Small fishing boat entering the S curve into Depoe Bay from the Pacific Ocean.

Normally I don’t review a portfolio this quickly since the last update, but the owner of the Schrodinger added new money so the portfolio could be tax managed. According to Schwab’s website an Intelligent Portfolio, of which the Schrodinger is an example, must reach a level of $50,000 before it is “tax managed.” The Schrodinger now exceeds this level. It will be interesting to see how Schwab negotiates the next bear market.

As mentioned many times, the Schrodinger is designed for the investor who has little interest or competence in managing investments. The Schrodinger is computer managed or what I call a Robo Advisor portfolio. After the initial setup all one does is save. Continue to add money to the portfolio when possible. The Schrodinger model is designed to answer the question, “Who will manage the family portfolio when I die?” The cost is zero and there is absolutely nothing to do but add new money to the portfolio. This portfolio is on automatic pilot.

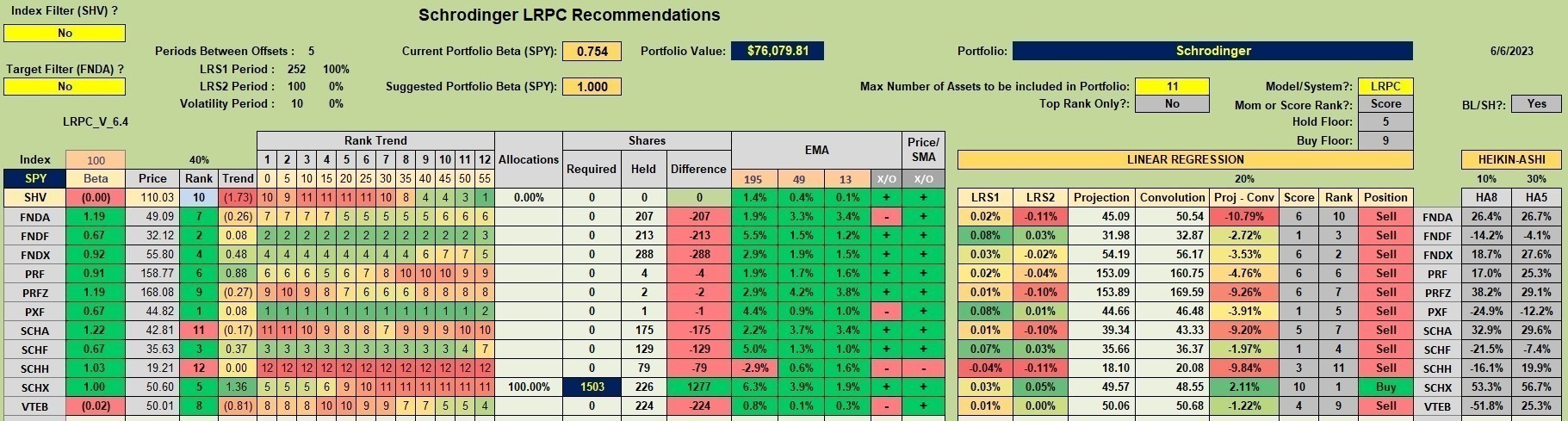

Schrodinger Investment Quiver

Below is the current investment quiver and holdings within the Schrodinger. Pay no attention to the Buy and Sell recommendations as the Kipling spreadsheet is not used to manage the Schrodinger. I include the following worksheet so readers can see which Exchanged Traded Funds (ETFs) Schwab uses to populate this Intelligent Portfolio and how many shares are invested in each. The Schrodinger is set up to be aggressively managed with an emphasis on U.S. Equities. This simply means that international equities are down-played.

I have no idea why the computer invested in PRF, PRFZ, and PXF as those three ETFs will make little difference in the portfolio performance. I consider them to be shard holdings.

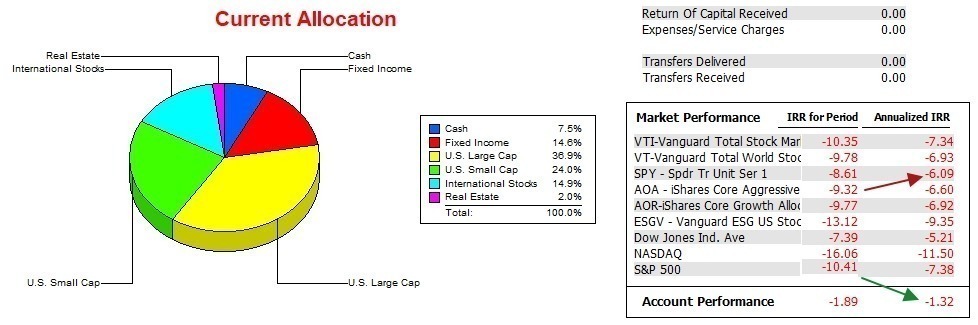

Schrodinger Performance Data

While the owner of the Schrodinger has held this portfolio for nearly six years, the following data only includes the past 17 months. Newer portfolios have been added to the ITA stable of portfolios and I want to compare return and risk over the same time frame. That is the reason for using a different launch date.

