Mammoth Hot Springs – Yellowstone National Park

Coming sometime over the next two month is a new investing model. I’ll classify it as a Bullish Percent Indicator ETF Sector Model. I’ve hinted at this approach from time to time, but have not laid out the investing strategy in detail. I have no back-testing to support this model so be cautious if you plan to emulate this investing system.

With permission from the owner of the Carson Trio, the experiment will end sometime over the next two months. It is quite clear that the LRPC model works best when using the 60- and 100-trading days look-back combination. This is the default combination that was thoroughly back-tested a number of years ago by Hedgehunter. I’ll fold the proceeds from the Carson BHS and Carson HA portfolios into the Carson LRPC and title the new portfolio Carson. I’ll maintain the Carson LRPC Risk Ratio data with some adjustments to the Sortino Ratio as the Sortino involves the total value of the portfolio.

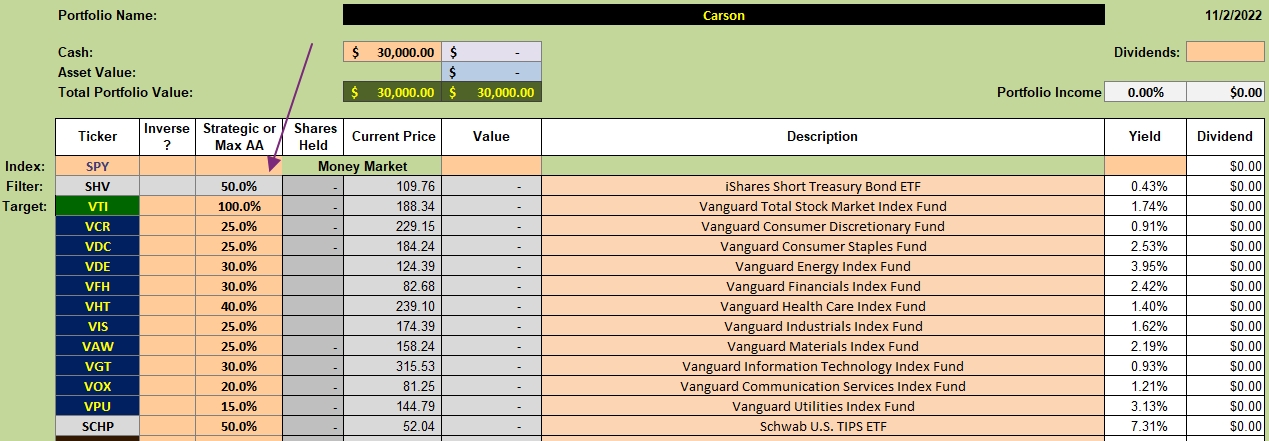

Carson Investment Quiver

Below is the investment quiver for the new portfolio. VTI will not be used as one of the investing “arrows.” It is included for the purpose of toggling the Target Screen on or off.

I plan to use the ten Vanguard sector ETFs as the core for investing. SHV and SCHP will be used as holding securities when there is excess cash.

Note the purple arrow which points to the maximum that will be invested in any single sector ETF at any given time. I favor certain sectors based on the percentages. These are guidelines at this time and will likely change in the future.

Basic Investing Process:

- When a sector ETF is in the over-sold zone it is a candidate for purchase. Over-sold is when a sector is 30% or lower in the BPI data table. The BPI table is published nearly every week.

- When a sector ETF is in the over-bought zone it is a candidate for sale. Over-bought is when a sector is 70% or high in the BPI data table.

- After an ETF is purchased and the sector ETF moves into the over-bought zone, a 3% TSLO is set under the ETF. When the TSLO is triggered, the money will revert to cash, SHV, or SCHP and wait for the next round of purchases.

Fine Tuning Investing Model:

- The Kipling will be used to spot the best performing sector ETF should there be times when multiple sectors are in the over-sold zone. Multiple purchase situations happen frequently when we are in a bear market.

- Note the Strategic or Max AA percentages in the following table. If more than one sector ETF is in a buying situation, we will fill the ETFs based on their ranking using the Ranking column found in the right side of the Kipling. This will become clear after a few reviews.

- When cash is available, it will be invested in either SHV or SCHP, two low volatile securities.

