John, Paul, George and Ringo in Liverpool, England

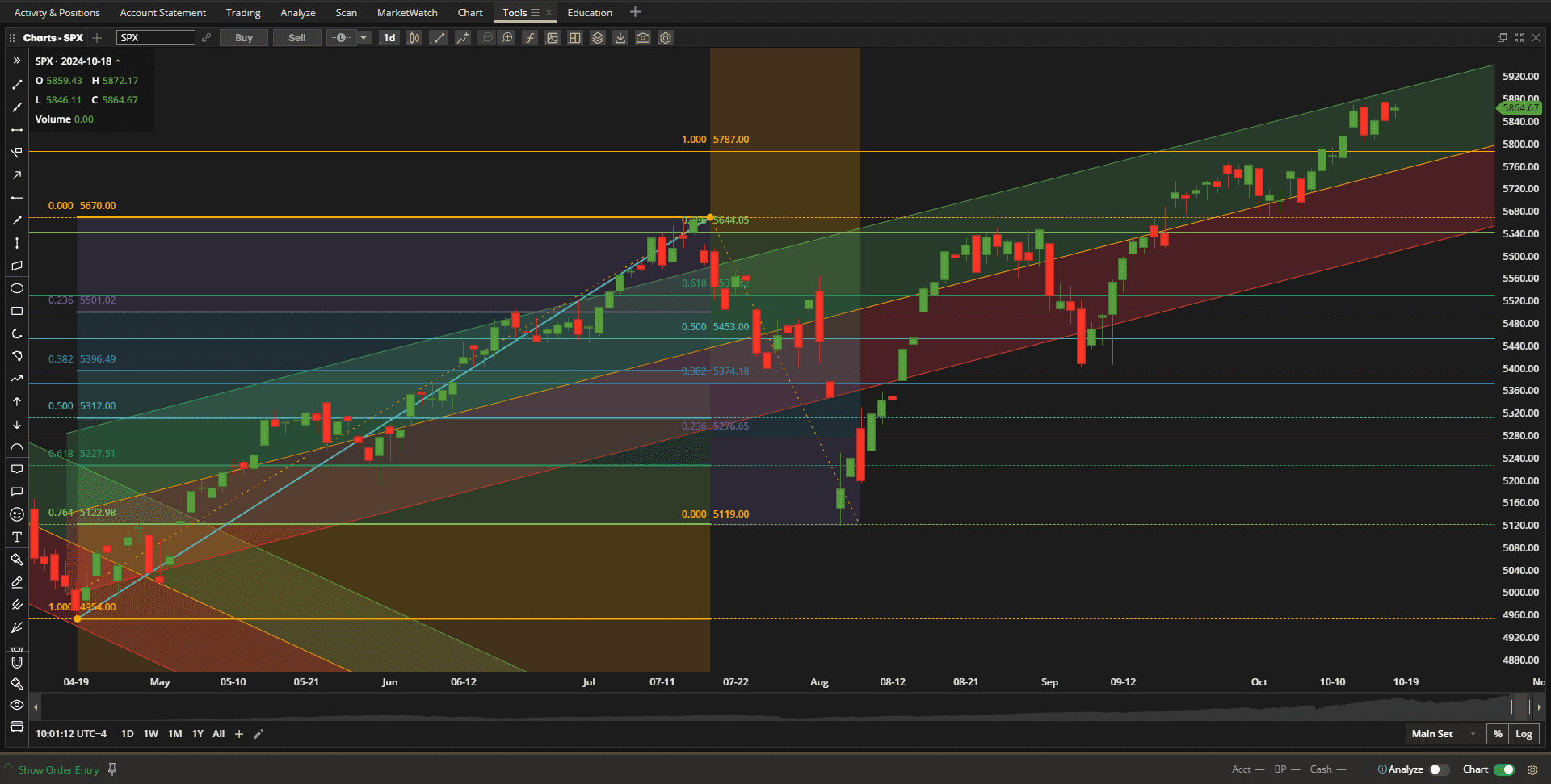

Travelling back home after a ~6-week trip resulted in me not finding the time to review Tranche 4 of the Rutherford Portfolio last week – so I will review Tranche 4 as well as Tranche 1 this week so as to get back on schedule. Recent price movement in the S&P 500 Index (SPX) looks like this:

where we can see that we finally broke through the ~5800 resistance zone in the last week.

where we can see that we finally broke through the ~5800 resistance zone in the last week.

