Remains of Peter Iredale*

Yesterday the Dow Jones Industrial Average (DJIA) closed above 38,000 for the first time in history. A few readers may recall a book titled: Dow 36,000: The New Strategy for Profiting From the Coming Rise in the Stock Market written by James K. Glassman and Kevin A. Hassett, published on October 1, 1999. Many investors, including me, scoffed at the idea the DJIA would reach this level. Particularly after the tech bubble crash of the early 2000s. We are now 2,000 points above that prediction from 25 years ago. And just to put a cherry on this desert, the Dow crossed the 1,000 mark for the first time in the mid-1960s and then dropped into the 500’s during the Nixon Administration. In August of 1982 this index was still hovering below 800. The last 40 years have been quite remarkable, yet we still see many U.S. citizens suffering and the reasons are too many to list.

This blog is a review of the McClintock, one of the more recent portfolios to join the Sector BPI investing approach. When I first came up with the Sector BPI hypothesis I built the strategy using only sector ETFs. It was not long before I, with help from ITA readers, spotted a weakness in the model. Right now we are in exactly this situation where a slow start to U.S. Equities in early January resulted in a number of sector ETFs hitting their 3% TSLOs and were sold out of most of the ITA portfolios leaving them holding a high percentage in cash. Then the stock market rebounded creating a cash drag on portfolio performance. To counter or patch this Sector BPI weakness equity ETFs such as VTI, VOO, and ESGV were added to the investment quiver. When sector ETFs are out of favor, as is currently the case, we look to these three ETFs as securities for investing the excess cash. If the market rises, ITA portfolio performance will also rise with these equity investments. If the market declines, the ITA portfolios will decline in value with the market. One way to protect capital is to place 8% TSLOs under VTI, VOO, and ESGV.

In the future I will be adding VEA and VWO to the investment quiver for a few Sector BPI portfolios as an experiment. Currently, VEA and VWO are a Sell so now is a good time to add them as future possibilities. Watch for these additions as Sector BPI portfolios are reviewed within the next month.

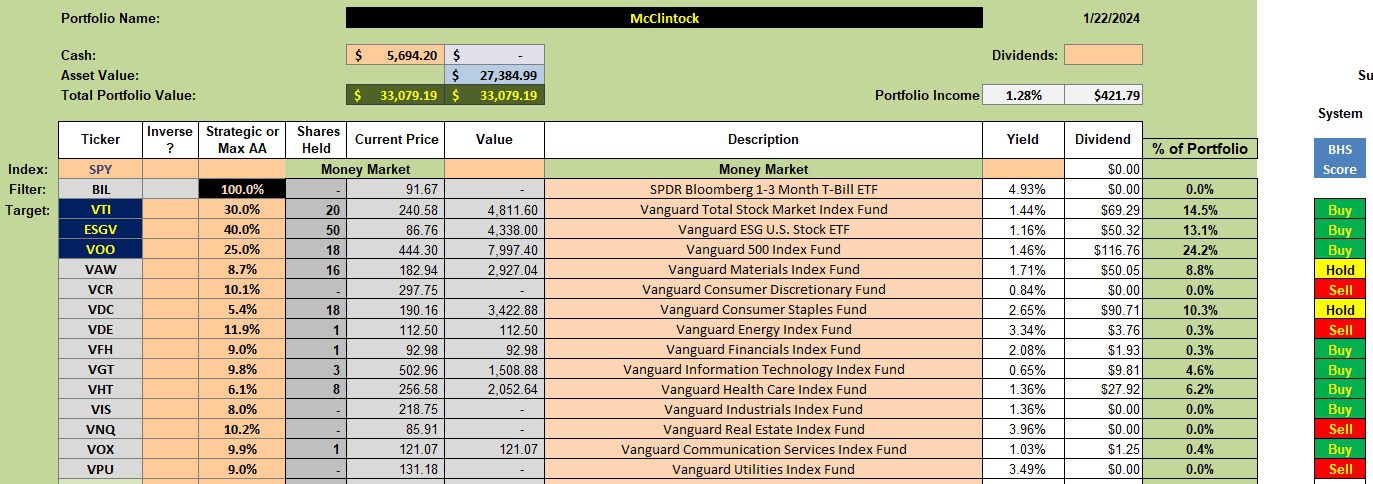

McClintock Security Holdings

One surprise in the McClintock portfolio is the VAW holding. I thought that ETF would be long gone out of the portfolio. The sector ETFs holding a single share are “shard” holdings and will remain in the portfolio through the next Buy/Sell cycle.

