Tree refraction in glass of white wine.

After updating a few lackluster portfolios, it is refreshing to review a strong yet simple portfolio. Other than the Schrodinger where the owner does noting but save, the Copernicus comes in a close second for simplicity.

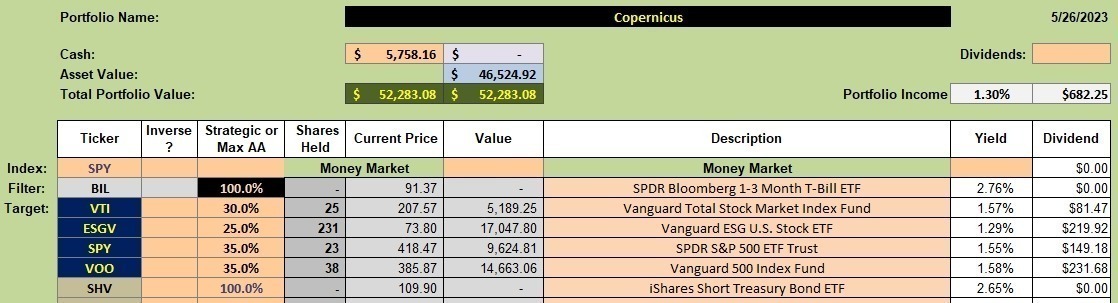

Copernicus Investment Quiver and Holdings

Below is the current investment quiver and holdings for the Copernicus. I added SHV as an additional option for times when none of the four U.S. Equity ETFs are recommended for purchase due to a recession. The goal of the Copernicus is to keep pace with the S&P 500.

Copernicus Security Recommendations

Using the default look-back periods of 60- and 100-trading days combined with the Buy-Hold-Sell (BHS) investing model, the Copernicus is recommending ESGV and VOO as the two ETFs of interest. VTI and SPY are Hold? recommendations which means the manager makes the decision to hold or sell. Since we prefer not to sell any shares out of the Copernicus I will continue to hold all shares in those two ETFs.

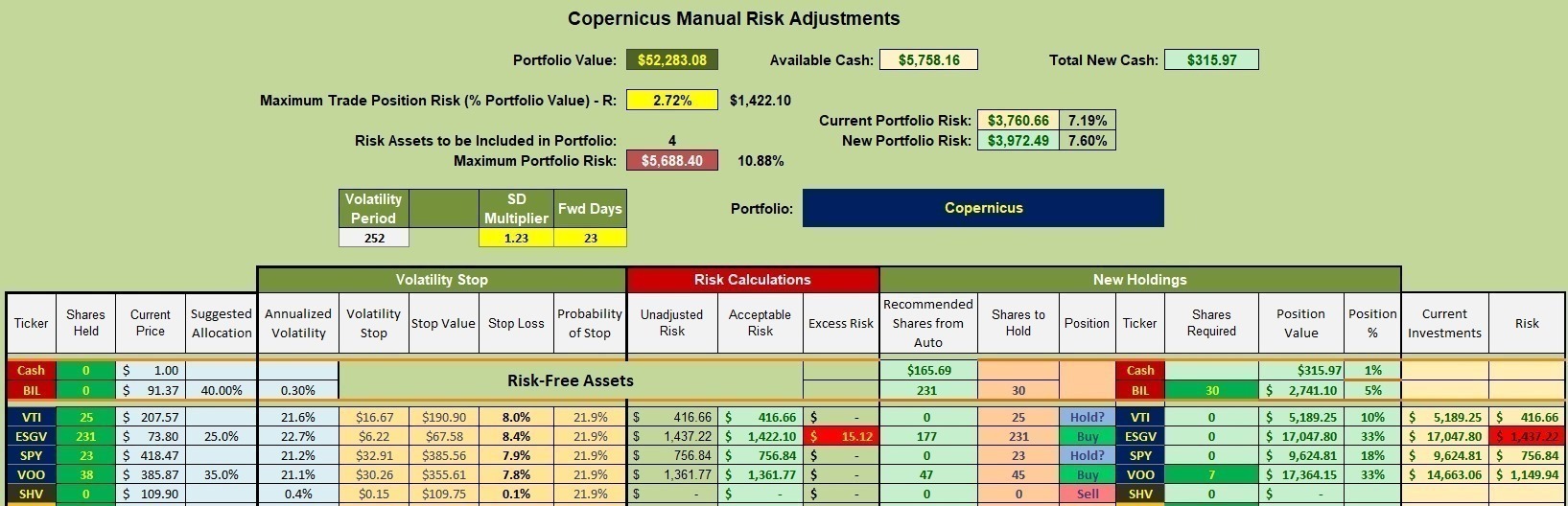

Copernicus Manual Risk Adjustments

The plan is to add seven (7) shares of VOO and then use all available cash to purchase shares of BIL.

