Infrared image in Canby, OR.

It has been several weeks since I last posted Bullish Percent Indicator (BPI) data. No changes were recommended during this period, but this week the Communications sector moved into the overbought zone. Portfolios holding VOX were alerted to sell. With a 75% bullish percentage I placed 2.5% Trailing Stop Loss Orders (TSLOs) under VOX in the three Sector BPI portfolios. If your broker does not permit decimal TSLOs, then set the percentage at 3.0%.

Overall, gains this week were minor.

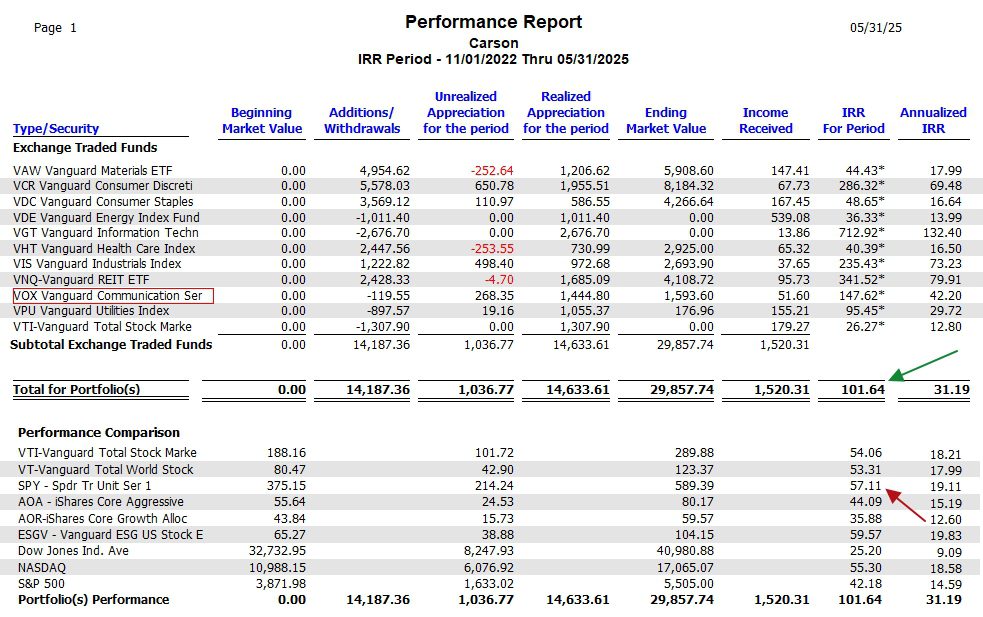

The third and final screenshot in this blog post shows the sector performance data for the Carson, the longest running Sector BPI portfolio. Come November the Sector BPI investing model will observe its third anniversary. While this is a relatively short period, it does cover several volatile market periods. We are beginning to see the benefits to this investing model.

