Marina Bay Sands Hotel, Singapore. Quite a Hotel with a Pool up there on the Top!

The Hawking Portfolio is an “Income” portfolio built from Closed-End-Funds (CEFs). As such, it requires very little management, other than to re-invest any dividends paid, except for occasional reviews to check on current yields (min 8% target) and discount/premium to Net Asset Value (NAV).

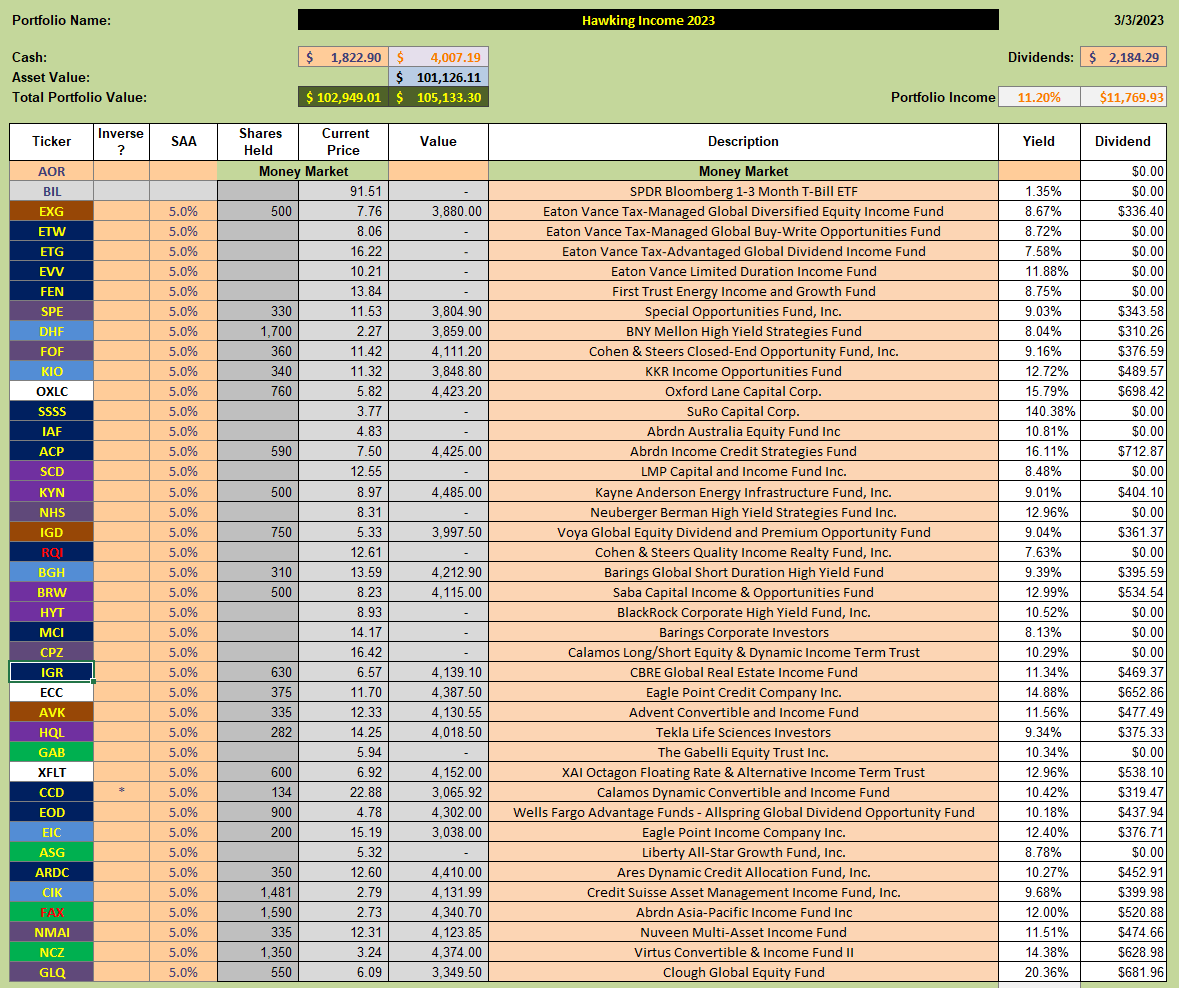

The Portfolio is currently holding 25 CEFs with an estimated annual yield of ~11%:

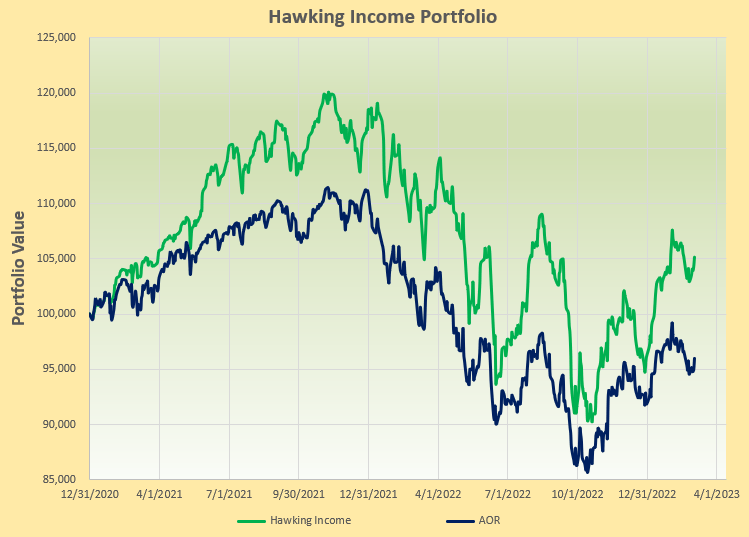

The portfolio has performed very well over the past 2 years and is clearly outpacing the benchmark AOR Fund:

The portfolio has performed very well over the past 2 years and is clearly outpacing the benchmark AOR Fund:

At the present time the portfolio is holding ~$4,000 in Cash for re-investment.

At the present time the portfolio is holding ~$4,000 in Cash for re-investment.

I have also taken a look at current evaluations and note that DHF is “only” paying a dividend of ~8% (8.04% according to Yahoo, 7.93 according to cefconnect.com). DHF is also currently trading at ~11% discount to NAV. This is not normally a situation where I might sell current holdings, however, I note that CPZ is currently paying over 10% and is trading at a 12% discount to NAV. I therefore plan to switch these 2 funds. With the excess Cash I will also buy shares in FAX and GLQ to add to existing positions.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.