Older fishing boats docked in Newport Bay.

Other than this being the first day of the month, this review or update of the Carson is an interesting one as Discretionary (VCR) was sufficiently close to a sale that I purged the Carson of this ETF. Telecom is still oversold so I added more shares of VOX and have limit orders to purchase more in order to fill the “21.7% requirement.”

This early in the month we don’t pay much attention to the current performance and risk readings. Concentrate on the trends.

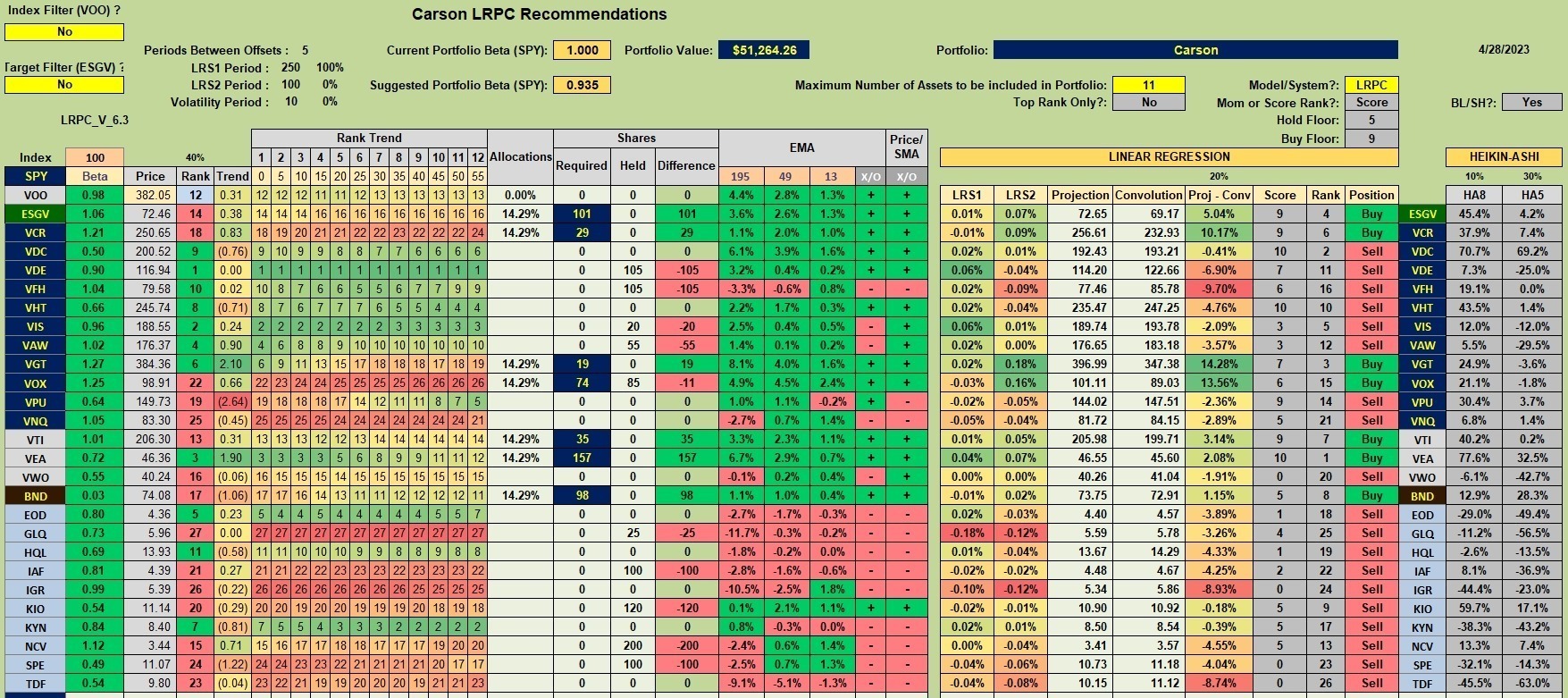

Carson Investment Quiver

Below is the current investment quiver for the Carson and its holdings. VDE, VFH, VIS, and VAW are still in the “neutral” zone so we continue to hold those shares. Since the Carson holds more cash than is necessary to fill Telecom we move down into the Dual Momentum™ group. More on this in the next section.

Carson Investment Recommendations

If you have been keeping up with the Sector BPI Plus model discussions you are aware that I added DM and Income generators to the sector ETFs. We follow and fill the recommendations in this order.

- Sector recommendations are filled first. Right now that is Telecom (VOX). The current recommendation is to purchase sufficient shares of VOX to make up 21.7% of the total portfolio.

- If there is additional cash available we move into the Dual Momentum™ group (VTI, VEA, VWO, and BND) and look for more recommendations. VEA is the highest ranked ETF from this group so we are set to purchase more shares of VEA.

- If cash is still available we dip down into the income or CEF group. Note that a few CEFs were purchased during the month of April.