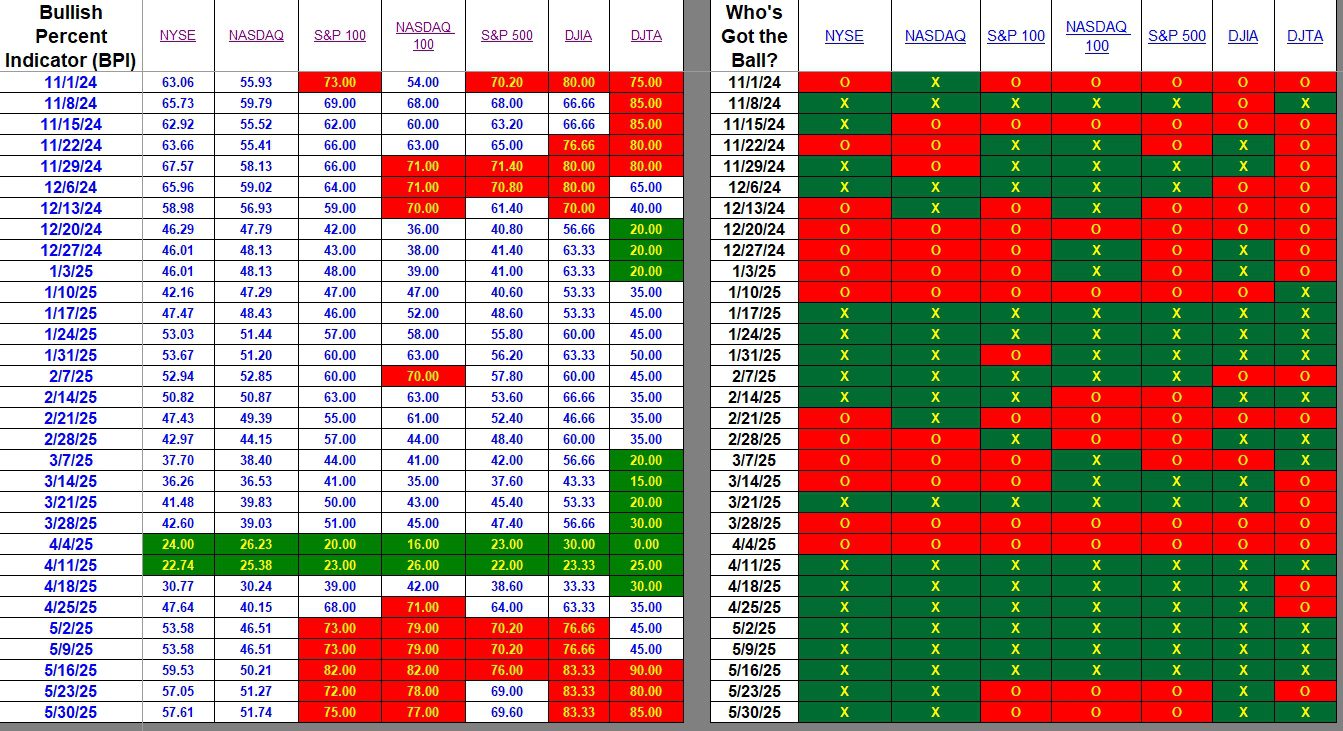

Index BPI

In general, large- and mega-cap stocks are overbought. Slight gains showed up in the NYSE and NASDAQ indicating possible minor improvement in some of the smaller cap stocks. The gains also might come from larger cap stocks. Hard to distinguish where the gains are coming from.