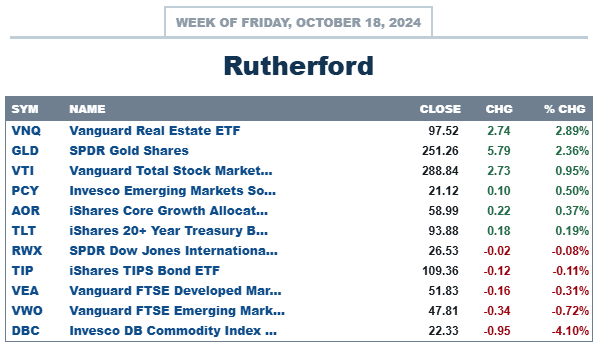

In terms of relative performance US Equities fared reasonably well although markets were not as strong as the Real Estate (VNQ) and Gold (GLD) sectors:

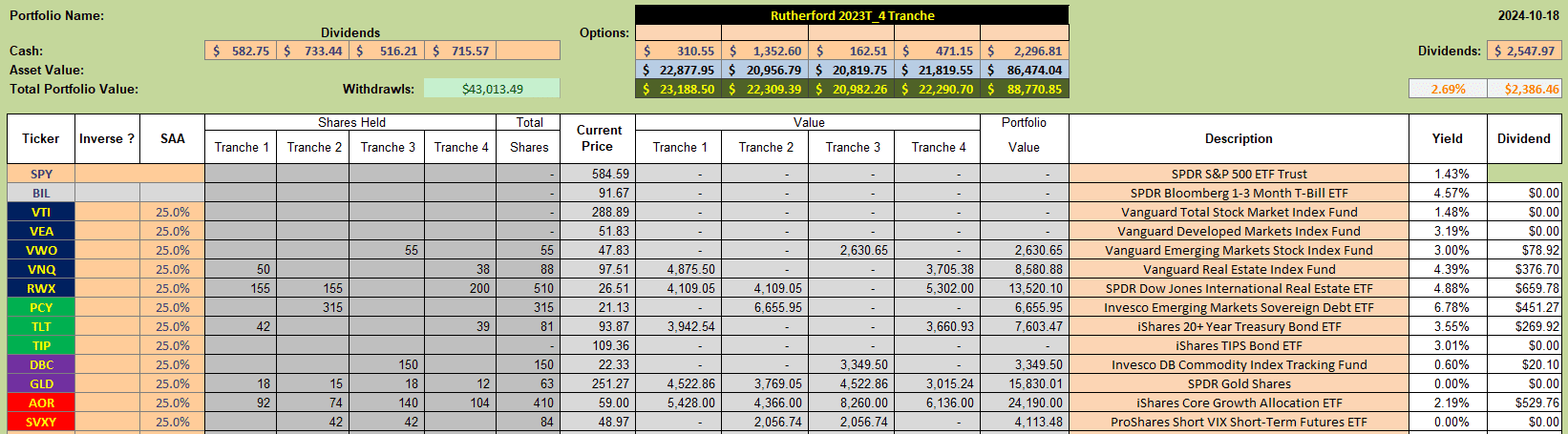

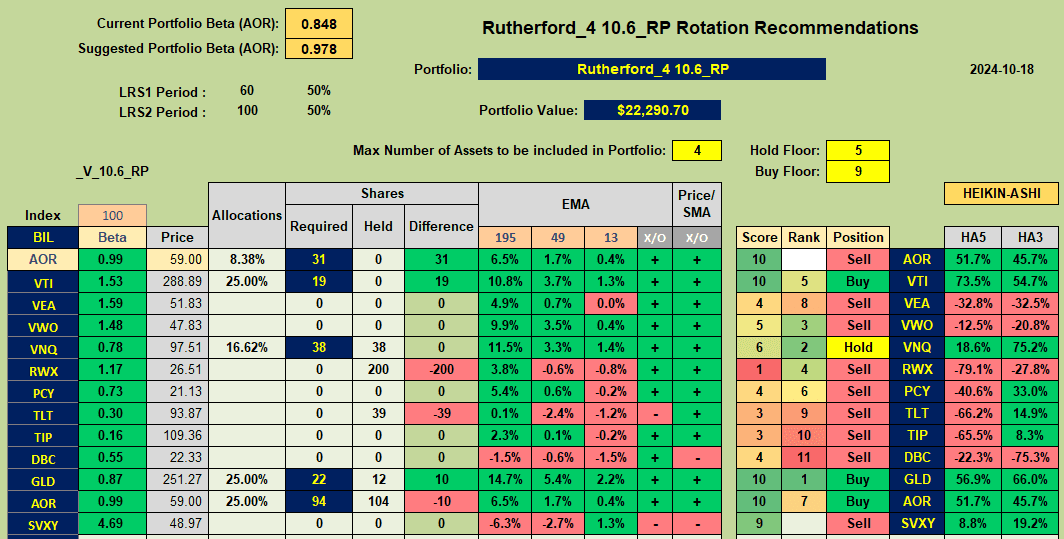

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

