Zion National Park

Franklin is the Sector BPI portfolio up for review today even though no sectors are in the oversold zone and we sold off all overbought sectors. The current holdings of Staples and Utilities are residing in the neutral zone. Over $2,200 remains in cash so we need to decide what to do with that money. We look for buying opportunities in U.S. Equities. Two choices are VOO or VTI.

Tomorrow I’ll update the Bullish Percent Indicator data, but I don’t expect any changes. It seem unlikely any of the sectors will dip into the oversold zone so long as the economy continues to hum along at the current rate.

Send this link on to your friends, family members, and social media outlets.

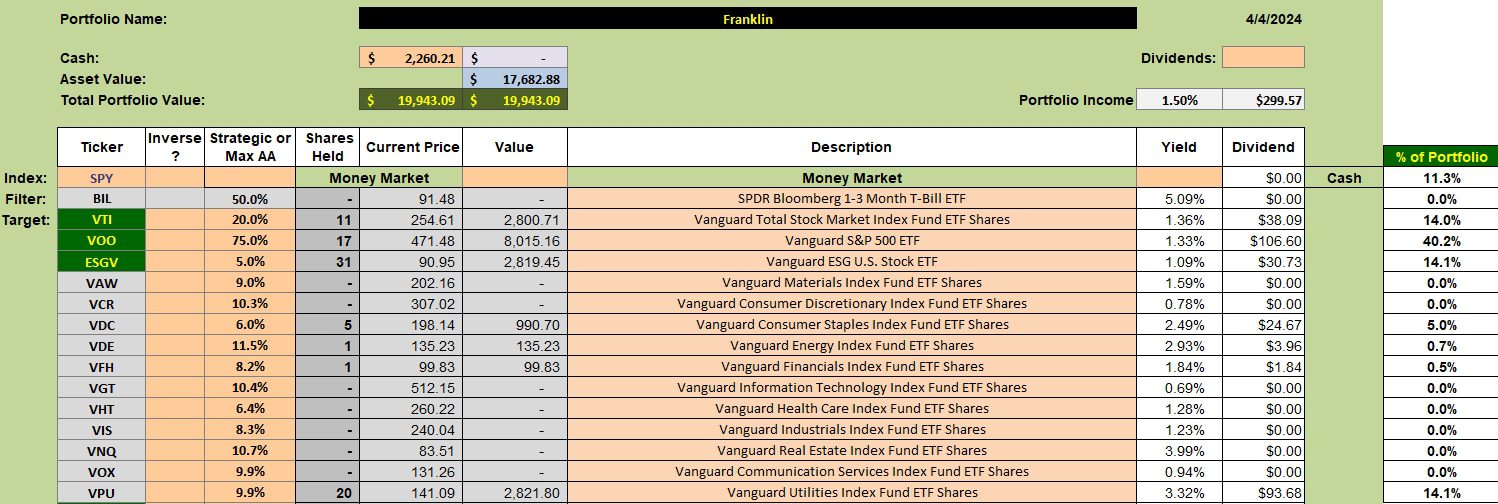

Franklin Security Holdings

Below is the investment quiver and current holdings in the Franklin. Since the objective of this portfolio is to match or surpass the S&P 500 the Franklin will concentrate on VOO when no action is recommended within the eleven sectors.

