Erick Schat’s Bakkery – Bishop, CA

We need more weeks like this one as all indexes increased or held even in the percentage of bullish stocks. Nearly all sectors also improved during the week. Two sectors, Staples and Utilities, merit watching as both are close to the oversold zone.

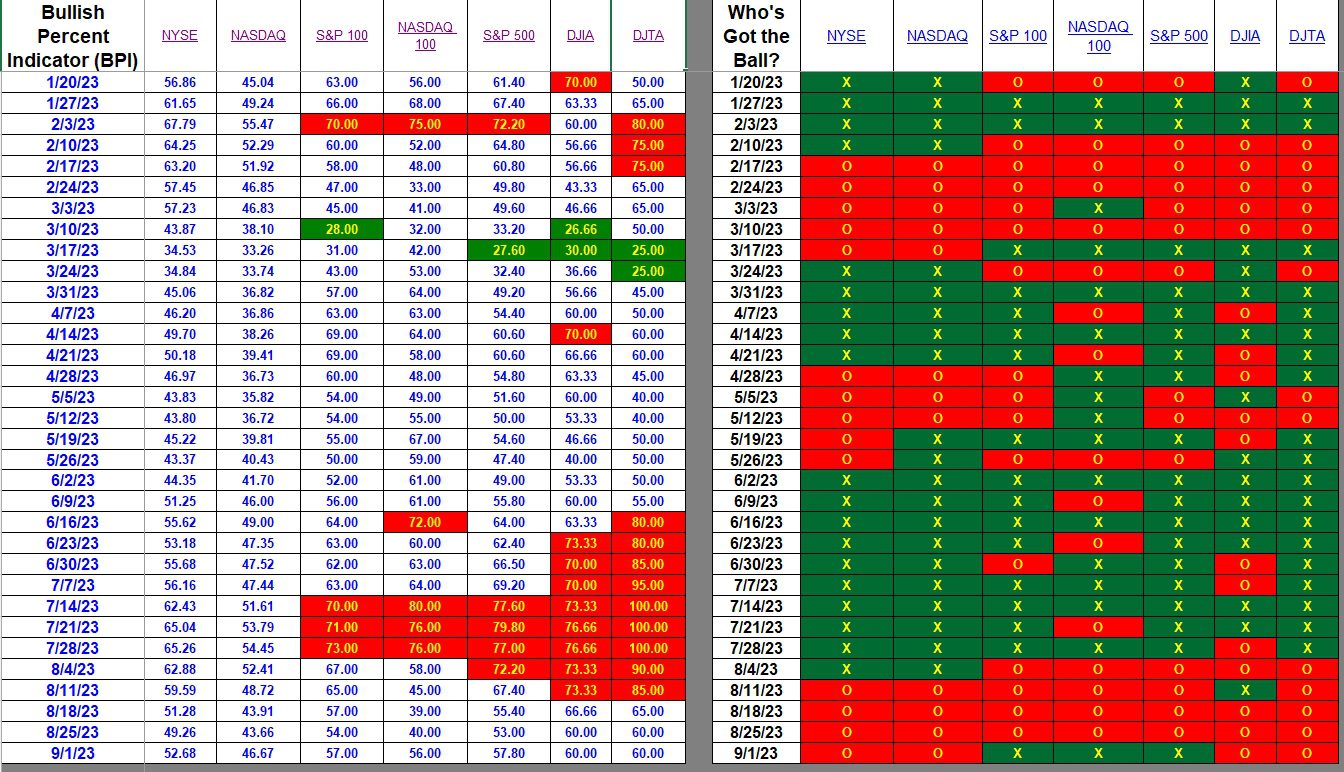

Index BPI

All seven indexes are within +/- 10% of 50% bullish so one can classify the current U.S. Equities market as average. It is neither bearish or bullish. Overall, we did see improvement this week. With a slight uptick in unemployment the FEDs may hold off on increasing the interest rate. That would be a boost for the stock market. Baked into the market is another 25 basis points increase.

