Barrier Reef Outcrop, Queensland, Australia

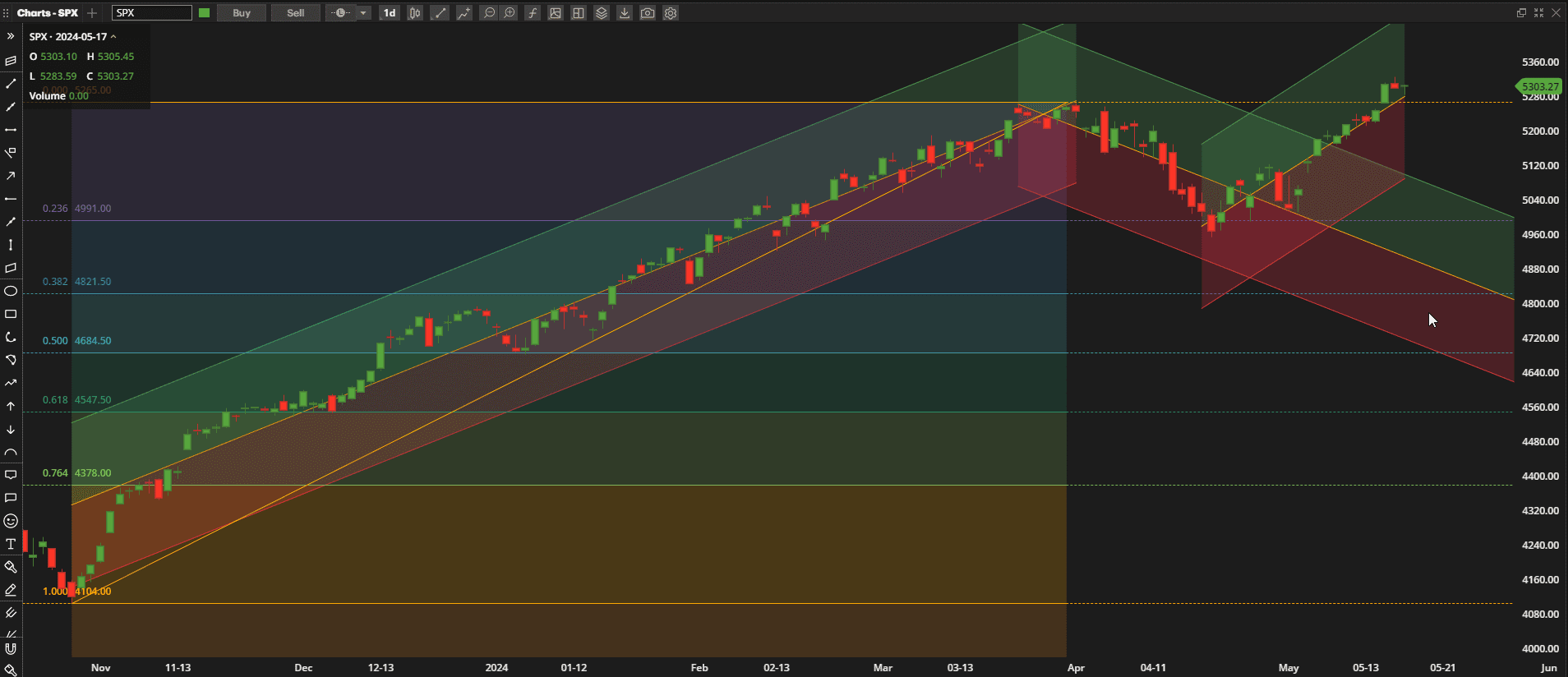

It was a bullish week in US Equities with the S&P 500 Index (SPX) taking out previous all-time highs:

Since price has closed outside the bearish regression trend channel, and taken out the prior highs, I have added a tentative new uptrend channel – although I still have a feeling that the “round” 5300 barrier might still provide resistance. Wednesday’s “surge” through prior highs was likely exaggerated by short covering.

Since price has closed outside the bearish regression trend channel, and taken out the prior highs, I have added a tentative new uptrend channel – although I still have a feeling that the “round” 5300 barrier might still provide resistance. Wednesday’s “surge” through prior highs was likely exaggerated by short covering.

