Morning fog at Japanese Garden.

As promised this Kepler review begins the transition from the Relative Strength model to the Sector BPI Plus model. I’ve simplified the Investment Quiver as readers will see in a moment.

The Investment Account Manager (IAM) only holds end of the month data so the “launch” date for this new model will be October 31, 2023.

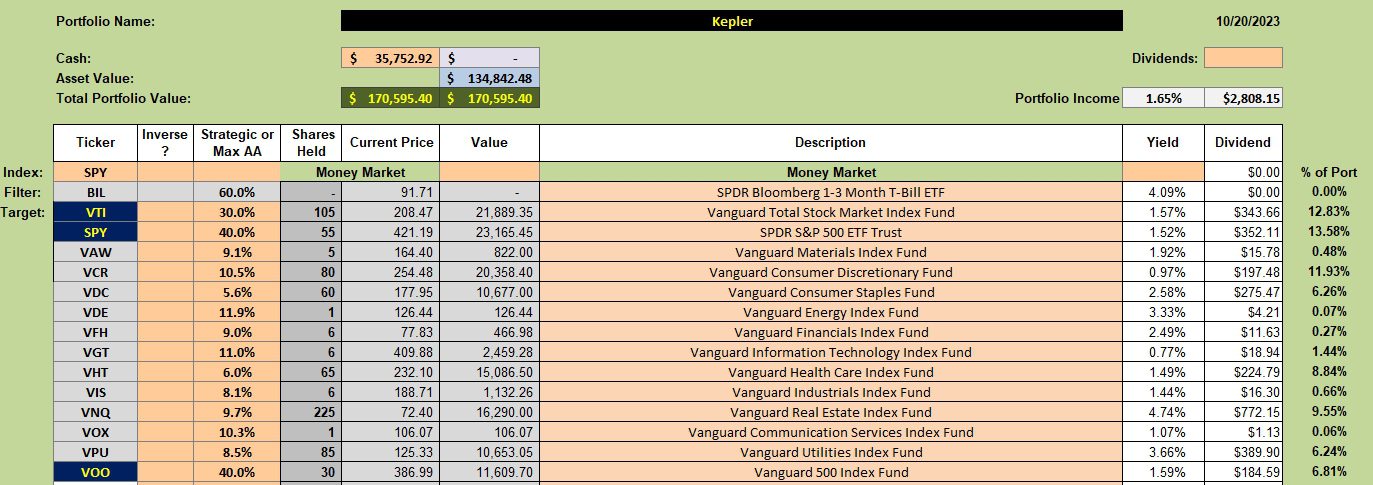

Kepler Investment Quiver and Holdings

Below is the new investment quiver and holdings. So I have a record for all eleven sectors, I purchased a few shares of those sectors that are currently in the neutral zone, while fully populating the oversold sectors.

The Strategic or Max AA percentage (third column from the left) is based on a three-year volatility. For example, Discretionary (VCR) is to hold a minimum of 10.5%. The current holding shows up in the column on the far right and for VCR that is 11.93% or rounded to 12%. I’m not concerned about the overage.