If you look to the far right you will see that VTI, VOO, and ESGV are all a Buy. Of the three, ESGV is the highest ranked ETF.

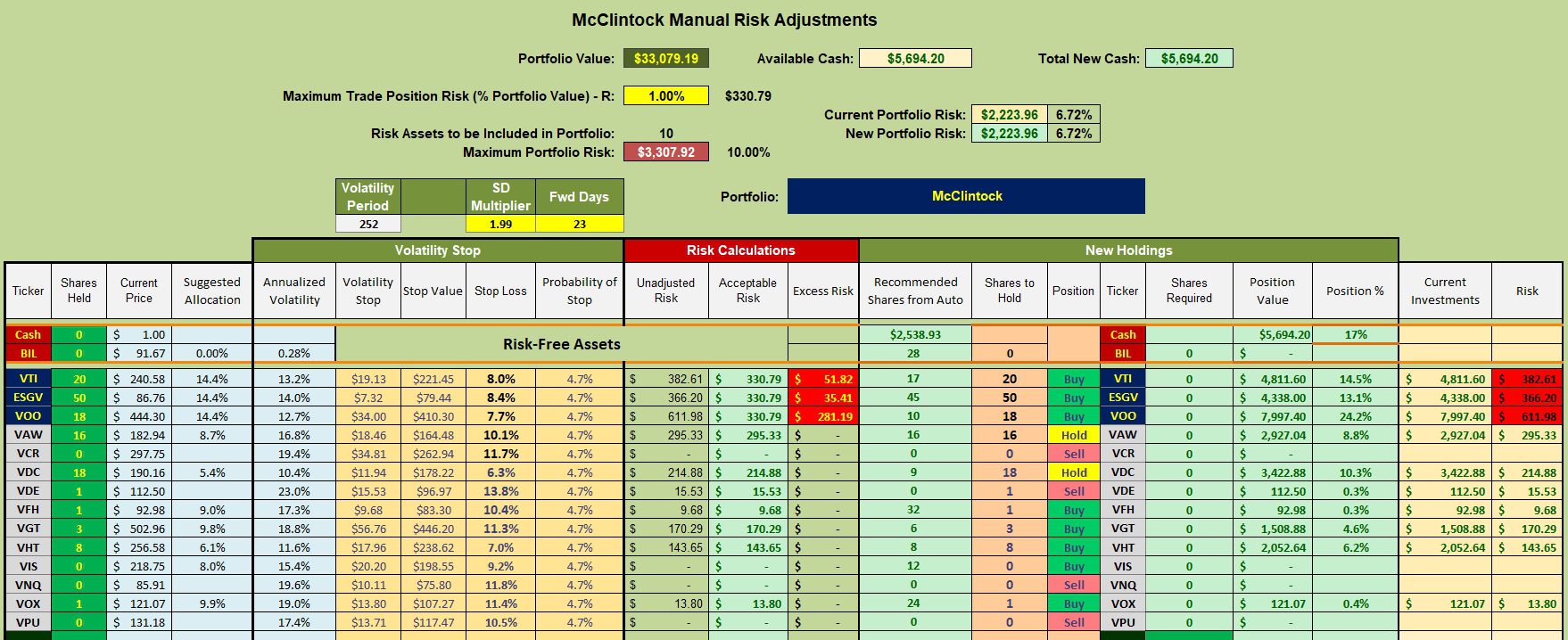

McClintock Manual Risk Adjustments

Even with the Maximum Portfolio Risk set to 10.0% there are no additions needed for VTI, VOO, or ESGV. All three equity ETFs are currently holding more shares than recommended so we do nothing.

I have a few limit orders in place at lower prices to pick up shares of ESGV and VOO just in case the market drops in value.