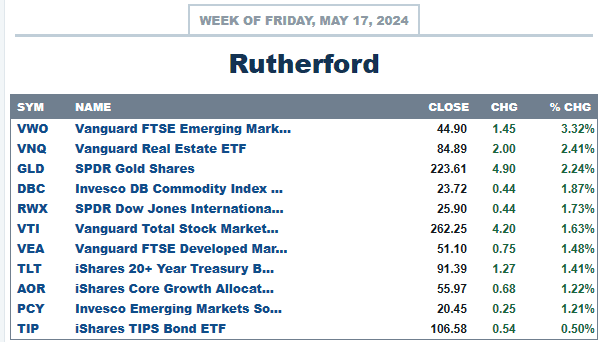

Despite the strong performance of US equities (up ~1.6% from last week’s close) it was not the strongest asset class over the past week:

with Emerging Market equities (VWO) doubling those returns.

with Emerging Market equities (VWO) doubling those returns.

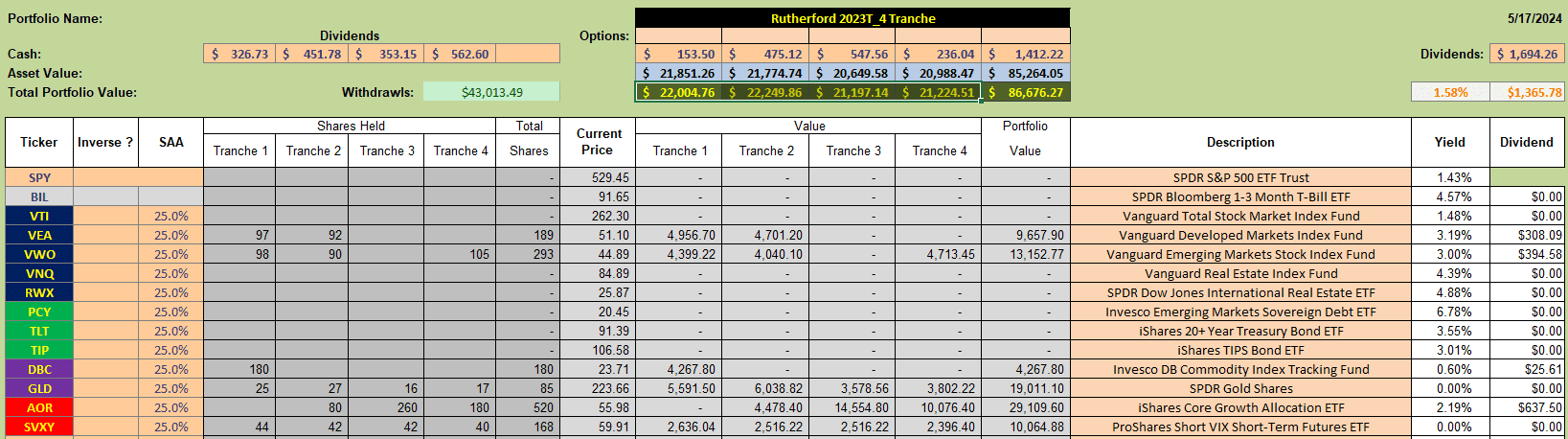

At present, holdings in the Rutherford Portfolio look like this:

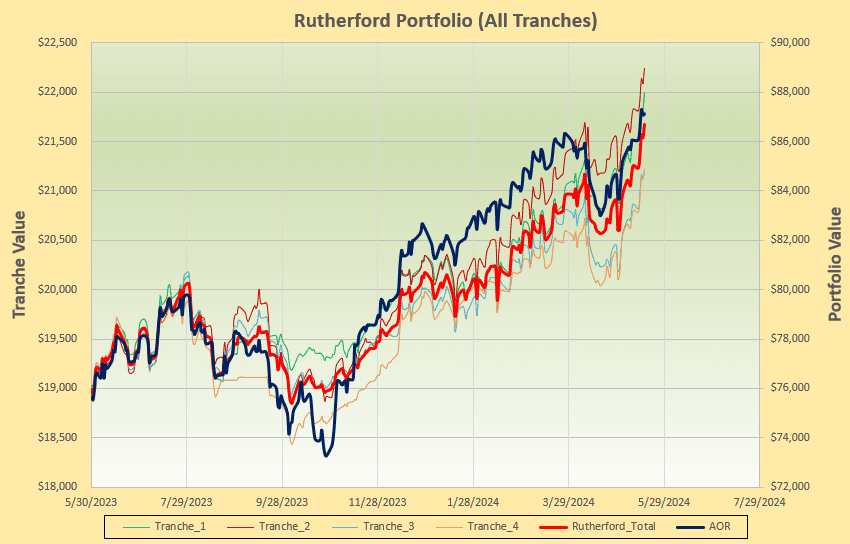

and performace like this:

and performace like this:

slowly catching up with the Benchmark AOR Fund.

slowly catching up with the Benchmark AOR Fund.

