Tree Lizard, Cairns, Queensland, Australia

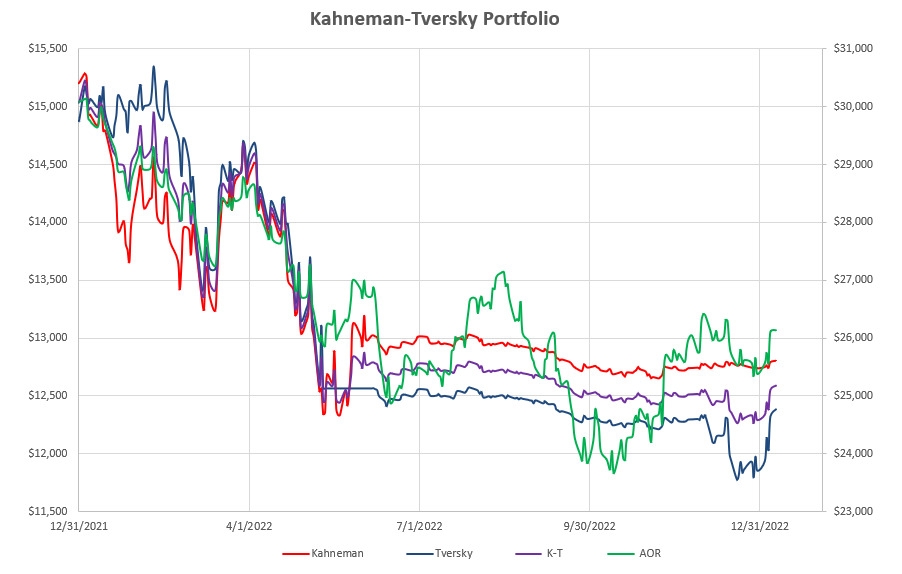

We start off the New Year with the following picture of performance for the Kahneman-Tversky (K-T) Portfolio through 2022:

The portfolio showed less volatility than the benchmark AOR Fund but returns were slightly lower with a ~16% draw-down on the year. This compares with a drop of ~19% in US equities over the same period.

The portfolio showed less volatility than the benchmark AOR Fund but returns were slightly lower with a ~16% draw-down on the year. This compares with a drop of ~19% in US equities over the same period.

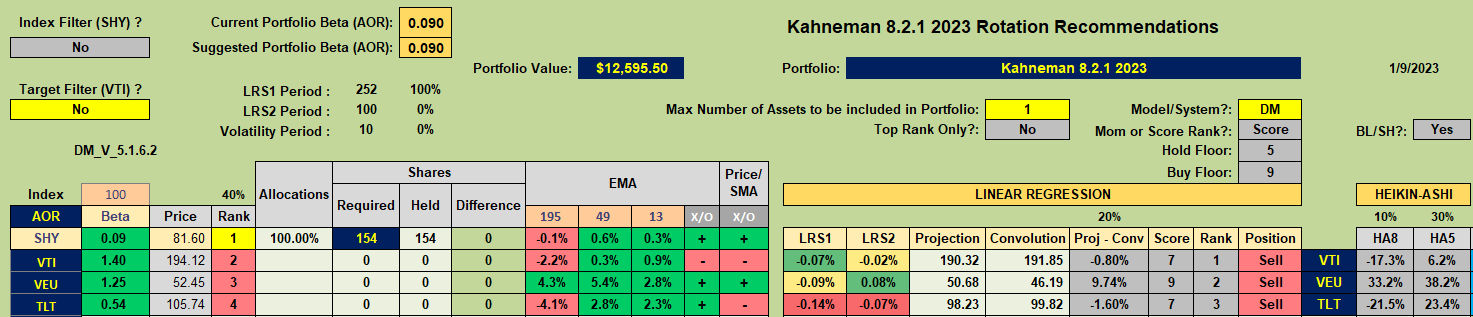

The portfolio is a simple Dual Momentum portfolio divided into two portions – a slow moving portion (Kahneman) that uses Gary Antonacci’s single 12-month (252 trading day) lookback to measure momentum:

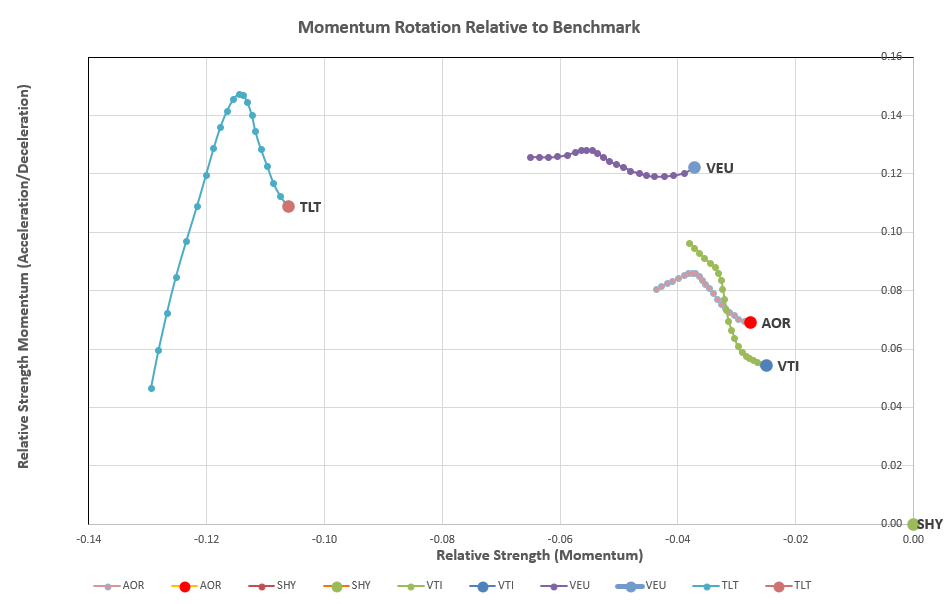

and this model recommends that we be invested in short-term Treasury Bonds (SHY). Rotation graphs of the assets to be selected from look like this:

