3 Second exposure of Willamette Falls.

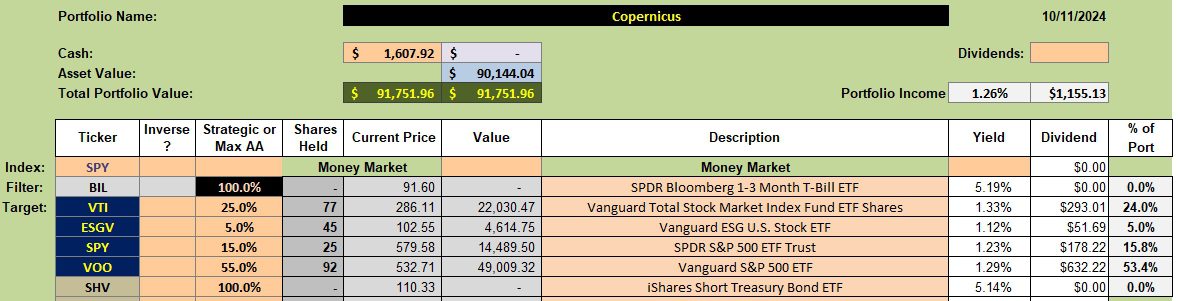

Copernicus is one of my favorite portfolios for young investors or someone who has a 15-year or longer investment horizon. The philosophy behind the Copernicus is to invest in U.S. Equities and never sell unless there is an emergency. Since the portfolio invests only in U.S. Equities the S&P 500 is an appropriate benchmark.

The goal is to stay fully invested at all times. If there is sufficient cash, buy VOO. Next in line for acquisition is VTI. When cash runs low purchase ESGV. If beginning again I would eliminate SPY as it overlaps with VOO.

Copernicus Investment Quiver and Holdings

To keep this portfolio as simple as possible invest only in VOO. Since I launched the Copernicus with four U.S. Equities ETFs I’ll stick with them.

Limit orders are in place to pick up shares of VOO, VTI, and ESGV.

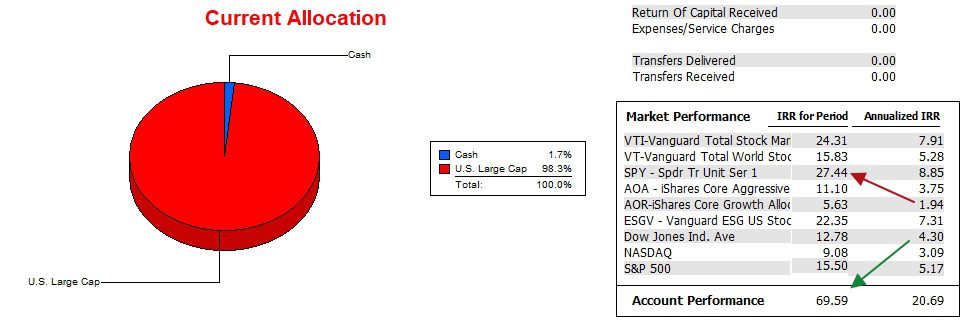

Copernicus Performance Data

Since 12/31/2021 the Copernicus is crushing all potential benchmarks. Shares purchased when the market was “low” in 2022 are now paying off. This is known as dollar-cost-averaging. DCA is a benefit to the investor so long as the market is moving up.

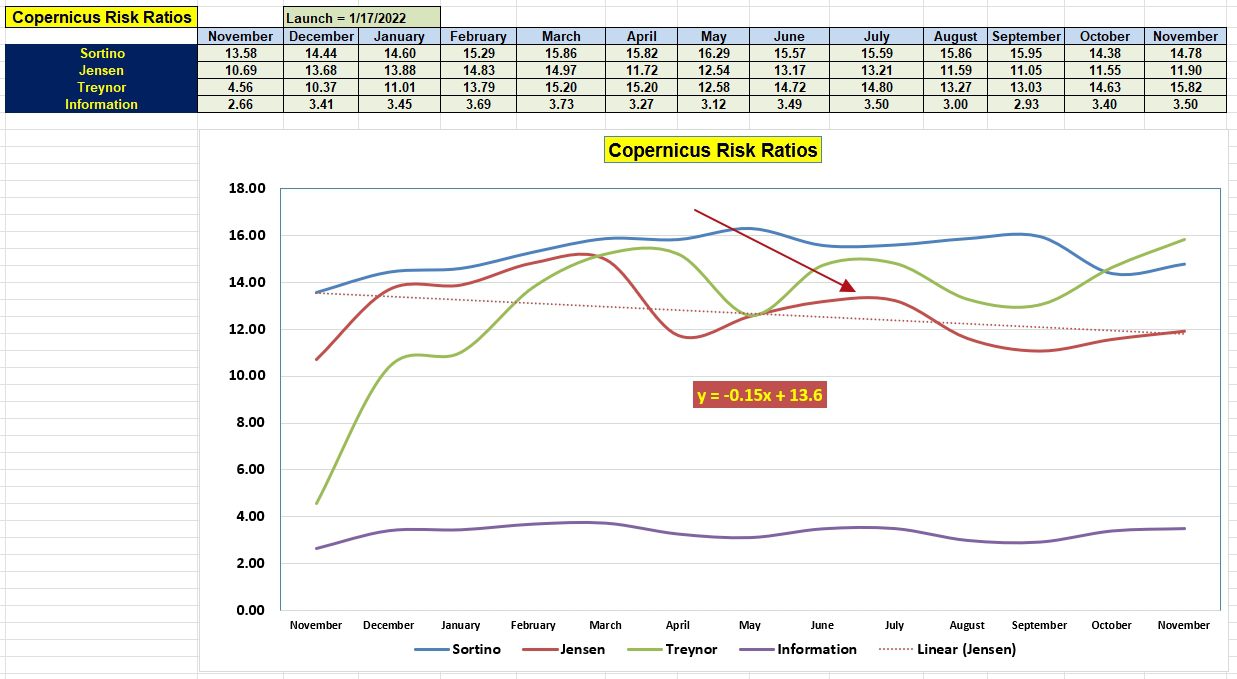

Copernicus Risk Ratios

We are coming up on three years of operation for the Copernicus. While the October and November values are not peaks for the year they are remarkably high.

Investors looking for simplicity will find the Copernicus an excellent option.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question