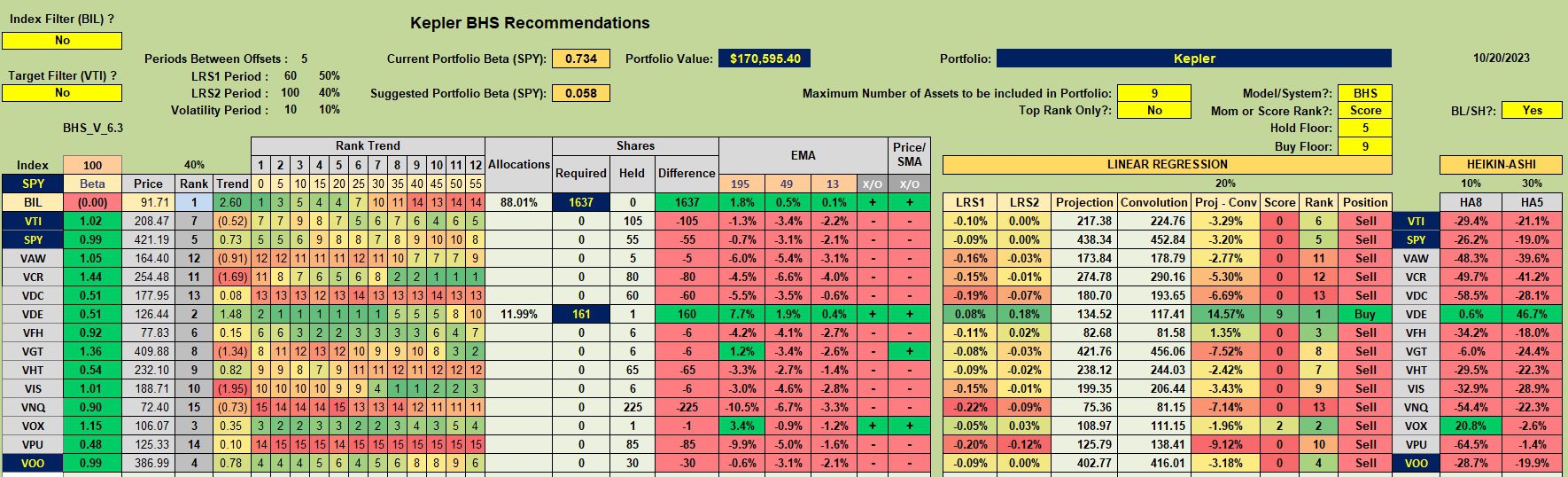

Kepler Security Recommendations

None of the U.S. Equity ETFs (SPY, VTI, or VOO) are recommended for purchase. With the Sector BPI portfolios we always concentrate on the oversold sectors. The week there are five in this condition.

