Crystal Springs – Portland, OR

While this past week was purported to be one of the weakest weeks for equities since last March, the Bullish Percent Indicators paint a slightly less pessimistic picture. While every major index, with exception of the two Dow indexes, declined slightly, all with exception of the NASDAQ 100 remain bullish. Portfolio values did decline this week adding to the old adage, “Sell in May and go play.” Several analysts viewed on CNBC are predicting a flat market for the remainder of the summer. My advice is to remain committed to your investment plan and let the market do its work.

Index BPI

Only the NASDAQ 100 is bearish while the DJTA held firm and the DJIA moved into overbought territory. As mentioned in another blog post, mega-cap stocks are buoying the equity markets while the mid- and small-cap stocks are going nowhere.

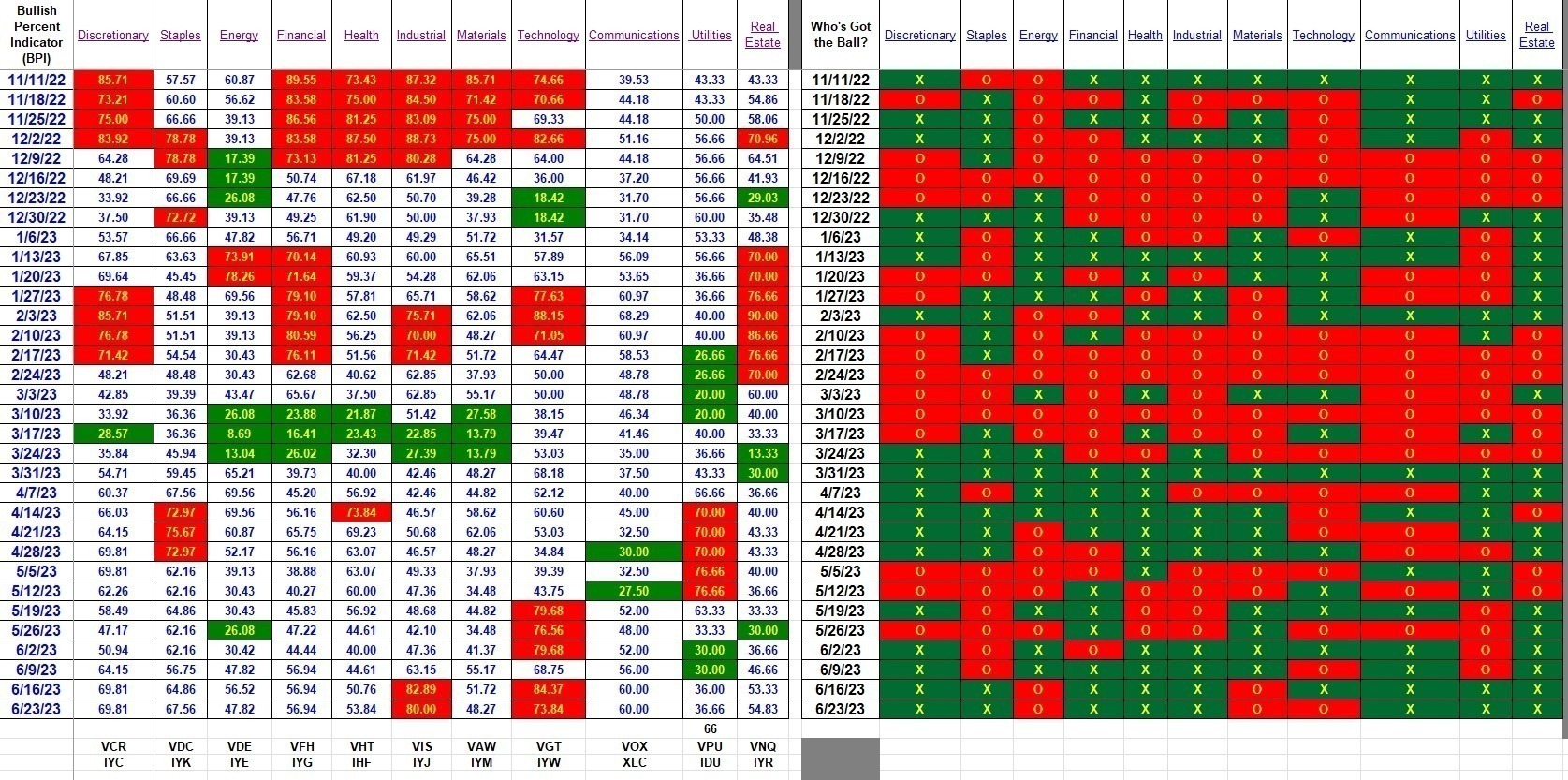

Sector BPI

Industrial and Technology sectors remain overbought so ETFs VIS and VGT are TSLO candidates. Place a 3% Trailing Stop Loss order on IYW or VGT if held in your Sector BPI portfolio. As for VIS or IYJ, place a 2% TSLO since the BPI value is 80% bullish. Most Sector BPI advocates likely have these orders in place already.

None of the sectors are oversold so there are no Buy recommendations. If the Sector BPI portfolio holds cash the recommendation is to use the Kipling spreadsheet to provide guidance as to which equity ETFs to put the excess cash to use. I’ll plan to update one Sector BPI Plus portfolio on Monday so readers can read about such an investment move.

Explaining the Hypothesis of the Sector BPI Model

The Argument for Self-Management

Constructing a “Core” Investment Portfolio : Part 3 – Risk Parity and Volatility Targeting

The ITA Wealth Management blog is now free to all who register as a Guest. Pass the URL ( https://itawealth.com ) of this blog on to your friends and family. Post the link on Facebook to gain a broader audience. I thank you in advance.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Latest BPI sector data as of 6/27/2023 is that Industrial (VIS or IYJ) and Technology (VGT or IYW) are overbought and therefore are candidates to liquidate.

I assume most users of the Sector BPI model already have TSLOs set for these sector ETFs as this call has been in existence for three weeks.

With yesterdays strong day I thought other sectors might move into the overbought zone. Such a move did not occur. I suspect smaller cap stocks are still not moving and it is the mega-cap stocks that are driving the U.S. Equities market.

Lowell