Time to dry wings.

With chaos emerging from the “Dunning-Kruger Administration” every day, what should investors be doing with their retirement accounts? A reasonable question. If you are young and are taking the long view, root for the market to decline so you can purchase shares at lower prices. If you are retired and need to live off your savings, root for the market to go up as preservation of capital is essential.

Let’s define young as someone who has at least ten years of savings ahead. If you are older perhaps a tad more financial conservatism is coursing through your veins. There a middle ground where you take Buffett’s words to heart. Remember the quote from last week.

“The stock market is a device to transfer money from the impatient to the patient.”

This morning the Bethe portfolio is up for review and this is an example of the patient approach. This portfolio is constructed around the long standing Asset Allocation investment model. Each time the Bethe comes up for review the effort is to keep the various assets within one percentage point of the target percentage. The portfolio is approaching a size where one narrows the “out-of-balance” percentage to 0.5% of the target.

The Bethe was moved to the Asset Allocation model only a few months ago so it will take a few more months before the portfolio is in balance with the stated target goals.

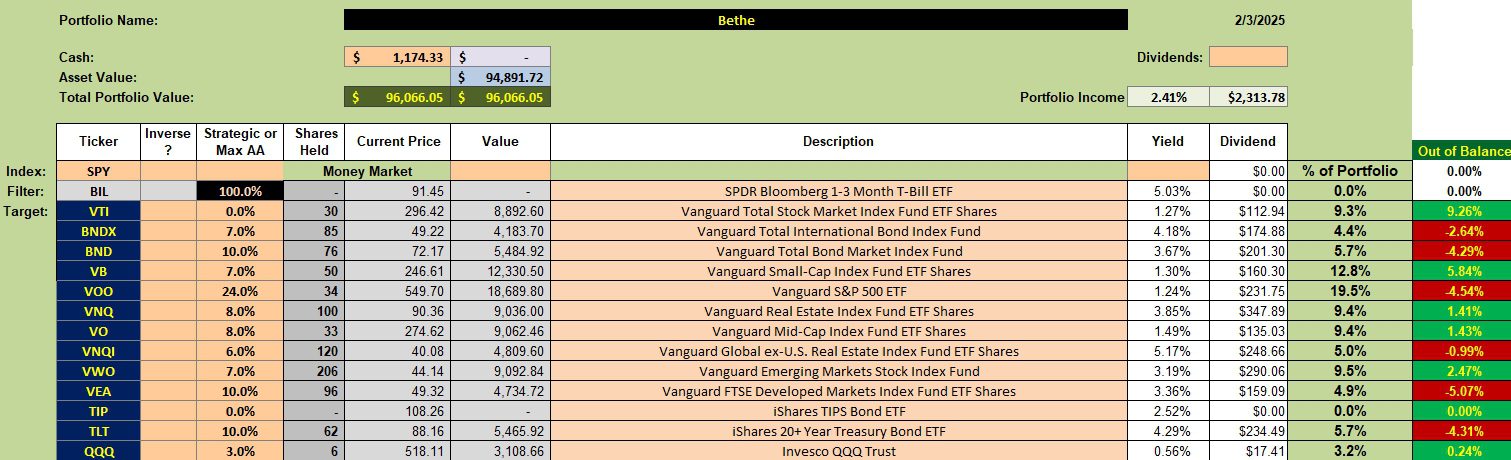

Bethe Security Holdings

Below are the Max AA percentages and the current holdings. In the far right-hand column we see how far out of balance each asset class is and where we need to go to bring each back into balance. I have a limit order in to sell all shares of VTI as this Exchange Traded Fund (ETF) is close to a duplicate of VOO and the combination of VO and VB. VOO, VO, and VB actually make up VTI.

If and when shares of VTI are sold, that cash will be used to bring asset classes below target up to the stated target percentages.

