PERURAIL bound for Machu Picchu.

Given the over-bought signal generated yesterday for Utilities (VPU) I wanted to update at least one of the four Sector BPI portfolios to see how well it is performing based on annualized IRR data and risk factors such as the Jensen Performance Index. Follow along as I walk through an update of the Millikan.

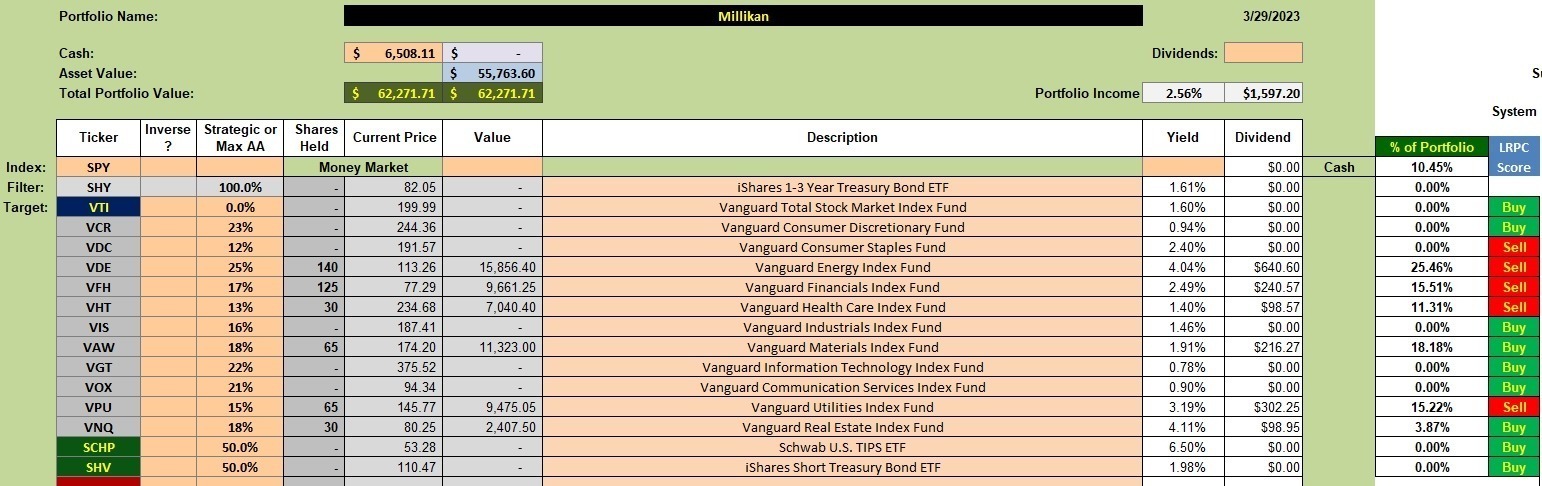

Millikan Sector BPI Recommendations and Current Holdings

Below is the investment quiver and current holdings for the Millikan. Of the six sectors recommended for purchase over the last few months, only Real Estate (VNQ) is significantly under the Max AA percentage and that is a result of running out of cash when Real Estate was over-sold. Now that cash is available the Real Estate BPI percentage is back up into the neutral zone so we are not purchasing more shares at these prices.

As mentioned on the Forum and in a Comment, I set a 3% TSLO to sell all 65 shares of VPU. If the price moves higher from this point, the TSLO sell price will move up under the current price of VPU. We are locking in profits at this point.

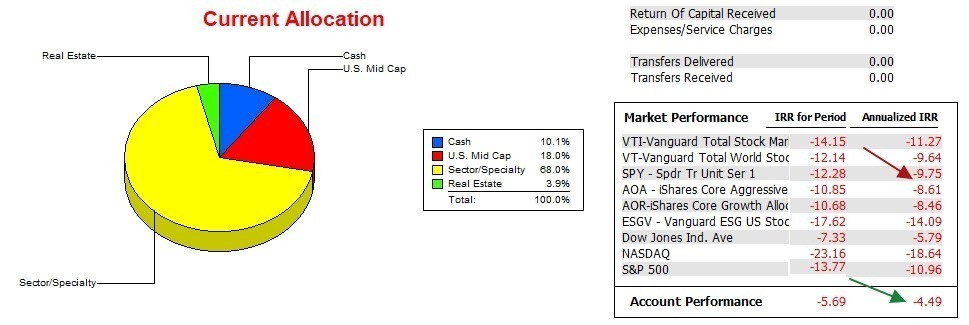

Millikan Performance Data

While the following data runs for over 15 months, I’ve only been using the Sector BPI model with the Millikan for approximately four months. Currently, the annualized IRR data for the Millikan is approximately twice as good as the SPY performance. In fact the Millikan is leading all possible benchmarks tracked using the Investment Account Manager software, a product I highly recommend for serious investors.

