This Hubble image gives the most detailed view of the entire Crab Nebula ever. The Crab is among the most interesting and well studied objects in astronomy. This image is the largest image ever taken with Hubble’s WFPC2 camera. It was assembled from 24 individual exposures taken with the NASA/ESA Hubble Space Telescope and is the highest resolution image of the entire Crab Nebula ever made.

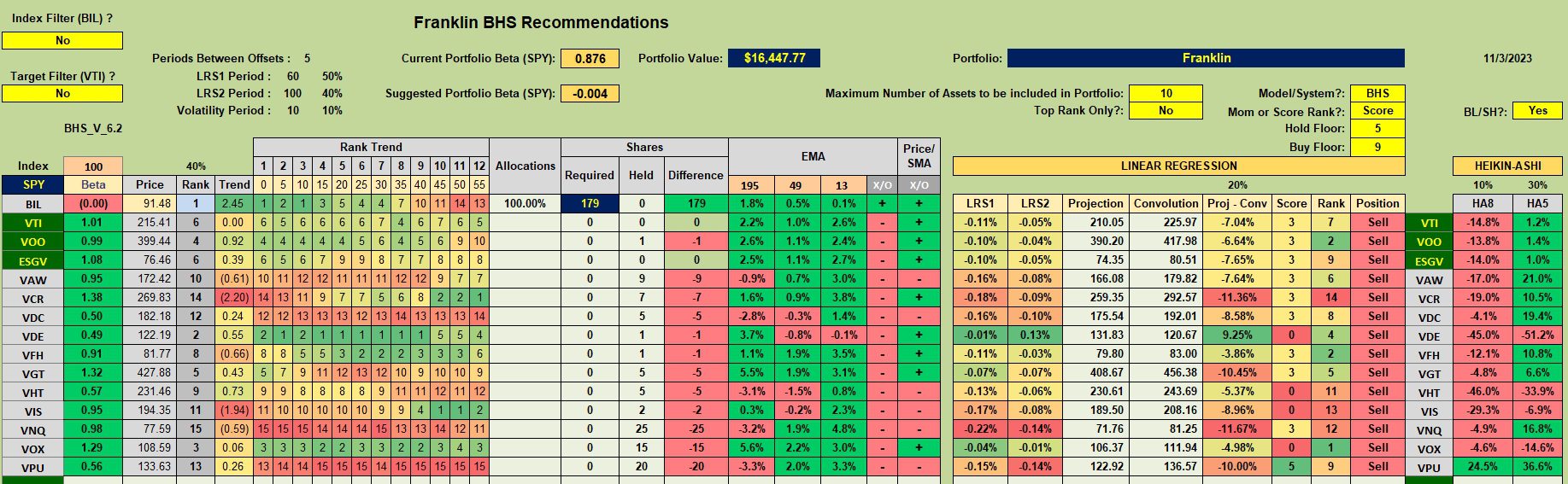

If you were paying attention to the last screenshot of the Bethe review earlier this morning, you noticed that VTI was a negative contributing factor to portfolio performance while VOO added little to the IRR value. Only ESGV played an important role and that was likely due to the period when it was part of the portfolio.

While the Sector BPI Plus investment model is working in line with the original hypothesis, is there a way to improve performance? Here is one suggestion.

Open the Kipling spreadsheet to the Tranch worksheet. Set the investing model to BHS and use the default look-back combination of 60- and 100-trading days. These look-back settings are made within the Main Menu worksheet. This look-back combination is relative fast, but not too fast, in recognizing market changes. If there are no Buy signals showing up for any of the three (VTI, VOO, or ESGV) broad market indexes, which is currently the situation, just continue to hold excess cash until there is a Buy signal for one of the three major equity ETFs. Purchase shares in the ETF ranked highest. While I’m not positive this tweak will improve portfolio performance, we know this addition will keep investors out of equities during a declining market.

This change, if one chooses to employ it, will not change any investment decisions related to investing in oversold sector ETFs. BPI decisions will remain the same.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.