Wildlife in Christchurch Botanic Gardens, New Zealand

Every year I take a breathe and find a little time to review my portfolios and the systems that I am using to manage those portfolios. As we remind readers almost every month, no system works “best” in all market conditions, and we don’t know what those conditions will be in the future, so it is difficult to adjust/change our management plans. In fact it is probably dangerous to do so when a system appears to be underperforming if the system has performed well in the past and there is no obvious major structural change in the markets.

Again, as we remind readers regularly, review-date (timing) luck is probably more significant in determining performance for actively managed portfolios than the system being used to manage those portfolios. Avoiding frequent adjustments (something closer to Buy-And-Hold) reduces this timing luck but offers no way to manage/limit acceptable risk/drawdowns. This may be acceptable for (young) investors with a 25+ year horizon but, as we grow older, we tend to become more risk averse and prefer to preserve capital – even if this might come at the expense of lower returns. But, then again, most of us would still like to see those nice positive returns every month.

When it comes to active management we have a choice of two major approaches – to use either a trend following or momentum system or to use an (almost) exact opposite mean reversion system (such as Lowell’s BPI system). Personally I tend to favor momentum systems for intermediate term actively managed “investment” portfolios and mean reversion strategies for short-term “trading” (not covered on this site). There have been many studies suggesting that trend following/momentum works best on an intermediate fime frame (~3-12 months) but that outside these time frames mean reversion works better. Of course this is an “on average” generalization and we will always be able to find exceptions if we look hard enough.

In this post I take a look at all the momentum-based models contained in the Kipling Workbook:

1. The Dual Momentum (DM) model based on Gary Antonacci’s system, as descibed in his book of the same name, but with a little more flexibility in that it might be used for portfolios with more than 3 assets in the investment quiver, allows for the possibility of holding more than 1 asset in which to invest and adjustment of the momentum look-back period. This usually results in a low turnover and a “reasonable” churn of assets to be held.

2. The Linear Regression Projection-Convolution (LRPC) model that is a proprietary system available only to ITA Wealth subscibers through the Kipling Workbook, that is an alternate system with longer-term focus and a low “churn” frequency similar to the DM model.

The problem with these longer-term focused systems is that they tend to be slow in getting us out of an uptrending market and in to a new uptrending market. Therefore,

3. The Heiken-Ashi (HA) model focuses on shorter term momentum (5- and 8-day defaults) to react quicker to short-term changes in momentum. The issue here is that short-term momentum tends to be mean reverting so, to counteract this, the LRPC signal is used as a filter i.e. the HA signal is only accepted on a positive LRPC signal.

4. The Buy-Hold-Sell (BHS) system attempts to combime the longer term momentum signals with the shorter term HA signals by weighting the signals to generate Buy, Hold and Sell recommendations.

5. The fifth system that I include in this review is the “Rotation” system – that is not included in the Kipling Workbook since the calculations of momentum are different from the calculations used for the other models and are based on the ratio of asset price to a benchmaek. The “Rotation” is visualized by plotting longer term momentum (similar to the above models – but not exactly the same) against the rate of change of this momentum (or acceleration/decceleration). This is combimed with a trend-following Moving Averate crossover filter in another attempt to combime long-term momentum with short-term momentum to generate Buy/Sell signals.

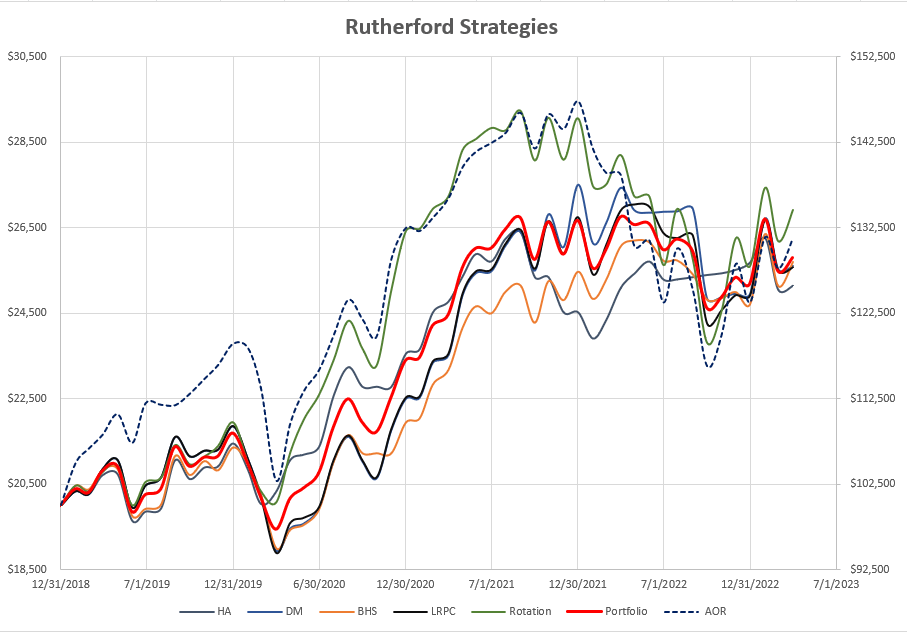

So, after that background, here’s the results of system performance since the beginning of 2019 (~1 year before the Covid shock) using the diversified Rutherford portfolio asset list as our test portfolio. The systems are all set up to hold a maximum of 4 assets:

As we can see, there is very little difference in return performance between the systems at the end of this ~4.5 year period – and yet the path to get there is significantly different. This supports our contention that no single system performs “best” under all market conditions.

As we can see, there is very little difference in return performance between the systems at the end of this ~4.5 year period – and yet the path to get there is significantly different. This supports our contention that no single system performs “best” under all market conditions.

There are a few caveats to bear in mind when looking at the above graphs:

1. An attempt is made to minimize the impact of review-date (timing) luck by adjusting holdings at the end of the month (EOM) for all systems – this does not necessarily mean that we would see the same/similar relative performance had we reviewed the portfolios on a different day of the month.

2. Although the “Rotation” system appears to follow the benchmark AOR fund more closely than the other systems it’s lead over the other systems at the end of the test period is marginal – and I’m not convinced that this is sustainable. I haven’t run the numbers but, looking at the above screenshot, I suspect it’s not the best in terms of risk adjusted returns (i.e. taking volatility into account).

When it comes to evaluating the efficacy of the “momentum factor” I suspect that this factor is not as strong as it was 10 years ago (since papers were published to support it’s efficacy) – i.e. the recognition of momentum as a valid factor in determining price direction has resulted in more adoption/use of the factor and resulted in efficiencies that has reduced the impact of this factor on performance. However, since momentum is likely a human behavoiral factor (influenced by the rate of information absorbtion/reaction times) that is difficult to change significantly I suspect that the factor will likely remain effective going forward, albeit maybe less strongly than in the past.

It is very difficult (if not impossible) to balance the impact of momentum and mean reversion in a single intermediate-term actively managed system. The best solution is probably to split our total investment portfolio into sub-portolios (tranches) that are mananaged under different system rules (system diversification).

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Very good work David. I found your observations most useful. Thx for taking the time needed to compile this report. John

Thanks John – I’m still battling with those cognitive biases and trying to tame them 🙂

ITA Readers:

Adding another reference to Hedgehunter’s data above, the Schrodinger over the same period turned in an annualized 7.0% since 12/31/2028 while SPY returned 14.0% annualized.

The IAM data show AOR with an annualized IRR of 6.7% and AOA with an annualized IRR of 8.6%.

VTI had an annualized IRR of 13.2%. This is again an example that it is difficult to outperform the broad market.

Lowell