Spring Dining.

Updating the Bullish Percent Indicator data is important this week as there are a few changes in the sector arena. Technology dipped into the oversold zone this week, but rebounded and is no longer recommended for purchase. I hope readers checked the Forum section of this blog to pick up that Buy recommendation when the sector was oversold.

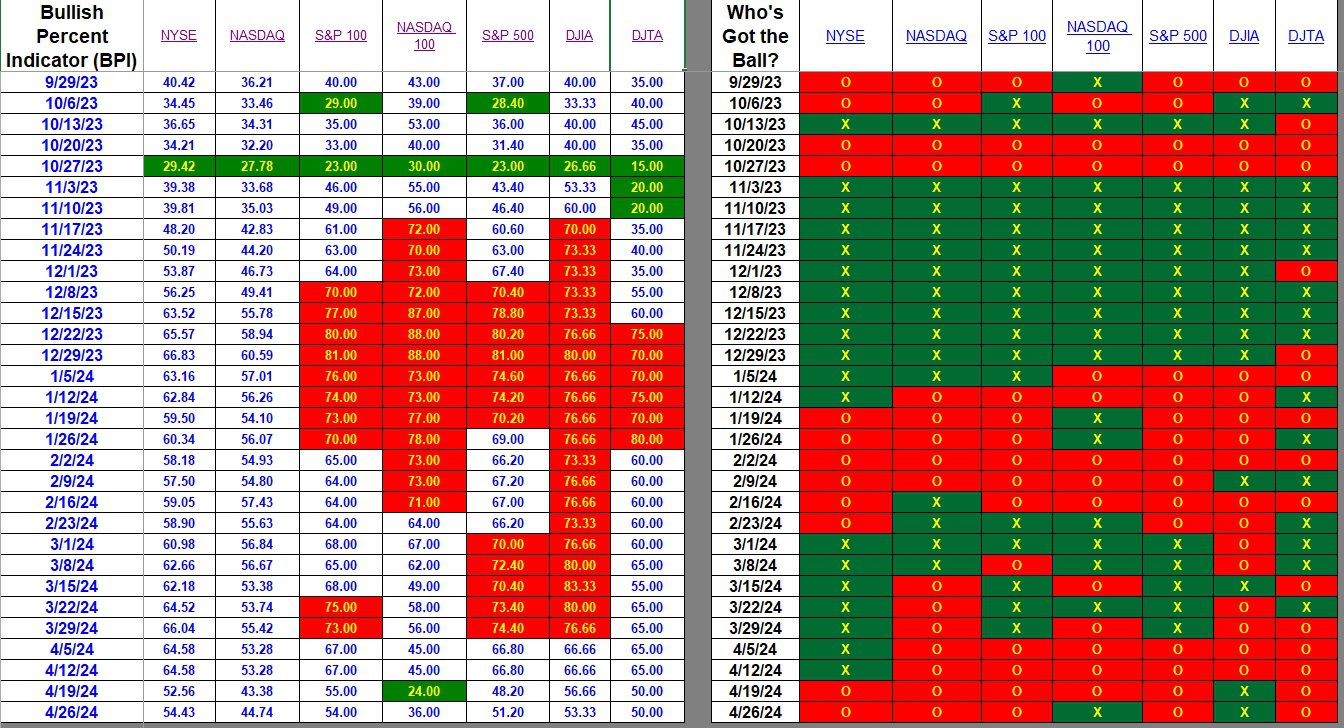

Index BPI

The NASDAQ 100 snapped back a tad this week and we know there are many tech stocks in this index. Stocks in the NASDAQ 100 account for VGT rebounding. We see slight improvement in both the NYSE and NASDAQ, the two primary indexes.

Overall, with several indexes hovering around the 50% bullish area, U.S. Equities are fairly priced. As we head into the summer months I anticipate a rather dull market until after the election. Stick with the investing models you are using to manage your portfolios.

Next week will be a busy one as five portfolios are up for review.