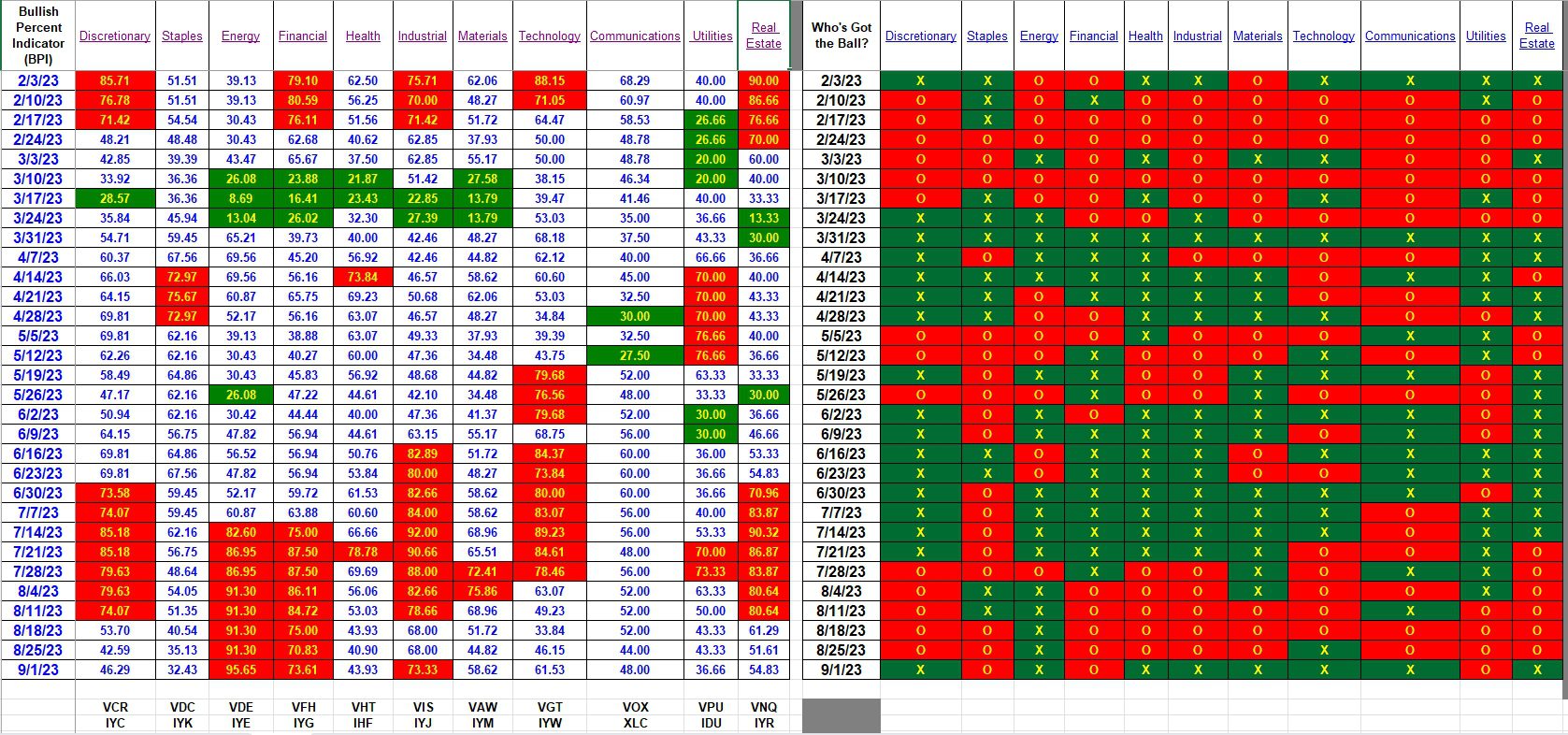

Sector BPI

Six sectors moved from bearish to bullish. Staples and Utilities are running in the opposite direction. I will pay attention to these two sectors in particular as either could easily dip into the oversold zone sometime this week. Were this to happen, I will post a comment linked to this post.

Investors holding Energy, Financial, or Industrial ETFs should have or place TSLOs as all three sectors are in the overbought zone.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

The error message, “You are here: Home / Oops! Wrong Membership Level” popped up on yesterday’s “Bethe Portfolio Review: 31 August 2023” link. I checked the dashboard and my membership displays as Platinum. This same problem happened a few months ago.

Thanks,

– Lee Cash

Lee,

Thank you for the notification. I fixed the problem so you should now be able to read the total Bethe post.

Lowell