Schrodinger is a Robo Advisor account or what Schwab calls an Intelligent Portfolio. Managed by computer algorithms, this is simply a report as no decisions are required. The portfolio is on automatic pilot. Since the portfolio is greater than $50,000 it qualifies to be tax managed.

I highly recommend a family have at least one Intelligent Portfolio so if something happens to the spouse who manages the money, all other taxable accounts can be merged with this account.

Schrodinger Intelligent Portfolio

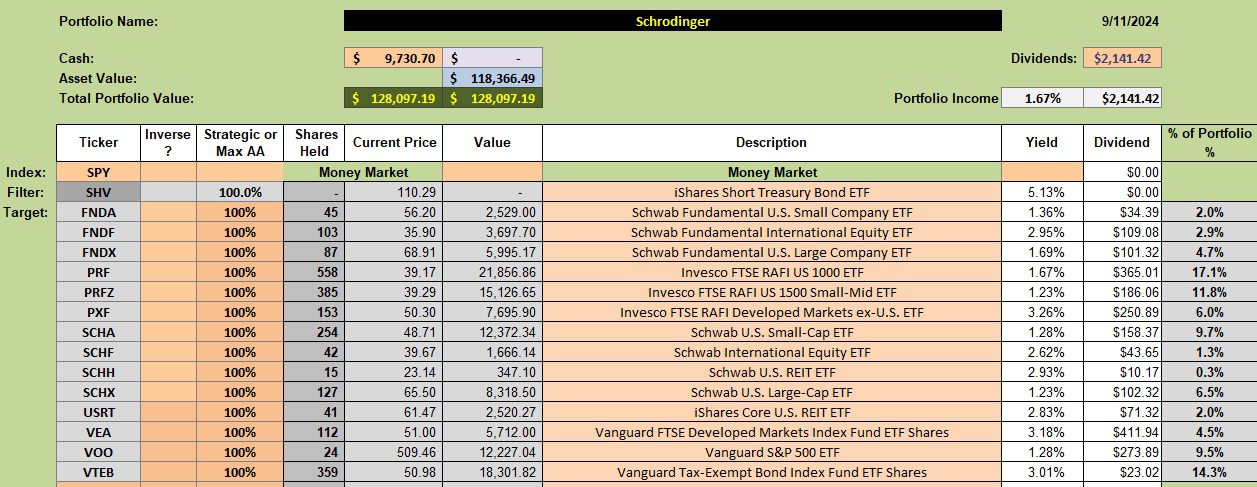

Below is the Schrodinger investment quiver and current holdings. Despite “computer intelligence” I find it puzzling why there are two REIT ETFs (SCHH and USRT).

Once third quarter dividends are paid I anticipate Schwab will add a few new shares so some of the current holdings.

Schrodinger Performance Data

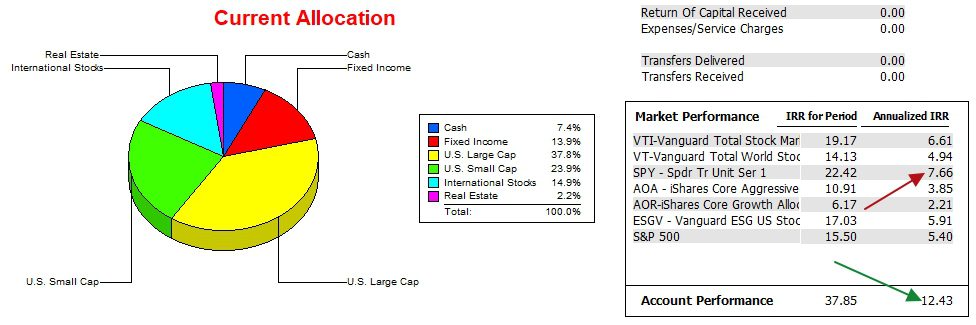

Since 12/31/2021 the Schrodinger has opened up a significant lead on the SPY benchmark. Despite holding between 7.0% and 8.0% in cash the portfolio continues to be one of the top return performers among all the ITA portfolios.

