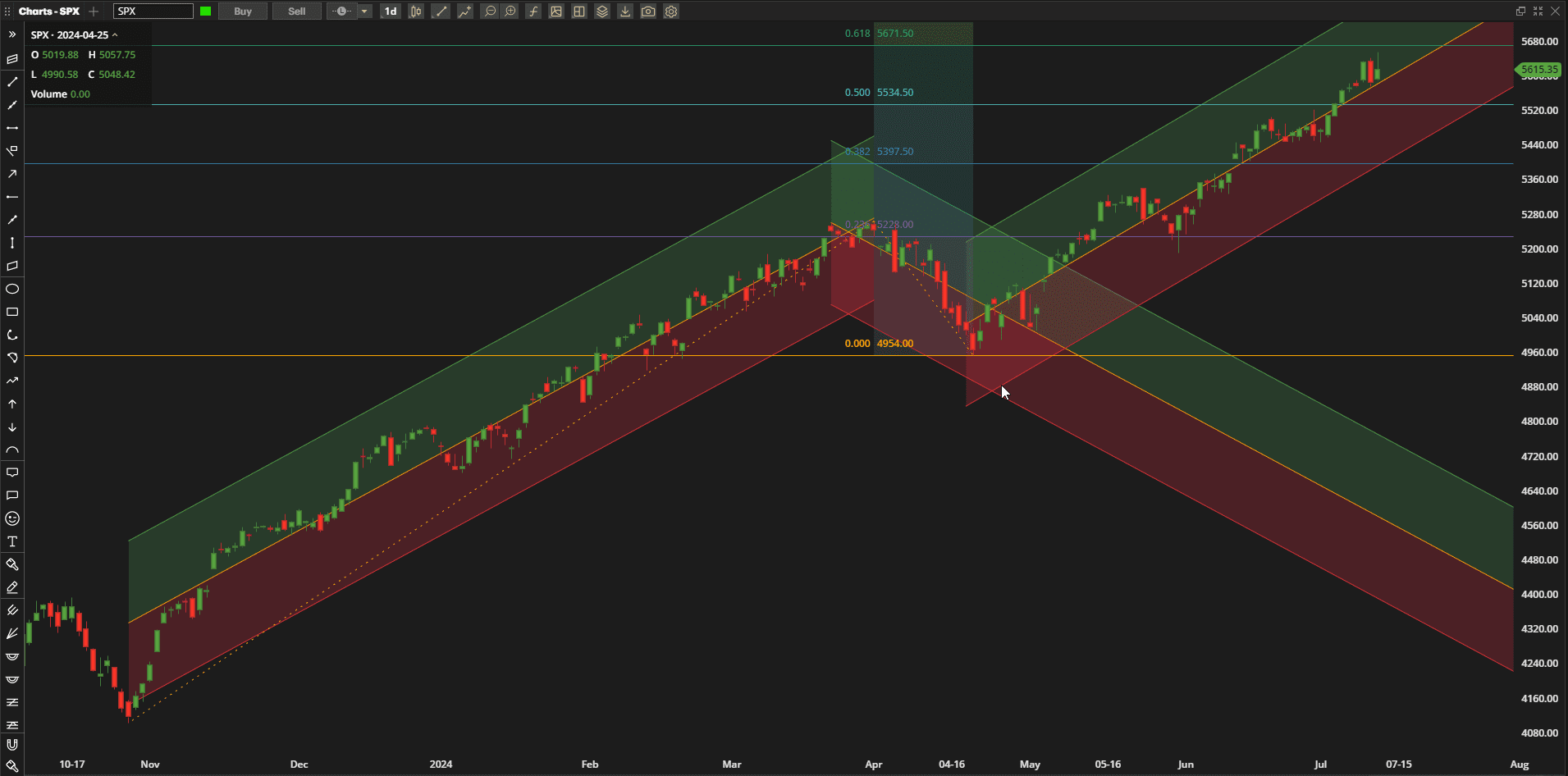

US Equities continued their climb to new all-time highs again this week with the SPX (S&P 500 Index) closing the week ~0.9% higher than last week’s close:

I am still anticipating that this ~5680 level will provide resistance although emotional reactions to the recent assassination attempt on Donald Trump may be more significant that any technical indicators/analysis – at least in the short term.

I am still anticipating that this ~5680 level will provide resistance although emotional reactions to the recent assassination attempt on Donald Trump may be more significant that any technical indicators/analysis – at least in the short term.

