Thai Gift Store

The Kahneman-Tversky Portfolio is the simplest portfolio that I review on this site and consists of a choice of one ETF from three options – two Equity ETFs (US or International) and one Bond ETF (Long Term US Treasuries). The only twist to the portfolio is that it is split between two portions – one that responds slowly to price changes (the Kahneman portion that measures long-term momentum – 252 days or 12 month lookback) and a faster responding portion (the Tversky Portion that measures momentum over 60- and 100 days).

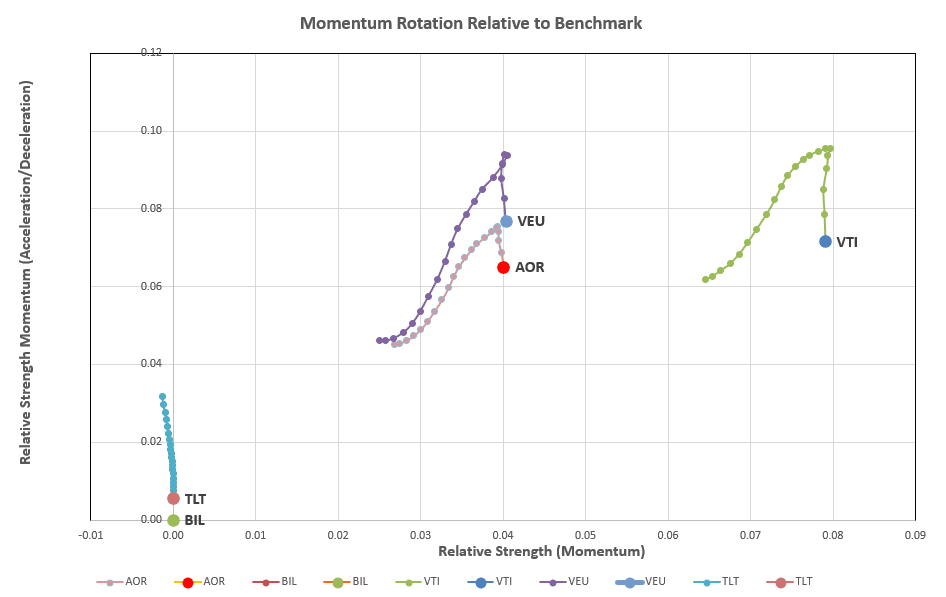

At the present time the rotation of the funds in the slower moving Kahneman portion look like this:

where we see everything weakening in the short-term (downward vertical movement) but with US Equities (VTI) still the strongest performer over the past 12 months.

where we see everything weakening in the short-term (downward vertical movement) but with US Equities (VTI) still the strongest performer over the past 12 months.

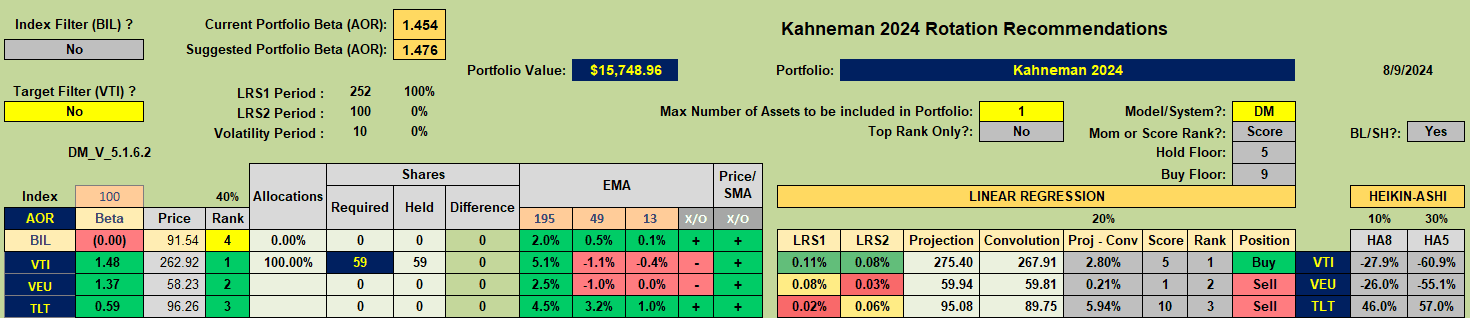

Checking the ranking/recommendation sheet we see that VTI is still the rcommended holding:

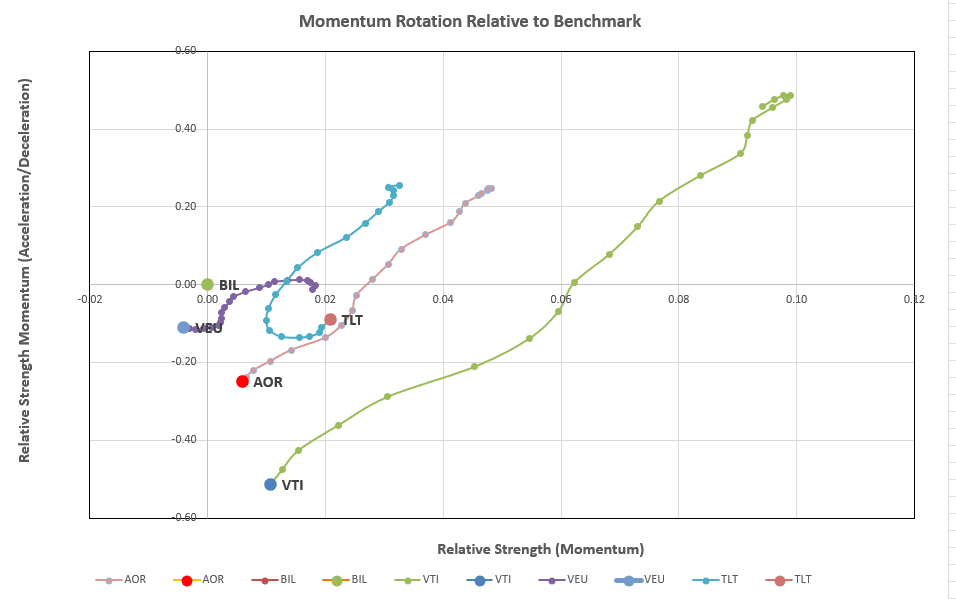

However, a check of rotations on the faster reacting Tversky portion of the portfolio shows a different picture:

However, a check of rotations on the faster reacting Tversky portion of the portfolio shows a different picture:

with equities retreating and bonds (TLT) maybe showing a little more strength – at least in the short term. Recommendations for the Tversky Portion of the Portfolio therefore look like this:

with equities retreating and bonds (TLT) maybe showing a little more strength – at least in the short term. Recommendations for the Tversky Portion of the Portfolio therefore look like this:

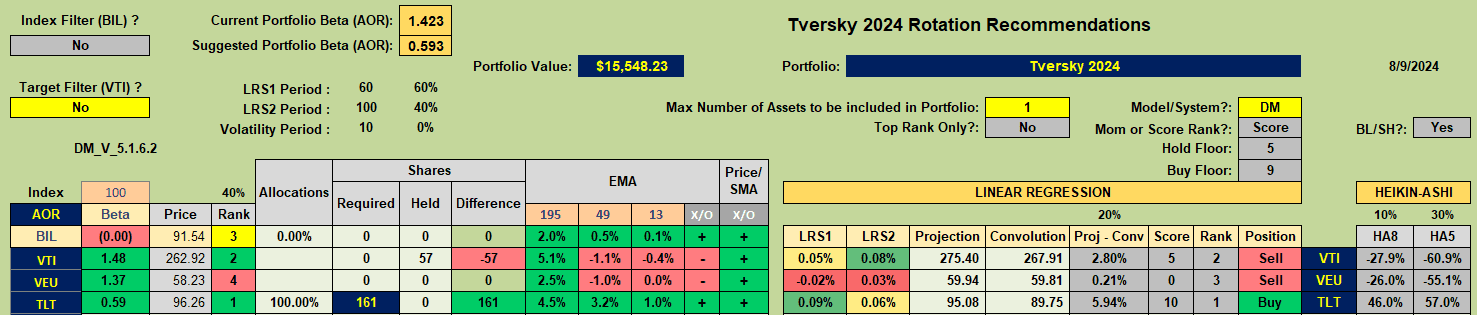

with TLT being the recommended asset to be held.

with TLT being the recommended asset to be held.

I shall therefore be switching the VTI holdings in the Tversky portion of the portfolio to TLT to give me a 50/50 equity/bond allocation to the total portfolio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question