Rocky Outcrops around Islands of Phuket, Thailand

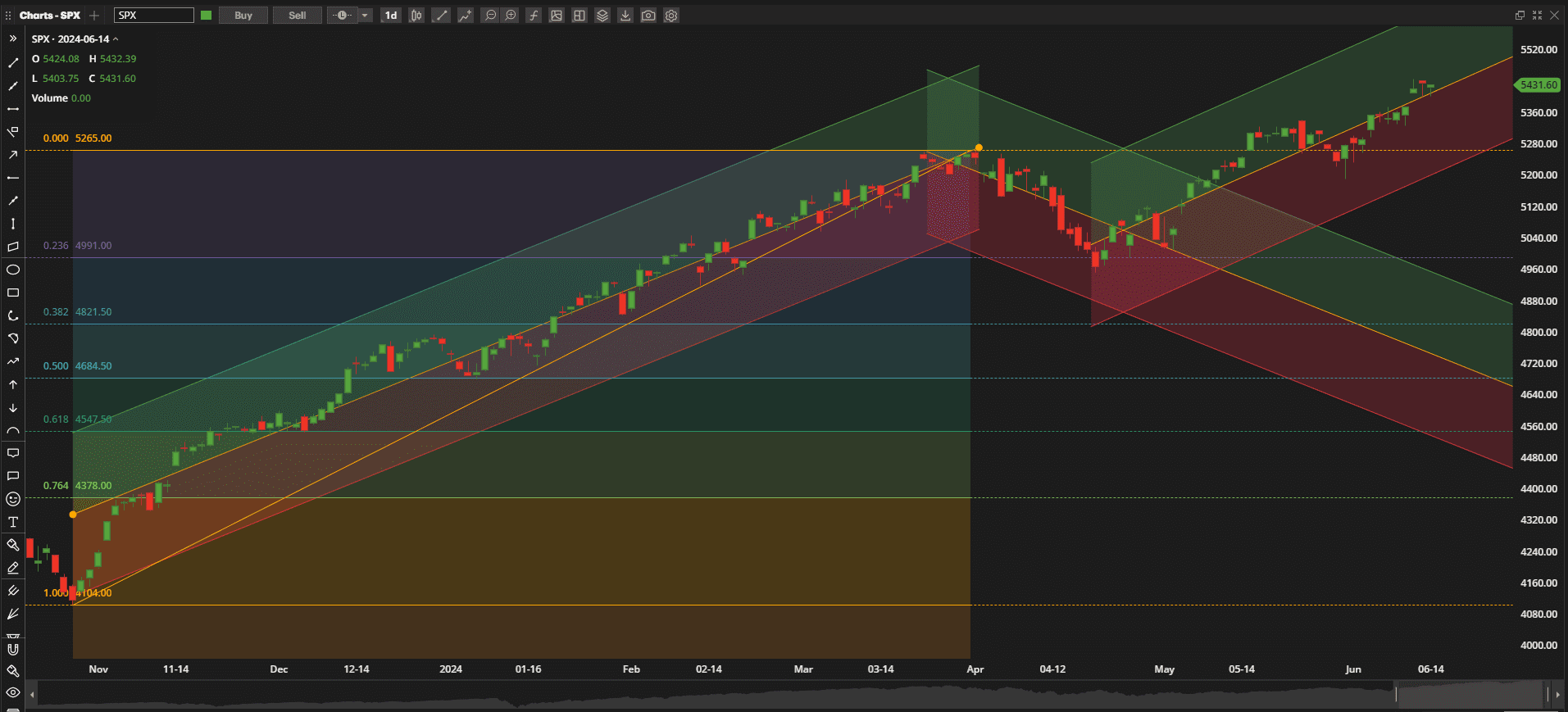

It was another bullish week in US equities with stocks continuing their slow climb to new highs:

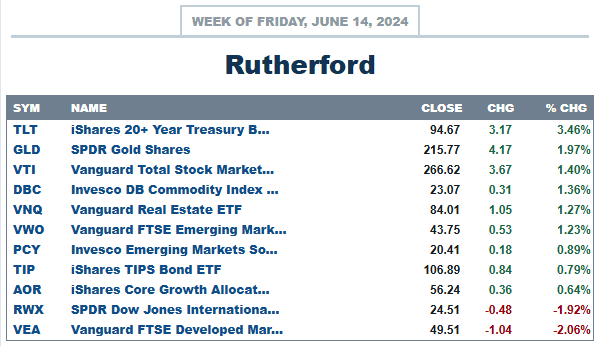

In terms of relative strength, compared with other major asset classes, US equities again came in close to the top of the list, although long term treasury bonds (TLT) stole the show:

In terms of relative strength, compared with other major asset classes, US equities again came in close to the top of the list, although long term treasury bonds (TLT) stole the show:

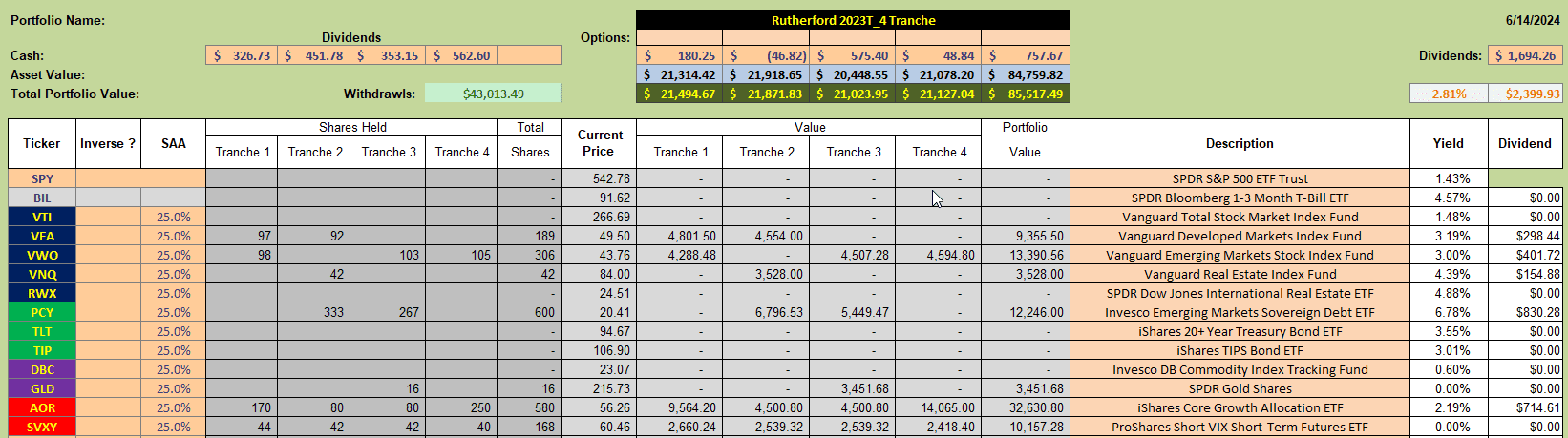

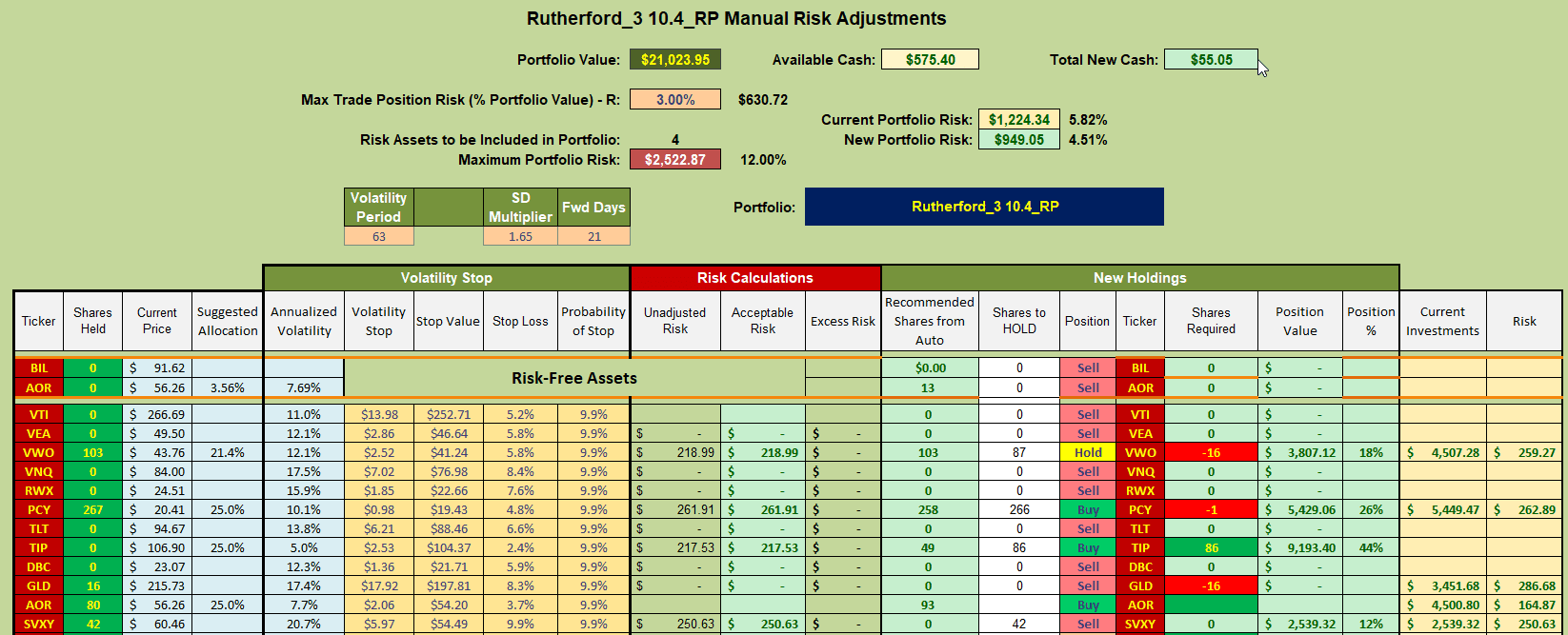

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

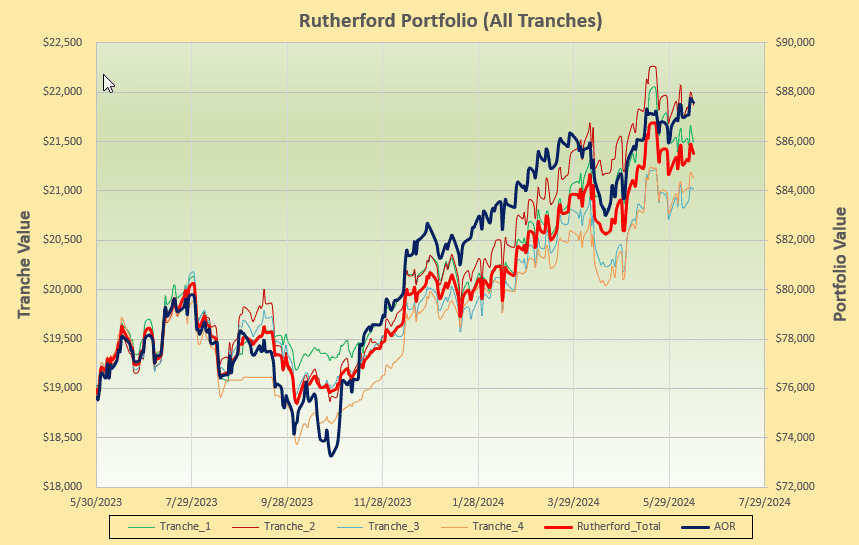

with recent performance:

with recent performance:

falling slightly off that of the benchmark AOR Fund.

falling slightly off that of the benchmark AOR Fund.

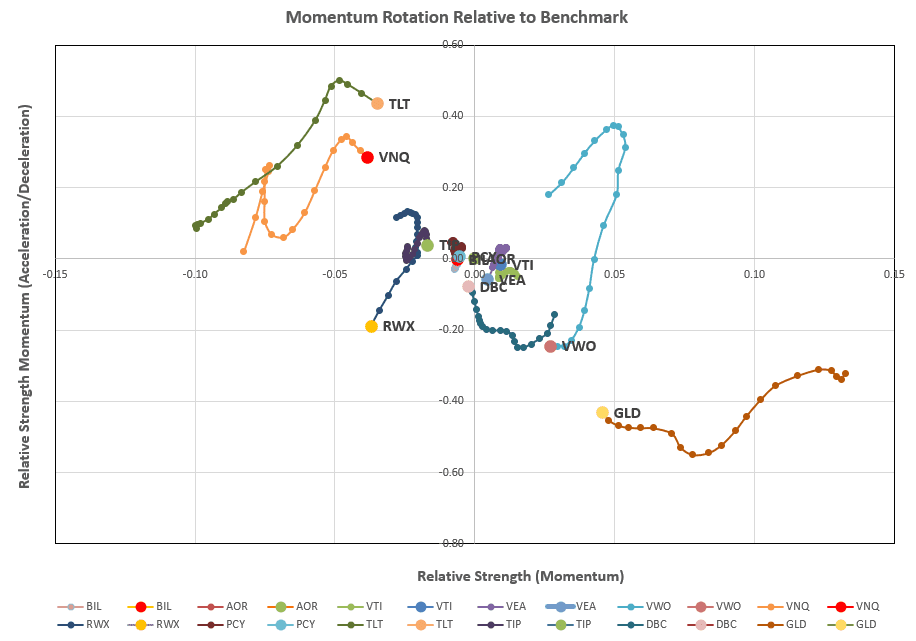

Tranche 3, the focus of this week’s review, is holding positions in VWO (Emerging Market Equities), PCY (Emerging Market Bonds) and Gold plus an allocation to AOR, the benchmark fund – so we’ll take a look to see whether any adjustments might be called for by checking the rotation graphs:

and, as we see from the above graphs there is nothing too exciting going on in the top right quadrant where we would want to see stronger assets hanging out.

and, as we see from the above graphs there is nothing too exciting going on in the top right quadrant where we would want to see stronger assets hanging out.

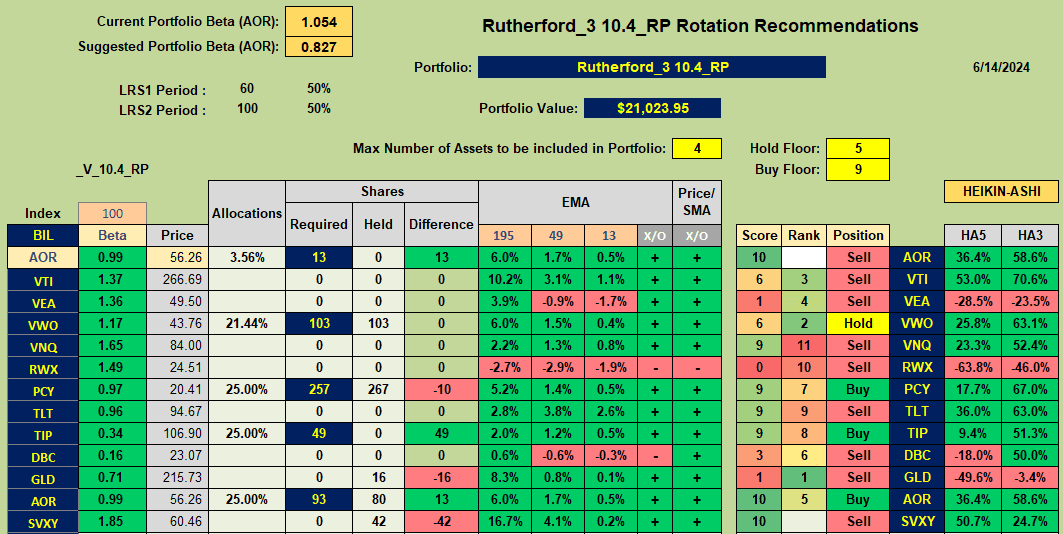

If we check rankings/recommendations from the rotation model algorithm being used to manage this portfolio:

we see Buy recommendations for PCY, TIP and AOR and a Hold recommendation for VWO – a rather unexpected selection of recommendations. However, since the objective of using any investment “system” or model is to have the discipline to stick with it I’ll follow the recommendations such that adjustments will look something like this:

we see Buy recommendations for PCY, TIP and AOR and a Hold recommendation for VWO – a rather unexpected selection of recommendations. However, since the objective of using any investment “system” or model is to have the discipline to stick with it I’ll follow the recommendations such that adjustments will look something like this:

i.e. I shall be selling my current position in GLD and using the proceeds to add a new position in TIP (Inflation-adjusted Bonds).

i.e. I shall be selling my current position in GLD and using the proceeds to add a new position in TIP (Inflation-adjusted Bonds).

It has been a long time since I designed this algorithm and I was confused as to why AOR was a recommended Buy but no allocation to AOR was being shown. The reason for this is that allocations are based on the volatility of the assets being recommended with no allocation to the benchmark fund unless excess cash is available. In this case, because of the low volatility of TIP, a high allocation (44%) is assigned to TIP such that the allocation to assets contained in the “quiver” (that excludes AOR) totals 100% of available cash – therefore AOR does not have any allocation assigned. Allocations are assigned on the basis of “Risk Parity” (allocations inverse to volatility) – of which I am not a great fan – although I do not go to the other extreme of assignment in proportion to volatility as does Lowell in some of his portfolios. My recommendation has always been “when in doubt – equal weight” so I will treat this as a discretionary adjustment and hold my current position in AOR with a lower than recommended allocation to TIP. This also keeps trading costs to a minimum – an exchange of GLD for TIP (~35 Shares or 20% allocation).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question