Botanic Gardens, Singapore

The Darwin Portfolio is a risk-adjusted allocation model with volatility targeting used to determine how many shares of each asset to hold. The portfolio holds only 5 conventional, but diversified, asset classes plus a 10% holding in a volatility product (depending on whether volatility is expected to increase or decrease) as a portfolio hedge.

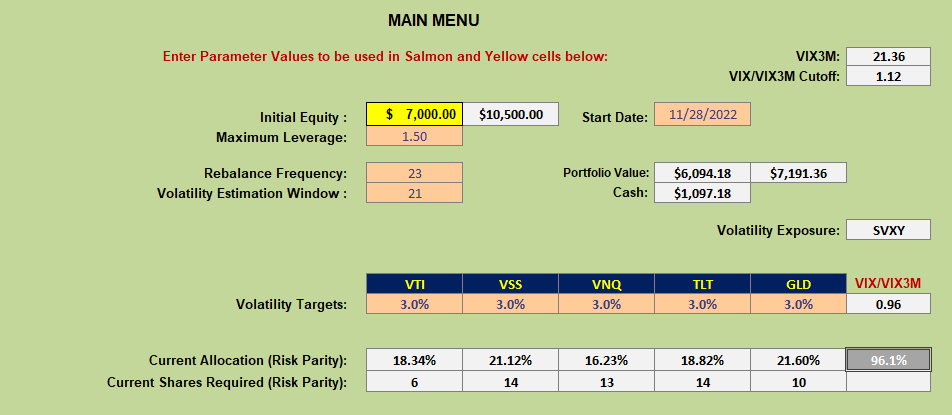

A current analysis of the portfolio generates the following recommendations regarding assets to be held:

Maybe a little surprisingly the recommendations are to hold more shares than are presently held. Since this is a small portfolio and I don’t want to overtrade and generate unnecessary commissions I only adjust holdings if the number of shares recommended differs from current holdings by more than 20%. As it turns out 4 of the 5 assets currently held are 20% below the recommended values. I have therefore adjusted holdings accordingly. Only VNQ does not now match the recommended holdings and remains at 12 shares rather than 13 (<20% difference). The increased recommended holdings are a result of lower volatility levels from the high levels at the end of 2022 resulting from the bearish market pullback.

Maybe a little surprisingly the recommendations are to hold more shares than are presently held. Since this is a small portfolio and I don’t want to overtrade and generate unnecessary commissions I only adjust holdings if the number of shares recommended differs from current holdings by more than 20%. As it turns out 4 of the 5 assets currently held are 20% below the recommended values. I have therefore adjusted holdings accordingly. Only VNQ does not now match the recommended holdings and remains at 12 shares rather than 13 (<20% difference). The increased recommended holdings are a result of lower volatility levels from the high levels at the end of 2022 resulting from the bearish market pullback.

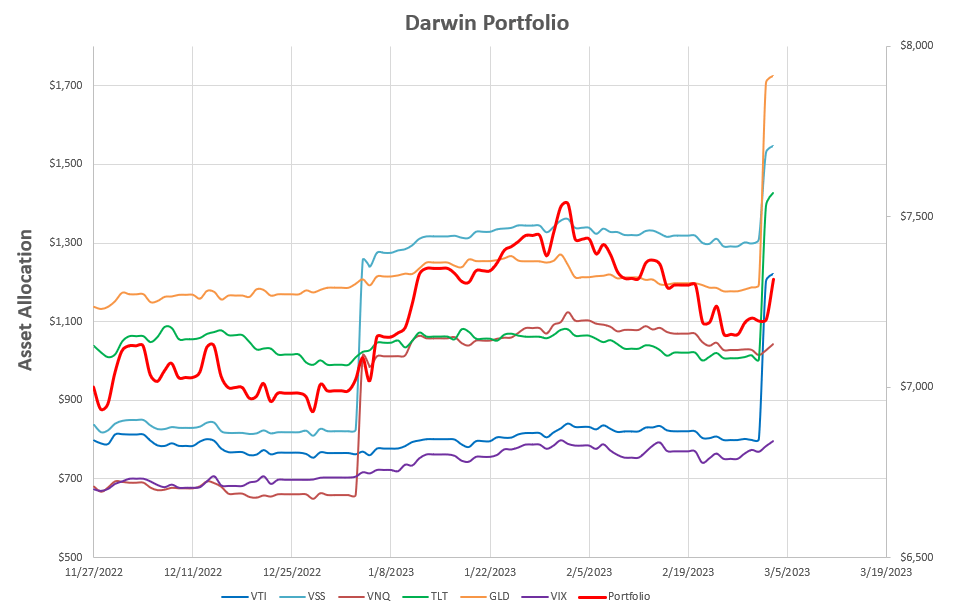

Let’s take a look at performance since I changed the target risk level (per asset) to 3% (from the original, overly aggressive, 10%). At 3% per asset target volatility, portfolio volatility is likely to fall well below 15% (5 assets x 3%/asset) due to the impact of diversification.

