Sunset at Ao Nang Beach, Krabi, Thailand – with Iconic Thai Longboat in reflections

US Equities had another strong week with the S&P 500 Index up close to 2% on the week and ~7.7% in the month from the closing price on 31 December 2022:

We have now taken out the prior December high at 4100 and closed above this level – so we could tentatively call a valid change in trend – although we hit a strong resistance point (61.8% extension) on Thursday and are presently sitting at the top of the new uptrend channel. We might expect to see at least a small correction in the coming weeks.

We have now taken out the prior December high at 4100 and closed above this level – so we could tentatively call a valid change in trend – although we hit a strong resistance point (61.8% extension) on Thursday and are presently sitting at the top of the new uptrend channel. We might expect to see at least a small correction in the coming weeks.

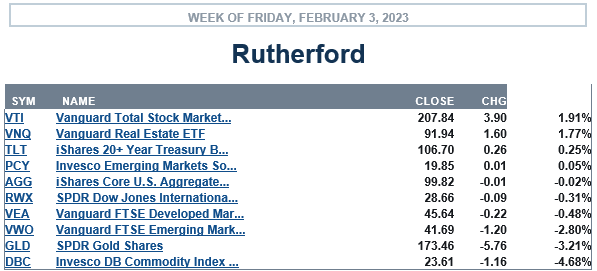

US markets also topped the best performing asset class list last week:

with equities, real estate and long-term bonds leading the list.

with equities, real estate and long-term bonds leading the list.

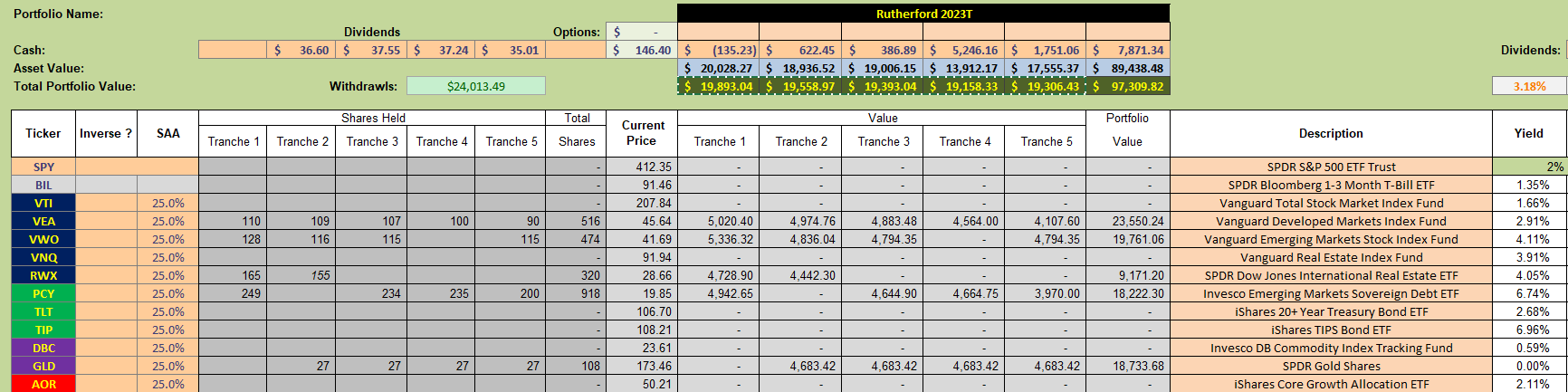

With the Rutherford portfolio not holding any of these assets:

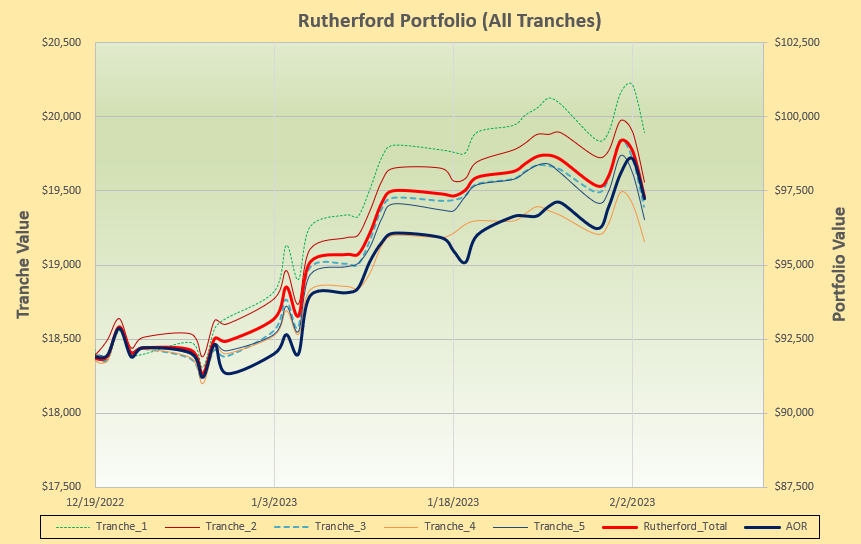

performance lost out to the benchmark AOR Fund:

performance lost out to the benchmark AOR Fund:

although still running slightly ahead since the rotation system was adopted for portfolio management.

although still running slightly ahead since the rotation system was adopted for portfolio management.

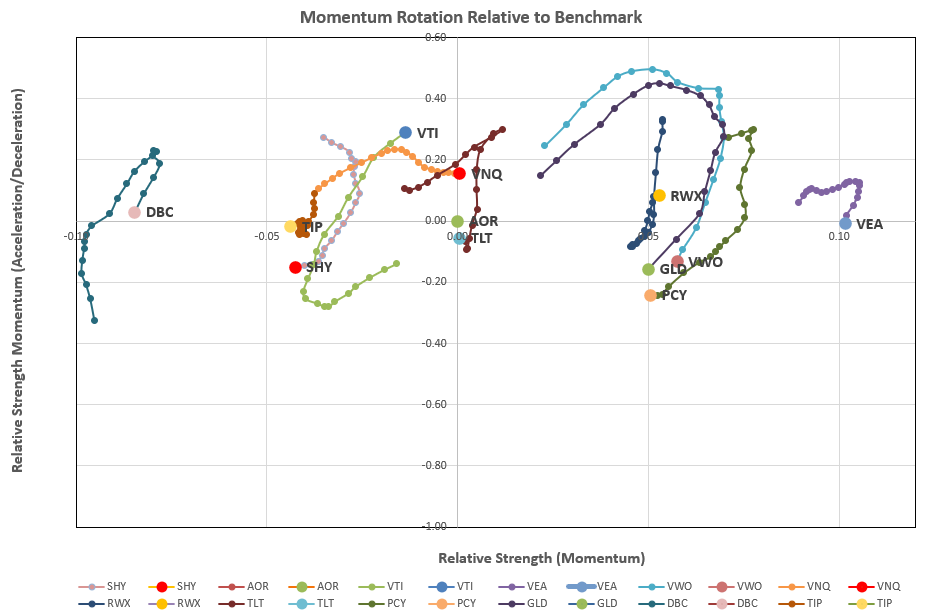

Checking on the rotation graphs:

we see Developed equity markets (VEA) showing the strongest long-term relative strength (horizontal movement) although weakening in the shorter term (downward vertical movement) – as are many of the recent strong performing asset classes.

we see Developed equity markets (VEA) showing the strongest long-term relative strength (horizontal movement) although weakening in the shorter term (downward vertical movement) – as are many of the recent strong performing asset classes.