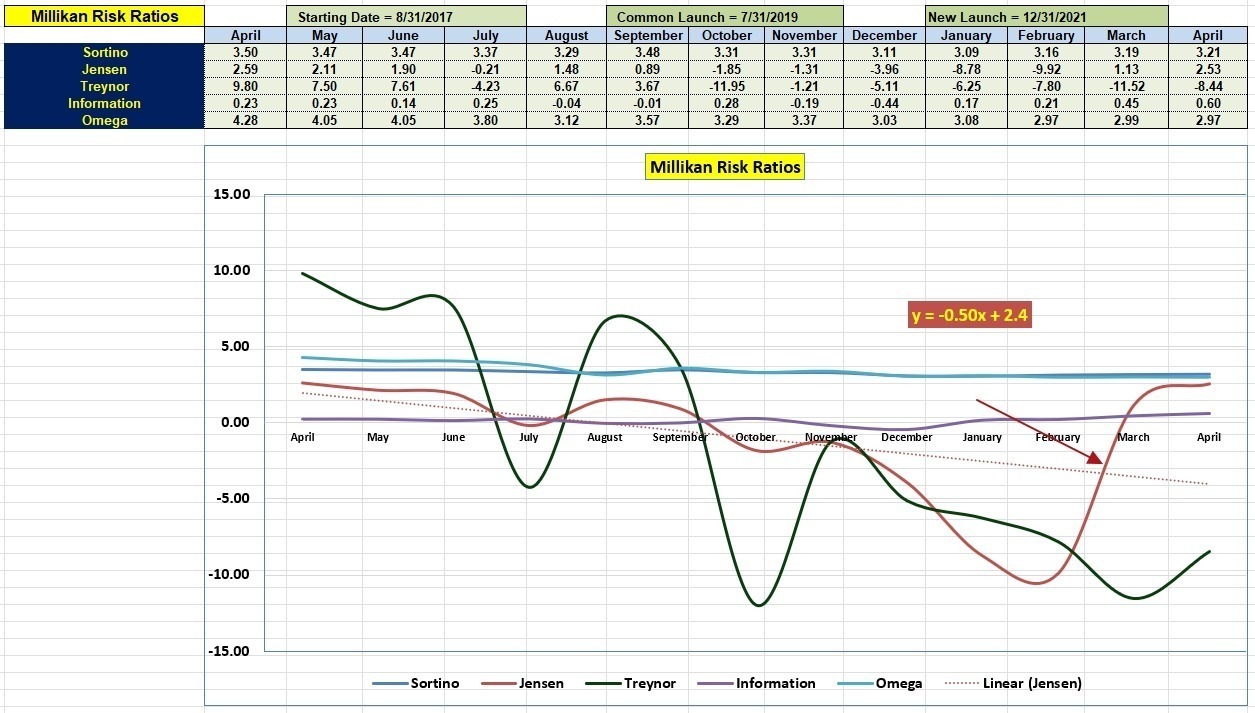

Millikan Risk Ratios

Risk Ratio data also looks strong. While it is still early in April, the current Jensen 2.53 value is the highest it has been since last April. Since the last Millikan update the negative slope of the Jensen has been nearly cut in half, but it is still negative.

The Information Ratio is a good guide as to how well the portfolio is performing with respect to the benchmark and it is currently at the highest level during the most recent year.

Overall, the Sector BPI model is working very well for the Millikan.

Notice: The ITA Wealth Management blog is free to all who register as a Guest. Please follow the registration suggestions and pass on the https://itawealth.com link to your friends and family.

Questions and Comments are always welcome. Post them in the Comments section provided below.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.