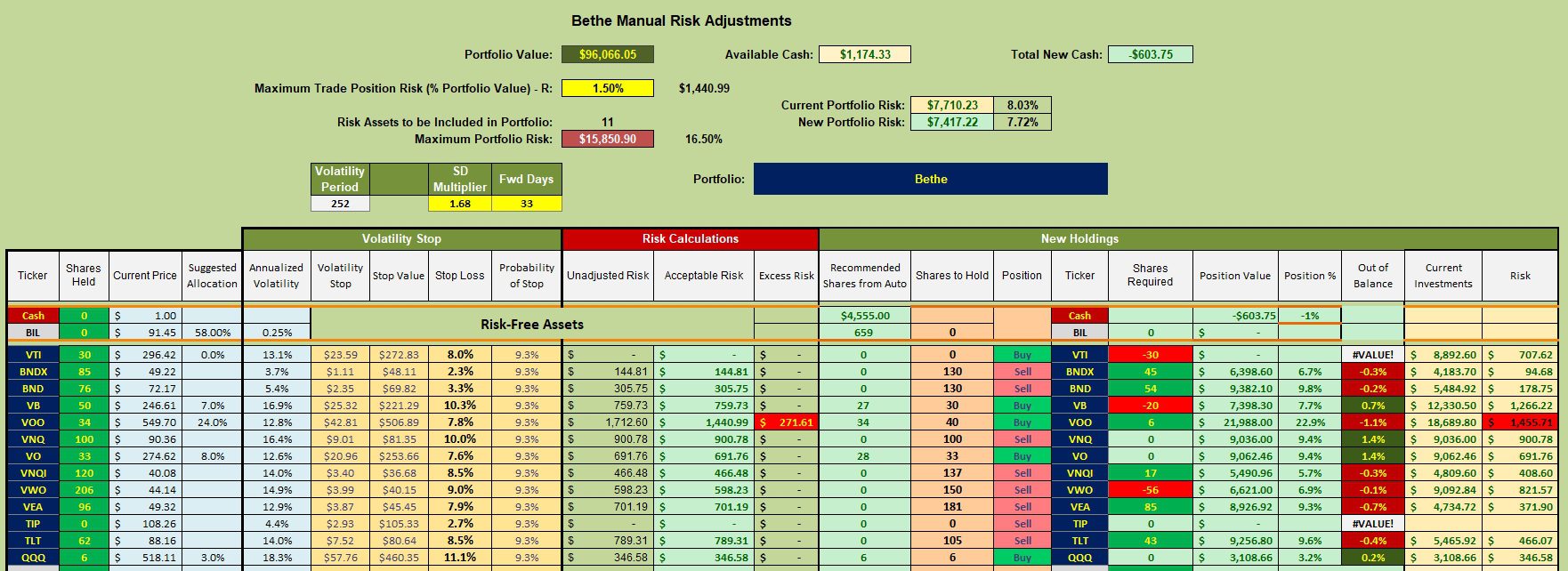

Bethe Rebalancing Recommendation

The “Shares Required” column (6th from the right) is a first round of goals to bring the various asset classes into balance. If one has major concerns as to market volatility, and most of us do, then concentrate on bringing the lower volatile asset classes into balance first. BND and BNDX come to mind. Filling those two securities also has another benefit in that they throw off monthly dividends and that money can then be used to bring other asset classes into balance.

Due to price changes each month we can count on one or more asset classes falling out of balance. Once we have the various asset classes where we want them to be, the goal is to never sell, but to use fresh cash deposits and dividends to buy shares of assets below target. This is classic dollar-cost-averaging.

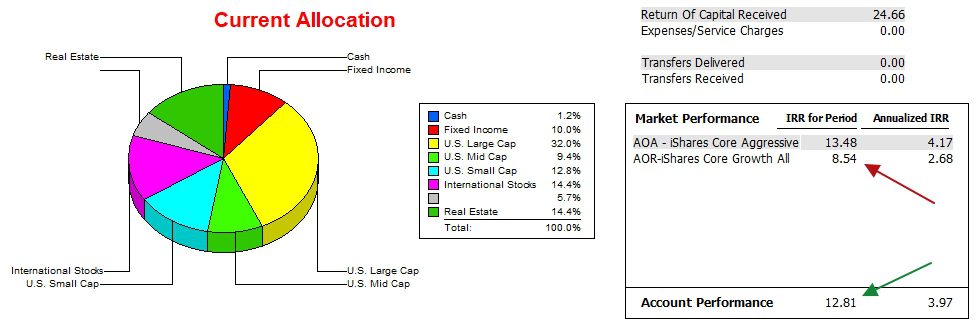

Bethe Performance Data

Since 12/31/2021, or the launch date of the youngest ITA portfolio, the Bethe has a slight edge on the AOR benchmark, but lags the AOA security.

