Tillicum Crossing Bridge – Only for bicycles, pedestrians, buses, and light rail.

The Bullish Percent Indicators (BPI) tell us this past week was rest time. Overall, both the broad markets and individual sectors were flat to slight improvement in smaller stocks. There is one new Sell signal and that is Materials. If you are holding either VAW or IYM in your Sector BPI Plus portfolio, place a 3% TSLO under the Material sector.

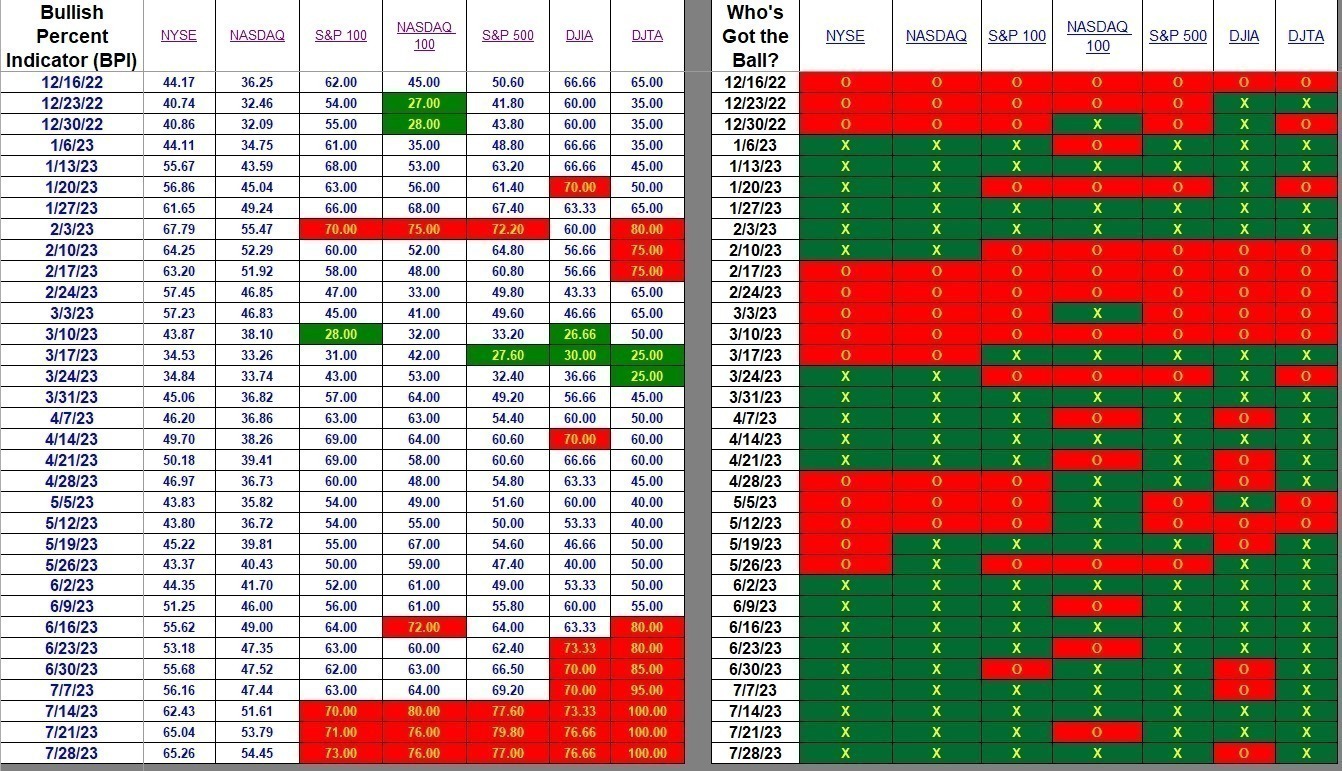

Index BPI

Both NYSE and NASDA show slight improvement. This is encouraging as a few of the smaller stocks shifted into the bullish zone. Note that the S&P 500 declined 2.8 percentage points. The loss is tied to larger companies moving out of the bullish phase. These moves are so minor as to be noise. However, keep watch to see if this trend continues. Ideally, we want to see all size companies move up.