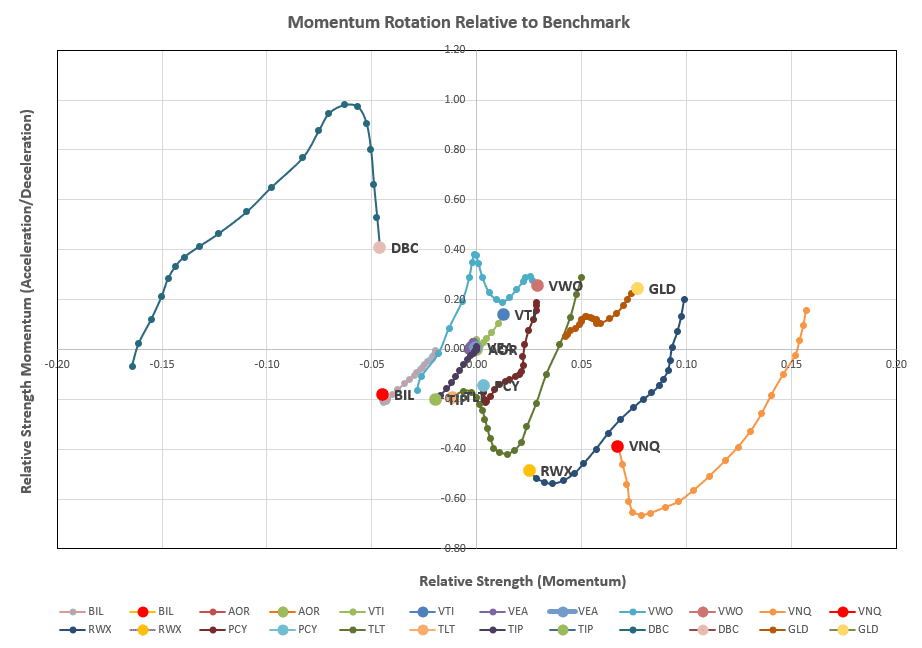

and a check of the rotation graphs:

and a check of the rotation graphs:

shows a fallback in Commodity markets (led by Oil), weakening in Bonds and continued strength in GLD and equities.

shows a fallback in Commodity markets (led by Oil), weakening in Bonds and continued strength in GLD and equities.

