Oppenheimer pipe from statue in Los Alamos.

It has been nearly two years since the Franklin portfolio began using the Sector BPI investing model. Over this period the portfolio managed to keep pace with the S&P 500 (SPY) index, a major goal for these Sector BPI portfolios.

Since the last review shares of VCR and VDC were sold out of the portfolio as the 3% TSLOs were struck. Before beginning this blog post I checked the BPI data on Energy and it has not reached the overbought zone. VDE is the lone sector holding in the Franklin.

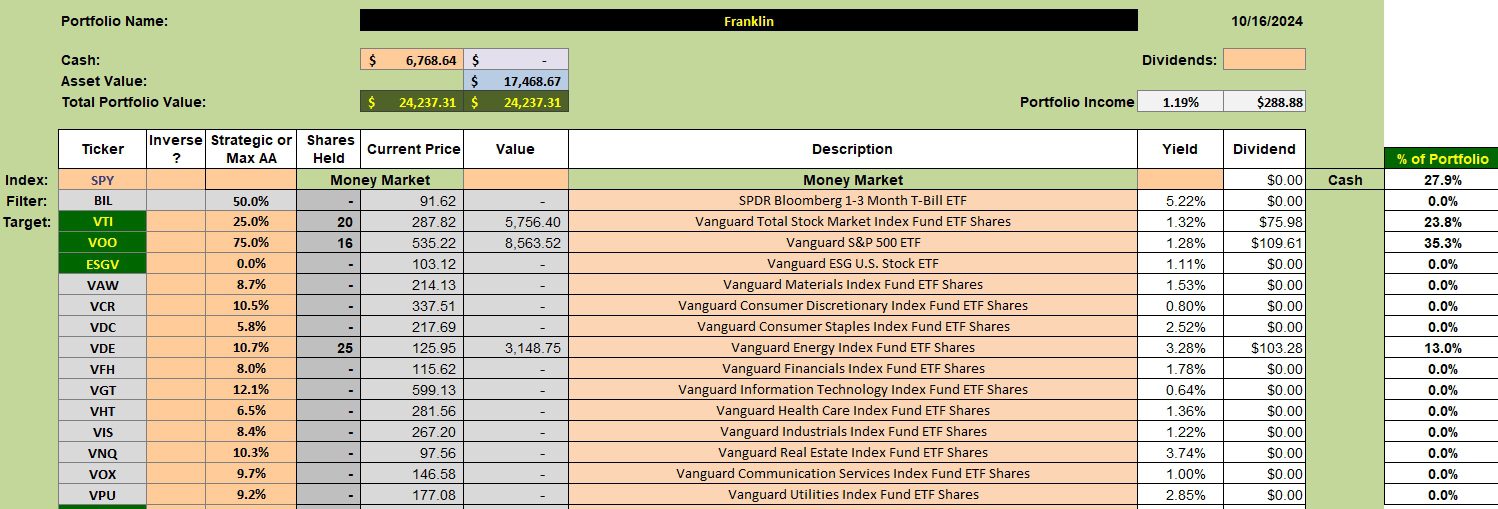

Franklin Security Holdings

The high percentage remaining in cash is due to selling VCR and VDC. Limit orders are in place to purchase more shares of VTI and VOO.

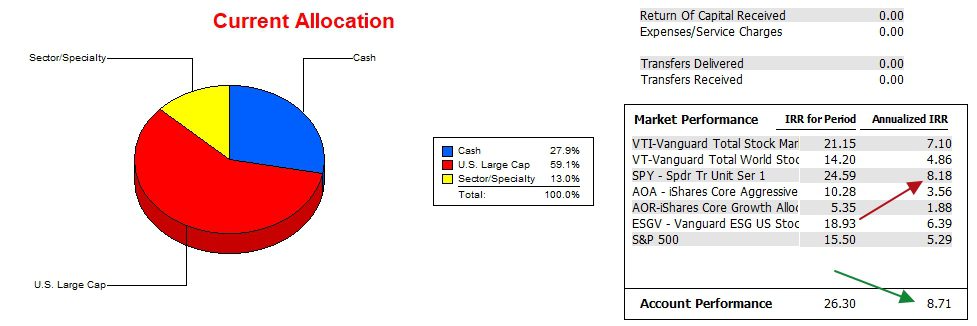

Franklin Performance Data

Since 12/31/2021 the Franklin generated an 8.7% annualized IRR while the SPY benchmark nearly matched this return at 8.2%. Once more we see from all the potential benchmarks I track, the SPY ETF is the most difficult to outperform.