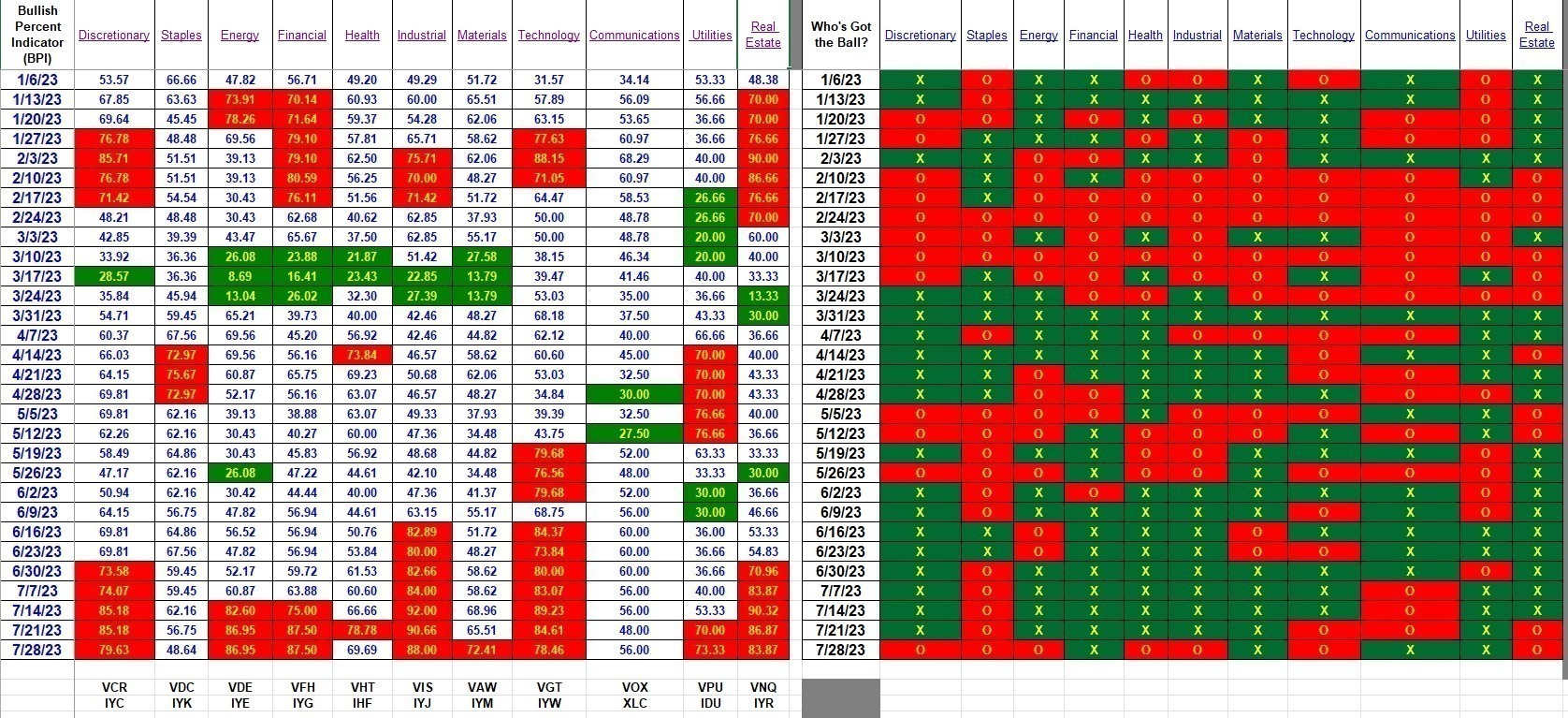

Sector BPI

As mentioned above, check your Sector BPI Plus portfolio to see if you are holding a Materials ETF. If so, place a 3% TSLO on that ETF as Materials moved into the overbought zone. TSLOs should also be in place for all sectors with a red background when looking at the left side of the following screenshot.

I will need to check the Sector BPI portfolios I’m tracking as I think one or two of the Sell sectors were sold yesterday.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.