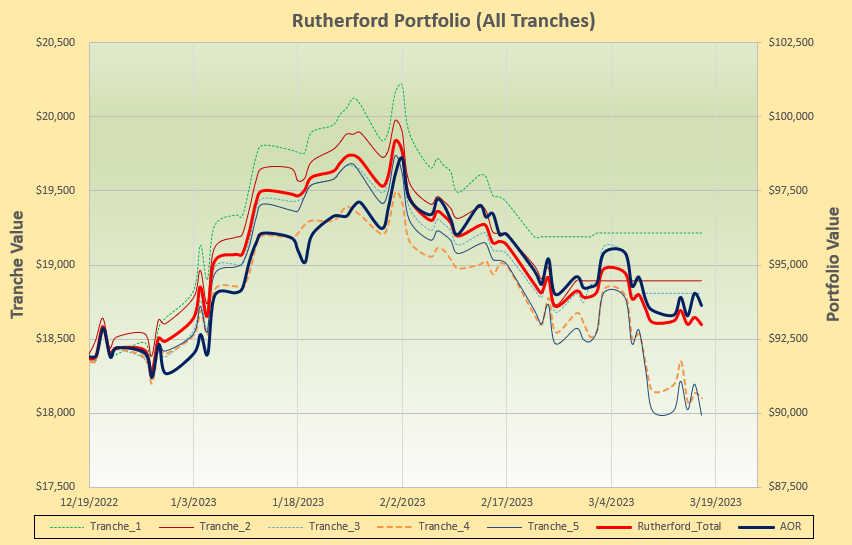

with performance looking like this:

with performance looking like this:

and this week we have to decide how to manage Tranche 5 of the portfolio – the only tranche left holding any securities after 5 weeks of recommendations to Sell everything.

and this week we have to decide how to manage Tranche 5 of the portfolio – the only tranche left holding any securities after 5 weeks of recommendations to Sell everything.

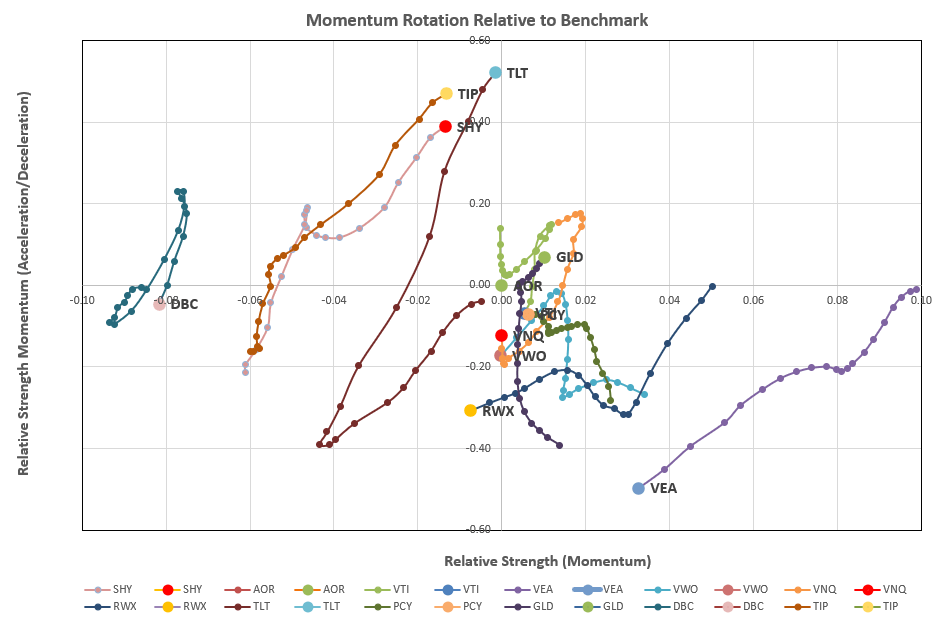

So let’s take a look at the rotation graphs:

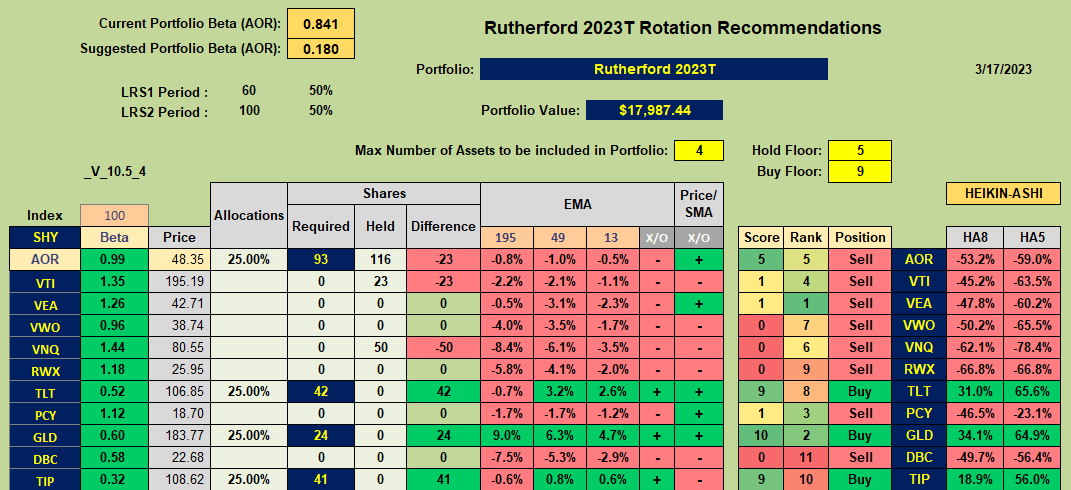

where we see little action in the desirable top right quadrant of the graph. However, if we check the recommendations of the rotation model:

where we see little action in the desirable top right quadrant of the graph. However, if we check the recommendations of the rotation model:

we see Buy recommendations in the “defensive” Commodity and Bond sectors of the market.

we see Buy recommendations in the “defensive” Commodity and Bond sectors of the market.

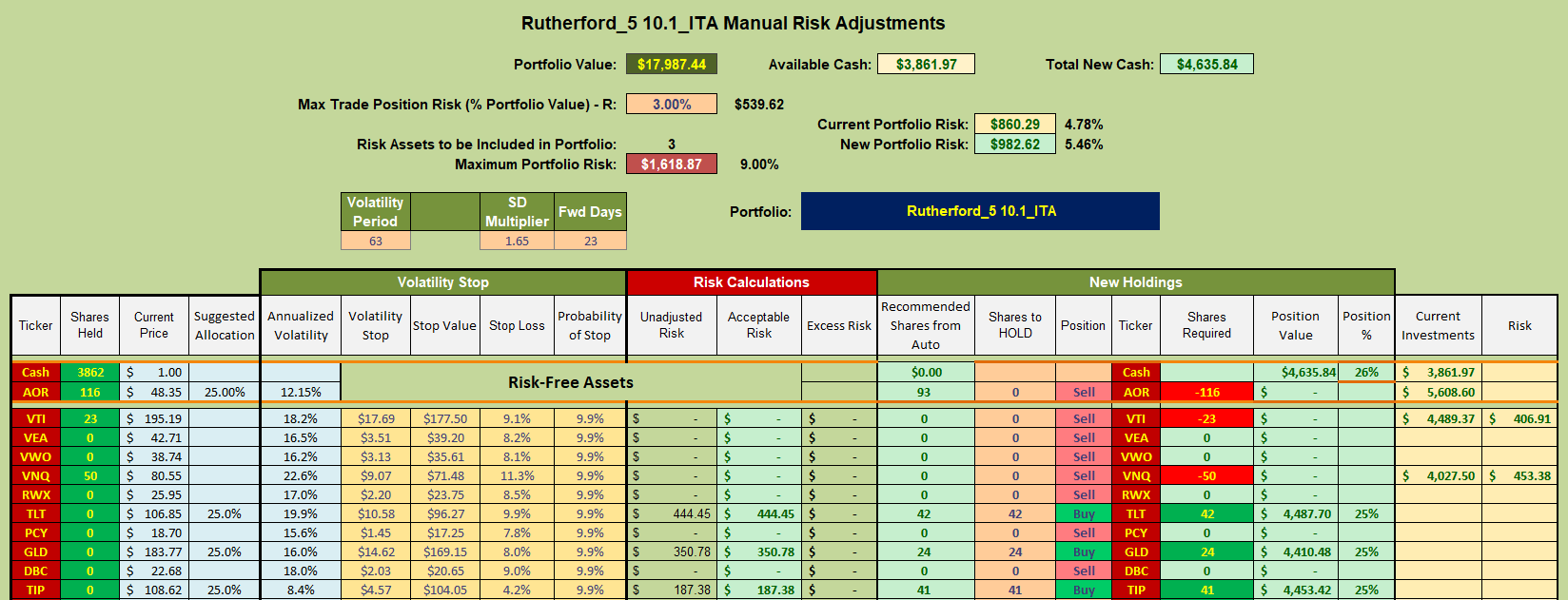

Consequently, this week’s adjustments to the portfolio will look something like this:

i.e. I will sell holdings in VTI, VNQ and AOR and add positions in GLD, TLT and TIP.

i.e. I will sell holdings in VTI, VNQ and AOR and add positions in GLD, TLT and TIP.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.