and this model recommends that we be invested in short-term Treasury Bonds (SHY). Rotation graphs of the assets to be selected from look like this:

and, although looking stronger over the past month (moving left to right) are still sitting to the left of the vertical axis – i.e. have negative long-term momentum relative to SHY.

and, although looking stronger over the past month (moving left to right) are still sitting to the left of the vertical axis – i.e. have negative long-term momentum relative to SHY.

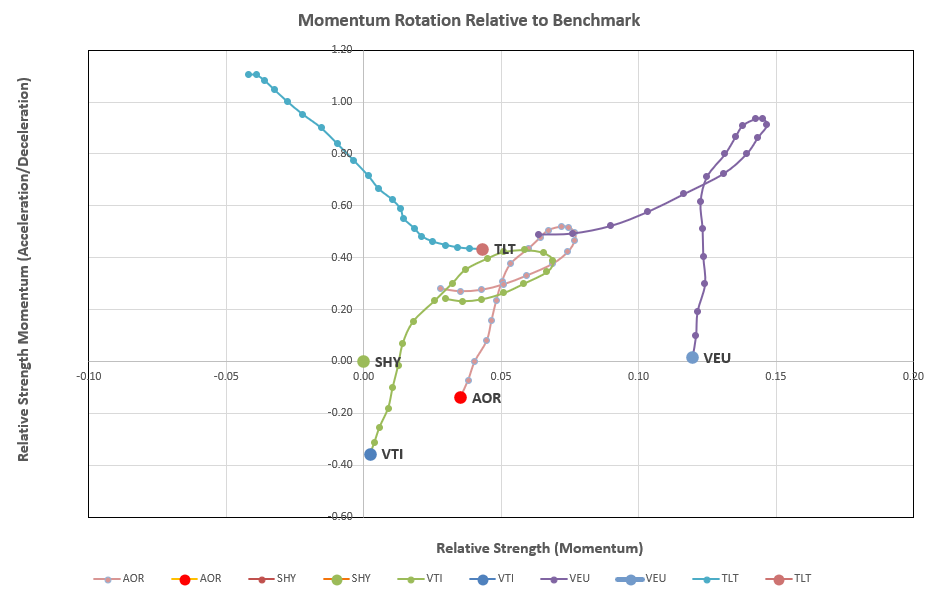

Rotation graphs of the same assets but using shorter (60- and 100-day) lookbacks to measure momentum – the faster reacting Tversky portion of the portfolio – look like this:

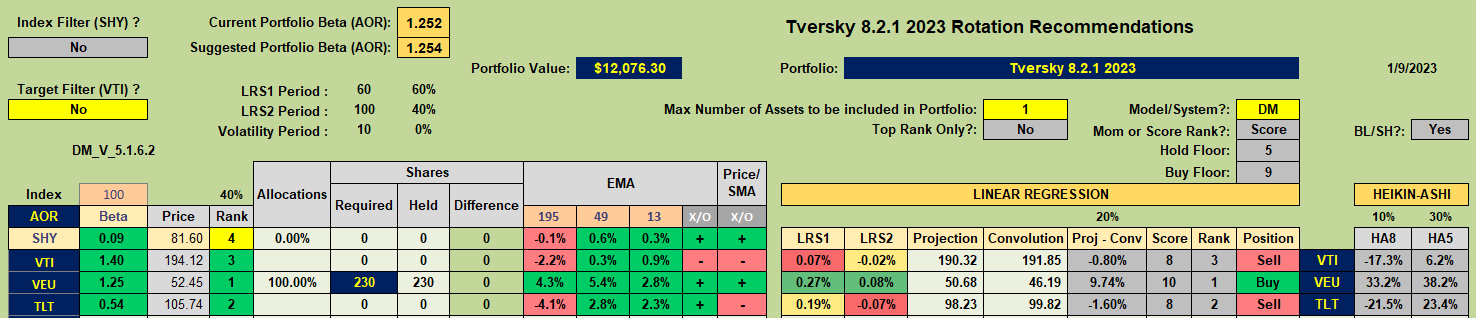

with all ETFs lying to the right of the vertical axis (positive relative momentum) on this intermediate-term time frame, but showing shorter term weakness (moving down from top to bottom of the chart. Recommendations from this model:

with all ETFs lying to the right of the vertical axis (positive relative momentum) on this intermediate-term time frame, but showing shorter term weakness (moving down from top to bottom of the chart. Recommendations from this model:

suggest holding VEU (International equities).

suggest holding VEU (International equities).

Since these are the current ETFs held in the portfolio, no adjustments are deemed necessary at this time.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.