Hollywood House

This was a good, but not stellar week for U. S. Equities. Nearly every index and sector Bullish Percent Indicator (BPI) either gained or held steady this week. The one major change happened in the Financial sector as it moved into the overbought zone. This will require attention in those portfolios that might be holding shares of VFH and/or RSPF. I don’t think any portfolios hold RSPF as the equal-weight ETFs are a new addition to the Sector BPI investing model.

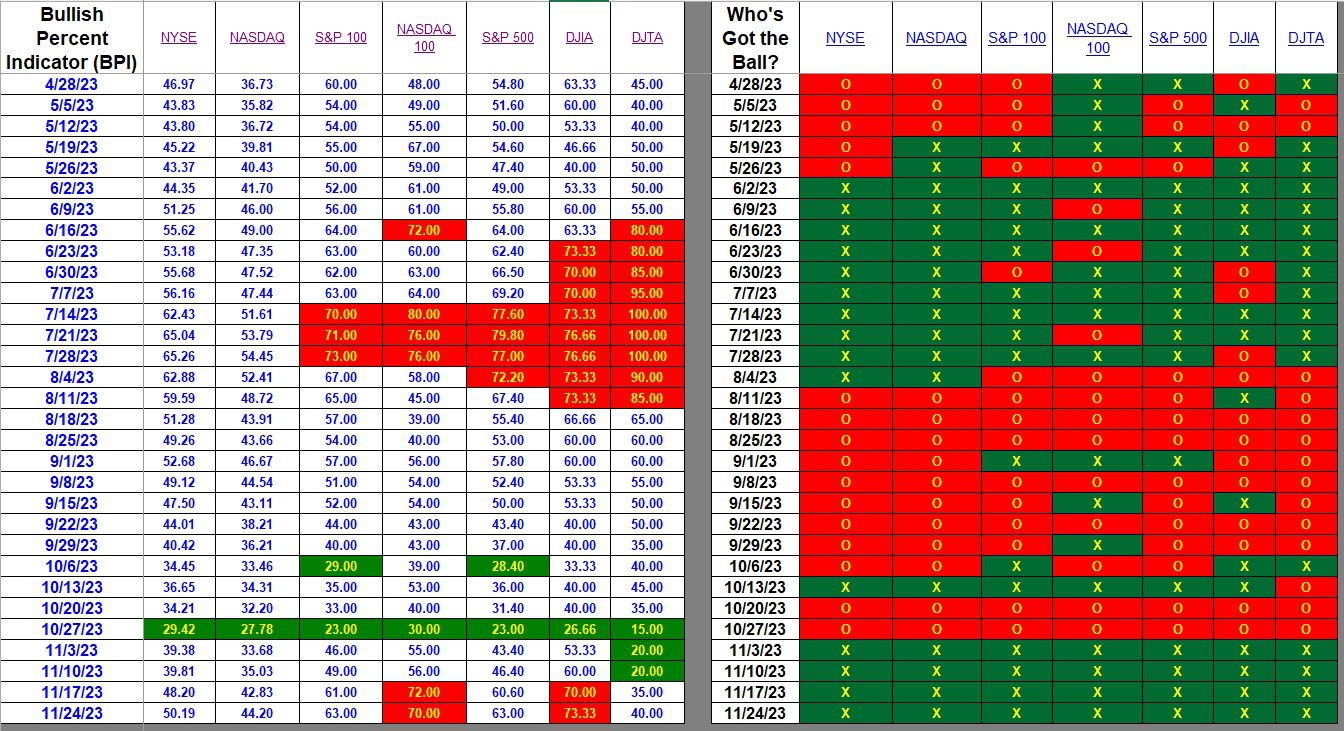

Index BPI

All seven major indexes remain bullish. Only the NASDAQ 100 showed a two percentage point drop and that is insufficient to flip the index from a bullish BPI to a bearish BPI.

The two primary indexes I watch are the NYSE and NASDAQ. Both are hovering around the 50% bullish level indicating the small- and mid-cap stocks are not driving this market.