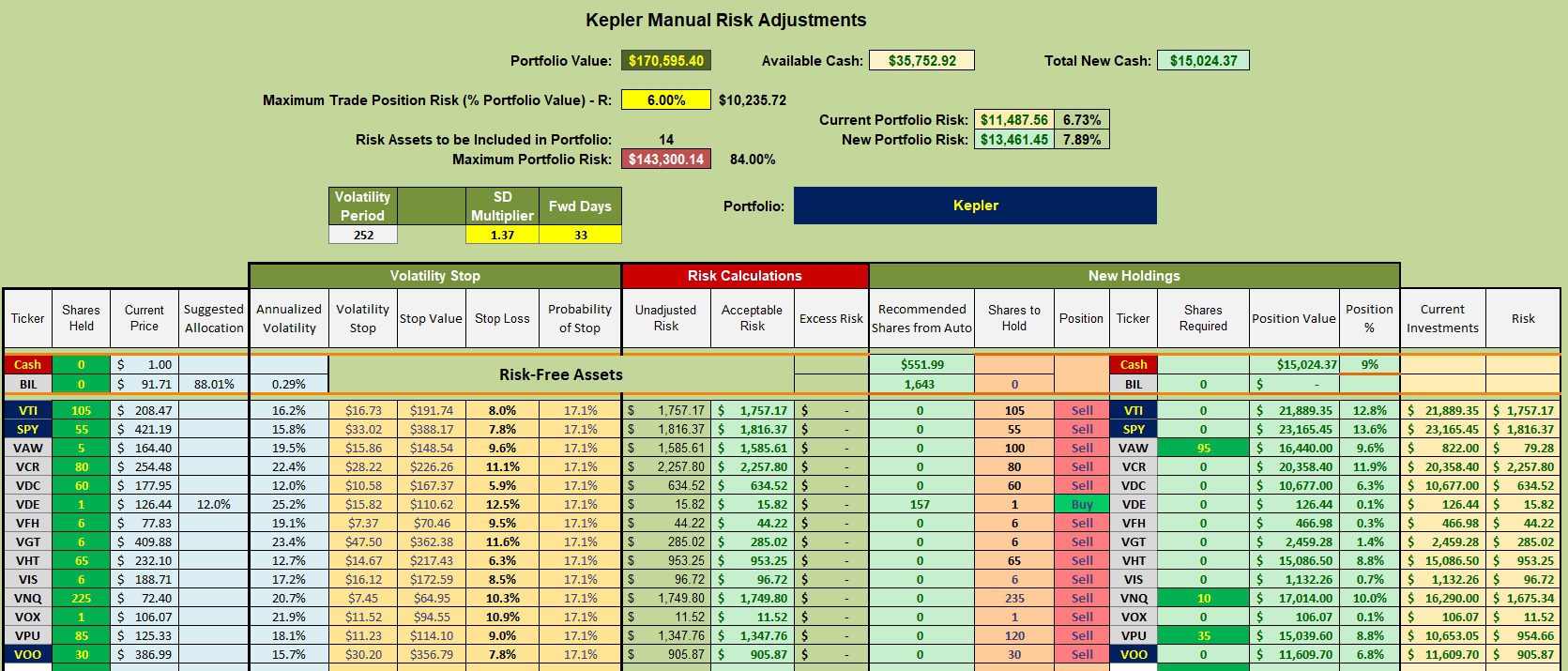

Kepler Manual Risk Adjustments

To bring the oversold sectors into the recommended balance we need to add 95 shares to VAW, 10 shares to VNQ, and 35 shares to VPU. This still leaves approximately $15,000 in cash. One could either leave this money in the money market or put it to use by purchasing shares of VTI, SPY, or VOO. In the above screenshot you can see that VOO ranks highest so I’ll likely place several limit orders to pick up more shares of VOO.

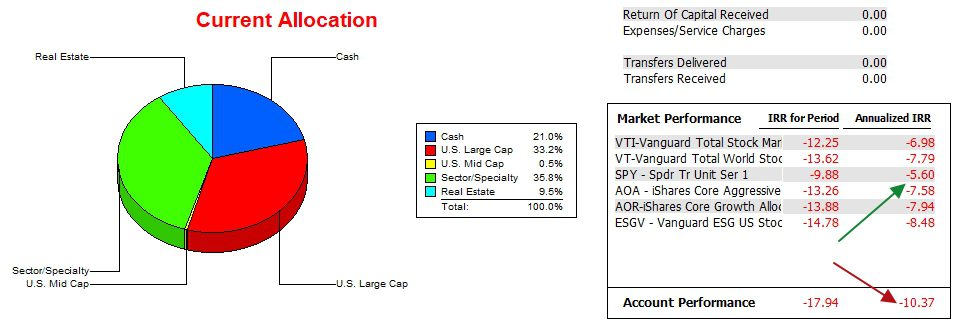

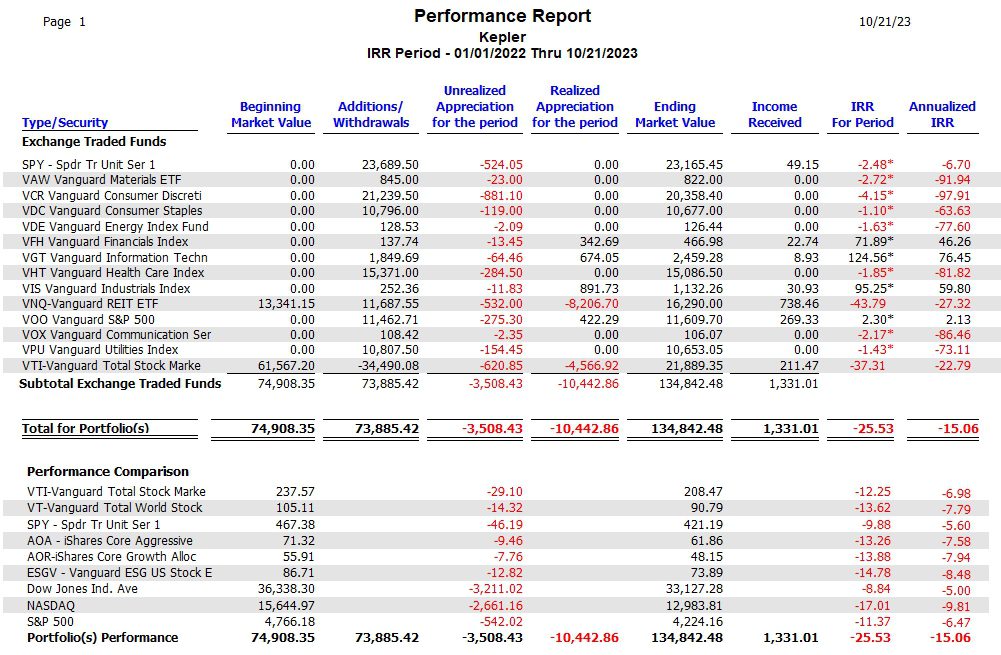

Kepler Performance Data

Over the past 22 months the Kepler has been well below the SPY benchmark. This is the primary reason for moving over to the Sector BPI investing model.

