Mt Shasta on 6/15/2024

If you have been looking for portfolio updates over the past week and saw little action, I took a few days off for a trip to Southern California. Now back from that trip, expect to see quite a bit of action as I update a number of portfolios. Fortunately for the sector portfolios no sectors dropped into the oversold zone while I was absent. Thus no new purchase recommendations showed up over the past two weeks. Based on the strong economy we may be many months away before any new sectors are recommended for purchase. In times such as this the focus reverts to U.S. Equities such as VTI and VOO. These are the two ETFs of focus for the Millikan when sectors are hovering in the neutral zone.

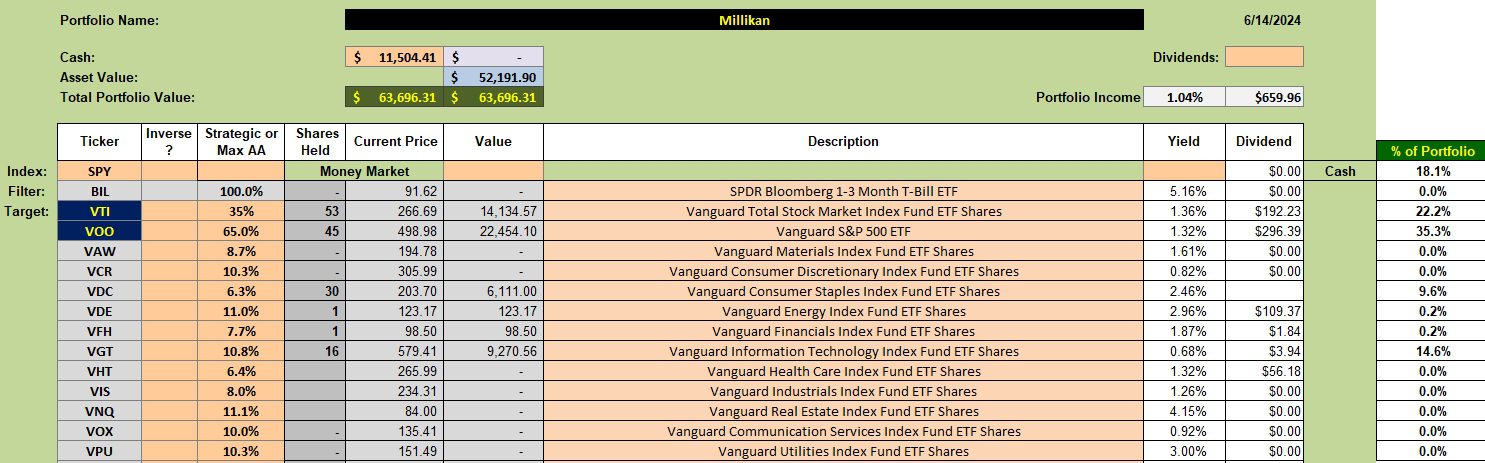

Millikan BPI Portfolio

The Millikan continues to hold four sectors, but Energy and Financial are only “shard” holdings. A Trailing Stop Loss Order (TSLO) is in place to sell Technology (VGT) as it hit the overbought zone since it was last purchased. Consumer Staples (VDC) has been part of the portfolio for many months. Note that it is now 9.6% of the portfolio while the recommended percentage is 6.3%. This growth while positioned in the neutral zone is favorable.

Limit orders are in place to purchase more shares of VOO and VTI as there is still over $11,000 resting in cash. Early in June the Millikan did add more shares of VOO and VTI.