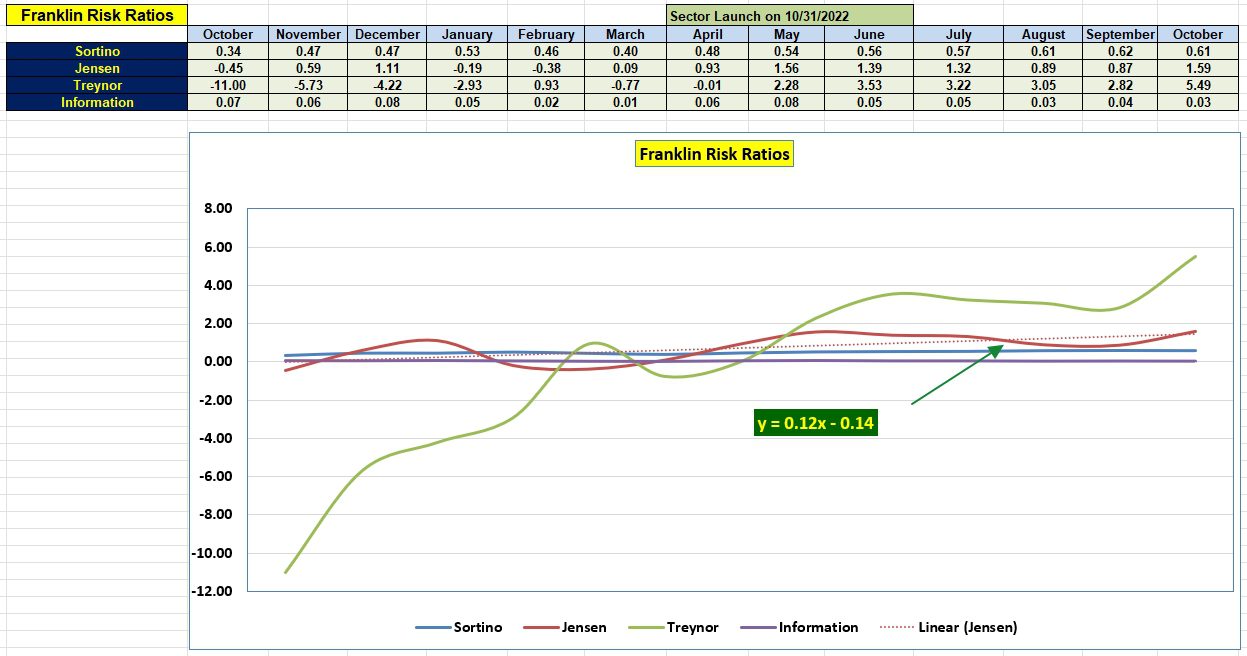

Franklin Risk Ratios

Here in mid-October of 2024 the Franklin reaches a high point for the Jensen Performance Index. The Information Ratio, while still positive, is not doing as well. Of the four risk ratios I place the most importance on the Jensen.

The yield on the short-term treasury (SHV) remains at a high 5.14% level. If an when this interest rate drops it will benefit the Jensen Alpha calculation. Right now the Jensen is bucking a high interest rate.

So long as the Sector BPI model continues to work as it has over the past two to three years I plan to use it with the five portfolios currently employing this investing system.

Millikan Sector BPI Portfolio Review: 6 September 2024

Gauss Sector BPI Portfolio Update: 3 January 2024

Franklin Portfolio Review: 21 July 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.