Street Musician

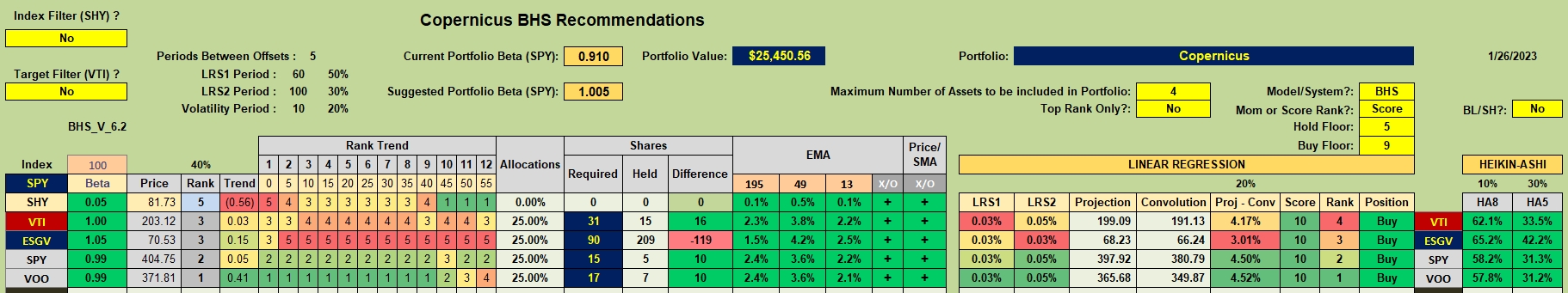

Investors looking for simplicity need look no further than the Copernicus model. All that is required is the discipline to save and invest in U.S. Equities. It is simple as that. The Copernicus is definitely a model for young investors who do not have time to spend working with their investments. Dollar cost averaging is a benefit as well.

Copernicus Investment Quiver

While any of the four ETFs (VTI through VOO) will do as a single security. I am using all four with the Copernicus. If there is insufficient cash I use ESGV as it is priced at the lowest value.

Copernicus Performance Data

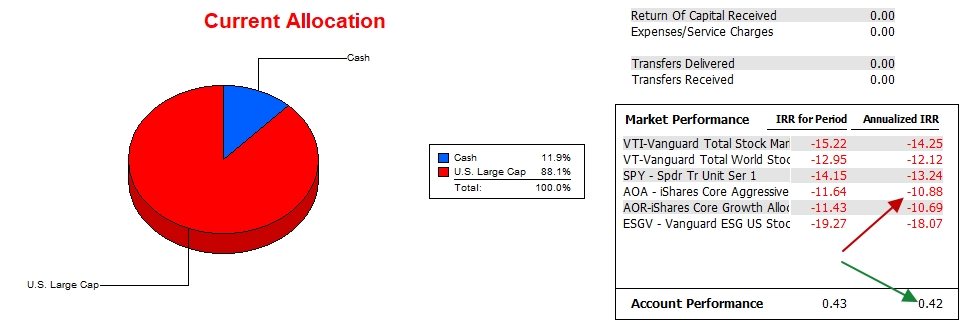

Over the past 13 months the Copernicus finally moved into positive territory whereas the AOA and SPY benchmarks are well into the red. An 11 percentage point lead on the AOA benchmark is significant.

Copernicus Risk Ratios

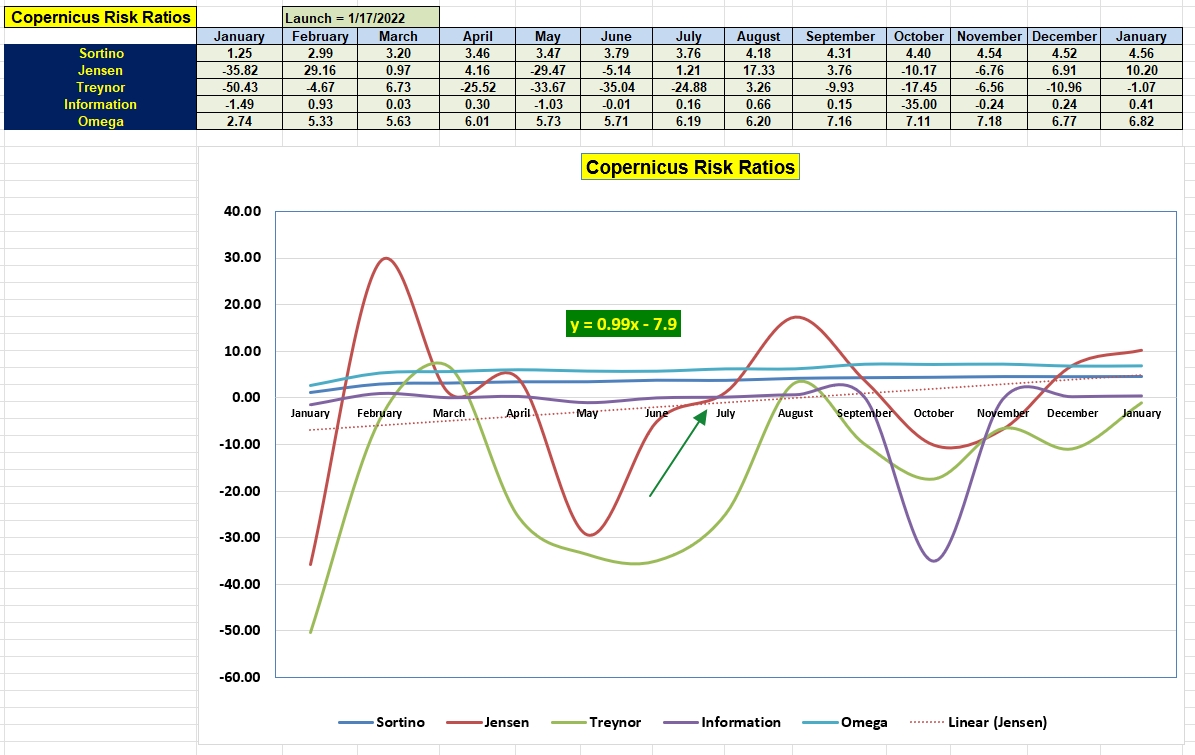

All the critical ratios are positive. The January Information Ratio improved since last November and the slope of the Jensen is positive. The Jensen Performance Index is a very high 10.2 and will be extremely difficult to maintain this level.

The Copernicus is all set to go into “neglect” mode until February.

Copernicus Portfolio Review: 11 August 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.