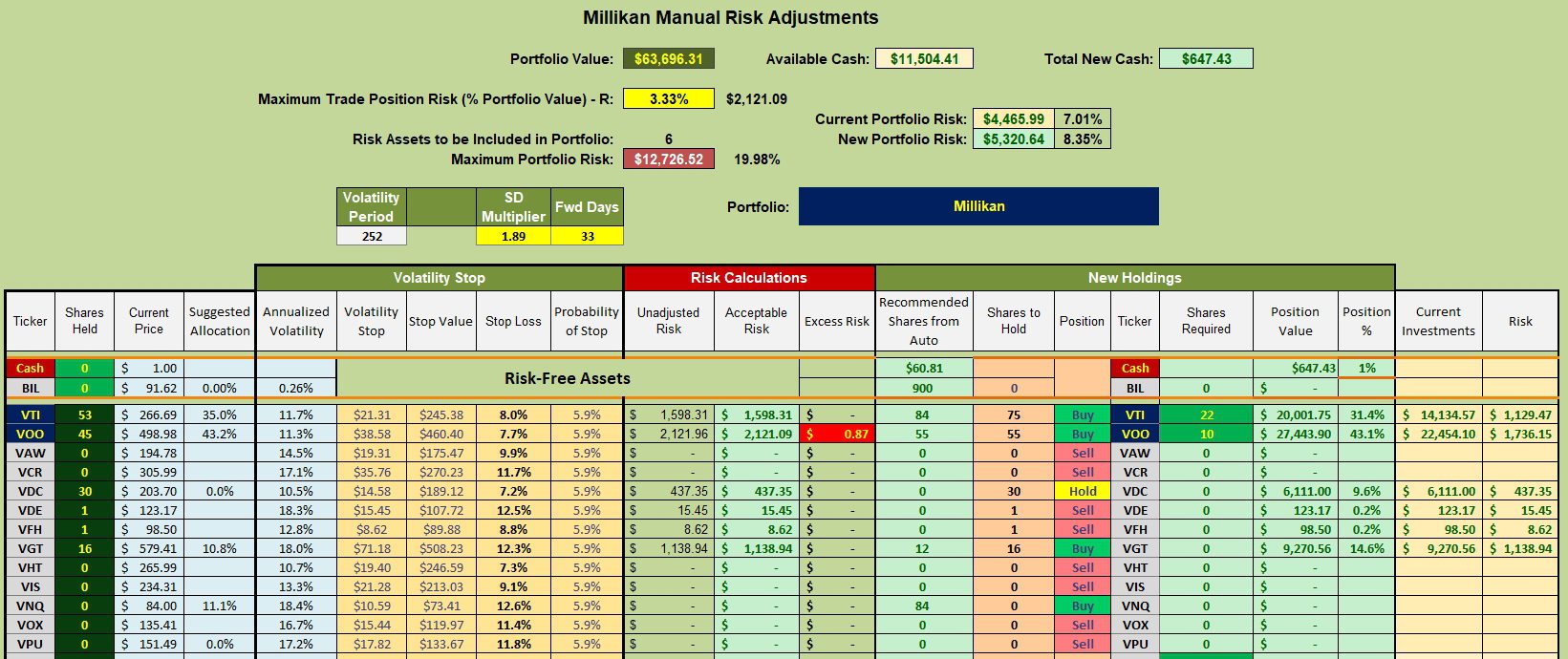

Millikan Manual Risk Adjustments

The goal is to pick up 22 more shares of VTI and 10 more shares of VOO. Other than the TSLO set to sell all shares of VGT, not other action is planned for the eleven sectors.

