Geothermal Hot Springs, Tarangoa, New Zealand

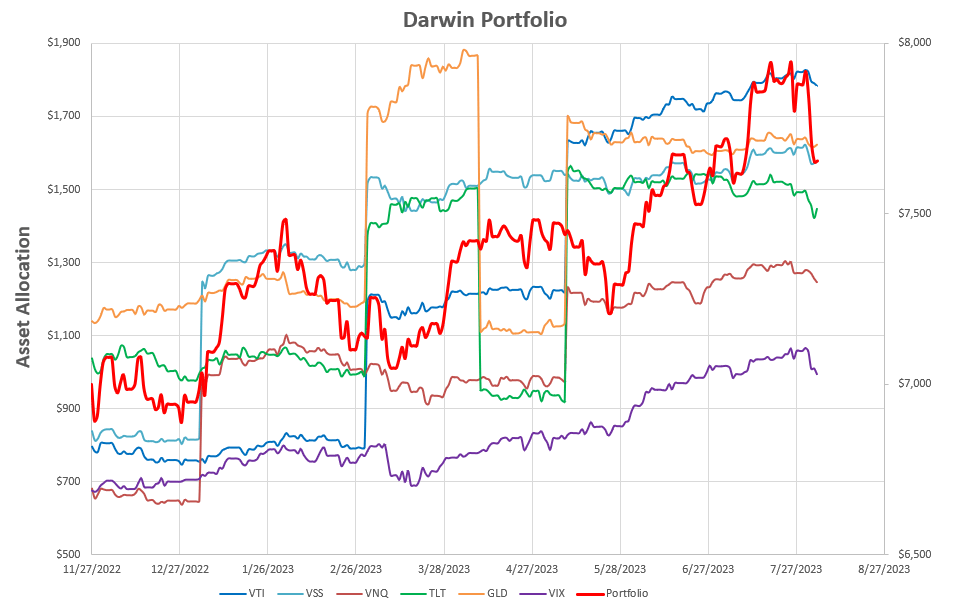

The Darwin Portfolio is an “all-weather” portfolio that it adjusted, as necessary, on the basis of risk parity. Performance to date looks like this:

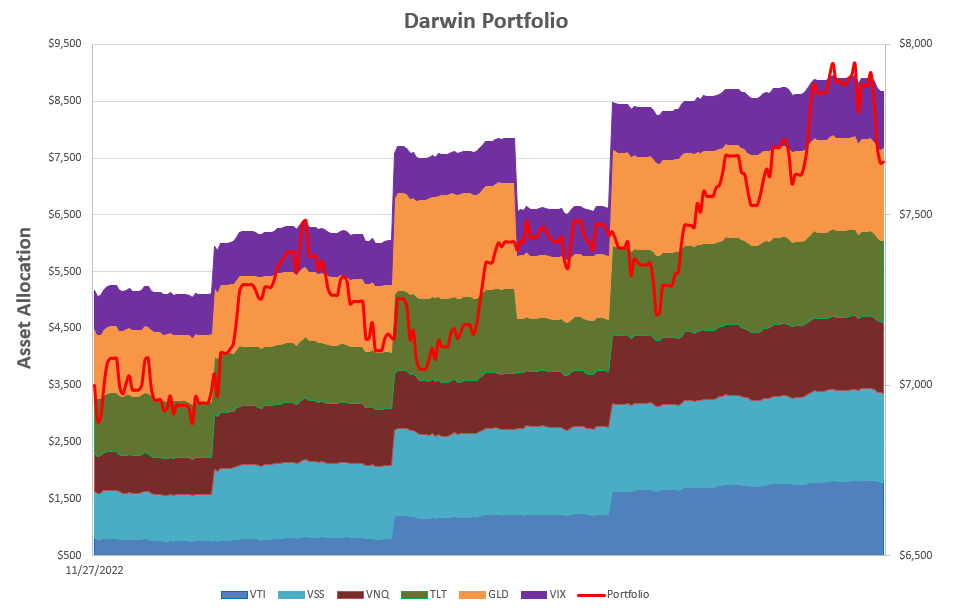

0r, in stacked format:

0r, in stacked format:

The discontinuities in the graphs correspond to allocation adjustments.

The discontinuities in the graphs correspond to allocation adjustments.

