Milford Sound, New Zealand

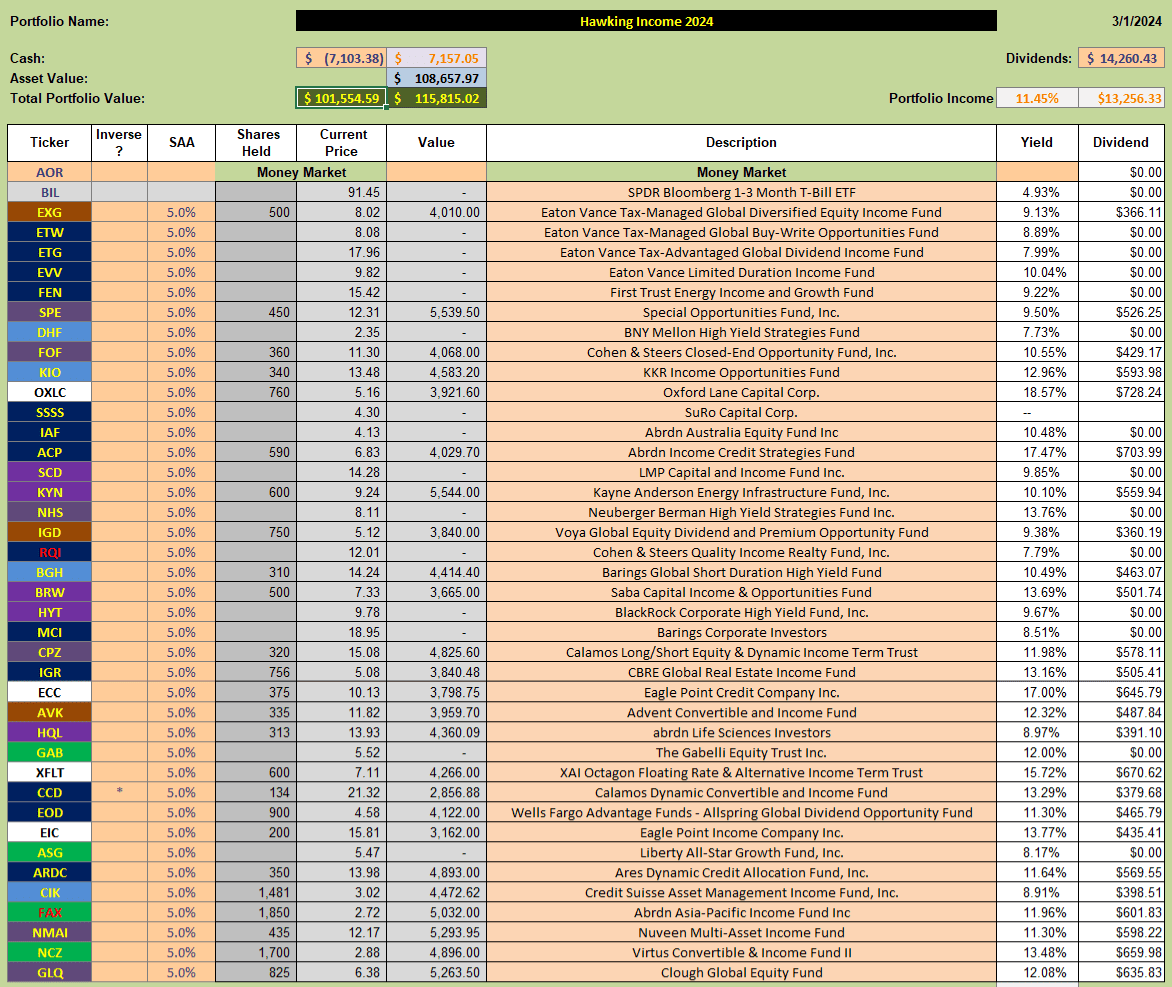

I have held off my review of the Hawking portfolio so as to log the month-end distributions for February. This Portfolio needs very little attention since it is essentially a “Buy and Hold” portfolio built on the purchase of high yield Closed-End Funds (CEFs) for income generation. The portfolio currently holds twenty-five (25) positions to provide diversification between asset classes and to avoid a significant impact on portfolio performance should one of the funds fail. At the present time the portfolio holdings look like this:

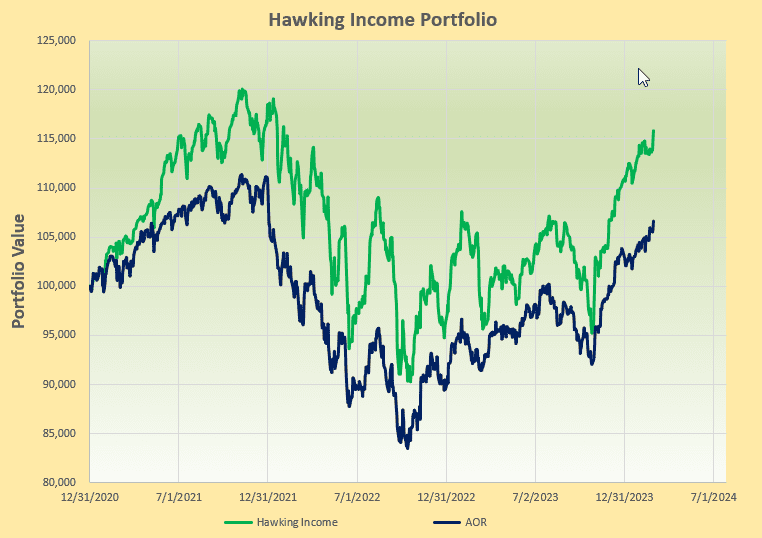

Since the last review on 1 December, 2023 (3 months) the portfolio is up ~8.5% and is outperforming the benchmark AOR fund by over 9% since inception 38 months ago (~3% per annum “edge”).

Since the last review on 1 December, 2023 (3 months) the portfolio is up ~8.5% and is outperforming the benchmark AOR fund by over 9% since inception 38 months ago (~3% per annum “edge”).

The portfolio does show relatively high volatility but we are rewarded for this through the high returns and the ability to re-invest dividends so as to generate our own compounded growth. This ~$100,000 portfolio generates ~$1,000 per month (most of it paid monthly) in income from distributions. As can be seen from the top figure, the portfolio has generated $14,260 in the 14 months since the distribution tracking was reset at the end of December 2022.

The portfolio does show relatively high volatility but we are rewarded for this through the high returns and the ability to re-invest dividends so as to generate our own compounded growth. This ~$100,000 portfolio generates ~$1,000 per month (most of it paid monthly) in income from distributions. As can be seen from the top figure, the portfolio has generated $14,260 in the 14 months since the distribution tracking was reset at the end of December 2022.

Perhaps the only disappointing observation here is that we have not yet taken out the October 2021 highs in the same way that major US equity indices have done – but, hopefully, we will catch up and eventually be rewarded if/when investors rotate out of US equities to some degree. Relative to the AOR benchmark fund this still remains one of the best performing portfolios.

I still need to update my database on these (and similar funds) and decide where to re-invest ~$7,000 in received distributions. I have been too distracted over the past ~6 months to get around to doing this but, hopefully, I will find the time to do so before the next review.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Thanks for the review, David.

~jim

Not too much happening in this portfolio so I’ll wait until the dividends are in at the end of April to review again. However, I did have a significant amount of Cash in hand from dividend payments so I have added positions in ACRE (that I described in the Dirac Review https://itawealth.com/dirac-portfolio-a-look-at-a-mean-reversion-strategy/ ) and in FSK. FSK is a BDC fund and I am not presently diversified in this area so I’ve chosen this fund.

Although it doesn’t seem like the best time to be buying too much I think I’d prefer to be re-investing the dividends rather than holding the cash – at least that’s the idea behind the “income” reinvesting geometric growth concept. To date ACRE is still a falling knife (although a portion of that is due to the price drop after the quarterly dividend payment – that is covered by the payment) and FSK is doing ok – with nice 13+% dividends to look forward to.