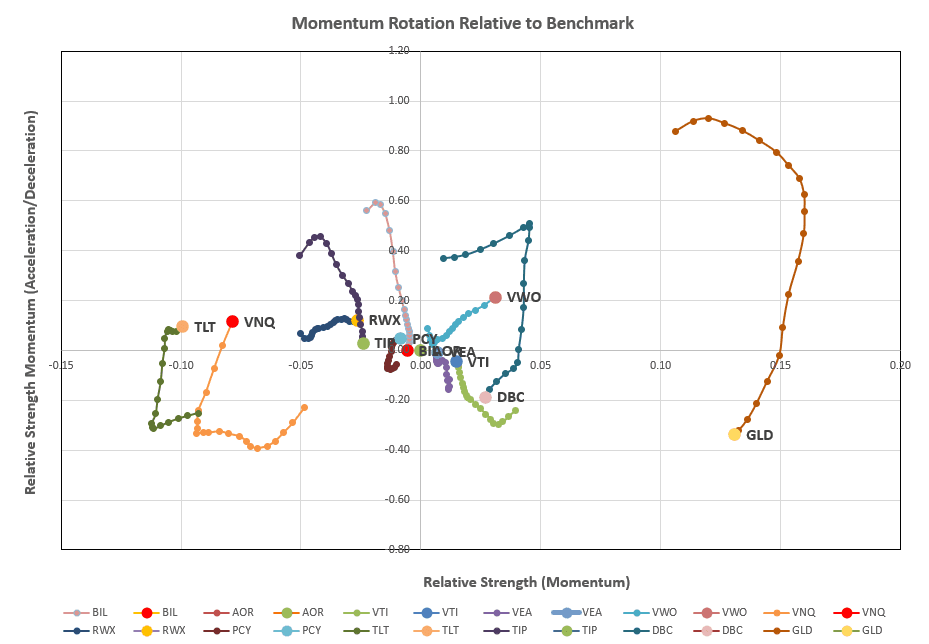

Present holdings in Tranche 3 (the focus of this week’s review) are the benchmark AOR Fund and Gold (GLD) – another strong performer over the past week. So let’s check on the rotation graphs:

where the recent strength in VWO is confirmed through the upward and left-to-right horizontal movement into the desirable top right quadrant. Moving to the ranking/recommendation sheet:

where the recent strength in VWO is confirmed through the upward and left-to-right horizontal movement into the desirable top right quadrant. Moving to the ranking/recommendation sheet:

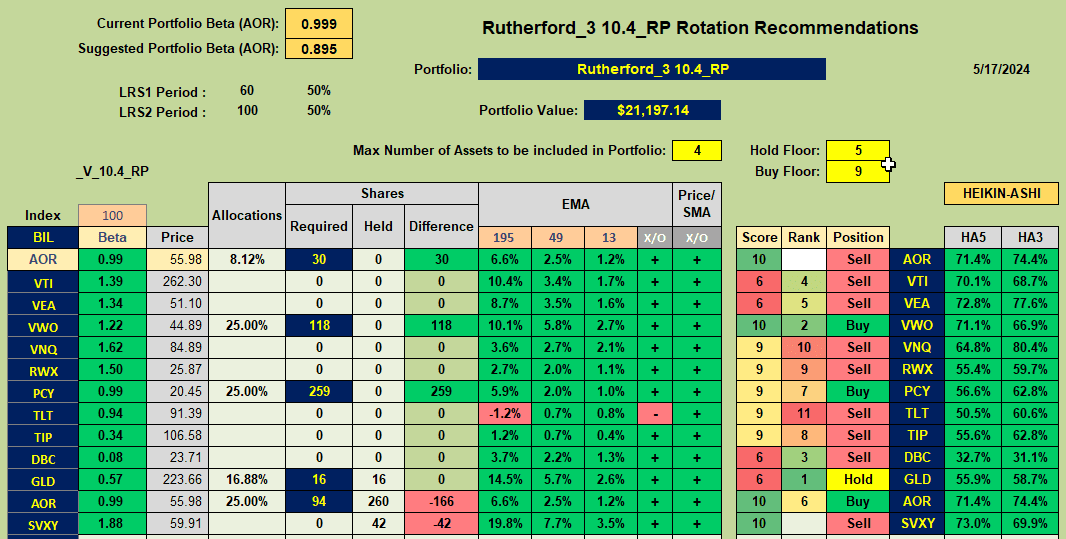

we see buy recommendations for VWO, PCY (Emerging Market Bonds) and AOR with a hold recommendation on GLD.

we see buy recommendations for VWO, PCY (Emerging Market Bonds) and AOR with a hold recommendation on GLD.

