Boat Harbor, Auckland, New Zealand

The Kahneman-Tversky (K-T) Portfolio is a simple Dual Momentum Portfolio using different lookback periods to measure momentum/relative strength in separate portions of the total portfolio. The Portfolio only has a choice of 3 assets from which to choose – VTI (US Equities), VEU (International Equities – ex USA) or TLT (Long Term Treasuries) although the benchmark AOR fund may be held if it seems that a blended asset class may perform better.

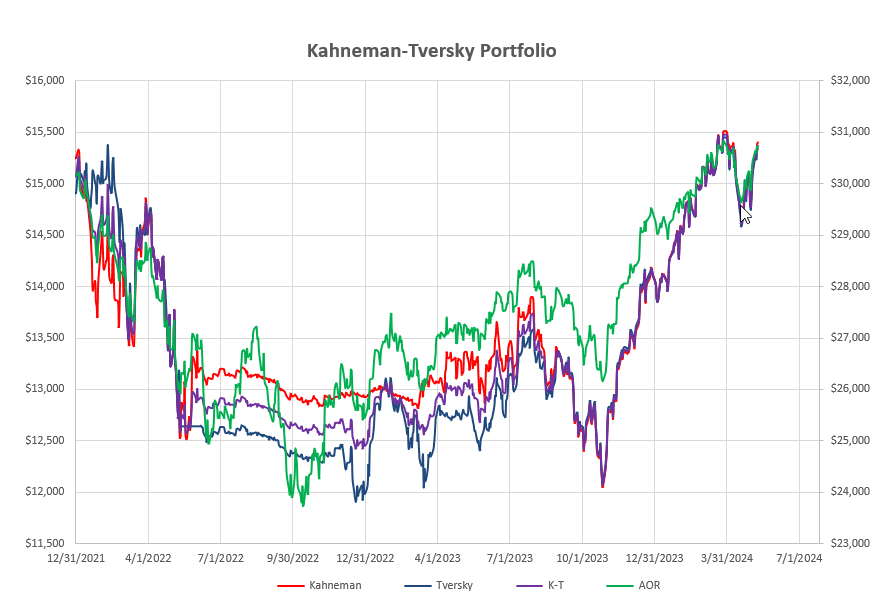

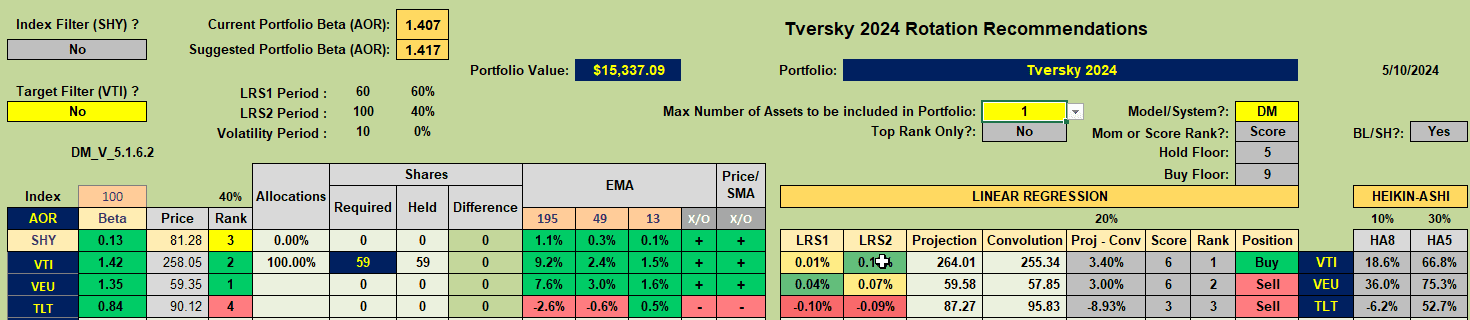

Currently, both portions of the portfolio are holding the same asset – VTI, or US Equities, and this is leading to the following performance:

where returns over the past ~28 months are virtually identical to the diversified benchmark AOR Fund after seeing some differences through the 2022 downturn in US Equity markets.

where returns over the past ~28 months are virtually identical to the diversified benchmark AOR Fund after seeing some differences through the 2022 downturn in US Equity markets.

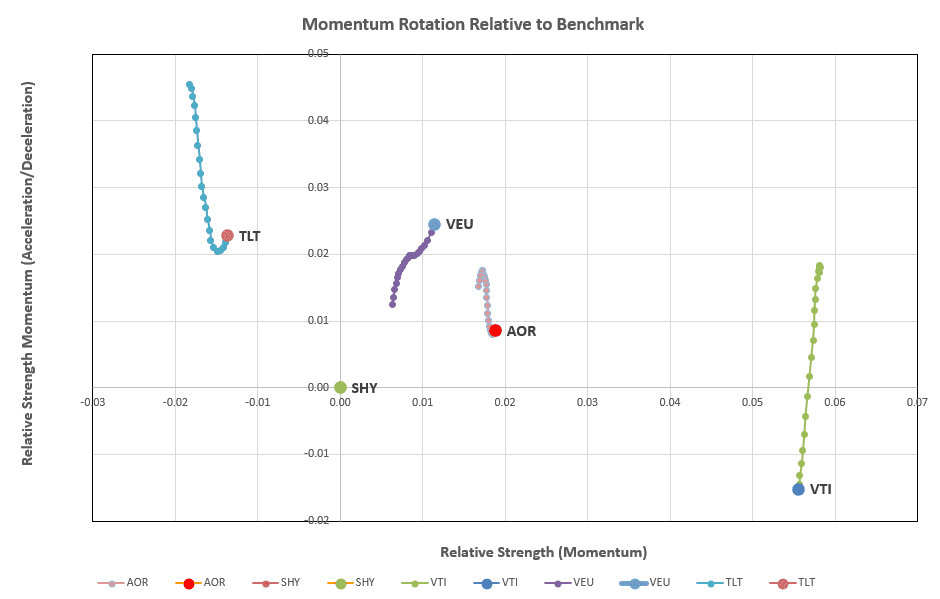

Checking on the relative performance of the assets in the portfolio quiver using a longer-term lookback (the “slow” Kahneman portion of the portfolio) we see the following:

with US Equities showing short term weakness (downward vertical movement) but stronger longer term relative strength (further to the right on the horizontal axis) than the other assets in the quiver. VEA is showing the better strength in the short term.

with US Equities showing short term weakness (downward vertical movement) but stronger longer term relative strength (further to the right on the horizontal axis) than the other assets in the quiver. VEA is showing the better strength in the short term.

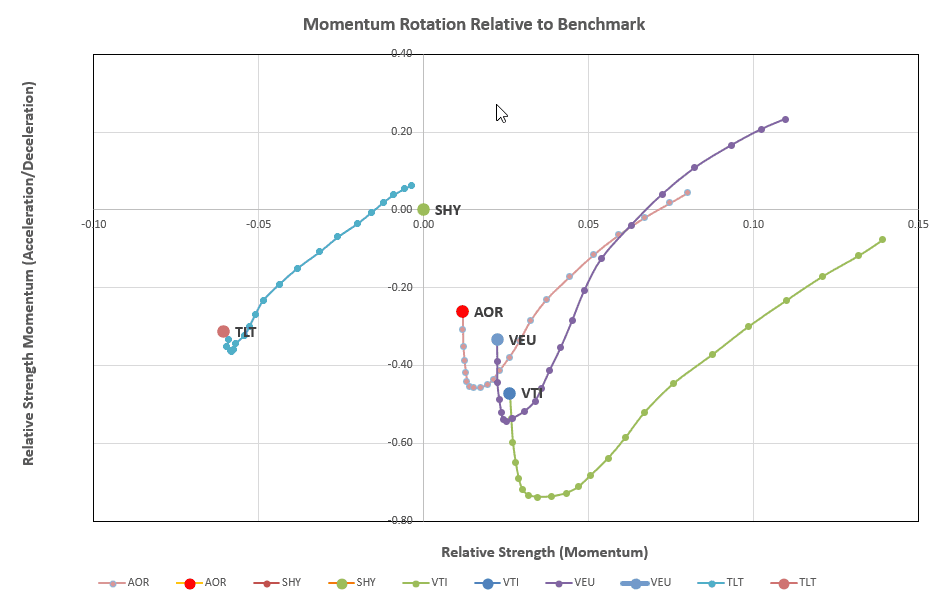

Moving to the picture for the “fast” moving Tversky portion of the portfolio:

we see short-term strength (upward vertical movement) in all assets but with VTI still leading in the longer (horizontal/intermediate) term performance. Unlike for the Kahneman portion of the portfolio, over these intermediate time frames, VEU leads the benchmark AOR fund – however, we see deceleration (all below the horizontal axis), or slowing of momentum, in all assets.

we see short-term strength (upward vertical movement) in all assets but with VTI still leading in the longer (horizontal/intermediate) term performance. Unlike for the Kahneman portion of the portfolio, over these intermediate time frames, VEU leads the benchmark AOR fund – however, we see deceleration (all below the horizontal axis), or slowing of momentum, in all assets.

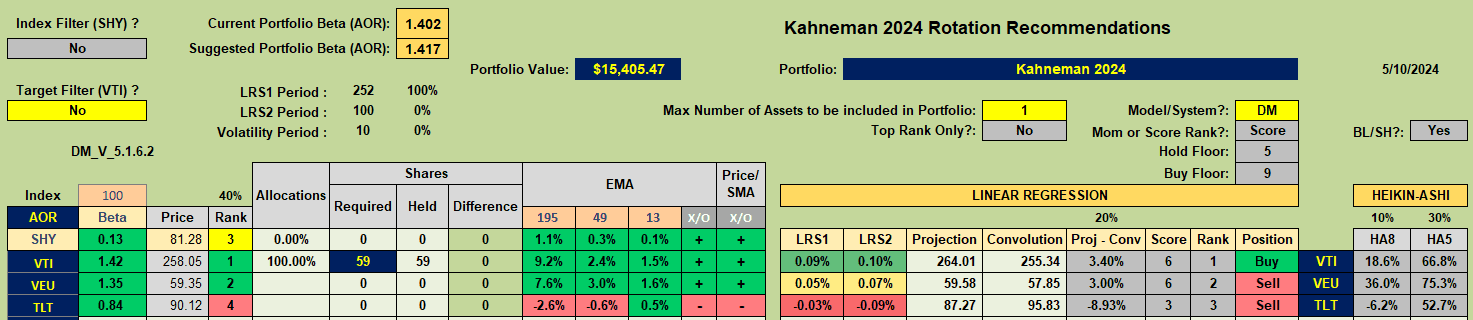

Since the K-T portfolio favors the longer term momentum measurements for selecting the asset to hold, both portions of the portfolio still show VTI as the asset-of-choice to hold:

Consequently, no adjustments are called for at this time and the portfolio will continue to hold only VTI.

Consequently, no adjustments are called for at this time and the portfolio will continue to hold only VTI.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question