Kilauea Lighthouse

Yesterday I updated the Carson portfolio, one of several accounts managed using the Sector BPI Plus investing model. This morning the Millikan, another Sector BPI portfolio, is scheduled for an update. Over the last two reviews the Millikan gained slightly on the SPY benchmark, a positive sign for this particular investing model.

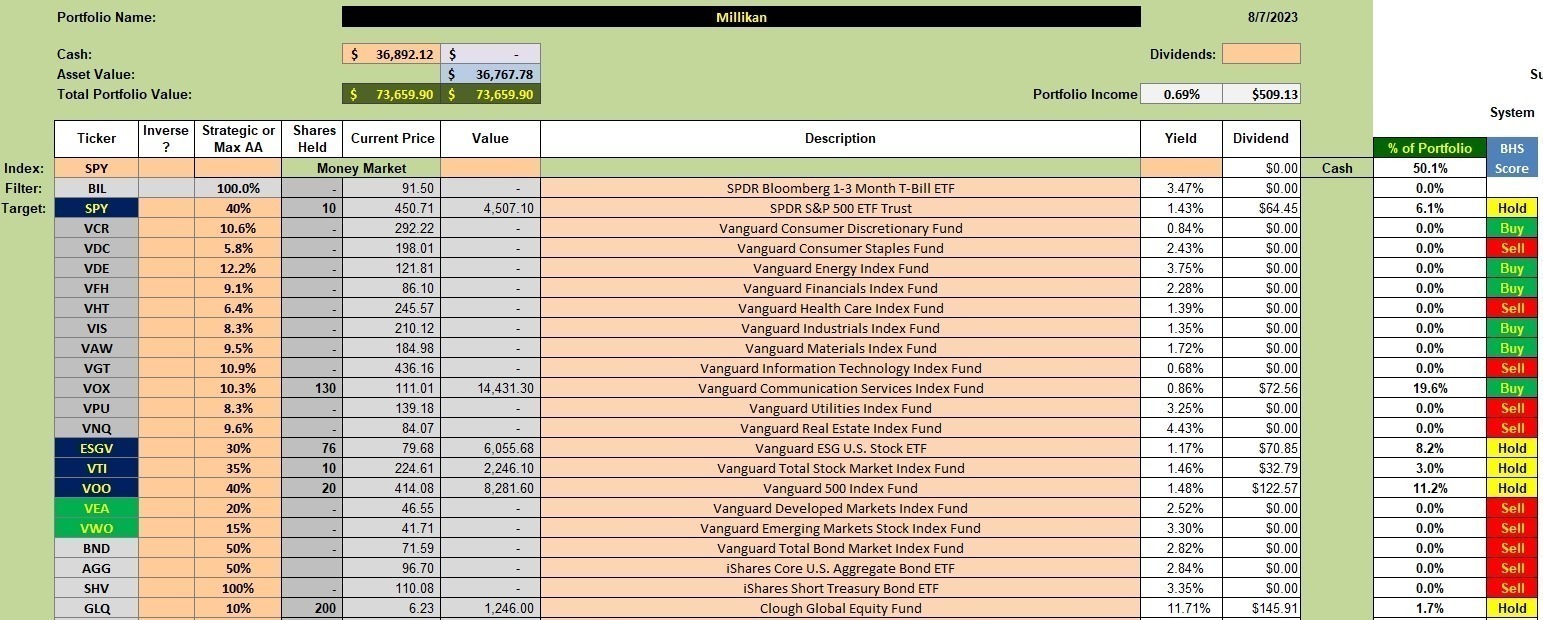

Millikan Investment Quiver and Holdings

Several sector ETFs were sold out of the portfolio since the last review raising the level of cash to nearly $37,000. This money needs to be reinvested and that is the primary focus of this update. If SHV showed up as a Buy the cash would be invested in that short-term treasury ETF.

