Yamhill, Oregon

Portfolios fall into two major categories, actively managed or passively managed. The Copernicus portfolio is of the latter variety as the plan is to invest only in U.S. Equities. Only add or purchase Exchanged Traded Funds (ETFs) and only sell in an emergency. Over the past 17 months the Copernicus has been the top performing portfolio of all tracked here at ITA.

Copernicus Investment Quiver

Four ETFs make up the Copernicus investment quiver and they are: VTI, ESGV, SPY, and VOO. If you look up these tickers on Finance-Yahoo you will find there is significant overlap. That is not a problem as all focus on U.S. Equities. An investor could chose two or three of these four and accomplish exactly what we intend with the Copernicus.

The following worksheet comes out of the Kipling spreadsheet and here is how I use it with this particular portfolio. Using the default look-back periods and the investment style set to Buy-Hold-Sell (BHS) I simply set limit orders for the ETFs recommended for purchase. This morning the recommendations were either or both ESGV and/or VOO. Right now I am trying to mimic the S&P 500 so I set several limit orders for VOO.

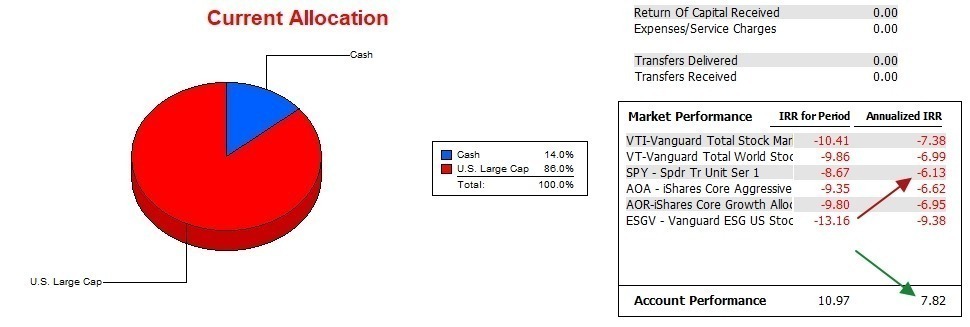

Copernicus Performance Data

Over the past 17 plus months the Copernicus holds a commanding lead over the S&P 500 (SPY). There is a major difference between an Internal Rate of Return of 7.8% and negative 6.1%. It will be very difficult to maintain this huge lead, but that is the goal for the Copernicus.

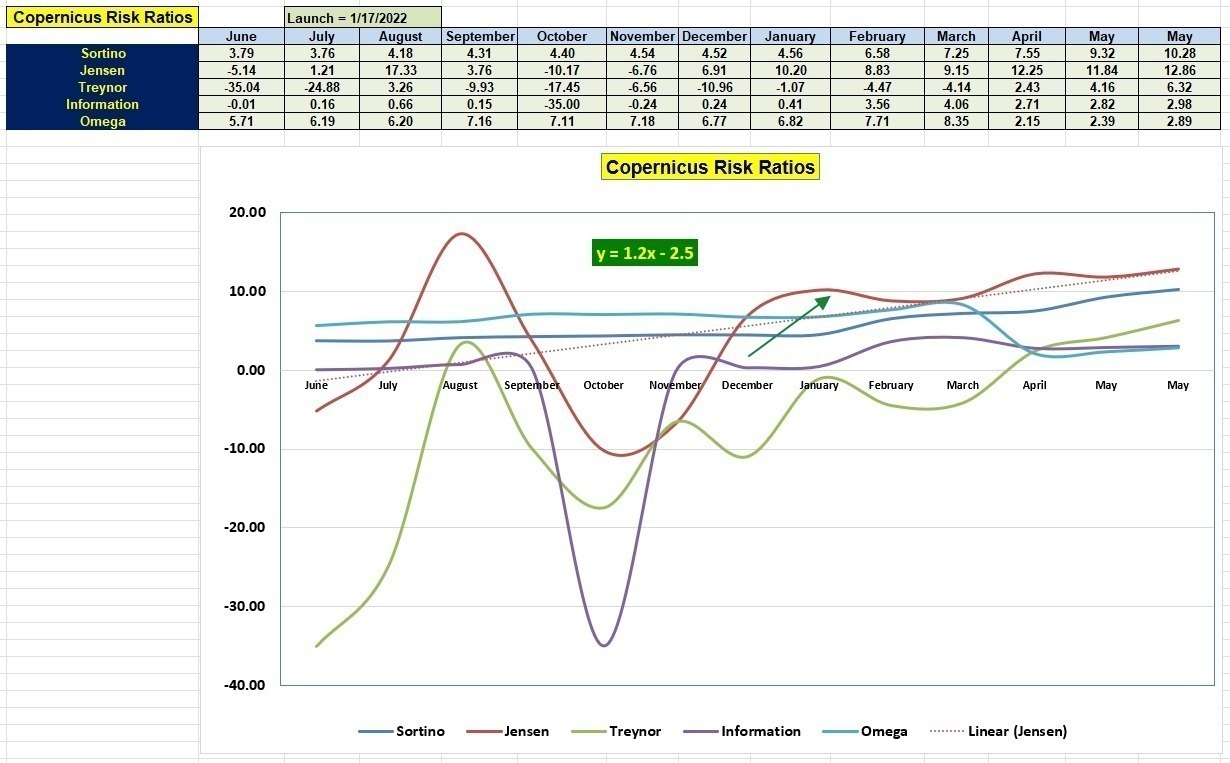

Copernicus Risk Ratios

While it is still very early in June, the Jensen Performance Index or sometimes called the Jensen Alpha, reached its second highest level in over a year. Check over the following table and become familiar with the different terms. Pay most attention to the Jensen, Information, and Sortino Ratios.

The last column should say June, rather than May as I forgot to update the month. To be corrected later.

I recently spoke with a long-time friend and encouraged her to seriously consider using Schwab’s Intelligent Portfolio model. That is the Schrodinger portfolio here at ITA Wealth Management. More on this later when I update the Schrodinger. I need to do this soon as the owner of the Schrodinger recently added money to the portfolio to the point where Schwab will now “Tax Manage” the portfolio.

Expect to see more information as to the actual cost for someone to manage your portfolio. Rather than take my word or advice, try the following.

Split the portfolio in half. Invest half with a Schwab Intelligent Portfolio and leave the other half with the “professional” money manager. If you invest new money, invest exactly the same amount with each half of the portfolio. Each quarter, compare the value of each. Do this for as long as it takes to determine which account performs best. Be sure to subtract the management fee from the professionally managed portfolio.

Lowell

Copernicus Buy & Hold Portfolio Review: 18 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

Is there a fix for the missing descriptions problem?

Bob_P

Bob,

Yes, I can send you the ITA file.

Lowell

PLEASE DO and SENDTO

BPETERSEN123@GMAILCOM

I am having trouble with my comcast email acct.

thanks

Bob Petersen

Bob and Jim,

See if this link will take you to where you can download the latest ITA file.

https://www.dropbox.com/s/1w6ev0cflkkyuaj/ITA%20-%205.0.7.1.xlam?dl=0

Lowell

Lowell,

That worked, and I am now getting ticker names in the Kipling spreadsheets. Thank you for the update.

~jim

Lowell,

Could you also send me the ITA file. Thanks.

~jim