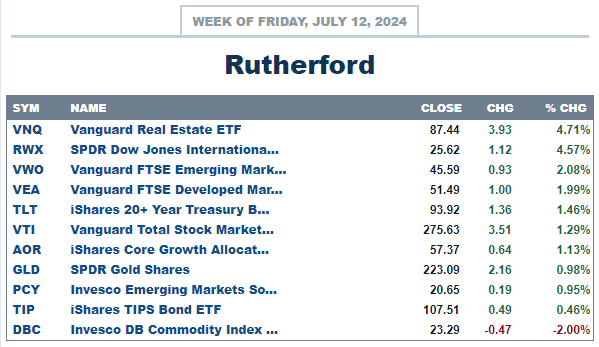

Again, despite the very positive performance of US equities, VTI (the ETF representing US equities in the Rutherford portfolio) only finished in the centre of the list with Real Estate showing the highest returns:

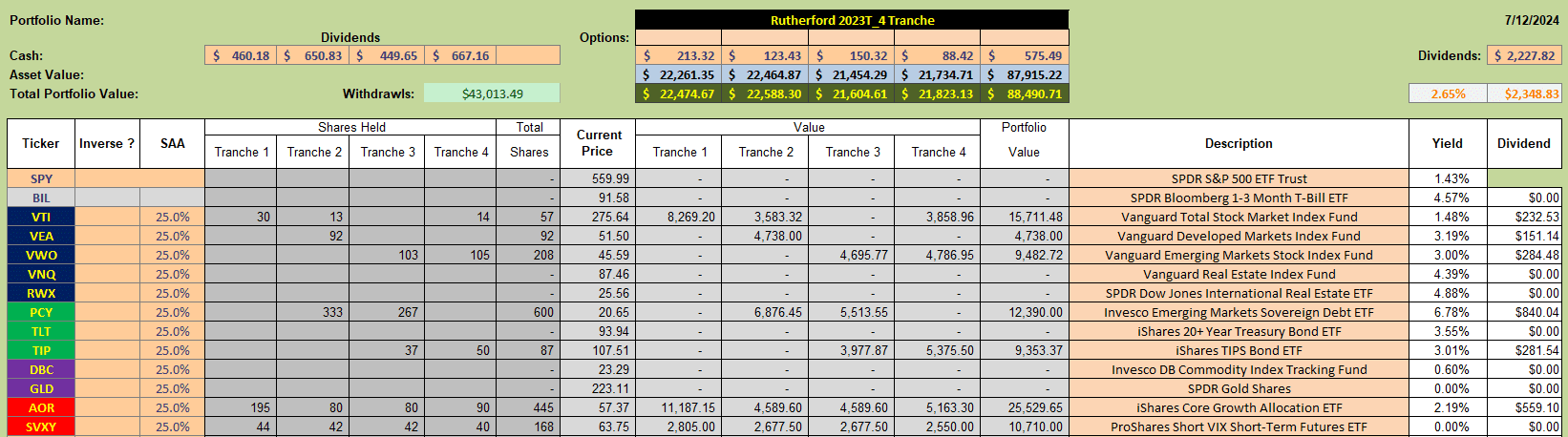

Current holdings in the portfolio look like this:

Current holdings in the portfolio look like this:

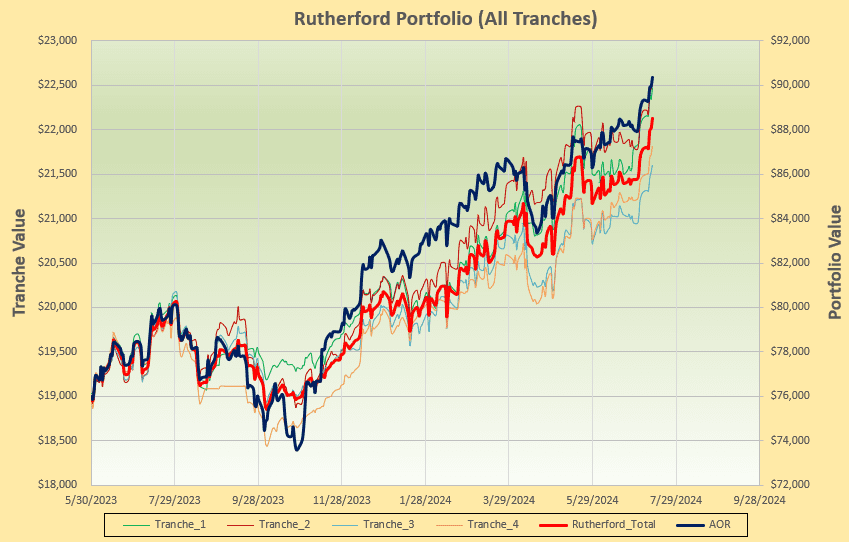

with the following performance:

with the following performance:

Tranche 3, the focus of this week’s review, is holding positions in VWO (Emerging Market Equities) , PCY and TIP (Bonds) in addition to the benchmark fund AOR and the inverse volatility ETF SVXY.

