White Dogwood

As I write this blog the U.S. Stock Market is attempting to regain early Monday losses. As long-time reader know, the Copernicus is an equities only portfolio. The management model is to save and purchase S&P 500 ETFs. Based on the current administration generated chaos I am moving toward a more conservative model. I am keeping tabs on the Buffett Indicator and the Shiller PE Ratio. Both are near historical (1999-2000) highs.

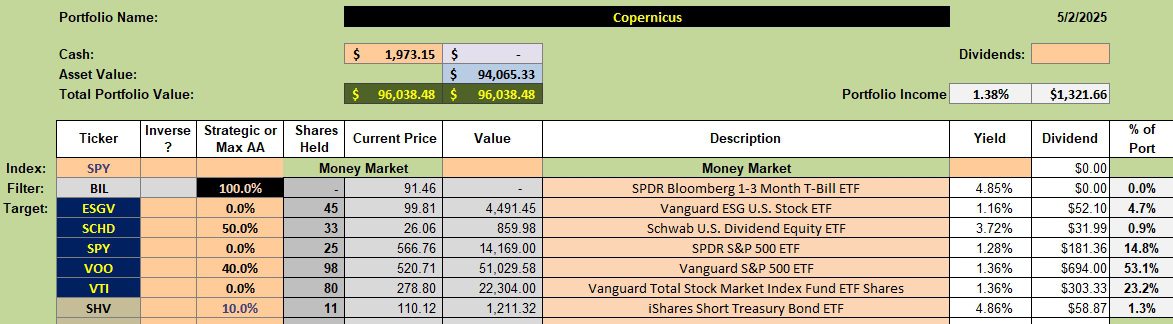

Copernicus Security Holdings

Note the changes in the Strategic or Max AA column. TSLOs are in place to sell all shares of ESGV, SPY, and VTI. If and when any of these three ETFs are sold I will invest the cash in SHV. Buffett made similar moves with his 300 billion plus cash holdings.

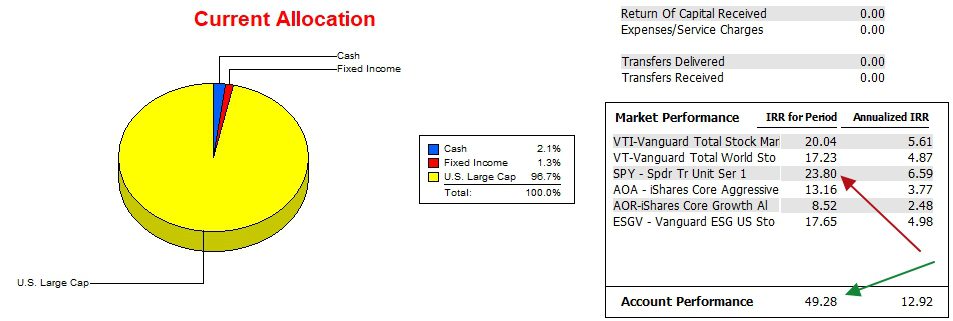

Copernicus Performance Data

Since 12/31/2021 the Copernicus holds a commanding lead over the SPY benchmark. I want to maintain this lead, and perhaps grow it, in anticipation of a market downturn.

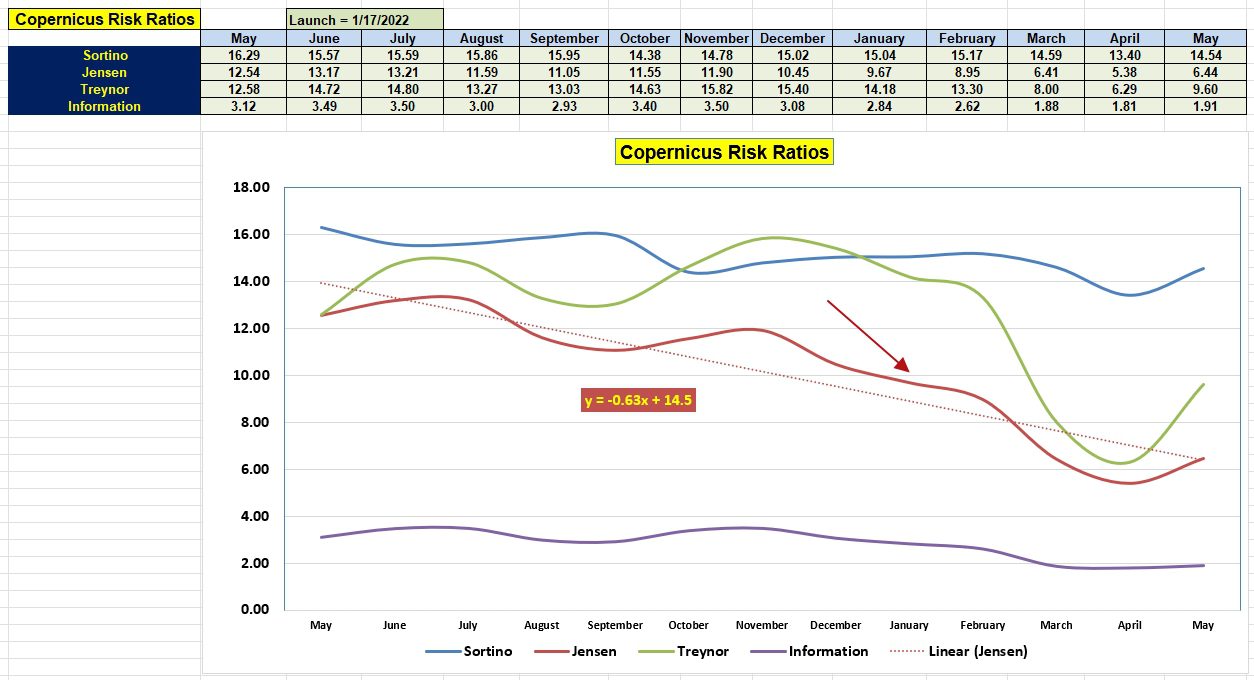

Copernicus Risk Ratios

In the early part of 2024 the Jensen Alpha was extremely high. That ratio is slowly returning to earth, although it did make some recent gains.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question