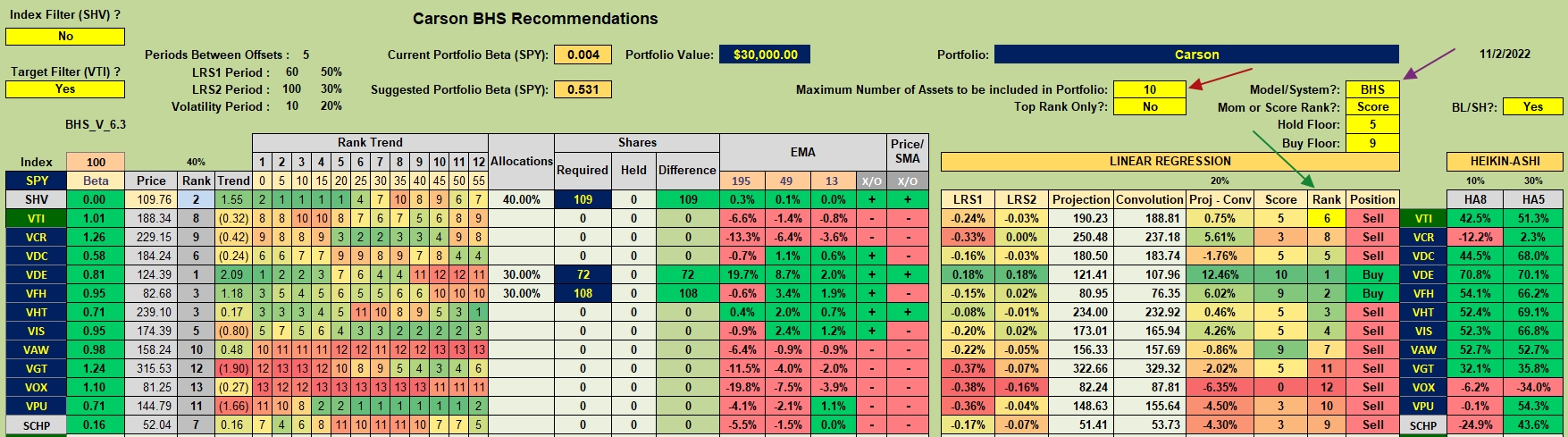

Carson Investing Model

Assume we find VDE and VFH are both over-sold. If this were the situation, we would purchase 70 to 72 shares of VDE and 108 or 110 shares of VFH. If VAW was also over-sold and cash is available, we would buy shares of VAW despite its #7 position. Bullish Percent Indicators will dictate buy and sell decisions rather than following the directions from the Kipling spreadsheet.

Readers: If you come up with any “what if” situations, place them in the Comments section and I’ll attempt to answer as best I can.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Since BPI data is published on the weekend, orders for sector ETFs, if found in the over-sold zone, will be placed on the following Monday morning.

Lowell

There is a strong possibility the new Carson portfolio will be up and running by next week.

Lowell

learning more of the models you share than k you. Your other writings suggest that you prefer index ETFs to sectors. so am still working out my preference for the models. the experimental tests are useful in understanding your process, over time. the world recession[?] keeps me in term deposits in australia. I have worked out now that I can use the ETFs and see the local equivalents which are approved by my 401 k equivalent. you are a ray of truth when it is hard to get on seeking alpha as experts compete for clicks and with some charts leading to their own views, opinions, and advise to fit those data. it gives me perspective on how useful your site is. got up to 2014 in your articles and posts there. should I read them all there? your site here may have lost some of those posts and even though i read a lot which is dated, sometimes your small observations add to my knowledge of the intricacies of your thought process and the moving parts in your systems. thank you.

Ken,

Just a bit about the history of ITA Wealth Management.

I began this blog on Valentine’s Day back in 2008. Sometime in 2013 the host site was hacked and destroyed by someone in Sweden. I lost somewhere north of 1,000 blog entries. So it was begin again, this time with a different host server where better backups were available.

Backups cost money and to keep expenses down, I go back in and delete the older posts from time to time. That is why you will find some of the older material missing at spots. Not a problem as the most recent material is the most important.

Approximately five years ago Finance-Yahoo changed their access to price data and this fouled up a portfolio tracking spreadsheet known as the TLH Spreadsheet. When this happened I moved to a commercial portfolio tracking program called, Investment Account Manager (IAM). When you see the screenshots of performance, that comes out of the IAM software.

A few years ago I set up some experiments that look at different look-back periods. With the Carson Trio, I was checking different investing methods. LRPC worked out the best in that experiment.

Based on performance and risk data, different models work better than others, although the review date plays a significant role in both performance and risk. My recommendation is to diversify using non-load mutual funds or ETFs. I prefer ETFs.

The other diversification has to do with using different investing models. That is one reason for beginning the new Carson portfolio. More on that later today or sometime this weekend.

Lowell

Lowell,

Where do the BPI data come from? Relative Strength Index (RSI)?

~jim

BPI data comes from Stock Charts. I have a spreadsheet built to gather that information for the large indexes and market sectors.

Lowell

Lowell,

I again did positions in the sectors after the most recent <30% signals. I have profits or small losses in all except for VOX which is down 5%. Wondering if we should use TSOLs in this strategy. Any way overall profit on this cycle is about 4%. Still holding 6 out of 10.

Bob Warasila

Bob,

I assume you are asking if one should place TSLOs immediately after purchase. I don’t plan to do that. If a sector remains in the over-sold zone of 30% or below, I plan to use dividends or new money to purchase more shares.

At the top end or over-bought zone, should the percentage move above 80% I plan to tighten the TSLO to 2%. If the sector ETF moves even higher, say 90% bullish or higher, I’ll tighten the TSLO to 1% so as to lock in profits.

Lowell

Hi Lowel,

Wa is meant by, “ VTI will not be used as one of the investing “arrows.” It is included for the purpose of toggling the Target Screen on or off.”? I’m not following what “toggling the Target Screen” means.

Also, what does LRPC stand for?

TF

Good Morning, TF.

With the Sector BPI portfolios (Carson, Franklin, Millikan, and Gauss) I am focusing on the eleven (11) sector ETFs. VTI is only included should one wish to turn on the Target Filter. I don’t intend to use the Target Filter with the Sector BPI portfolios so it is superfluous.

What the Target Filter does, when set to Yes, is to seek securities that are performing better than VTI. It makes sense to use this filter when using the Relative Strength or Relative Momentum approach.

LRPC stands for Linear Regression Projection Convolution and is one of the investing models built into the Kipling spreadsheet.

I hope this answers your questions. If not, ask again.

Lowell

Thank you for the kind reply!

The ten sectors expanded into eleven sectors as I added Real Estate (VNQ).

Lowell