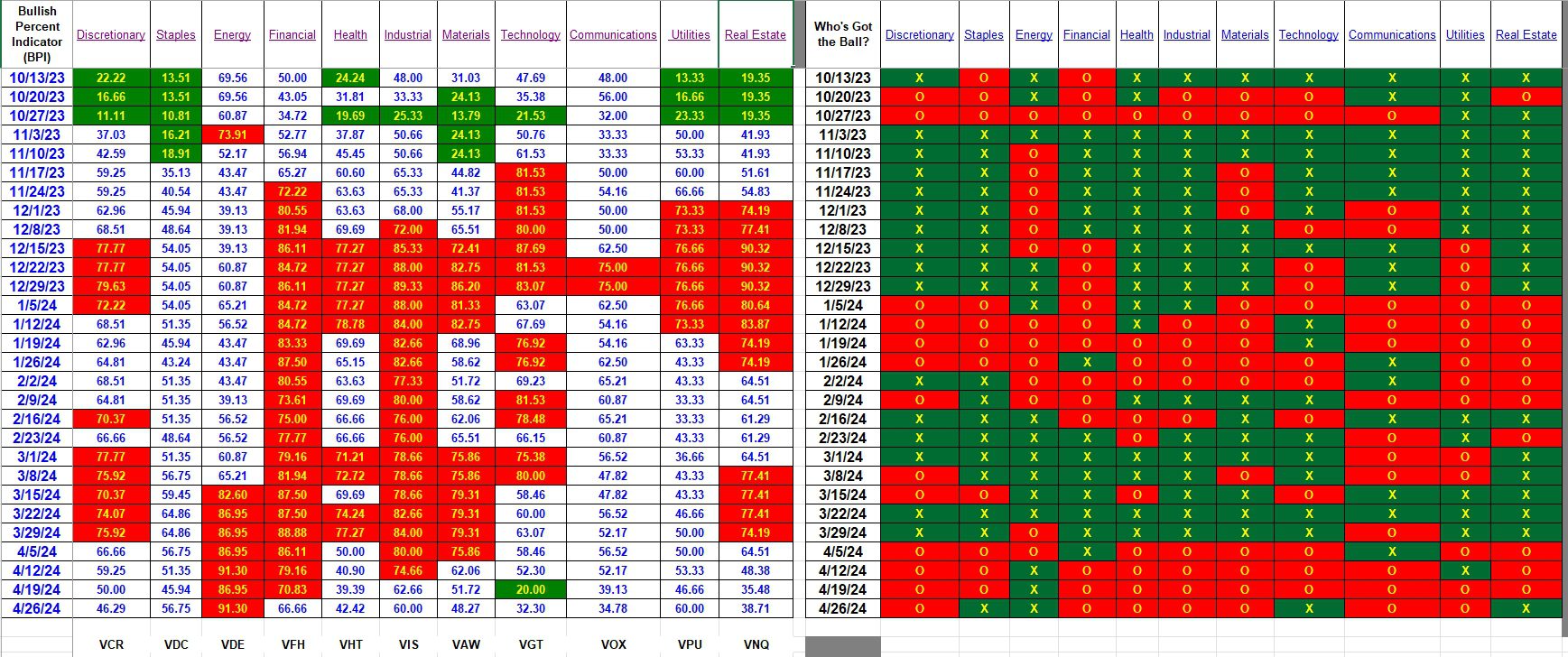

Sector BPI

Readers unfamiliar with the Sector BPI model will find more information by searching the blog for portfolios such as Carson, Millikan, Franklin, Gauss, Kepler, etc. Here is a summary of the logic behind this investing model.

- Use the following Sector BPI data table to see what sectors are in the oversold zone. Oversold is when the percentage of stocks within a sector drop to 30% or below. Point and Figure (PnF) graphs are used to determine bullish or bearish positions. When the oversold condition occurs populate the portfolio with the Vanguard ETFs for that particular sector. For example, this past week Technology moved into the oversold zone so we purchased shares of VGT.

- Rule 2 is to place a 3% Trailing Stop Loss Order on the sector ETF when that sector moves to 70% bullish or higher. Energy is currently overbought so we have a TSLO set for VDE if it is held in any of the Sector BPI portfolios.

A number of portfolios tracked here at ITA Wealth Management are using this model with great success. While it is still to early to draw definite conclusions, the early results are positive. The Carson portfolio is the oldest one using this model so check it out.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.