Fire Show – Krabi Beach, Thailand

The Kahneman-Tversky (K-T) Portfolio is a simple Dual Momentum Portfolio that is split between two lookback period options over which “momentum”, or Relative Strength, is measured. The Kahneman portion of the portfolio uses a single long-term lookback period of 252 trading days (12 months) and reacts slowly to changes in “momentum”. The Tversky portion uses a combination of 2 shorter look-back periods (60- and 100-days) and reacts more quickly to momentum or trend changes. Both portions of the portfolio select only one asset from a choice of 3.

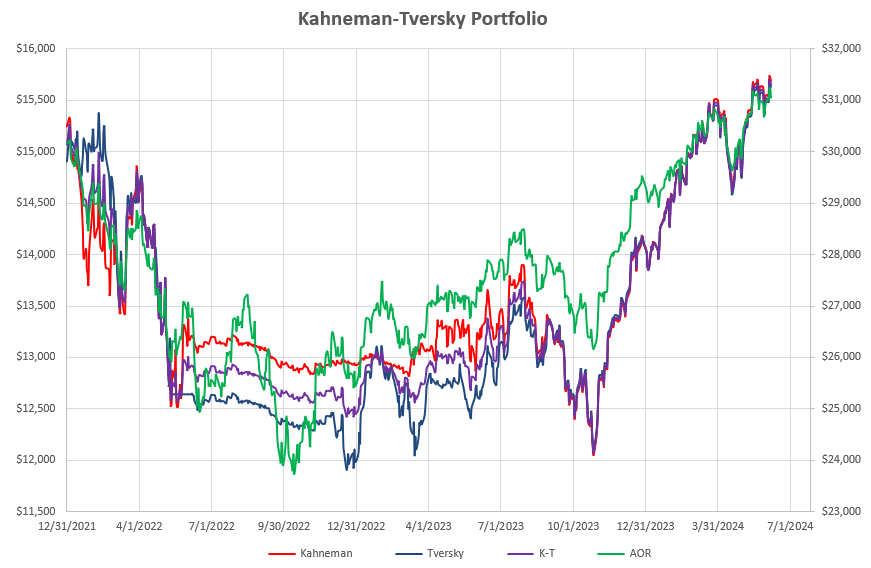

The K-T portfolio is currently holding VTI (US Equities) in both portions of the portfolio and performance of to date looks like this:

where we can see that both portions of the portfolio have produced essentially the same returns over the past ~2.5 years and essentially the same as the benchmark AOR Fund (green line). Take your pick as to which route/trajectory would make you the most comfortable.

where we can see that both portions of the portfolio have produced essentially the same returns over the past ~2.5 years and essentially the same as the benchmark AOR Fund (green line). Take your pick as to which route/trajectory would make you the most comfortable.

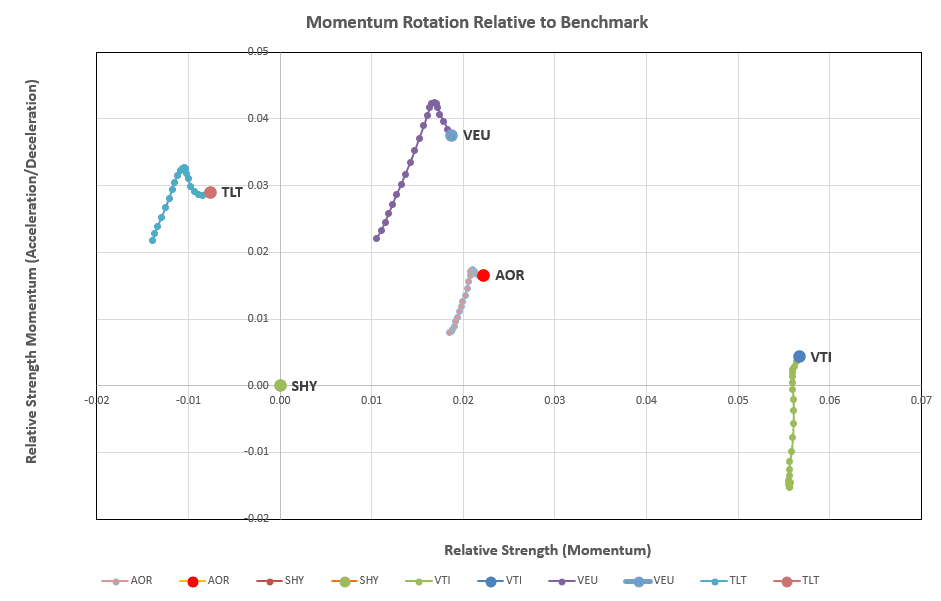

We’ll take a look first at the current rotation graphs of the slower moving Kahneman portion of the portfolio:

where we see VTI (US Equities) as showing the strongest long term (252-day) momentum as a result of it’s position furthest to the right along the horizontal axis. In the shorter/intermediate time frame VEU is looking stronger in terms of it’s top position along the vertical axis.

where we see VTI (US Equities) as showing the strongest long term (252-day) momentum as a result of it’s position furthest to the right along the horizontal axis. In the shorter/intermediate time frame VEU is looking stronger in terms of it’s top position along the vertical axis.