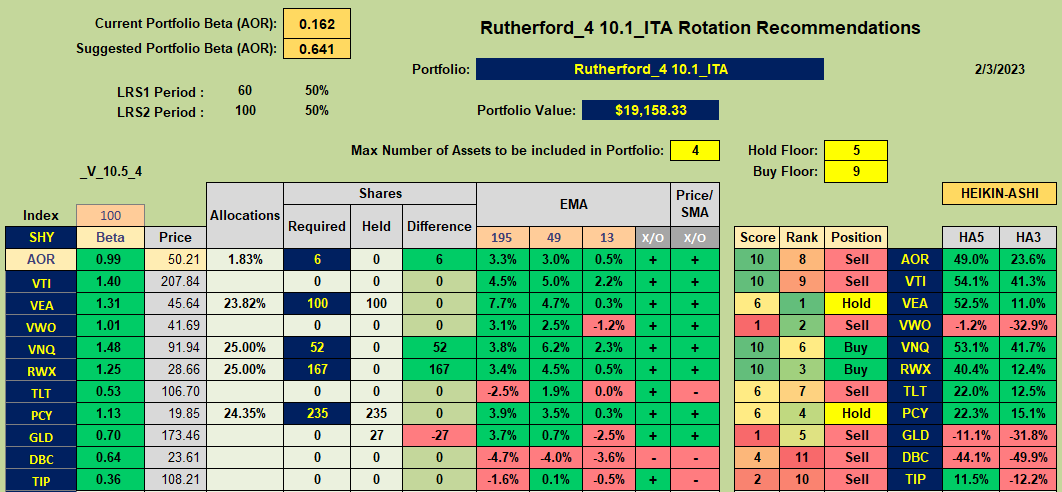

From the model recommendations:

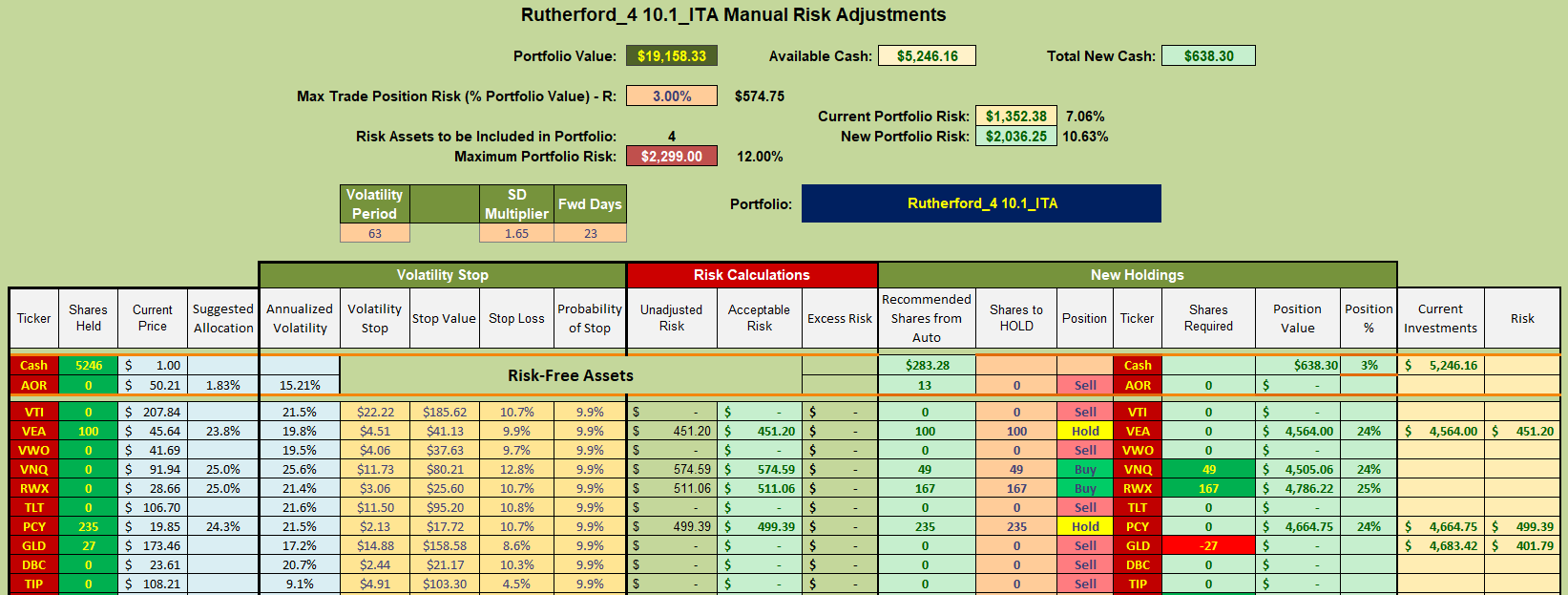

we see Buy recommendations for VNQ and RWX with Hold recommendations for VEA and PCY. Accordingly, this week’s adjustments will look something like this:

we see Buy recommendations for VNQ and RWX with Hold recommendations for VEA and PCY. Accordingly, this week’s adjustments will look something like this:

where I will use the Cash generated from the sale of 27 shares in GLD, together with available Cash, to add positions in VNQ and RWX (US and International Real Estate).

where I will use the Cash generated from the sale of 27 shares in GLD, together with available Cash, to add positions in VNQ and RWX (US and International Real Estate).

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.