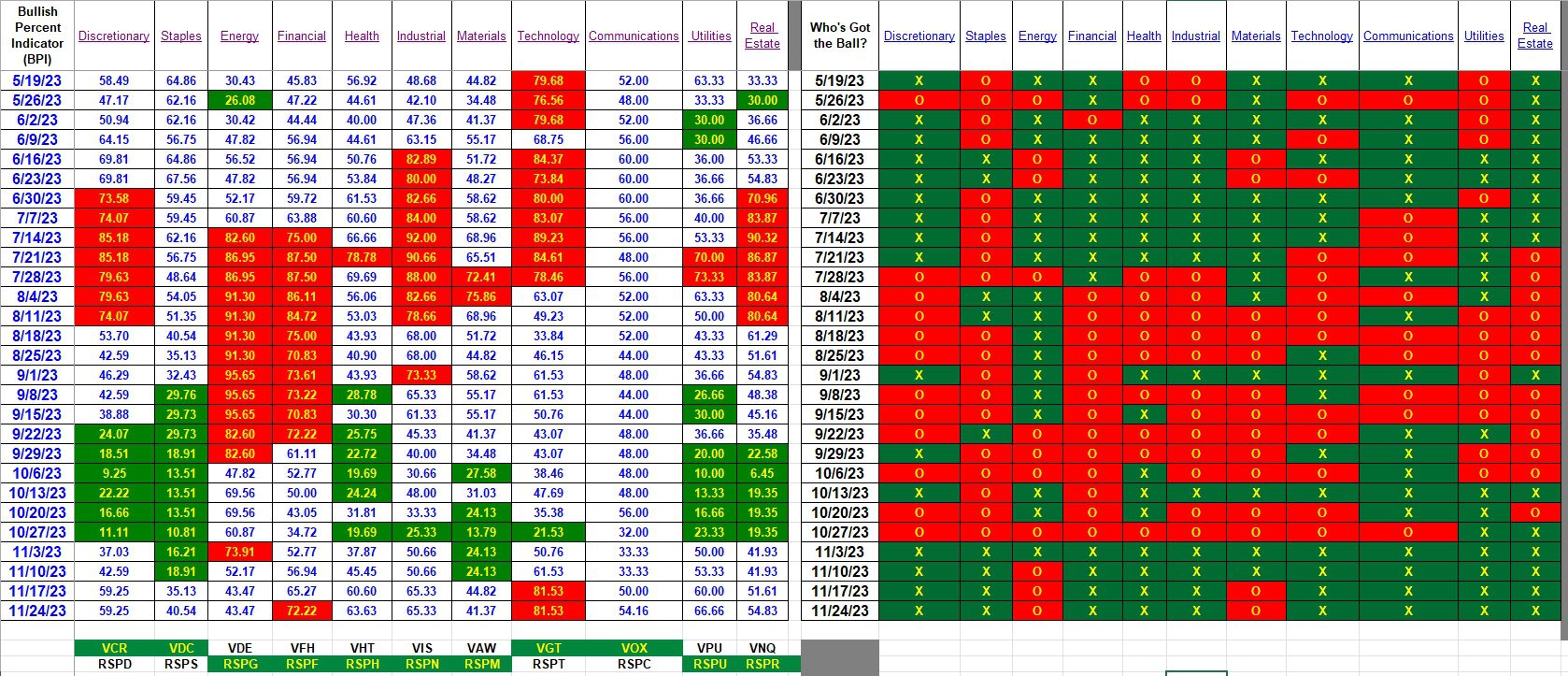

Sector BPI

Energy and Materials continue in the bearish position (right hand section of the following table) while the remaining sectors are bullish. Financials joins Technology as an overbought sector and as a result I will be going through all the Sector BPI portfolios this weekend and setting 3% Trailing Stop Loss Orders (TSLOs) for VFH in those portfolios holding shares in this ETF. If the portfolio is housed at Schwab I will set a 2.8% TSLO since the BPI is 72.22% bullish. If the BPI, for example, happened to be 76% bullish, the TSLO would be set at 2.4%. Schwab permits decimal TSLOs while TD Ameritrade only permits whole percentage values.

The ITA blog is now free to all users who register as a Guest. Former Platinum members have been grandfathered into the Lifetime membership.

Pass the https://itawealth.com URL on to your friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I went through the Sector BPI portfolios and set TSLOs for any of the overbought sector ETFs. TSLOs for VGT were already in place so most of the new settings were for Financials.

Lowell

Moments ago I checked the sector BPI data and Utilities (VPU) is overbought as it reached the 70% bullish zone.

The recommendation is to place a 3% TSLO on VPU or the Utilities ETF you might be using. I’ve set TSLOs on all VPU holdings.

Lowell