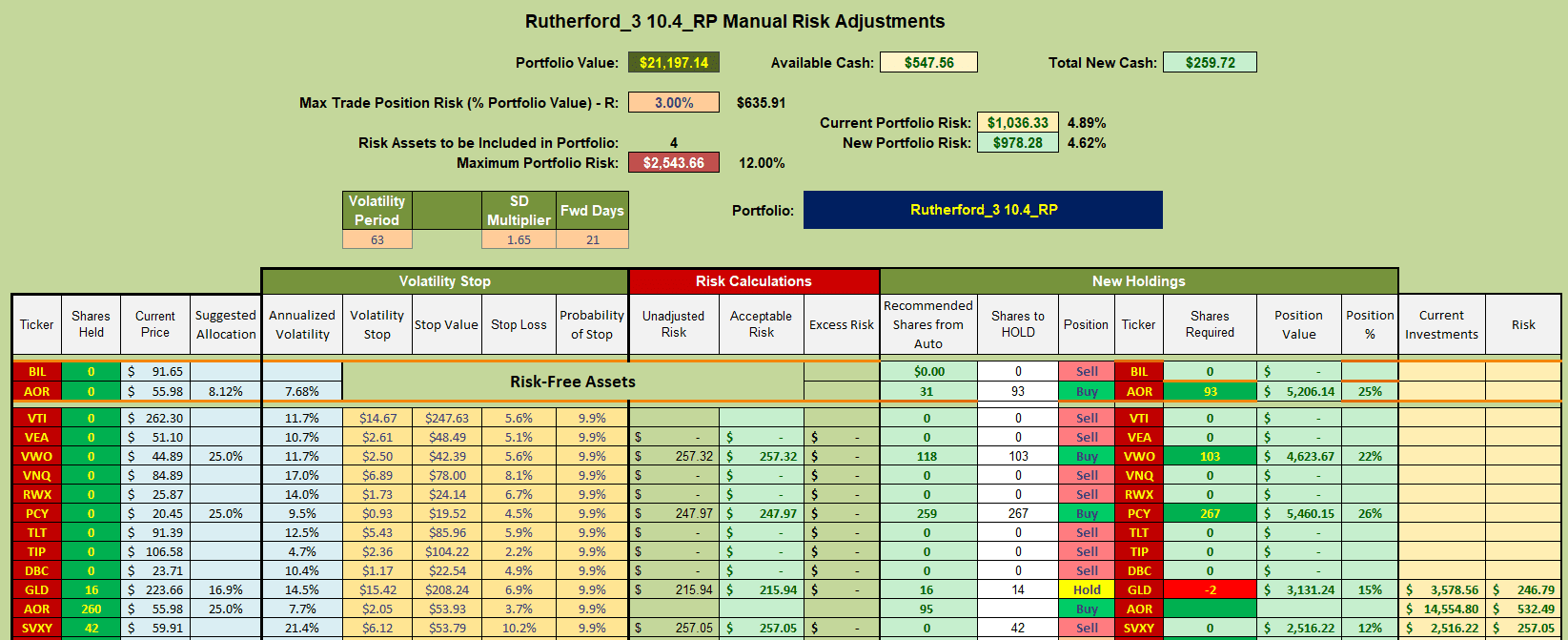

Consequently, my adjustments for this week will look something like this:

where I will be selling a portion of my current holdings in AOR and using the cash generated to add positions in VWO and PCY. I will not worry about the small adjustment in GLD to avoid unecessary trading costs. I do not expect these adjustment to make a significant difference unless the recent momentum in Emerging Market assets continues since AOR is a diversified equity/bond ETF on it’s own and we are just changing the focus slightly in favor of Emerging Markets.

where I will be selling a portion of my current holdings in AOR and using the cash generated to add positions in VWO and PCY. I will not worry about the small adjustment in GLD to avoid unecessary trading costs. I do not expect these adjustment to make a significant difference unless the recent momentum in Emerging Market assets continues since AOR is a diversified equity/bond ETF on it’s own and we are just changing the focus slightly in favor of Emerging Markets.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question