Cabin is a state of arrested decay.

As one of several Asset Allocation portfolios, the Huygens is beginning to meet all the percentage requirements. There are still a few asset classes that are oversubscribed or above the recommended percentage due to holdovers from the prior investing model. VB and VTI are two equity ETFs that are out of balance on the high side.

Third quarter dividends will provide a bit of cash to begin adding shares to asset classes on the low side. TLT is where we will first focus.

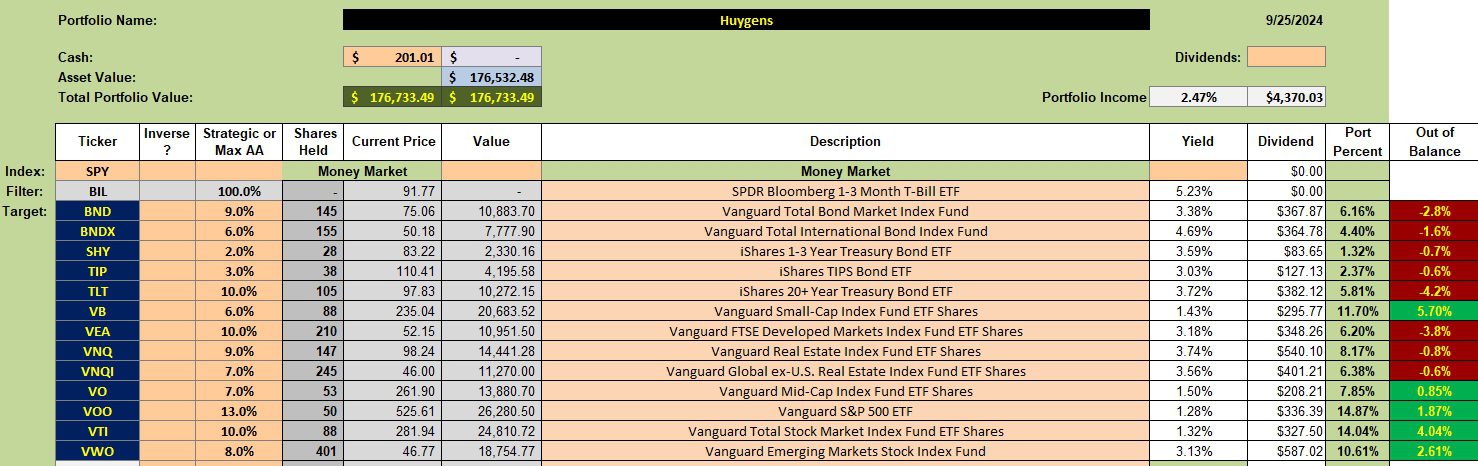

Huygens Asset Allocation Structure

Below is the investment quiver and current holdings for the Huygens. New cash will be invested in TLT and after we have that asset closer to the balance percentage we will go to work on VEA or developed international equities. Any new money will be invested in the asset class most “under water” when it is review time.

The goal is to do no selling, but use fresh cash and dividends to bring asset classes below target back into balance.