Tranche 3, the focus of this week’s review, is holding positions in VWO (Emerging Market Equities) , PCY and TIP (Bonds) in addition to the benchmark fund AOR and the inverse volatility ETF SVXY.

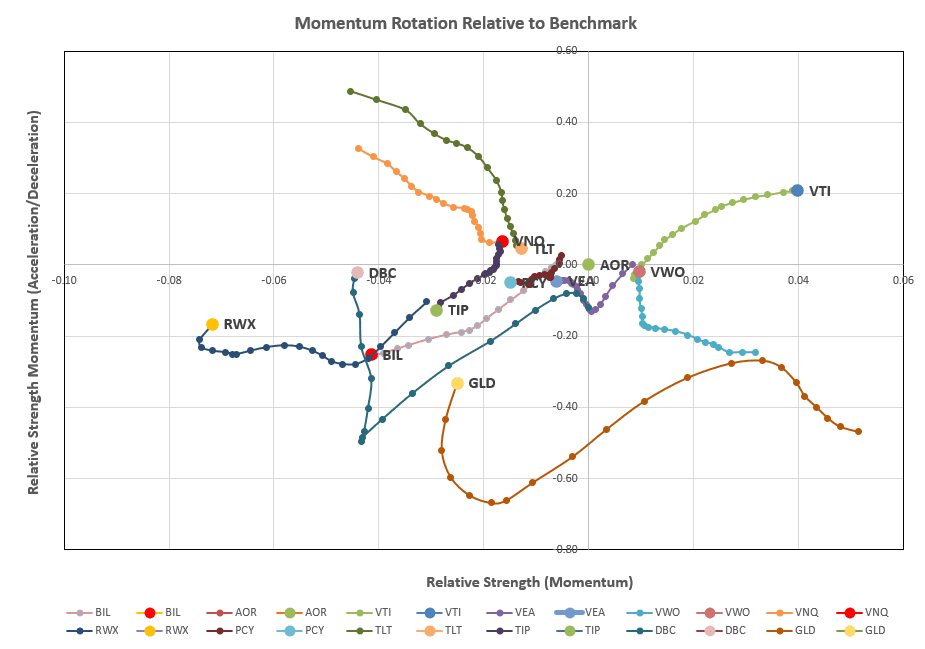

We’ll check the recent performance of each ETF in the quiver by taking a look at the rotation graphs:

where US Equities (VTI) continue to exhibit the strongest relative strength (in the top right quadrant).

where US Equities (VTI) continue to exhibit the strongest relative strength (in the top right quadrant).

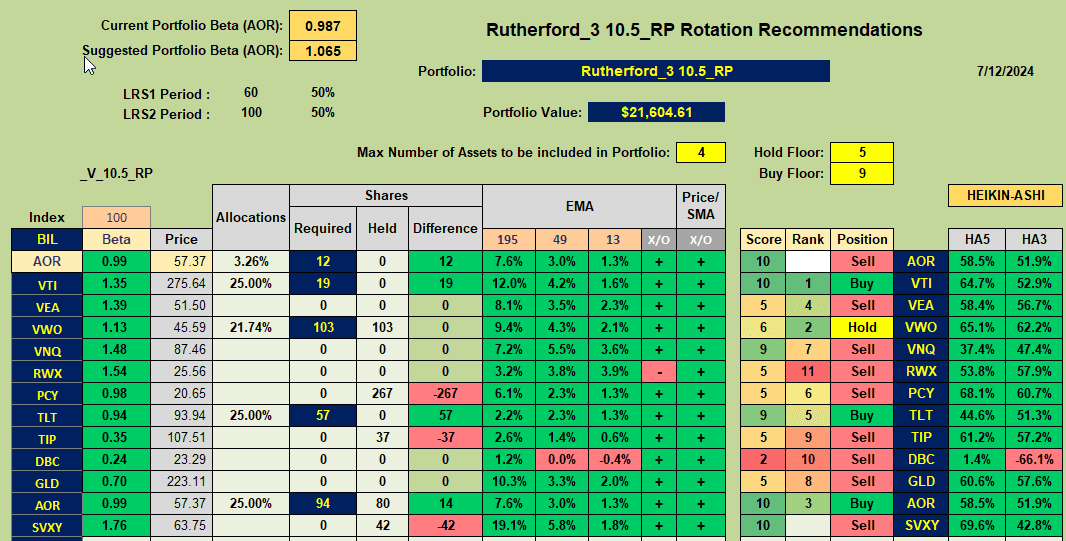

Checking the rankings and recommendations from the Rotation Model being used to manage this portfolio:

we see that VTI, TLT and AOR are recommended Buys with VWO receiving a Hold recommendation.

