Ruins in Turkey

Based on BPI data for this week, it was a positive five days for U.S. Equities. There were two exceptions among the eleven sectors, but overall it was a good week for stocks.

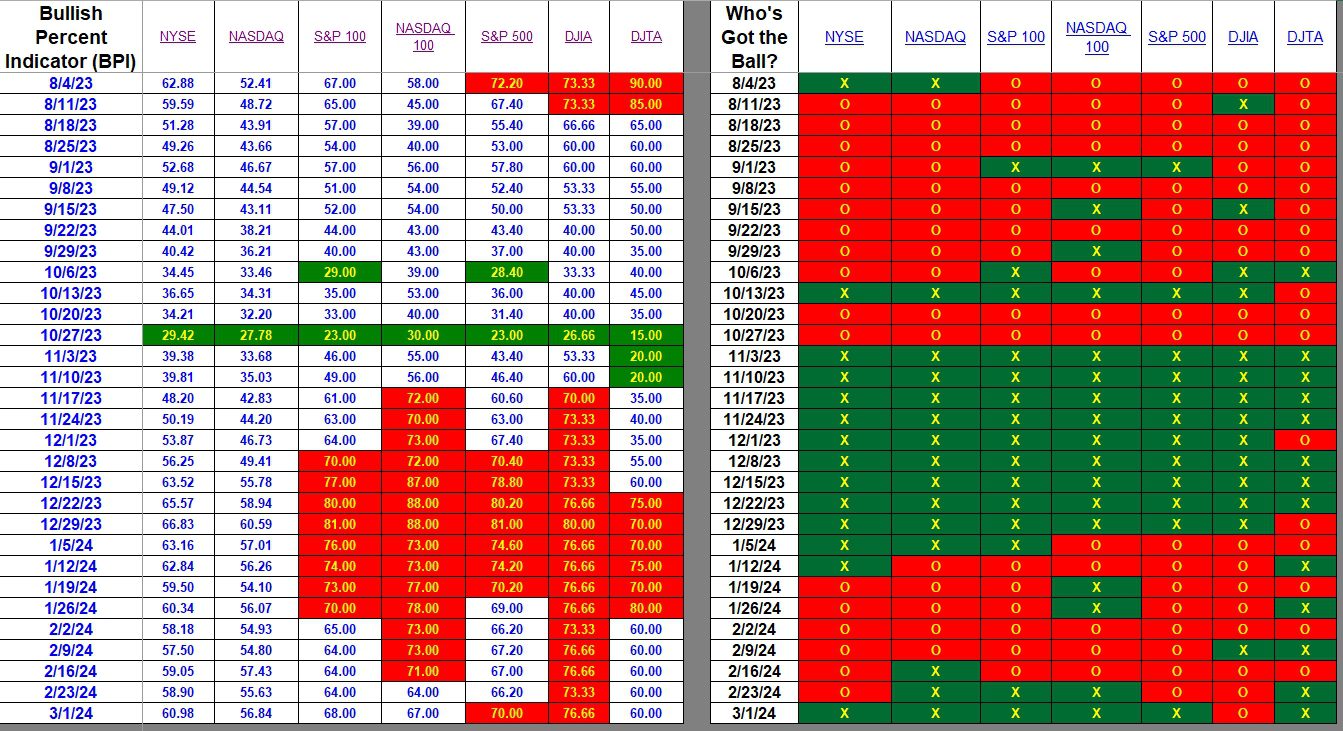

Index BPI

All indexes are bullish with exception of the DJIA and that is an anomaly as the percentage of bullish stock are higher. Due to mid-week action Friday’s Point and Figure (PnF) chart shows up bearish. Situations such as this one is why I pay more attention to the specific percentages and look to the X’s and O’s for a quick overview of what happened from week to week.

