Lighthouse on West Coast of USA

Franklin is one of four Sector BPI portfolios. Perhaps I should title these portfolios, Sector BPI Plus as each now contains more than the eleven (11) sector ETFs in an effort to patch one of the potential holes in the Sector BPI hypothesis. Past sector blogs explain in more detail the flaw in the Sector BPI model.

Moments ago I checked the Sector BPI spreadsheet and there are no major changes. Sectors still in the overbought zone (70% bullish or higher) are: Staples (VDC), Health (VHT) and Utilities (VPU). Where held in any of the Sector BPI portfolios, TSLOs are in place.

Franklin Investment Quiver

Limit orders (TSLOs) are in place to sell those sectors that have been designated as overbought. When cash is available, and $730 is a very small amount, we move down from the sectors into the Dual Momentum™ group (VTI through BND) where we pick up a few more shares.

I set a limit order to purchase three shares of VTI before finishing this post.

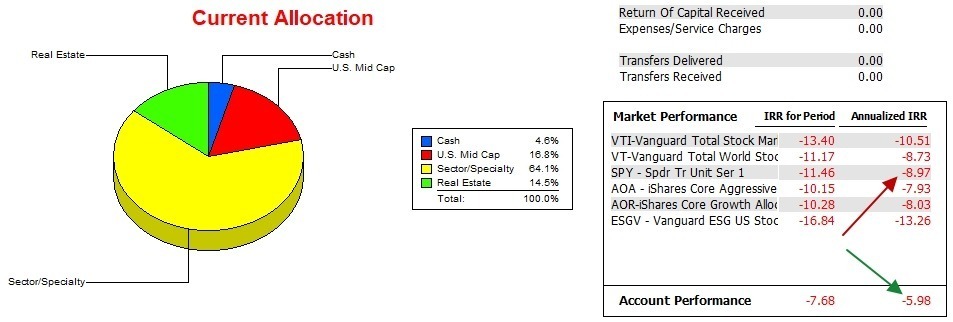

Franklin Performance Data

Over the past 15.5 months the Franklin has a 3 percentage point advantage over the S&P 500 (SPY) ETF. It will be a challenge to maintain this lead. The Franklin, with this small lead, is a useful test for the Sector BPI model.

Franklin Risk Ratios

For the first time in over a year the Jensen Performance Index pulled into positive territory and it is comforting to see a positive slope (0.21) for the Jensen. Due to a very poor year for equities in 2022 we have not seen many positive Jensen slopes.

This data is quite encouraging for the Sector BPI investment style.

Buying Guidelines For BPI Model Portfolios: 9 December 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Did any readers receive e-mail notifications this Franklin post was up on the website?

Lowell

Lowell,

I did not.

~jim

Jim,

In the lower right hand corner you should see a bell inside two circles. If you click on the bell you will be able to subscribe to future notifications of blog posts. Readers can also click on the bell and unsubscribe.

Lowell

LOWELL

I did received an email at 3:04pm EDT on Tuesday 4/18

Bob

In the process of updating the performance spreadsheet I see where the Franklin moved into the third spot based on Risk. This is a far cry from where the portfolio was positioned several months ago.

Lowell