Farming along the back roads of California.

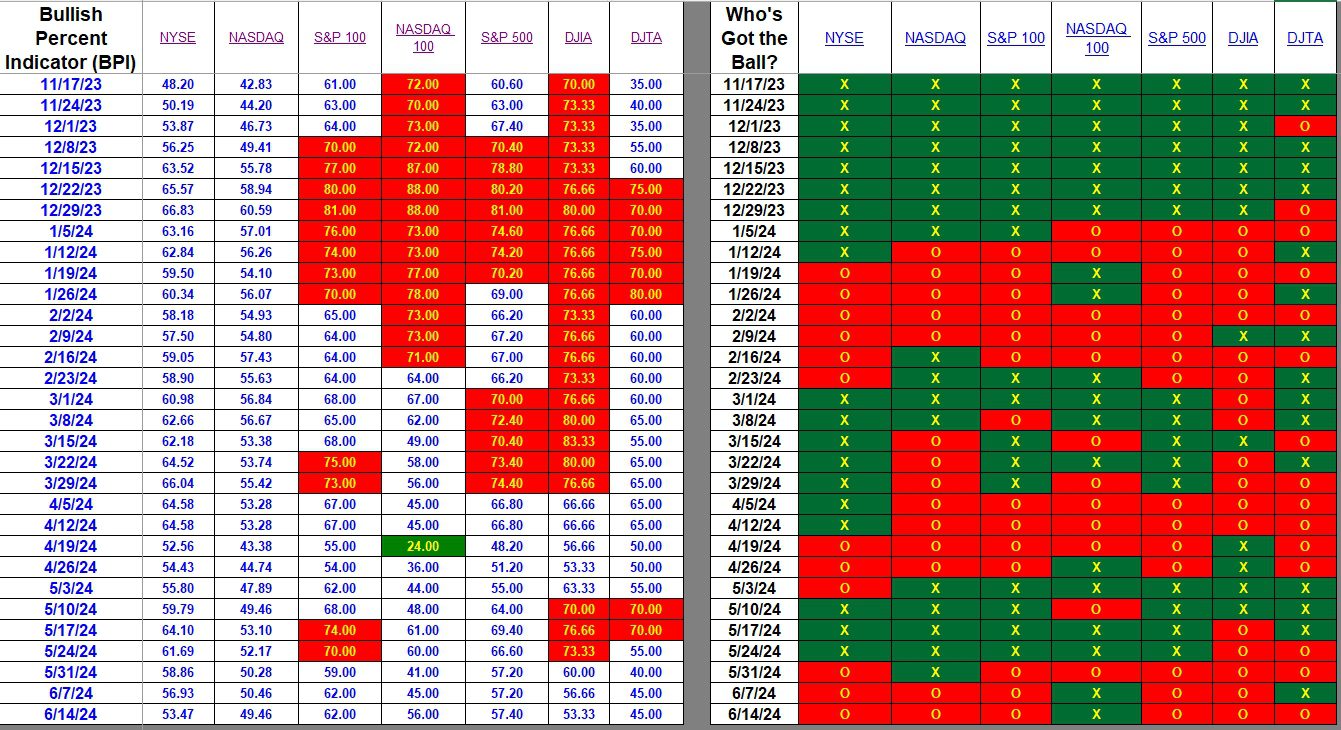

Bullish Percent Indicators were mixed this week. Both major indexes (NYSE and NASDAQ) declined in the number of bullish stocks. Large tech stocks performed well as we see improvement in the NASDAQ 100. We do not see broad strength in the U.S. Equities market. This is one of the reasons for holding a large percentage of cash in several portfolios.

Index BPI

Both the NYSE and NASDAQ are hovering near the 50% bullish zone. This indicates we are in neither a bull or bear market. Only the NASDAQ 100 and S&P 500 improved this week due to a few strong tech stocks.

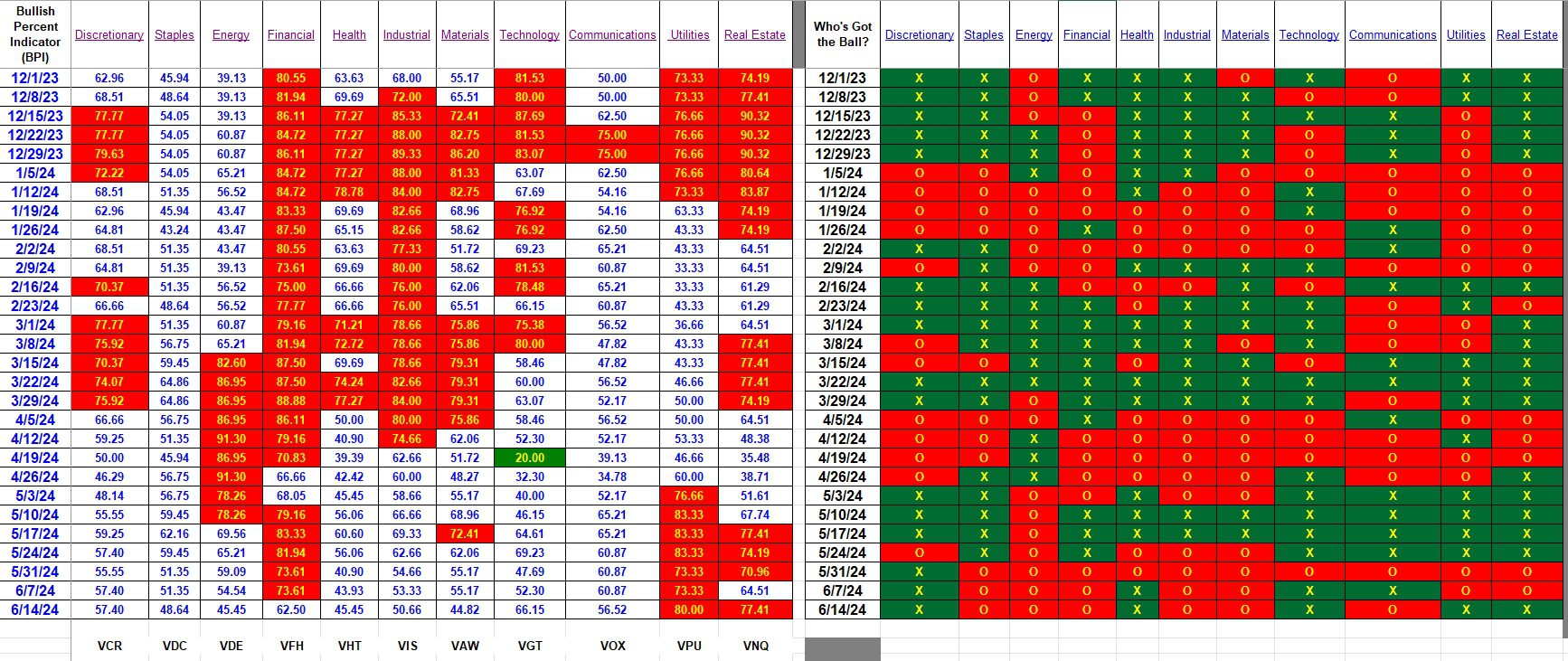

Sector BPI

No sectors are oversold so we don’t have any sector purchases to recommend. Check your portfolio to see if you hold Utilities (VPU) or Real Estate (VNQ). As I recall, most of those sectors ETFs were sold off a few weeks ago. Nevertheless, check to see if TSLOs are in place or if they need to be set for these two sectors.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.