Recommendations from the rotation model show the following rankings and recommendations:

with Buy Recommendations for VTI, GLD and AOR (the benchmark Fund) and a Hold recommendation for VNQ.

with Buy Recommendations for VTI, GLD and AOR (the benchmark Fund) and a Hold recommendation for VNQ.

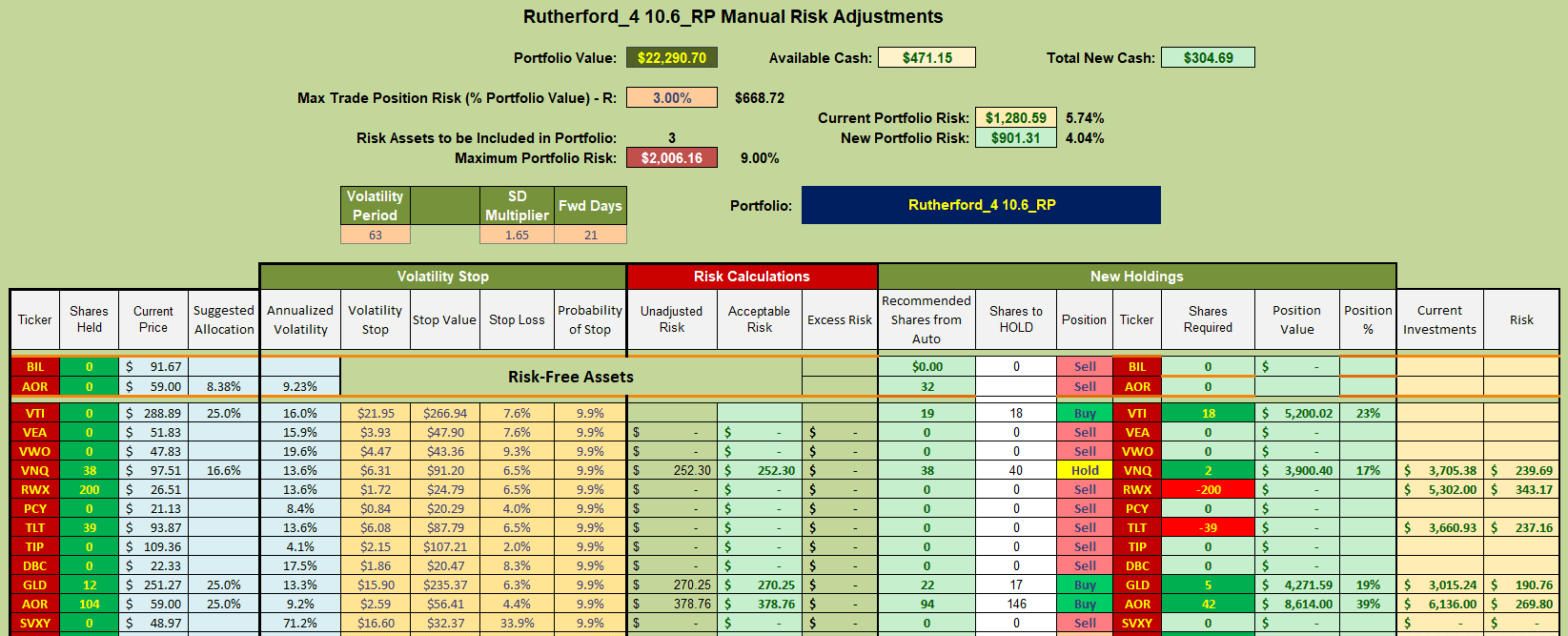

Accordingly, I will be adjusting positions in Tranche 4 as follows:

I will sell current holdings in RWX and TLT – this will generate ~$9,000 in Cash.

I will sell current holdings in RWX and TLT – this will generate ~$9,000 in Cash.