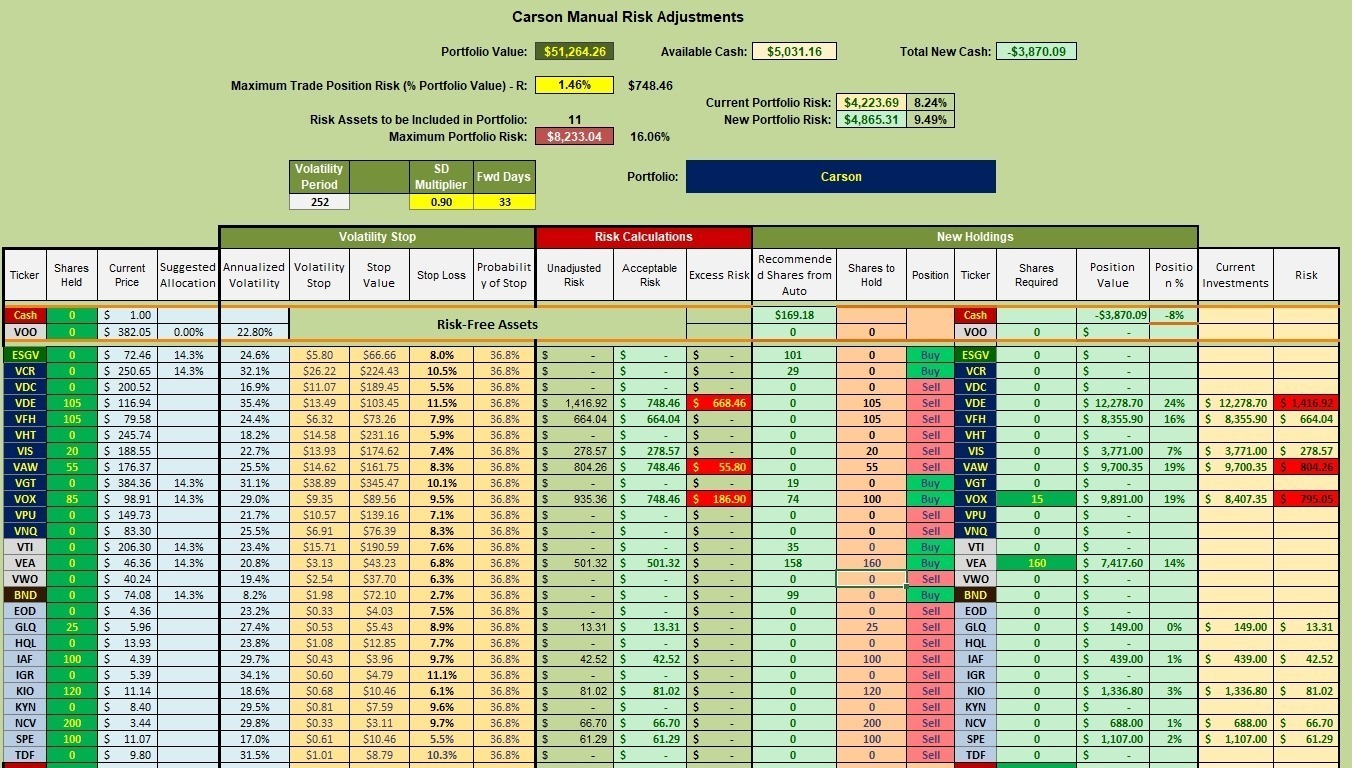

Carson Manual Risk Adjustments

If 15 more shares of VOX are purchased we are up to 19% of the portfolio. I need to buy 20 shares to push the percentage over 20%.

158 shares of VEA are recommended and I have limit orders set to purchase 160 more shares.

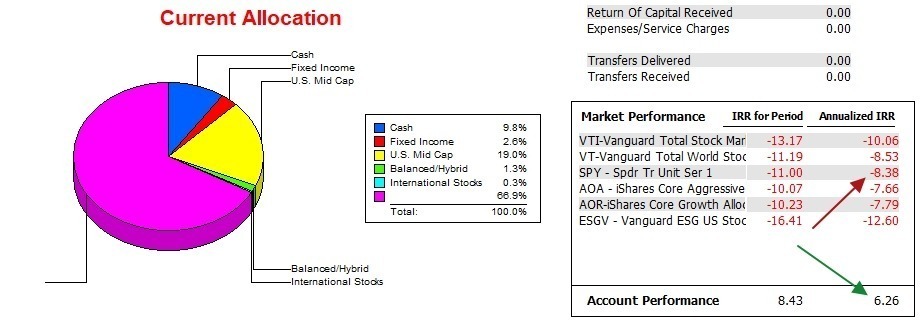

Carson Performance Data

Over the past 16 months the Carson has opened up a significant lead over SPY or the S&P 500. The same is true for the other potential benchmarks I track. Keep in mind the right-hand column is annualized IRR values whereas the left column is the IRR since 12/31/2021.