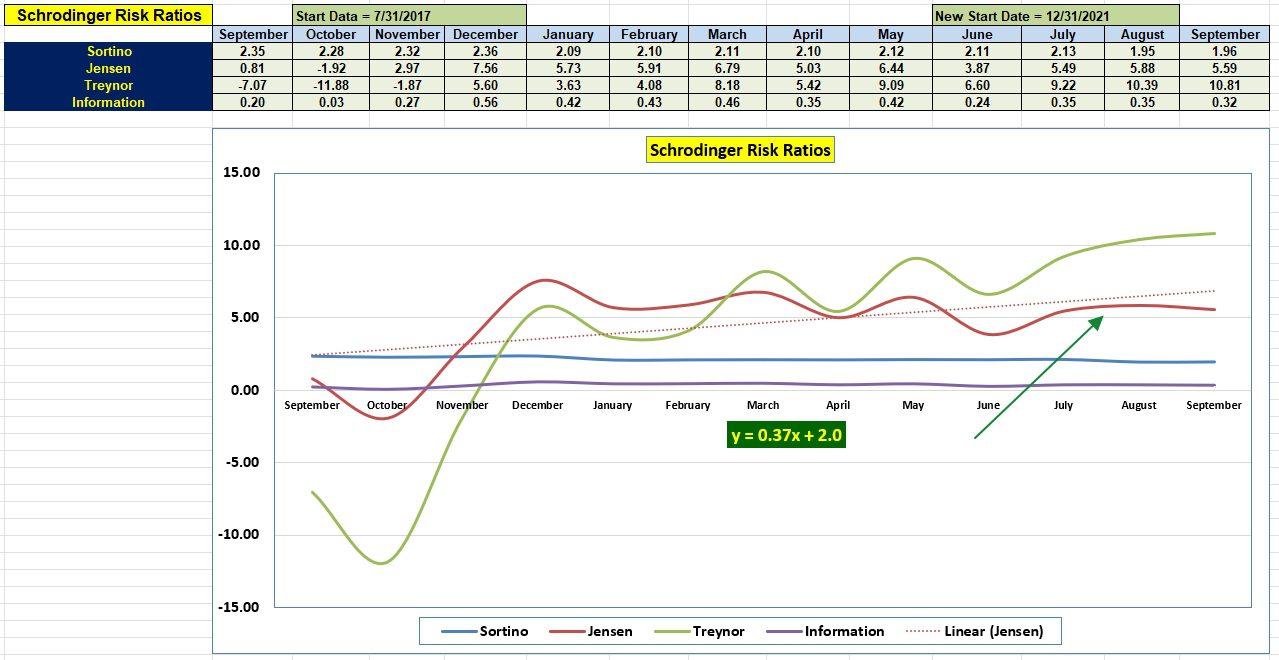

Schrodinger Risk Ratio

The Schrodinger tends to perform best in an “average” market or one where equities are not so strong. Bonds tend to be a drag in a strong bull market. Over this past year the slope of the Jensen has been positive – a very good indicator of how well the Schrodinger is performing.

Pass on the URL [ https://itawealth.com ] to friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

I recently setup a Schwab Robo Advisor account and my allocations are significantly different than Schrödinger. Could you possibly share the settings used for setting up the Schrödinger.

Thank you,

Bill

Bill,

The difference might be tied to my request to emphasize U.S. Equities and downplay International Equities. That is the only request I made.

Would this request make a difference in your asset allocations? Age is also a factor and I am not young.

Lowell

Bill,

If you were to create a pie chart of your Schwab Intelligent Portfolio would it look much different than the pie chart I show above?

Lowell

Lowell,

Yes. Mine is:

Cash 12.5%

Fixed 36.8%

US Large Cap 20.8%

US Small Cap 13.9%

International 14.9%

Real Estate 1.0%

My initial setup was very conservative since I’m in my late 70’s. I don’t recall all the setup questions but I may have chosen an income generation bias thus the high fixed percentage.

Bill

Bill,

As I recall I went into the Intelligent Portfolio and pushed the stock/bond ratio toward equities. Otherwise the computer would set up a more conservative ratio.

Lowell

Lowell/Bill,

Lowell is correct, you can ask Schwab to deemphasize international equities. I believe you can do this on their web site yourself. In addition, though, the Intelligent Portfolio asset allocation depends upon where you end up on the risk/reward scale – conservative, moderately aggressive, aggressive, etc. I had to play around with answering the risk/reward questions to get to the equity/fixed income allocation that I was happy with.

It has been a few years since I set up my allocation, so am not familiar with whether or not Schwab has changed its process/criteria for setting asset allocations in the Portfolios. Hopefully, you can set an acceptable allocation via a phone call with a representative. I would be interested in knowing that since I’m thinking about trying to change mine.

~jim

Lowell/Bill,

Lowell, you have more equity assets in your Schrodinger than I have in mine. For example, you have PRF, PRFZ, PXF, and VOO. I’m wondering if the assets chosen by the Schwab Intelligent models are different for taxable and retirement (e.g., IRA) accounts. VOO is the strangest one since you have both SCHX and FNDX already in the portfolio.

~jim

Jim,

This is a taxable account. Is your Schwab a tax deferred account?

PRF, PRFZ and PXF held nearly zero shares when first added to the portfolio. That was puzzling. Now they hold significant percentages.

I have the portfolio set to approximately 80% equities and 20% fixed income and cash. That is rather aggressive and not the percentages Schwab recommends for someone my age.

Lowell

Lowell,

My Schrodinger is in a tax-deferred account, also set at about 80/20. Since April 17, it has had an annualized 7.5% return.

~jim

Here is the link to a very fair review of Schwab’s Intelligent Portfolios.

https://www.youtube.com/watch?v=UVrR0xoR9T4

Lowell