Halloween comes to South Burlingame.

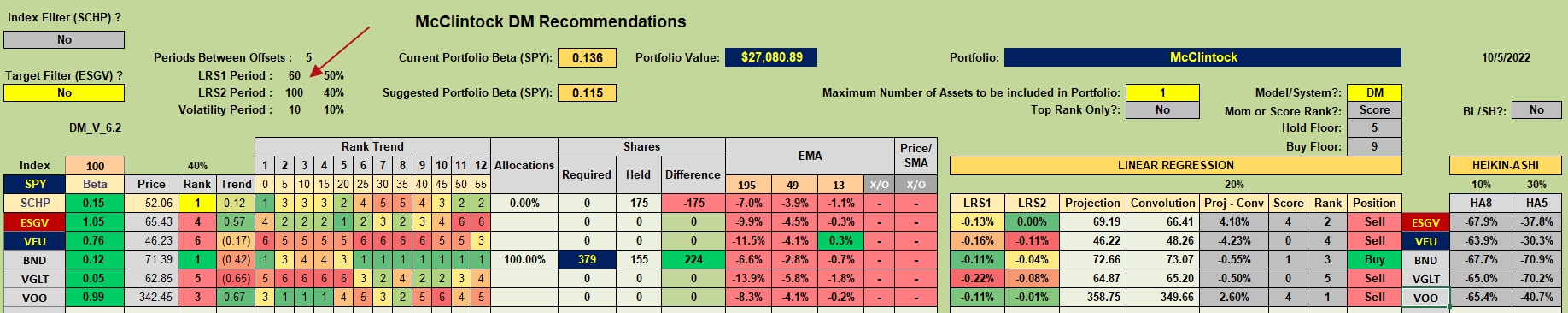

Updating the McClintock generated a surprise as I expected the Dual Momentum™ model would follow the recommendation we observed for both the Franklin and Pauling portfolios which was to invest 100% of the portfolio in U.S. Equities. Not so with the McClintock as the recommendation is to go with U.S. Bonds (BND).

If this were a full review, I would do nothing as the current holdings are BND and SCHP. Both are low volatile securities, relatively speaking. SCHP is an inflation protection security so it fits into a similar Dual Momentum “family” of securities.

A full review of the McClintock is due in a little over two weeks from today.

McClintock Portfolio Review: 10 June 2022

There are two “black” clouds hanging over the current market.

- Will Putin launch a nuclear attack?

- Will democracy survive in America?

Those are two heavy thoughts to contemplate when investing for the future.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell, What is the reason behind the behaviors? LRS1, LRS2 periods appear to be same? Jay R

Jay,

I don’t understand the question as the LRS days are different in the above screenshot. LRS1 Period = 60 days and LRS2 Period = 100 trading days. What am I missing? Are you looking or comparing two different portfolios?

Lowell

Hi Lowell: ….'”a surprise as I expected the Dual Momentum™ model would follow the recommendation we observed for both the Franklin and Pauling portfolios which was to invest 100% of the portfolio in U.S. Equities. Not so with the McClintock as the recommendation is to go with U.S. Bonds (BND).” My earlier comment was related to that, but written poorly.

I have a simple excel spreadsheet ( not like what you publish) which computes 1,3,6, 12 months and it is recommending Cash, similar to McClintock (60, 120 lookback). Not really sure why Pauling turned to US Equities!

Looking forward to your next review of all 4 DM portfolios with their lookback periods. Sure, it is due to the ‘pop&drop’ / bear market rallies we have had this year with the macro pictures of interest rates, inflation, QT etc., and lack of any momentum in any direction. Regards, Jay

Jay,

I too was surprised by the switch from equities to bonds. Just an example of what we refer to as the luck-of-review-day.

Lowell

thank you for the june link – beginner members need the context so that they can catch up on all background.