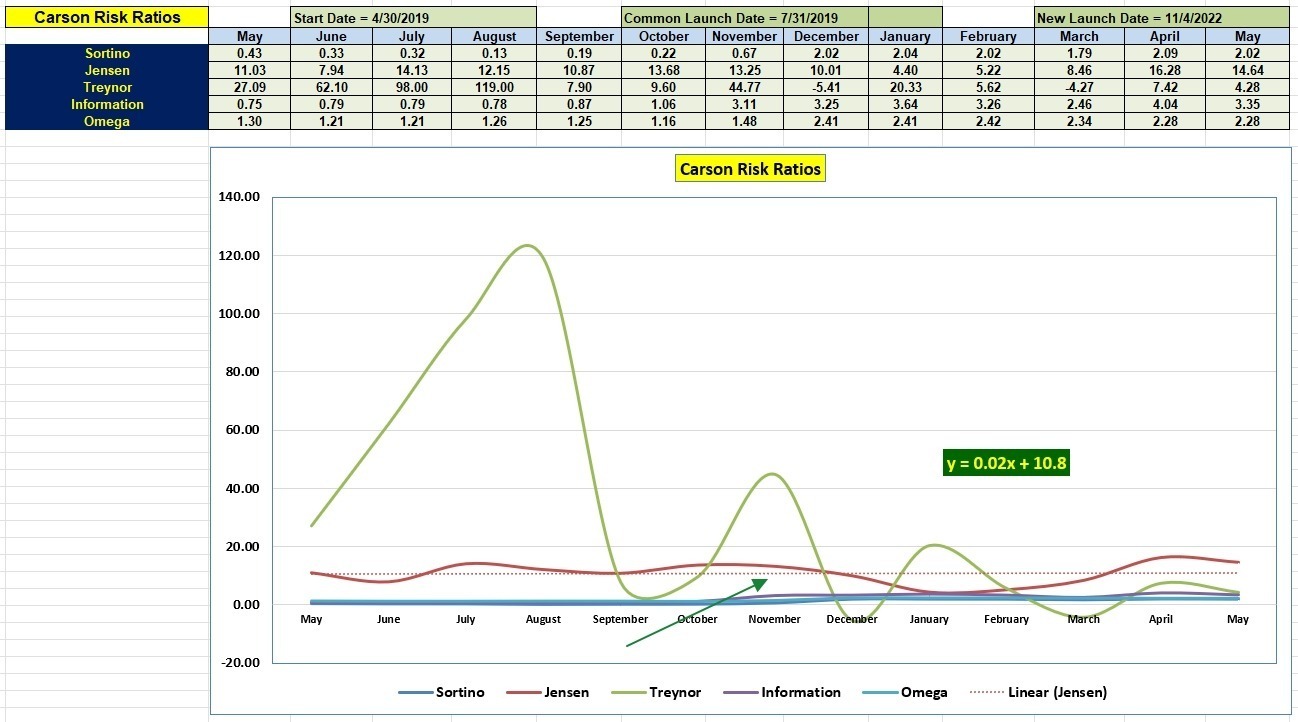

Carson Risk Ratios

Disregard the May data on the right as one day is meaningless. Pay more attention to the trends of the Sortino Ratio, Jensen Alpha, and the Information Ratio.

The Jensen slope is positive, but barely so.

While it is still too early to draw useful conclusions, the Sector BPI Plus investing model is showing promise. If other ITA readers are using the Sector BPI model, your comments are most welcome. Just post in the Comment section provided below.

New Carson Launched: 4 November 2022

Buying Guidelines For BPI Model Portfolios: 9 December 2022

Carson Portfolio Update: 18 November 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Before completing the update of the Carson I went into all Sector BPI portfolios and sold VCR to raise cash to purchase shares of VOX. No other action is currently required for these four portfolios.

Lowell

Hello Lowell I have missed a few blogs recently and suddently find myself behind the learning curve…..Could you please describe the “plus” in the BPI Plus investing model. Thank you.

John,

The Plus is to patch a potential hole in the original Sector BPI model. Here is an explanation of a possible hole.

Assume one of the sectors moves into the overbought zone and the manager places a 3% TSLO under the ETF. Further, assume the sector ETF is sold and as it moves down into the “neutral” zone or at least a 3% drop. Now the portfolio is holding cash from the sale of that sector ETF.

The next market move might be up at a time when the portfolio is holding cash from the sale of the sector ETF. If the market moves down, there is no problem. The problem, or weakness in the original Sector BPI model is if the market begins to rise. Cash is a drag in a rising market.

To combat this rising market problem, we have two alternatives in the wings waiting for investments.

1. If there are no Sector buy recommendations, but cash is available, we check the Kipling SS to see if there are any Dual Momentum buy recommendations. Currently, VEA and VTI are recommended. Since the DM model recommends only one security at a time, we check to see which is the highest ranked. That is VEA at the moment. Therefore we purchase shares of VEA to use up some of the available cash.

2. If none of the DM securities are recommended for purchase we then move on to the Income options which are CEFs. With the McClintock there is cash available even after filling the DM recommendation (VEA).

I hope this explanation helps. It is slightly complicated compared to the original Sector BPI model, but I think it will be stronger investing model.

Lowell

ThxLowell. Most helpful. John