From Swan Island Dahlias

As we approach the fourth quarter of 2025 I will be setting up portfolios for 2026. The outlook is less promising for the coming year compared to 2025 so a more conservative approach makes sense. The new asset allocation for the Millikan is designed to be a tad more recession proof compared to the previous allocation.

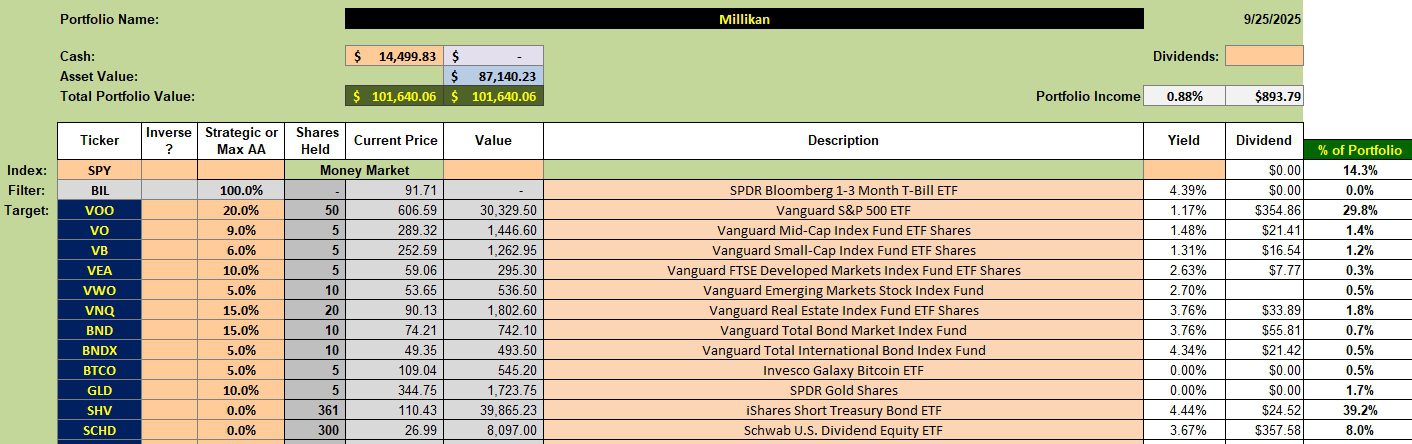

Millikan Asset Allocation Adjustment

Note the addition of two commodities, GND and BTCO. The percentages are quite low as dipping into Bitcoin is somewhat of a test. The two bond ETFs and Real Estate (VNQ) should add some income which can then be used to keep other assets close to the target percentages.

While I have the target for SHV set to 0%, there will most likely always be shares held in this ETF. Instead of letting cash sit in a money market drawing almost zero interest, I will move the money market cash over to SHV if no asses are below target. This will make sense when the updates take place. At least I will try to carefully explain what I am doing when moving cash from the money market to SHV and then to the recommended asset class.

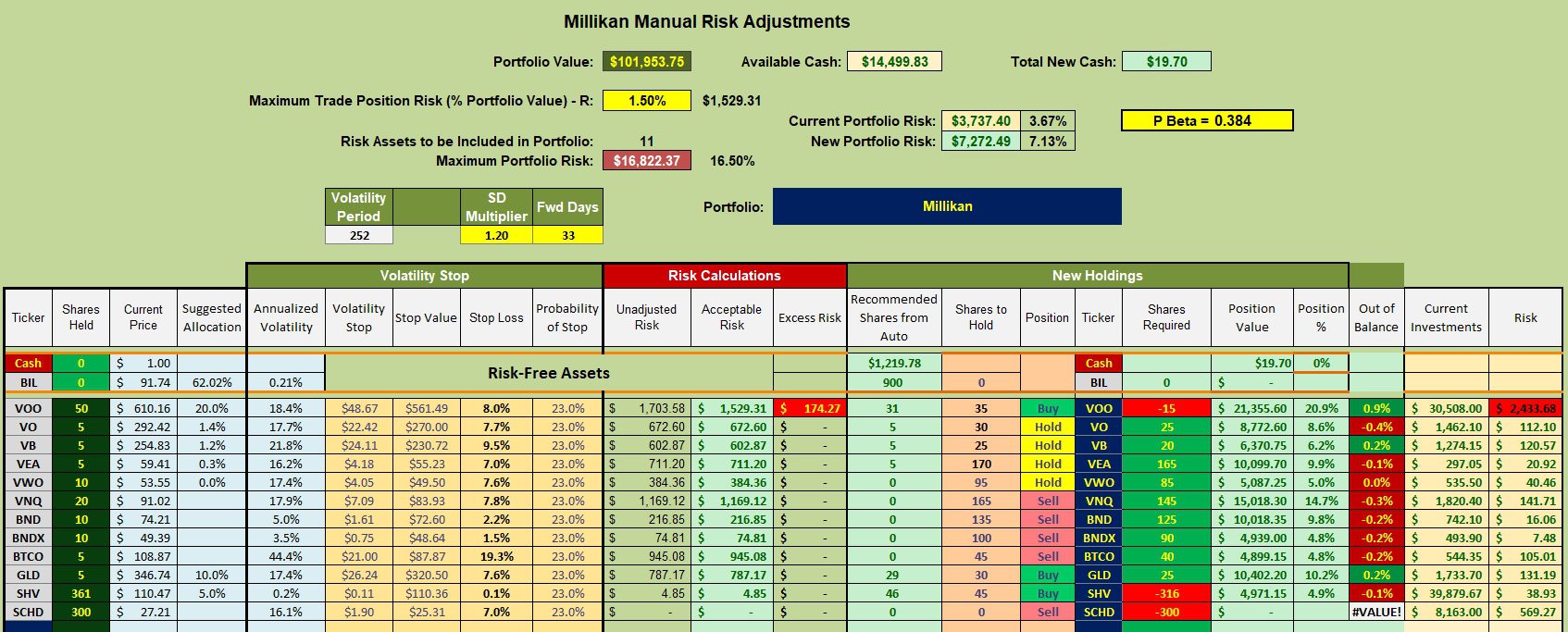

Millikan Rebalancing Recommendations

It will likely take a few cycles or updates before all the asset classes are in balance or close to the target percentages. The goal is to keep each asset within a few percentage points of the target goals. SCHD will eventually be replaced by VYM.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question