Over these past 17 months (includes the poor 2022 period) the Schrodinger managed to gain a significant edge on the S&P 500 (SPY). If I were to hazard a guess, the Schrodinger will outperform SPY in a bear market, but lose ground in a bull market.

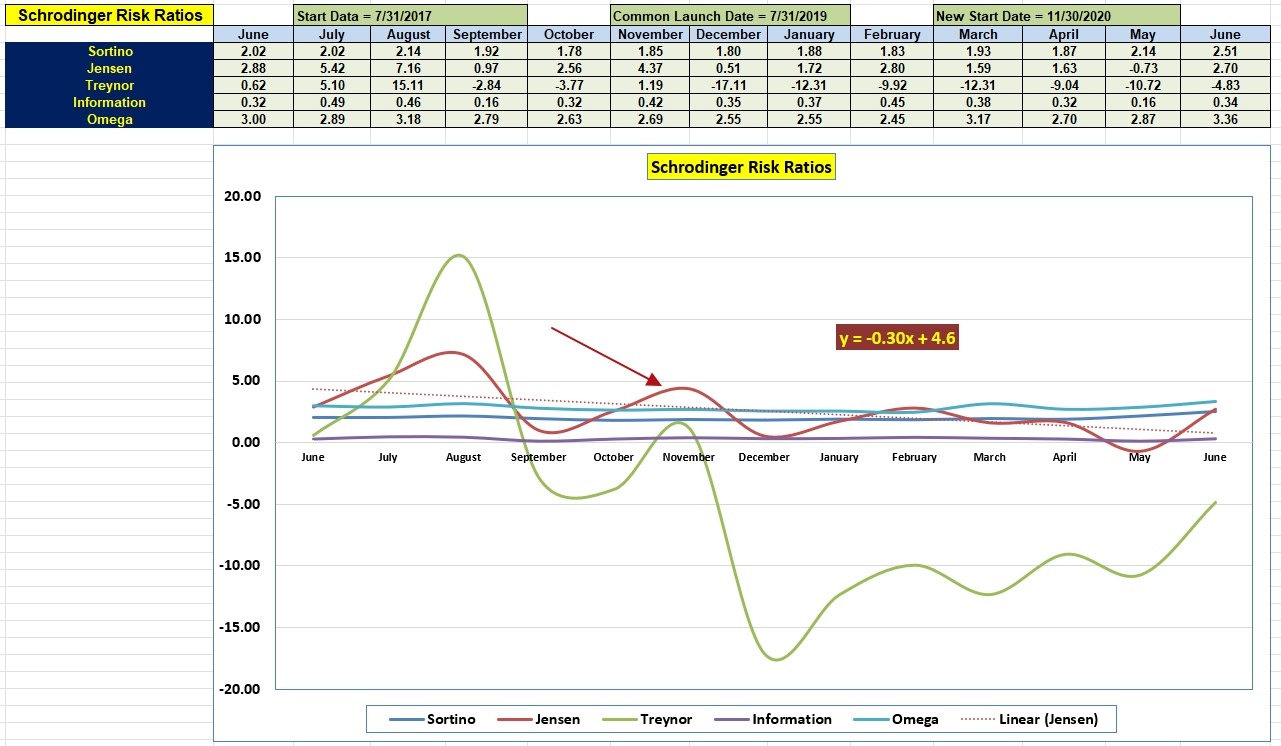

Schrodinger Risk Ratios

Over the past few months the portfolio has shown growth in the Jensen Alpha. Note the current 2.7 value. This is a high figure and anything above zero is positive. Once we clear the high from last August there is a good chance the slope of the Schrodinger will turn positive. Watch this space.

If you hired a professional money manager and are paying over 0.40% or 40 basis points, read these posts on self-management and the high cost of professional management. Also, check out my recommendation for splitting a portfolio into two parts where one part is managed by Schwab’s Intelligent Portfolio model. If you have questions, drop them in the comment section provided below.

Schrodinger Interim Update: 19 October 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

In an update of the performance spreadsheet this morning, the Schrodinger currently ranks #3 based on annualized Internal Rate of Return and #4 based on Relative Weight risk measurements. It is difficult to outperform this computer managed portfolio.

Only the Copernicus and Carson are besting the Schrodinger.

All four Sector BPI Plus portfolios are outperforming the SPY ETF or the S&P 500.

Lowell