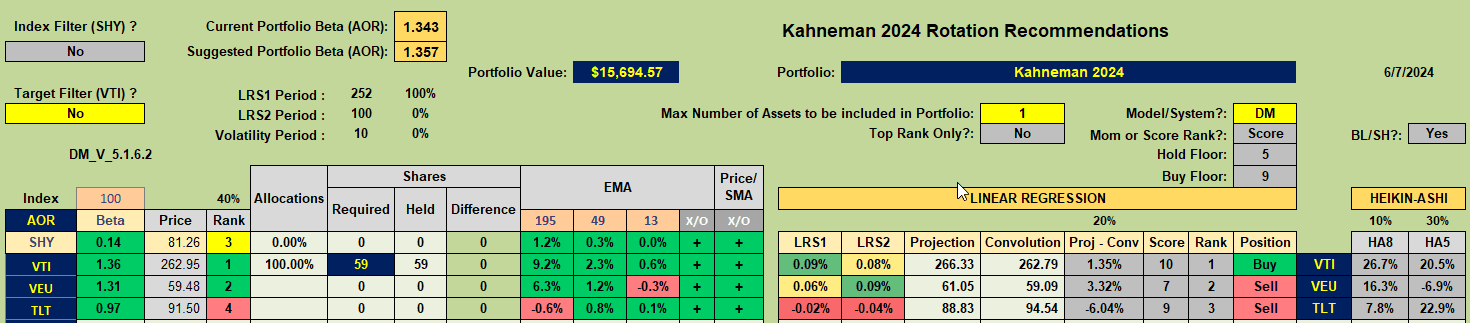

Based on the simplest momentum ranking used for this portfolio:

VTI is the asset of choice for inclusion in the portfolio.

VTI is the asset of choice for inclusion in the portfolio.

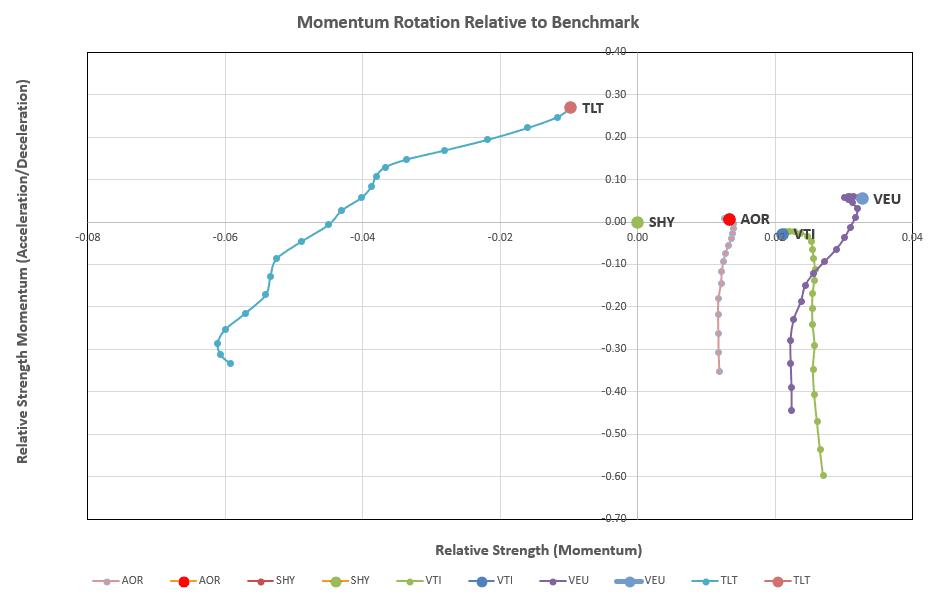

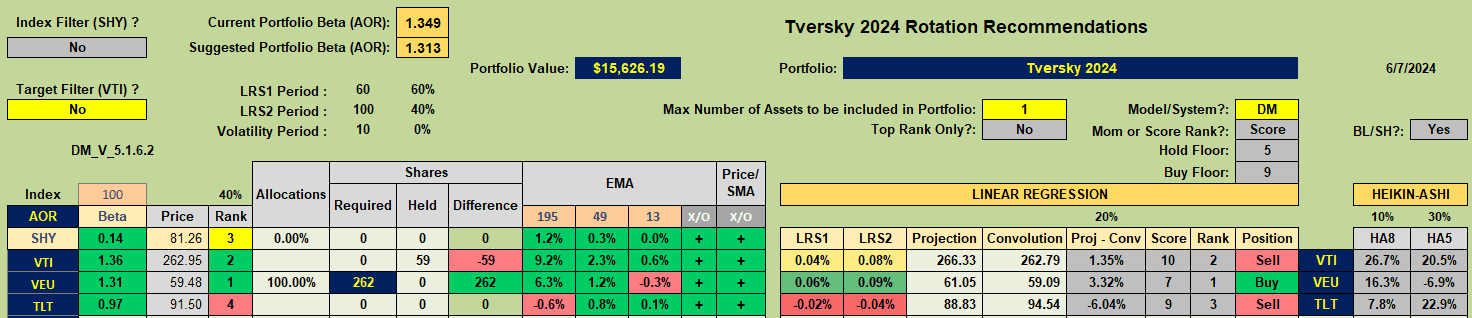

Moving to the faster moving Tversky portion of the portfolio ……

we note that VEU (International Equities) is now showing the highest relative strength in the 60/100 day time frame with TLT showing strong shorter-term strength.

we note that VEU (International Equities) is now showing the highest relative strength in the 60/100 day time frame with TLT showing strong shorter-term strength.

Rankings/recommendations for the Tversky portion of the portfolio look like this:

therefore I shall be rotating from VTI to VEU in the Tversky portion of the portfolio.

therefore I shall be rotating from VTI to VEU in the Tversky portion of the portfolio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.