As can be seen from the above screenshot, holdings are now increased significantly – in fact, since this portfolio is held in a margin account and I have set the calculations to allow up to 1.5x leverage, a little of that margin is currently borrowed money.

As can be seen from the above screenshot, holdings are now increased significantly – in fact, since this portfolio is held in a margin account and I have set the calculations to allow up to 1.5x leverage, a little of that margin is currently borrowed money.

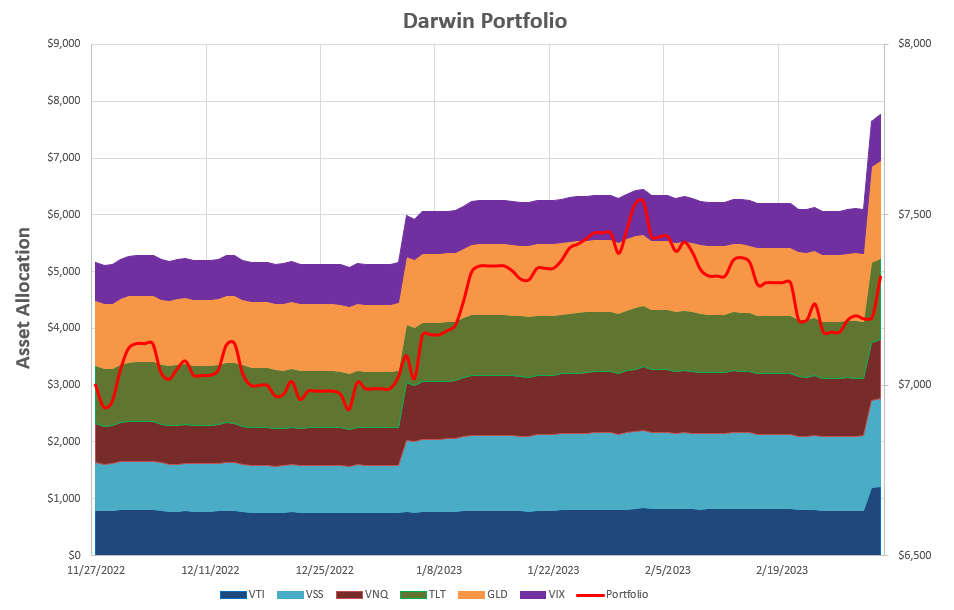

Another way of seeing these allocations is through the use of a stacked chart:

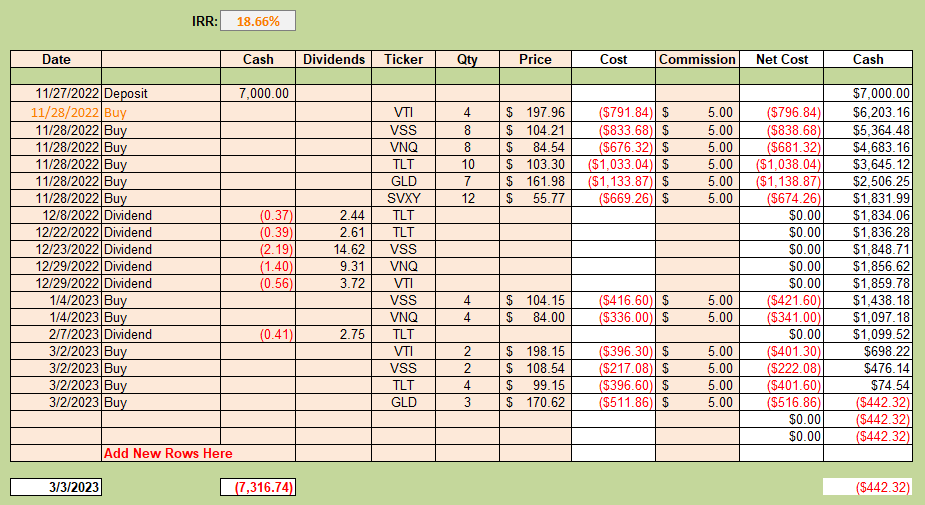

The following screenshot shows the activity in the portfolio since moving to the 3% volatility limits:

The following screenshot shows the activity in the portfolio since moving to the 3% volatility limits:

and shows the use of ~$440 in excess margin.

and shows the use of ~$440 in excess margin.

It has only been 3 months since this model was setup but current Internal Rate of Return (IRR) is showing as a little over 18%. I would be very happy if this level of performance could be maintained – but I am doubtful that this is realistic over the longer term.

Not shown in the above screenshots is the fact that portfolio volatility over this period is calculated at 9.5% – so well below the maximum target level of 15%.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Several amazing photographs of flowers from your recent trip.

Lowell

Lots more to come 🙂