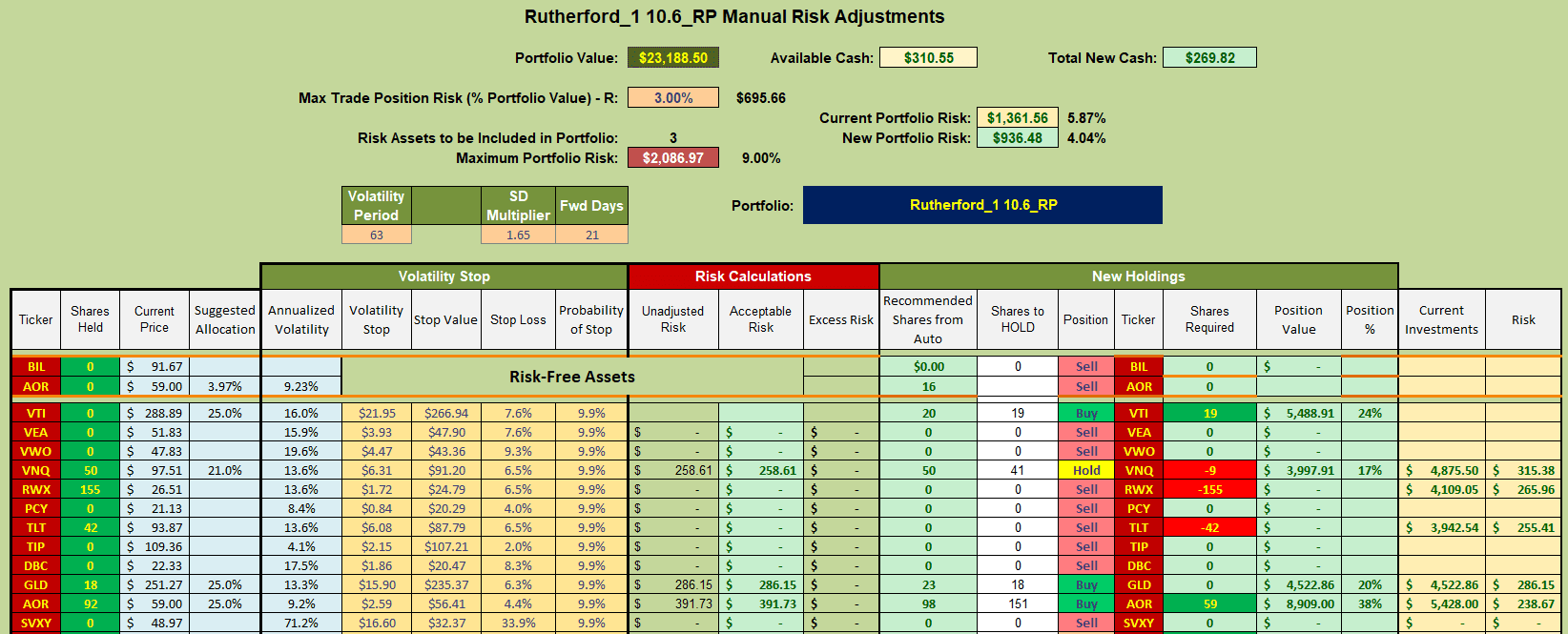

Suggested adjustments to Tranche 1 look like this:

and, again, I will Sell current holdings in RWX and TLT to release another ~$8,000.

and, again, I will Sell current holdings in RWX and TLT to release another ~$8,000.

Now, since this Portfolio is held in a tax-deferred retirement account and I need to make an ~$18,000 withdrawal from the account I am also going to Sell the 155 shares of RWX held in Tranche 3 and Sell my remaining positions in SVXY (Inverse Volatility ETF) to leave me with a total of ~$25,000 in Cash.

After making my mandatory withdrawal I will place the remaining Cash in T-Bills until I make a decision as whether to rebalance each tranche to ~$17,500 or move to an Income Generating Portfolio similar to the Hawking Portfolio. I don’t want to make this decision until after the elections.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question