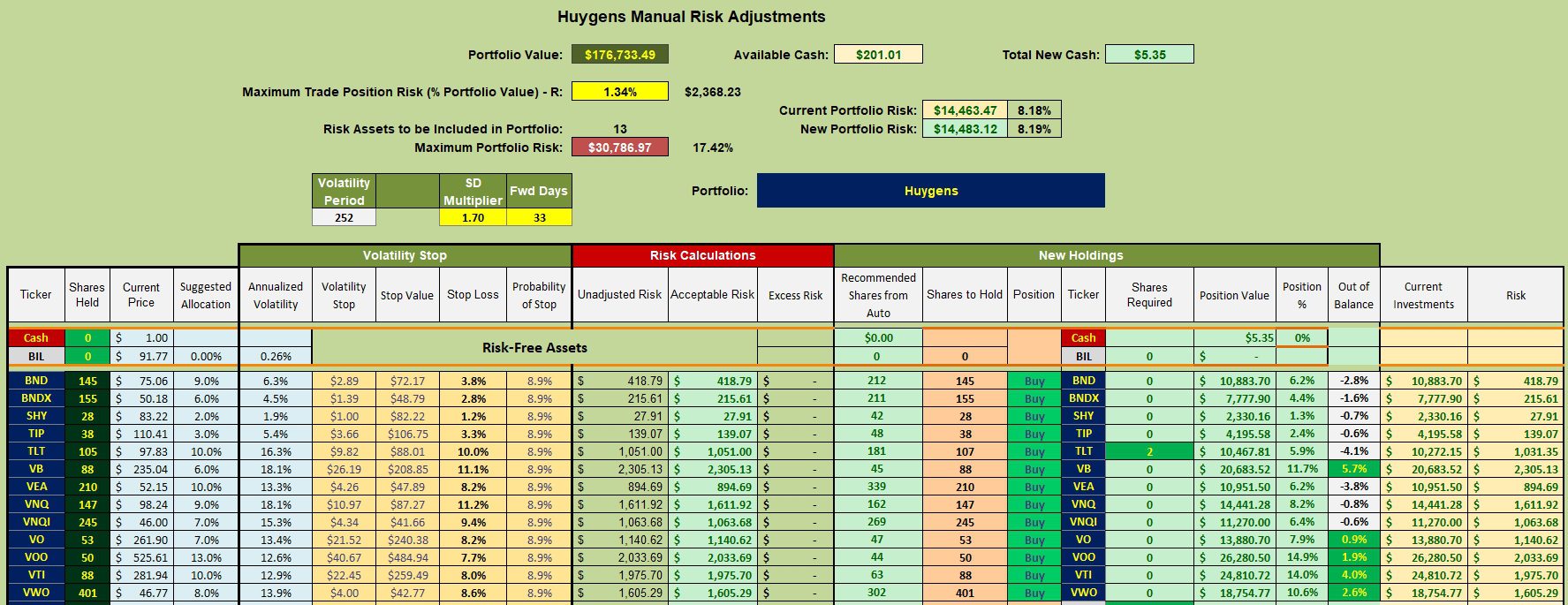

Huygens Rebalancing Recommendations

Cash is currently limited so the only recommendation is to set a limit order to purchase two (2) shares of TLT at $97.00/share.

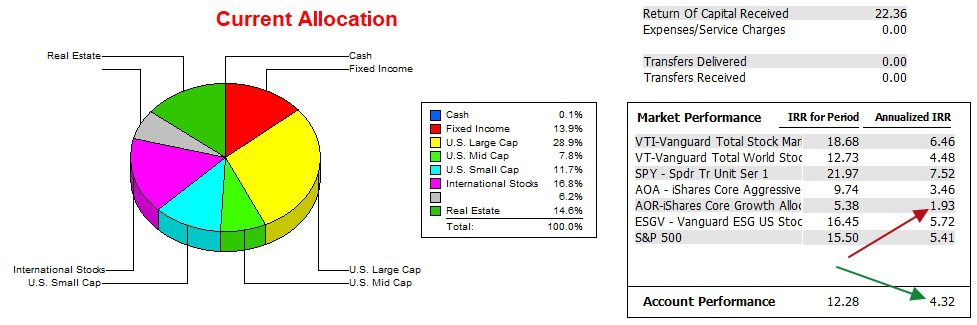

Huygens Performance Data

Since 12/31/2021 the Huygens has managed to outperform the AOR benchmark.

In the pie chart I think the gray area is treasuries.

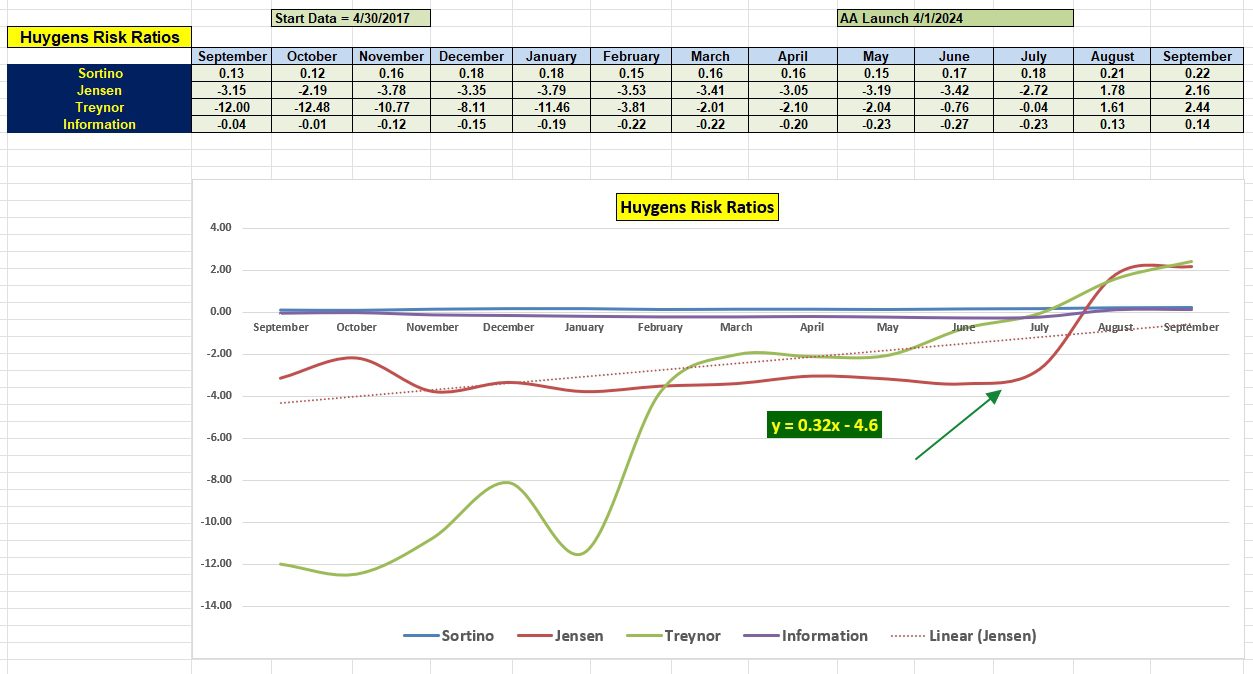

Huygens Risk Ratios

We don’t have much historical data for the Huygens when it comes to the Asset Allocation model. We are into this model with the Huygens for less than six months.

The positive slope for the Jensen is a positive signal. Now we need to extend this positive metric over the remainder of the year and beyond.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question