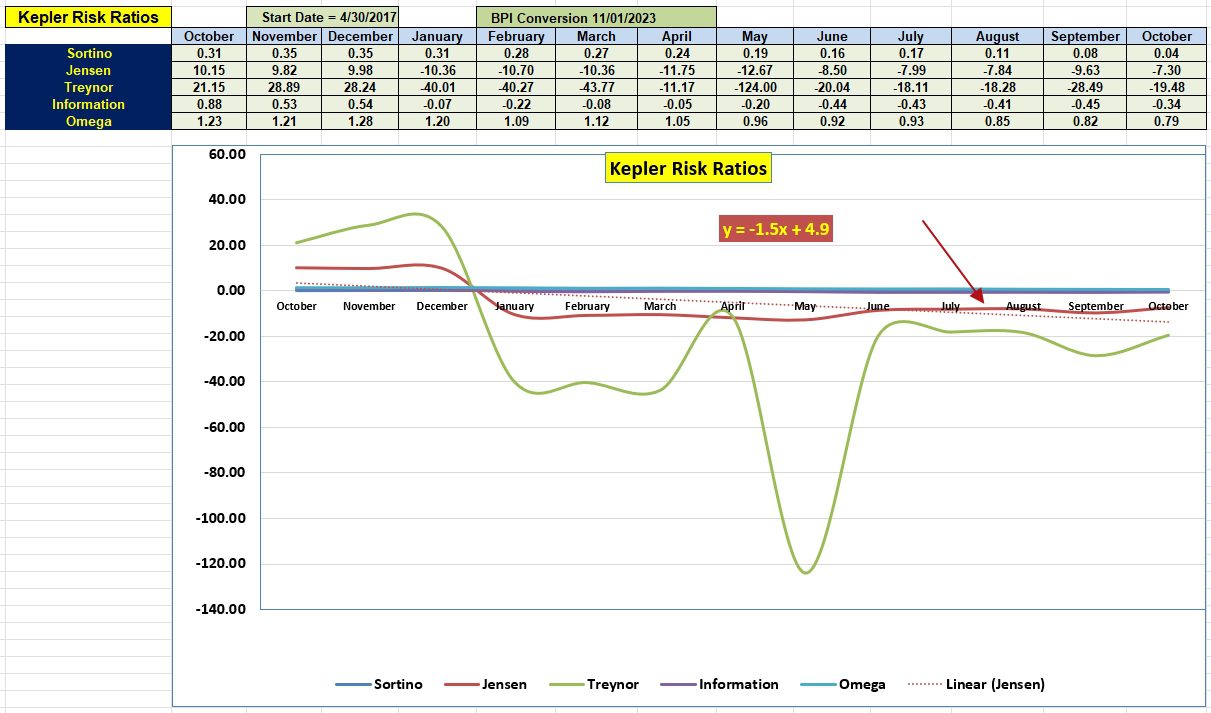

Kepler Risk Ratios

Both the Jensen and Information Ratios improved since September. We still need to see the Jensen move into positive territory. The goal is to make that happen sometime next year.

Kepler Portfolio Report (Initial)

This table is included primarily as a reference as most of the sector ETFs have not been part of the Kepler to be reliable. We need at least a year of data, although we should see some positive trends sometime next year if the Sector BPI model works as we think it will.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

SPY and VOO (and IVV) have a correlation 1.0. Why do you include both in the quiver?

~jim

Jim,

I don’t have a good reason. I will eventually drop SPY and keep VOO as the expense ratio is lower.

Lowell

Jim,

I’ve been reflecting on your comment. Expect to see changes in the ITA portfolios over the next month to six weeks.

Thank you.

Lowell

Jim,

Note that SPY is no longer part of the Carson portfolio. I took your words of advice to heart. Look for SPY to be history as I update more portfolios.

Lowell