Checking the pie chart, this portfolio may be too aggressive for older investors. If so, cut back on the percentage allocated to equities and increase the percentage directed to income oriented securities such as BND, BNDX, and TLT.

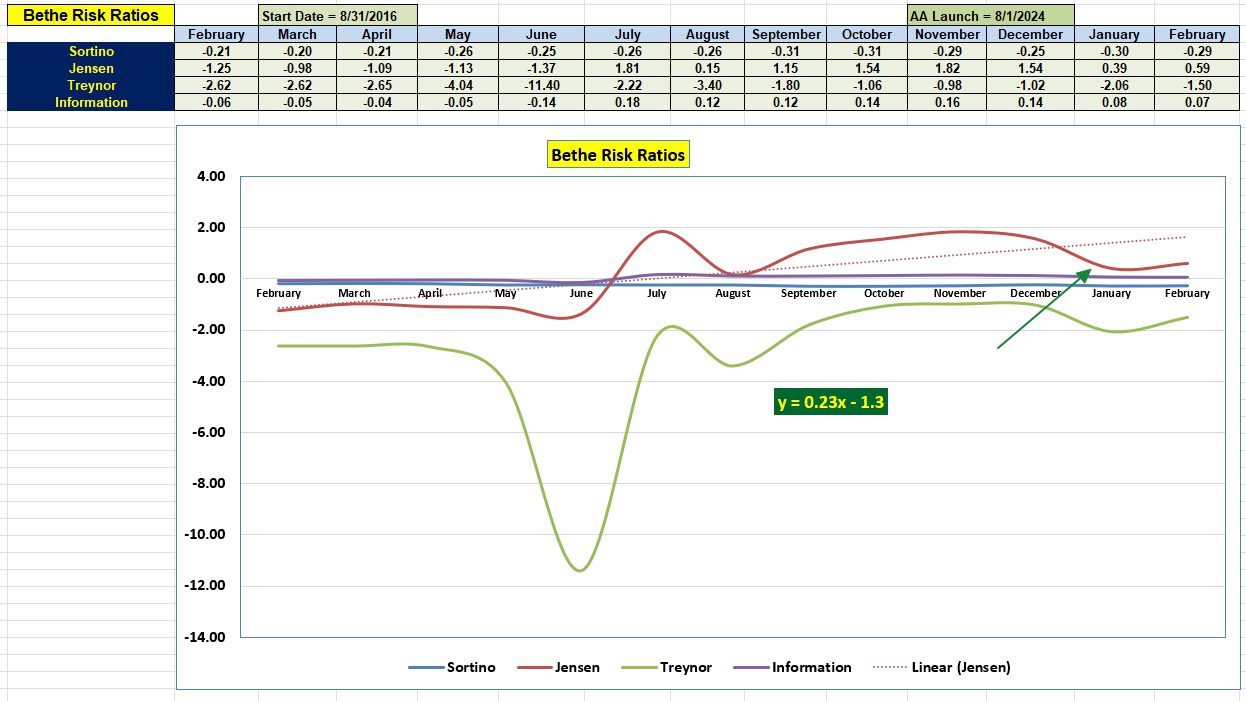

Bethe Risk Ratios

While the Bethe is an equity driven portfolio, the risk is not over done based on the Jensen Performance Index values over the past year.

Keep an eye on the Information Ratio as this value tells us how well the portfolio is performing compared to the benchmark. Over the last few months the Bethe lost ground to the AOR benchmark, not a good sign this asset class is working in this environment.

On a positive note, the slope of the Jensen is increasing and I consider the Jensen to be the most important of the four risk measurements. Should the interest rate on the short-term treasure decline, the Jensen Ratio will benefit. That rate decline a small amount over the last month.

Questions and Comments are always welcome.

This is a time to be patient and let the benefits of Asset Allocation do their work. I should mention that the Bethe portfolio operates so taxes do not become a liability. The fewer the transactions the less likely one will be impacted by taxes.

The Bethe is not going to cash. When one pulls out of the market you need to be right twice. Once when you get out and again if and when you enter the market.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question