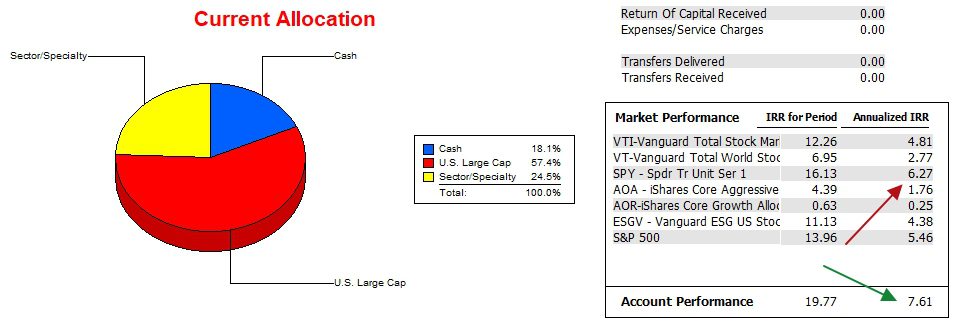

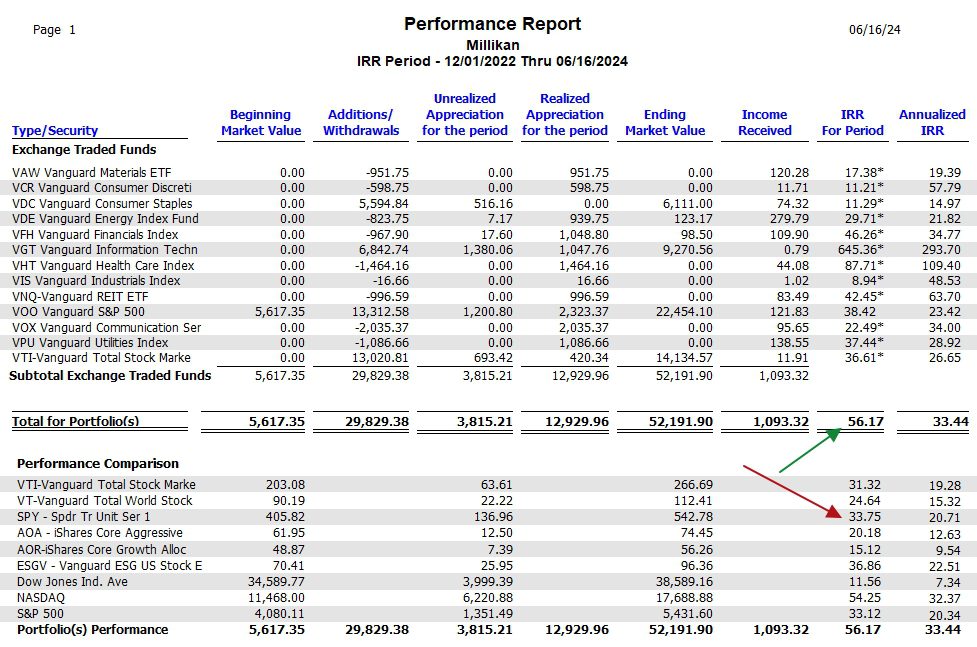

Millikan Performance Data

Since 12/31/2021 the Millikan is besting the SPY ETF by a little over one percentage point annualized. Keep in mind that SPY is the ETF used as a proxy or investable vehicle when attempting to mirror the S&P 500 index. In fact, SPY is currently outperforming the index.

The Millikan has only been using the Sector BPI model since early December of 2022 so we currently have about 1.5 years of data. See the last screenshot for more performance information.

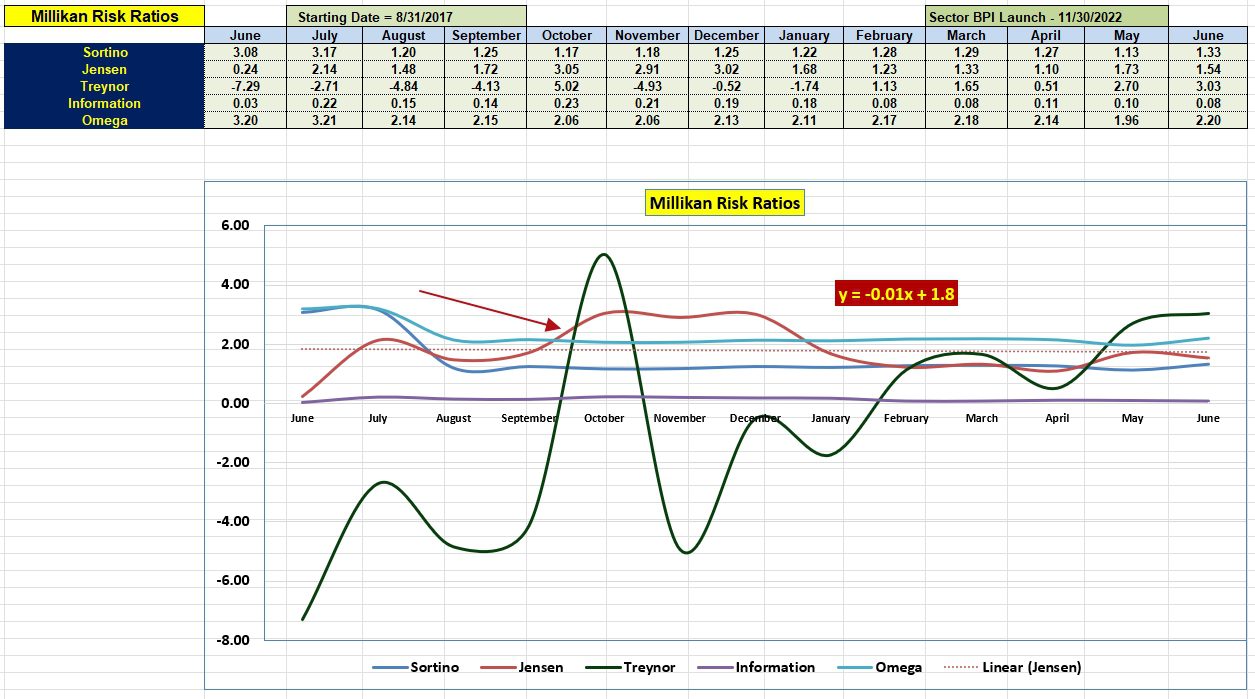

Millikan Risk Ratios

Both the Jensen and Information Ratios are stronger than they were a year ago. Current high cash holdings have been a drag on performance and that accounts for the Jensen dip since this past May. The slope of the Jensen Alpha is essentially flat for the past year.

Millikan Sector Performance Report

Since the Millikan was switched to the Sector BPI investing model, how has it performed? The far right-hand column shows the annualized figure while the IRR For Period column shows the actual performance for the different security holdings. VGT is the big winner.

One can conclude that the Sector BPI model has definitely worked well over the past 1.5 years for the Millikan.

Despite the strong performance of the Sector BPI model, the Copernicus and Schrodinger portfolios maintain high performance positions without all the detailed work that is involved with the Sector BPI model.

The Argument for Self-Management

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question