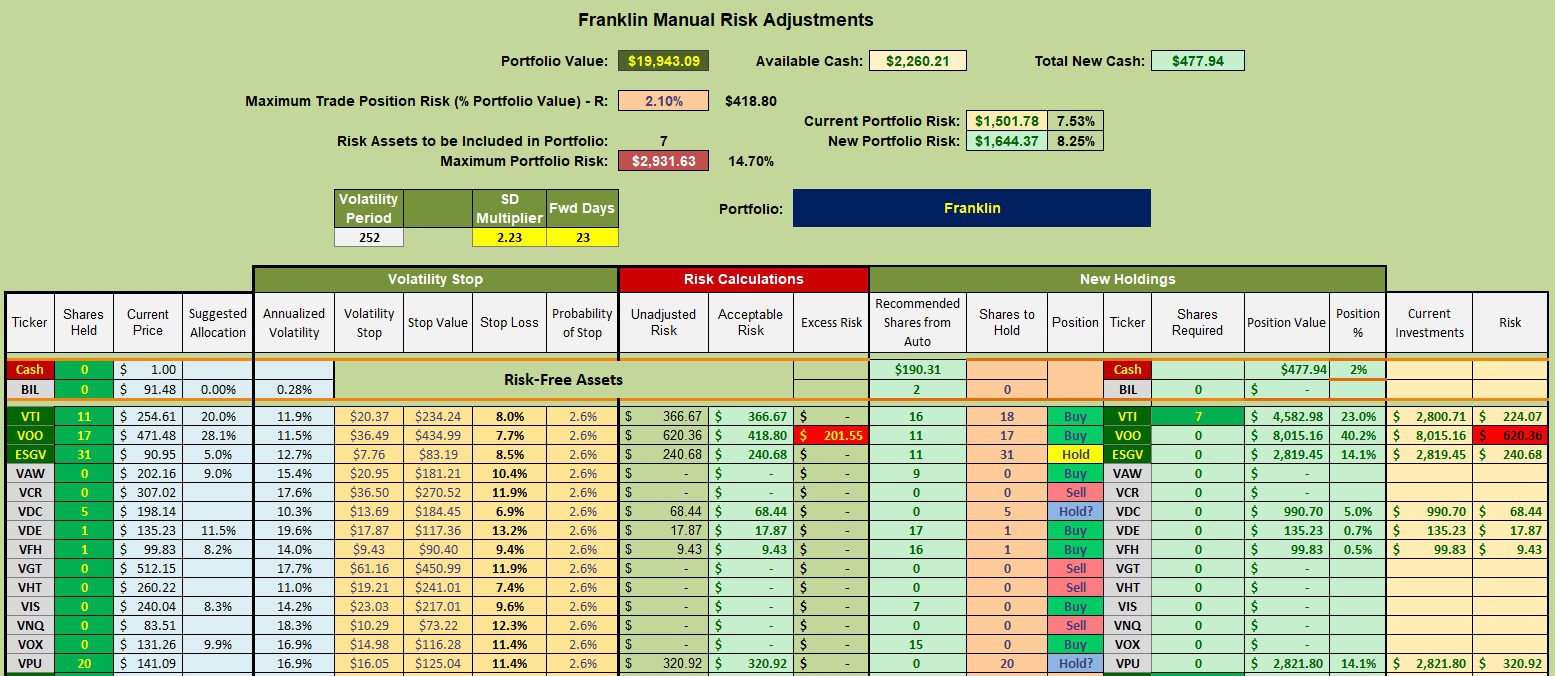

Franklin Manual Risk Adjustments

I have a TSLO set to sell all shares of ESGV and a limit order is in place to purchase more shares of U.S. Equities. Contrary to the seven shares of VTI, I think I set a limit order to pick up more shares of VOO.

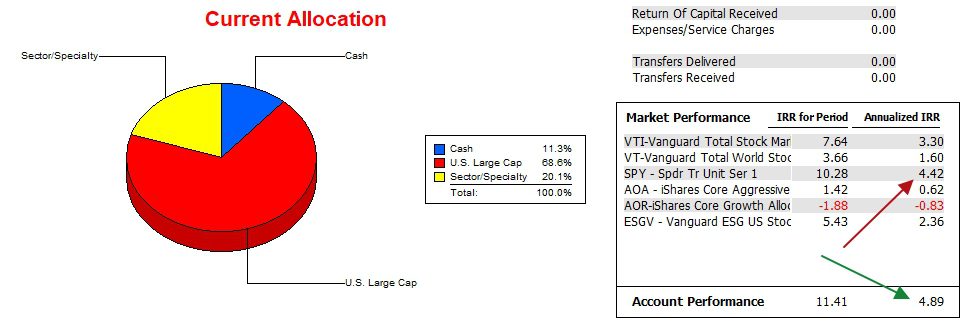

Franklin Performance Data

Since 12/31/2021 the Franklin is edging out the performance of the SPY benchmark. The 4.89% performance is much greater than all the other possible benchmarks.

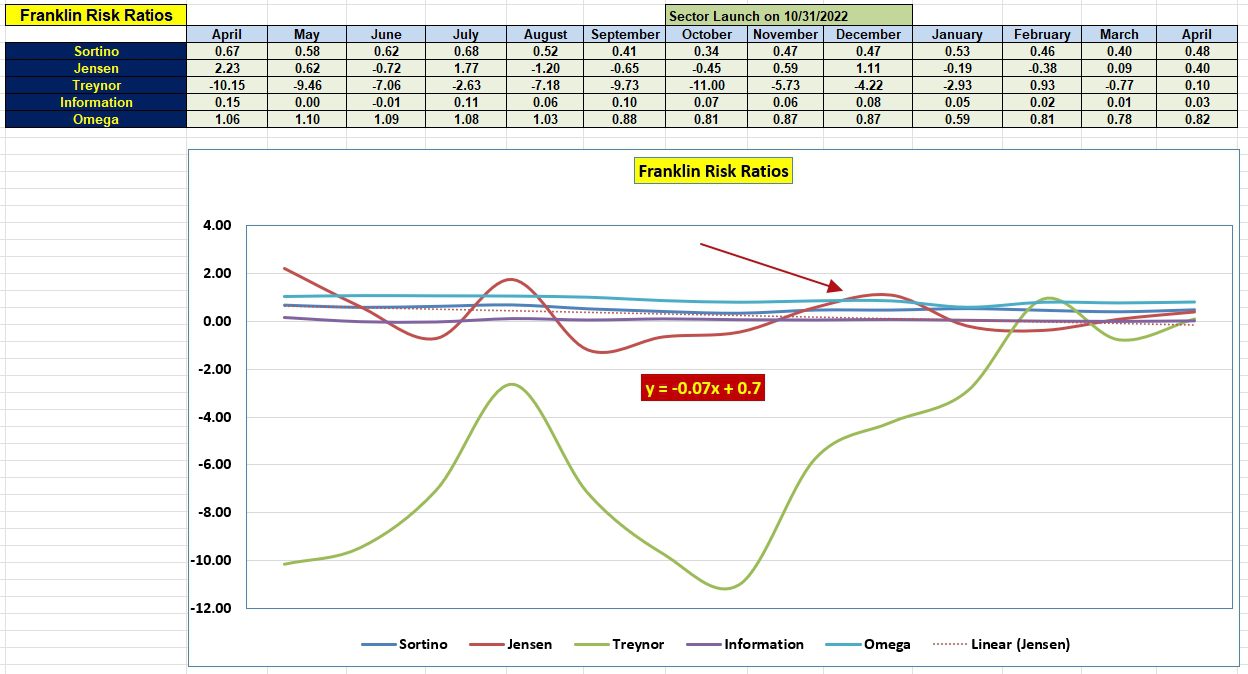

Franklin Risk Ratios

The current Jensen Alpha value (0.40) is the highest its been since last December. Over the past year the slope of the Jensen is essentially flat and might turn positive sometime this summer if the market holds close to even.

The Information Ratio has been positive most of the year, an encouraging outcome.

Tentative Asset Allocation Model

Pauling II Asset Allocation Portfolio Launch: 1 April 2024

Pauling II Update: 1 April 2024

Comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question