we see that VTI, TLT and AOR are recommended Buys with VWO receiving a Hold recommendation.

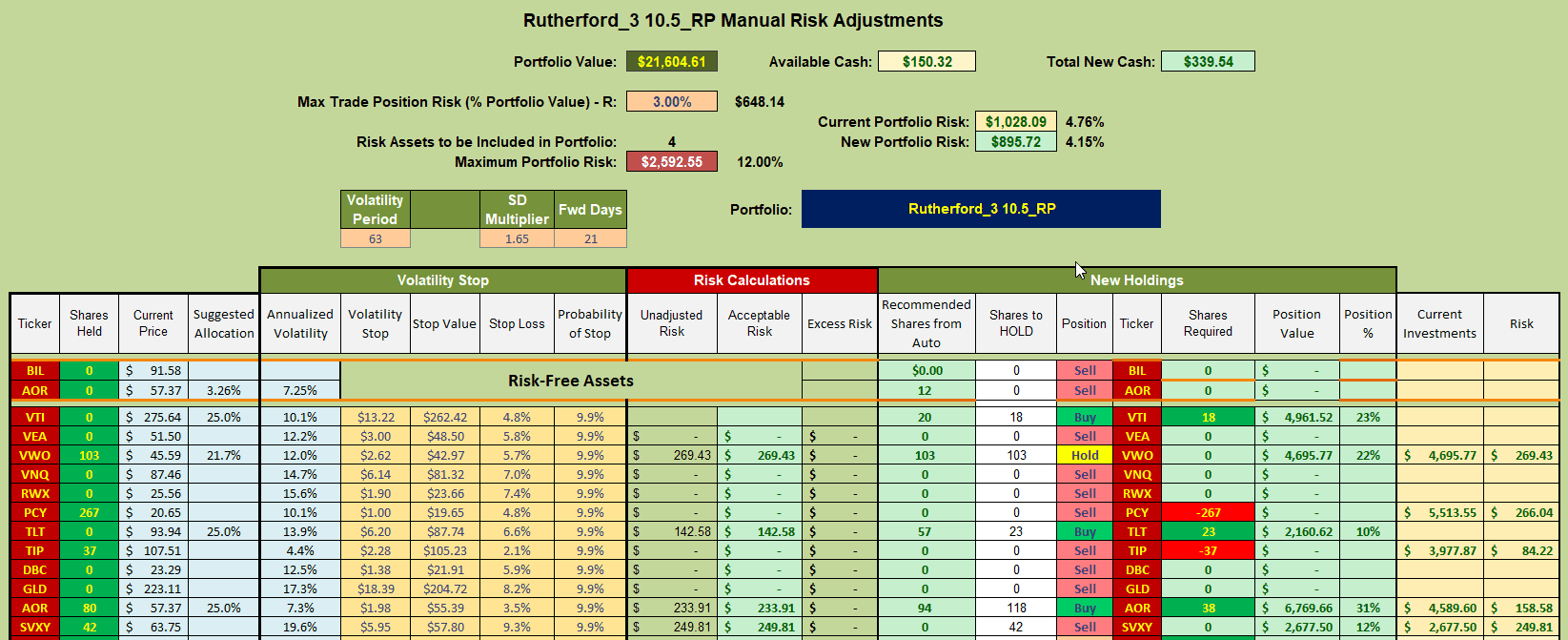

Accordingly, this week’s adjustments will look something like this:

where I shall be selling current holdings in PCY and TIP and using the funds to add shares of VTI and TLT. Any cash remaining will be used to add a few more shares of AOR. No adjustments are called for in VWO and currently held shares will continue to be held.

where I shall be selling current holdings in PCY and TIP and using the funds to add shares of VTI and TLT. Any cash remaining will be used to add a few more shares of AOR. No adjustments are called for in VWO and currently held shares will continue to be held.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question