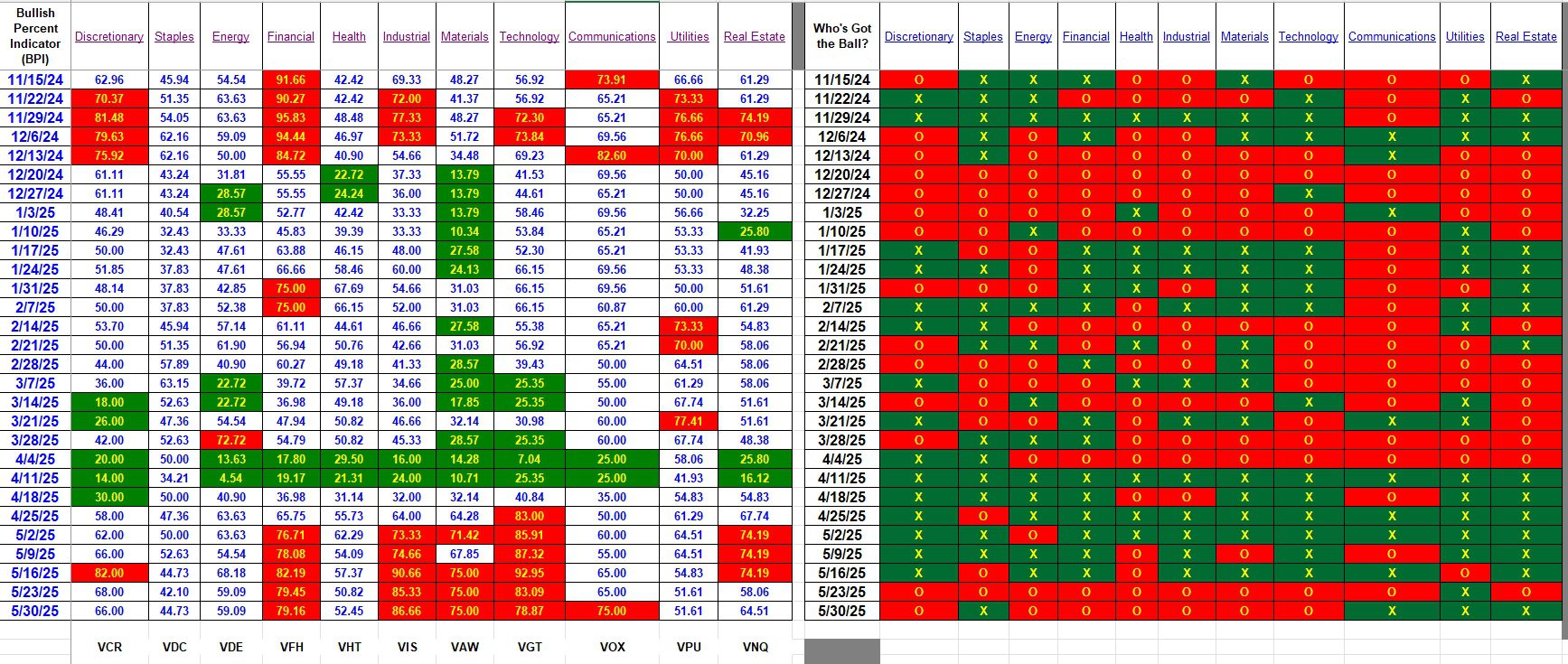

Sector BPI

The single change this week is the Communications sector move into the overbought zone. TSLOs are in place to sell all shares of VOX. We already have TSLOs in place to sell VCR, VFH, VIS, VAW, and VGT (already sold).

In normal times available cash would be reinvested in VOO. Due to major market uncertainty I’ve been investing available cash in SHV, a short-term treasury. If interested on the Sector BPI investment model, follow the Carson, Franklin, or McClintock portfolios.

Carson Sector Performance Since 11/1/2022

The following data comes out of the Investment Account Manager software. We are looking at the sector holdings within the Carson, the longest running Sector BPI portfolio. Over the past 31 months sector ETFs held by the Carson returned nearly 102% while the S&P 500 (SPY) returned 57.1%. Based on this data, the Sector BPI investing model is working very well. The logic behind this approach to portfolio management is more than meeting expectations.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

BPI data this week is not recommending any changes for the Sector BPI portfolios. I did observe interesting changes in the seven sectors. The two broad indexes, NYSE and NASDAQ, are the two that include small- and mid-cap stocks. Those are the two indexes that are bullish this week while the other five indexes, made up primarily of large- and mega-cap stocks, are all bearish.

Within the eleven sectors only Energy and Utilities are bullish. No sectors are oversold so there are no Buy recommendations. Of the oversold sectors, 3% TSLOs are already in place.

Lowell

August 1, 2025 BPI update

All major indexes are bearish, but only the NASDAQ 100 and DJTA are below the 50% bullish line. DJTA is lowest at 40%. Most of the major indexes are hovering around the 50% bullish zone.

Sectors – As I mentioned over in the Forum, Health and Materials are the two sectors most likely to drop into the oversold zone. Health is 37.7% bullish while Materials comes in at 39.28% bullish.

I plan to check the BPI data each day next week as I anticipate one or more sectors to drop into the oversold zone. Friday’s selloff is likely the beginning of this low employment and tariff debacle.

Lowell

Check the Forum for the latest information on BPI movements.

Lowell

No new sectors are in the oversold zone. Check the Forum for more details.

Lowell

Lowell,

I suggest that we might want to shy away from using the BP approach with consumer discretionary (VCR). While the BP for the sector is low (28% today), VCR has not been decreasing in price. The issue is that Amazon and Tesla make up nearly 40% of the ETF. As they go, the ETF goes.

An alternative for VCR might be to use Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RSPD). It’s price has generally been falling, coinciding with the fall in the BP for the discretionary sector.

~jim

Jim,

Good suggestion. I will make the change in the spreadsheet and eventually switch in the three Sector BPI portfolios. Another suggestion is to hold both ETFs at this time and eventually switch totally to RSPD.

Lowell

Jim,

Have you read “The Fundamental Index” by Robert D Arnott, Jason Hsu & John West? This book is all about using equal weight index funds.

Lowell

Lowell,

I haven’t. Sounds like you think it might be a good idea.

~jim

Jim,

Reading Arnott’s book is in line with your suggestion to use an “equal weight” ETF for the Discretionary sector. It has been many years since I read the book, but as I recall Arnott argued that one would have reduced losses during the dot com bubble if one used equal weight indexes rather than cap weighted indexes.

Lowell