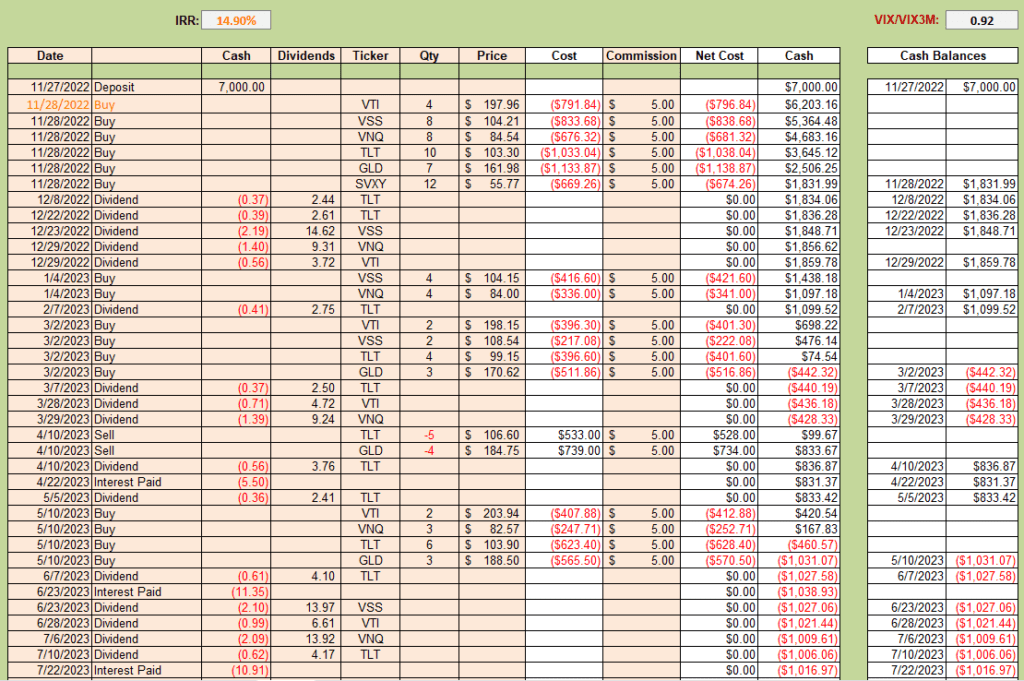

Despite the weakness over the past few days, Internal Rate of Return (IRR) is still standing at 14.9%:

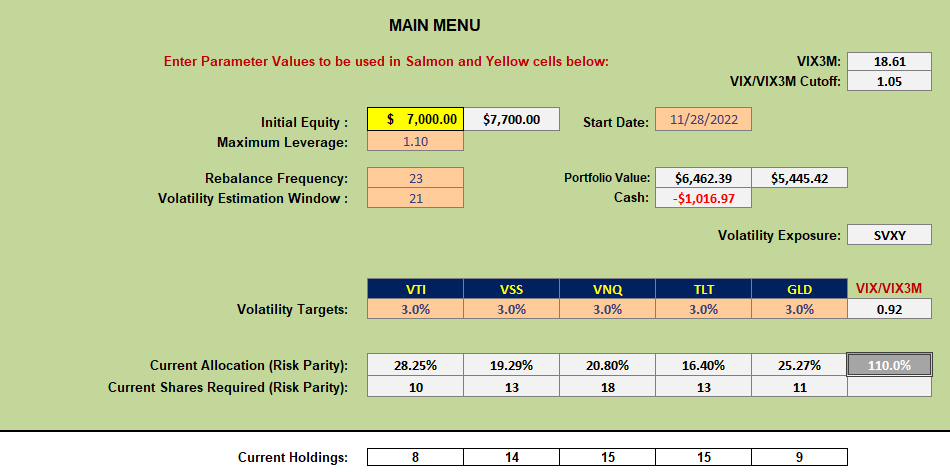

Running the current performance calculations we can see the differences in current holdings and suggested allocations:

Running the current performance calculations we can see the differences in current holdings and suggested allocations:

Although the differences are small, since there have been no adjustments for ~3 months I will rebalance as follows:

Although the differences are small, since there have been no adjustments for ~3 months I will rebalance as follows:

- Buy 2 shares VTI

- Buy 3 shares VNQ

- Sell 2 shares TLT

- Buy 2 shares GLD

Since the difference for VSS is only 1 share I will leave that position as-is.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.