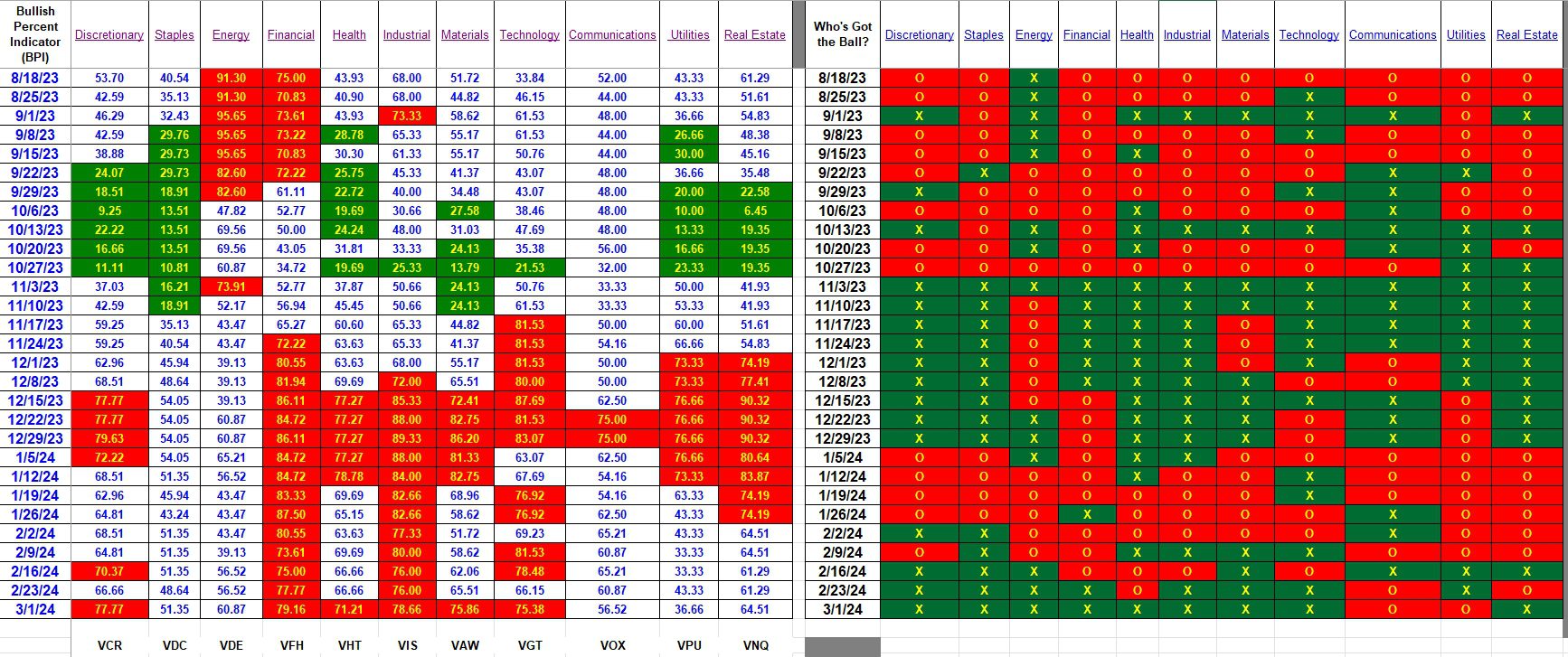

Sector BPI

Now we come to the sectors to see if there is any guidance for this coming week.

- No sectors are in the oversold zone which means there are no sectors with a 30% or lower bullish percentage. Utilities (VPU) comes closest. Readers will recall Utilities hit the oversold zone mid-week a few weeks ago and we managed to purchase a number of shares in most of the Sector BPI portfolios.

- Six of the eleven sectors are overbought. These are sectors with a 70% or higher bullish percentage. I think the Sector BPI portfolios are not holding any of the overbought sectors. Most portfolios are down to Staples (VDC) and Utilities (VPU).

The only action planned this week is to check each portfolio as it comes up for review to see if any of the oversold sector ETFs are held in the portfolio. Available cash will be invested in either VOO or VTI in an effort to participate in further upward movement of U.S. Equities. Check the middle footer to see what portfolios are scheduled for review this coming week.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.