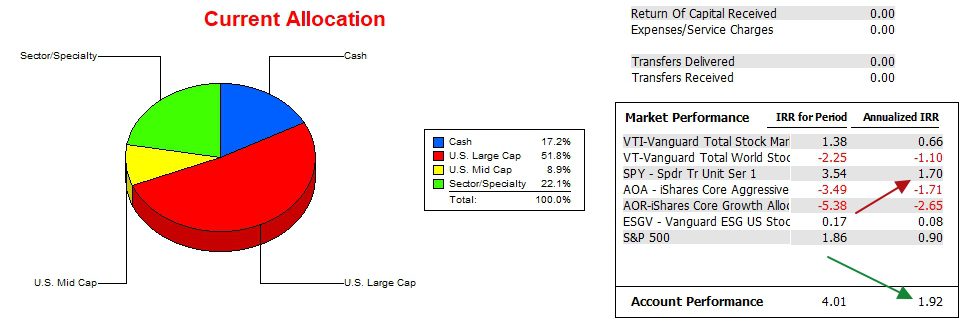

McClintock Performance Data

Over the last 24.5 months the McClintock has a slight edge over the SPY benchmark. Call it a dead heat within the limits of uncertainty.

I added the actual S&P 500 so readers can see how well SPY compares to the actual index. SPY is actually performing a tad better than the index.

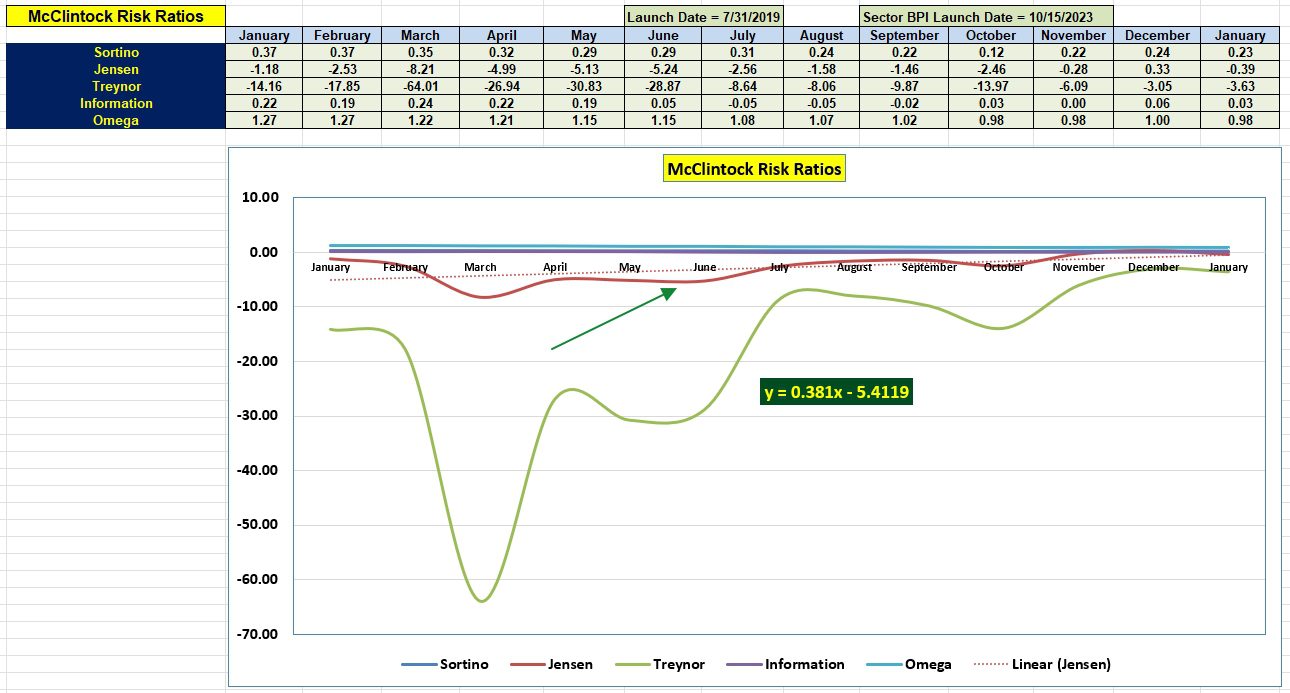

McClintock Risk Ratios

While the slope of Jensen’s Alpha is positive, the Jensen did decline in value in January compared to the positive value in December. The Information Ratio is still positive or a clue as to how well the portfolio is performing compared to the benchmark.

Overall, the McClintock is in good, but not excellent shape.

No transactions are required, recommended, or anticipated for the McClintock.

- The Peter Iredale image was post-processed using ON1 Photo RAW.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.