Oregon Wine Field

Copernicus is the portfolio on the dock for updating this morning. While performance is disappointing, this portfolio will eventually recover as new money is adding U.S. Equity shares at ever lower prices. This is what the young investor needs to consider. As stated before, young savers are hoping for a decline in market prices, assuming they don’t need to sell shares, while retired investors are praying the market moves higher.

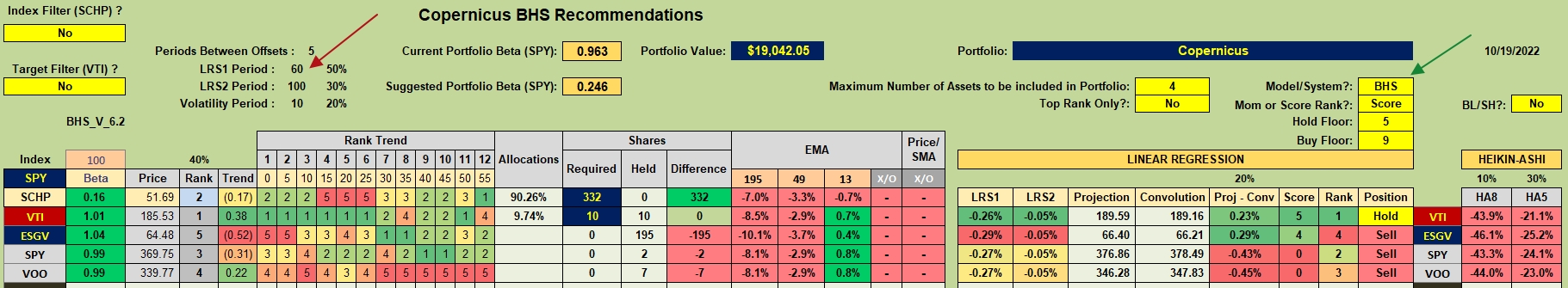

Copernicus Security Recommendation

The Copernicus is setup to invest in U.S. Equities only, be it through VTI, ESGV, SPY, or VOO. While I am using all four with the Copernicus, to keep things simple, you might want to select one or two of the four Exchange Traded Funds (ETFs).

I have the investing model set to BHS (green arrow) for the October review. If set to LRPC, VTI is a Buy. It does not matter as the Copernicus is one portfolio where shares are not sold. We only add to existing holdings. Over the past 30 days shares of VOO and SPY were added to the current positions. With the little bit of cash available, I have two limit orders set to purchase more shares of VTI since it is currently the highest ranked ETF of the four used with the Copernicus.

The red arrow points to the default look-back periods and the weights associated with each. For example, the 60-trading days look-back is given a weight of 50%.

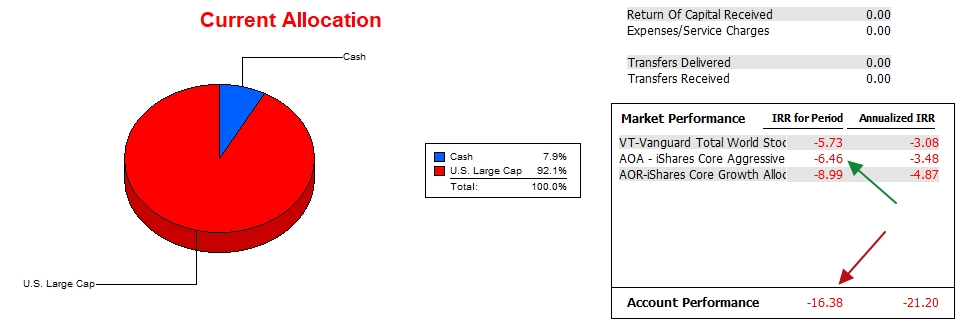

Copernicus Performance Data

Keep in mind the Copernicus was launched at the beginning of the bear market. Even so, it is not coming close to keeping up with the AOA benchmark. This is one of the few ITA portfolios not outperforming the AOA benchmark. This is a 30- to 40-year portfolio plan so nine or ten months is nothing. Be patient and continue to save is the motto of the Copernicus.

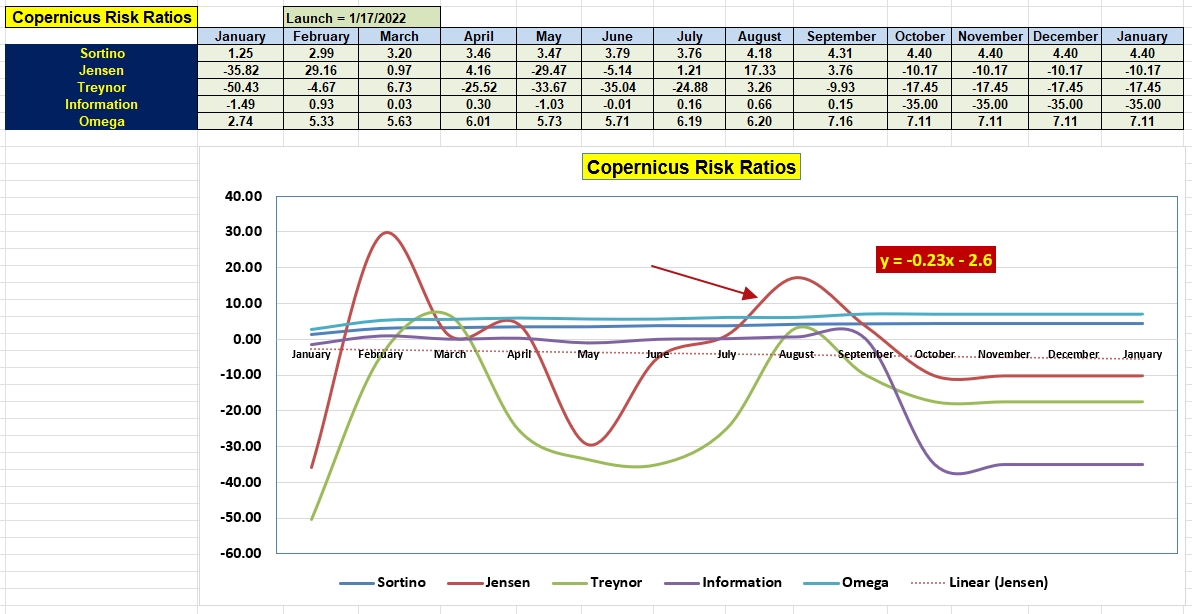

Copernicus Risk Ratios

Since the Copernicus has not existed for a full year we are still filling on months of risk ratio data. This is why November, December, and January repeat the numbers from October. Each month the data becomes more useful. At this point, concentrate on trends rather than absolute values. Particularly watch the slope of the Jensen over the next six to 12 months.

If you prefer not to receive notifications of portfolio reviews, let me know by e-mail ( itawealth@comcast.net ) and I will move you to Spectator level so you don’t receive all these notifications.

Just Received My First Paycheck

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Thank you. Am reading all new posts. REad your 2011 posts on SA. Now onto 2012. May be obsolete but am learning the intricacies of all the working parts of your process. am in term deposts and a guaranteed CPI+ option [balanced smoothed equivalent] in my australian 401Ks [super and pension accounts]. Hope to start investing once your models show a turn in the recessionary outlook.