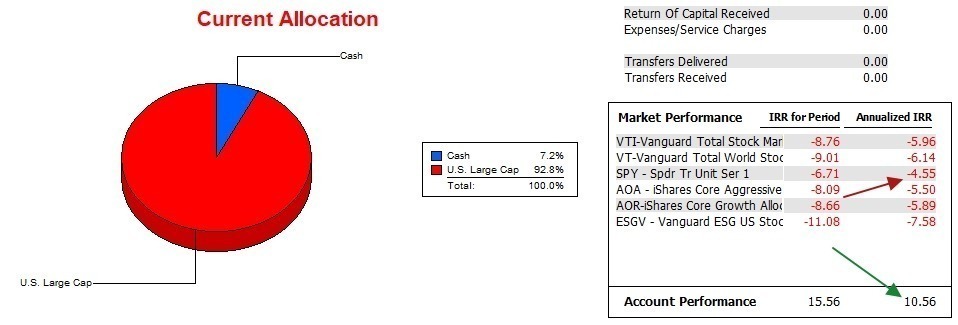

Copernicus Performance Data

Over the past 18 months the Copernicus outperformed the S&P 500 (SPY) by 15% annualized. This occurred as new money was added and shares were purchased during periods of market weakness in 2022.

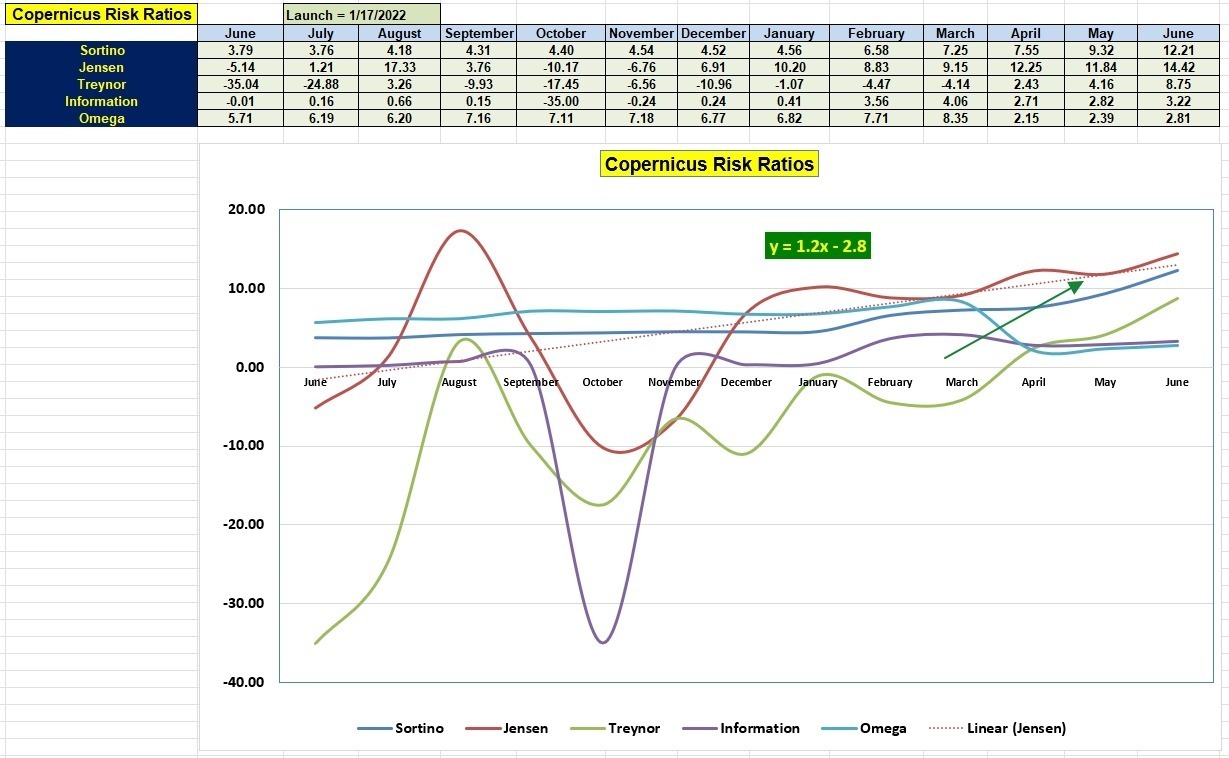

Copernicus Risk Ratios

All risk measurements for the Copernicus are strong and near all time highs. The Information Ratio is close to the February high and Jensen’s Alpha is approaching the high of last August. The Jensen slope (1.2) is very high.

Copernicus Buy & Hold Portfolio Review: 18 May 2023

The Copernicus and Schrodinger are excellent choices for young investors willing to invest heavily in U.S. Equities.

The ITA blog is free to all who register as a Guest.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.