Schreiner’s Garden Display

As with several other ITA portfolios, capital preservation is of significant importance to the owner of the Bohr portfolio. As a result there is a willingness to give up potential returns during these uncertain times. The on again, off again tariff battle is an anathema to business as it interferes with future planning. Right now the Bohr portfolio is hunkered down to holding a dividend paying Exchange Traded Fund (ETF) and a short-term treasury. SCHD and SHV are the two current holdings and are likely to remain the sole investments throughout the remainder of the year. Should Individual-1’s tariffs defy court orders we should begin to see their effects during the third and fourth quarters of this year.

A few readers may recall the blog post of what to do if one were fortunate to come into the possession of a relative large amount of cash. This link will take you to one possible strategy.

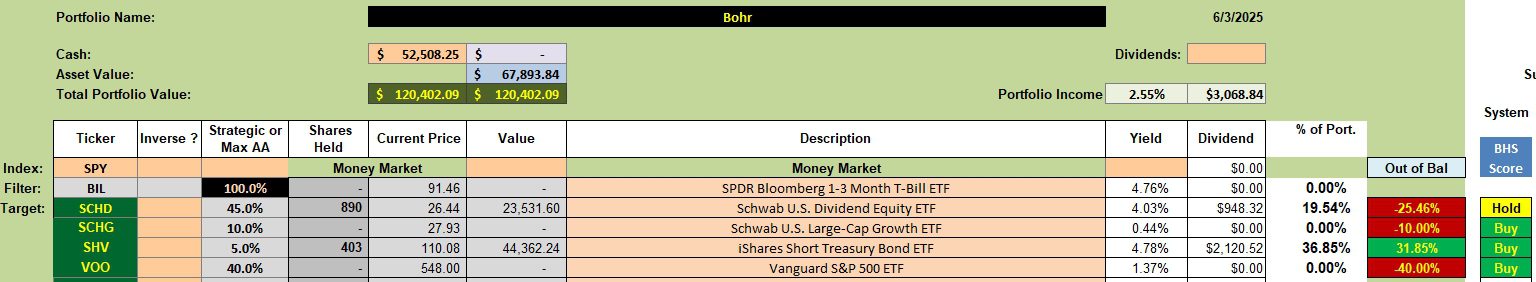

Bohr Security Holdings

As mentioned above, the Bohr currently holds only SCHD (dividend payer) and SHV (short-term treasury). This is a very conservative position and one not recommended for “normal” times.

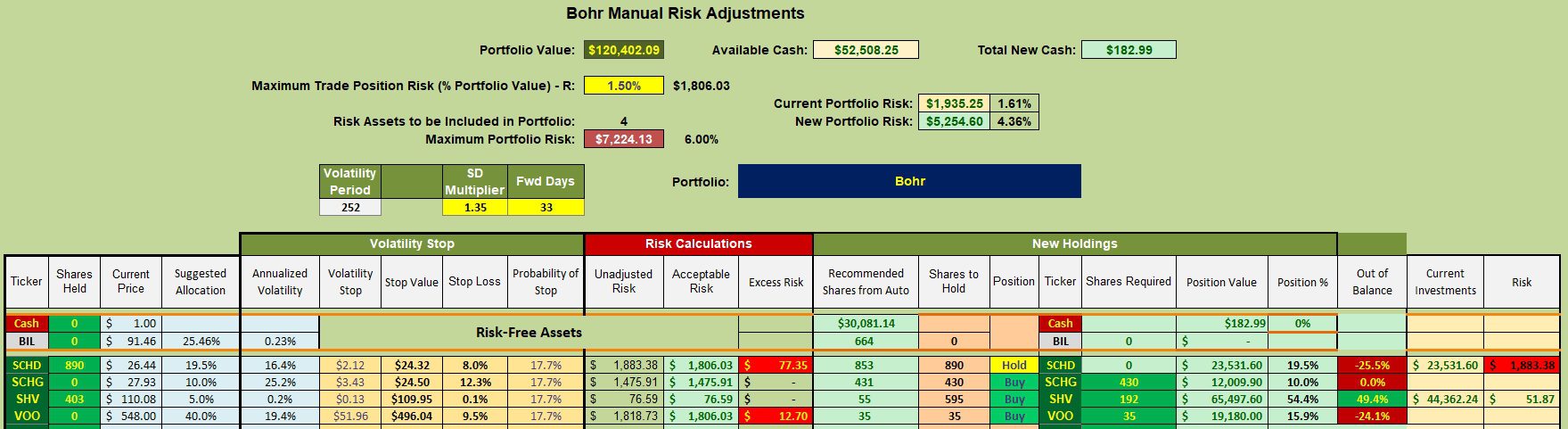

Bohr Rebalancing Recommendations

In “normal” times I would follow the recommendations shown below. This worksheet comes out of the Kipling spreadsheet and you see three of the four ETFs are a Buy. SCHD is actually a hold.

Instead of adding more shares to VOO and SCHG, I will be investing more of the available cash in SHV. SHV is currently paying a dividend of 4.78%.

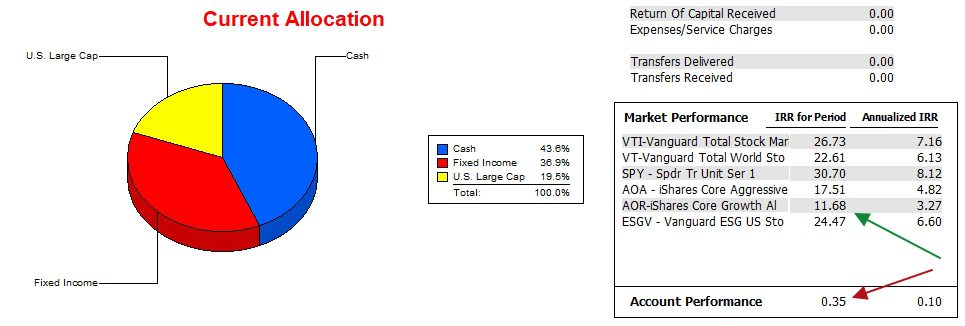

Bohr Performance Data

By taking a conservative capital preservation position the Bohr sacrifices returns and this is evident in the performance since 12/31/2021. The gap is significant when one compares the portfolio performance with SPY, the ETF that tracks the S&P 500. Check out the Copernicus for a portfolio that goes head to head with the S&P 500.

Bohr Risk Ratios

When risk enters the equation, how is the Bohr performing? The slope of the Jensen is nearly flat with a slight positive bias. Based on the Sortino Ratio, the portfolio is slowly gaining in value, although not as fast as its benchmark. All risk ratios, with exception of the Treynor, improved over the past year. The Treynor is the least important of the four as it is too dependent on the portfolio beta.

Comments and Questions are always welcome.

Buffett Indicator & Shiller PE Ratio

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question