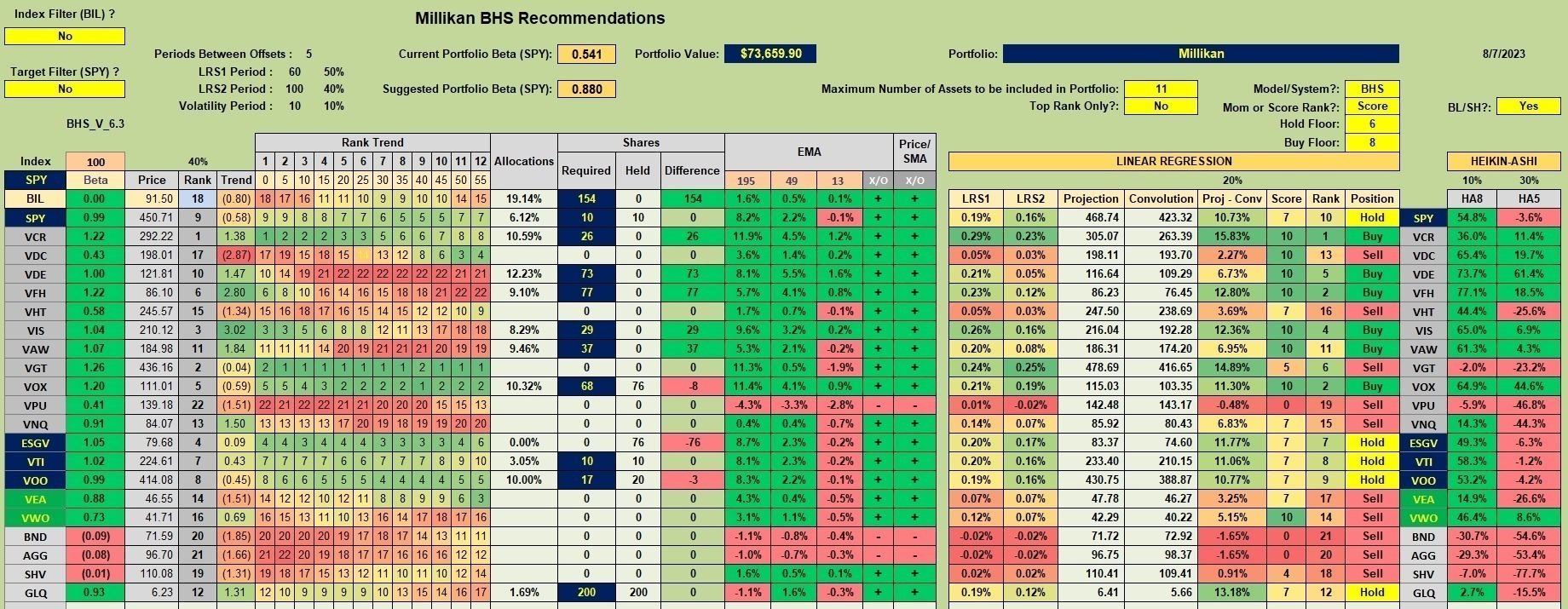

Millikan Security Recommendations

Using the BHS investing model I see where all the equity options are recommended as a Hold. Since no sectors are recommended for purchase, where do we go to reinvest all the cash? That will become clear in the next screenshot.

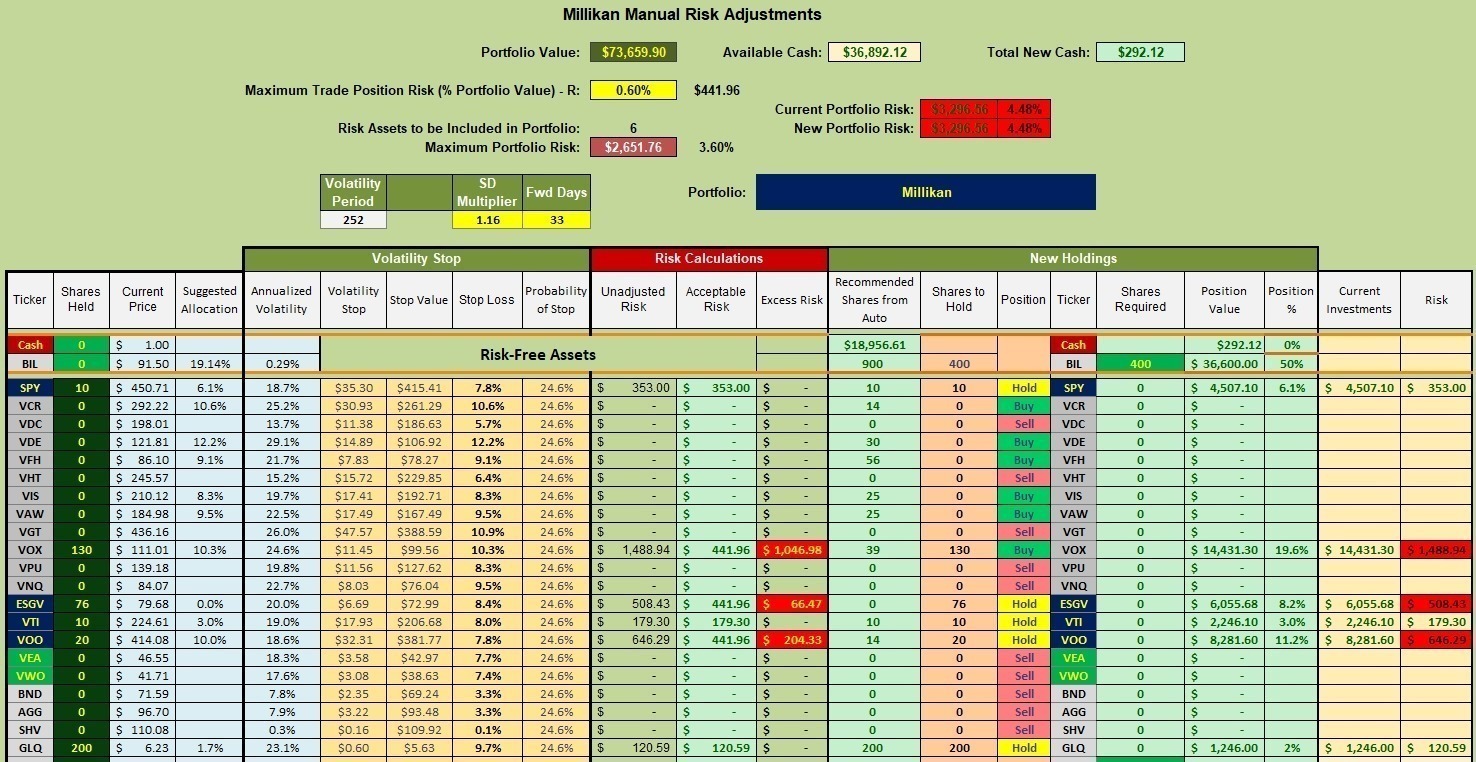

Millikan Manual Risk Adjustments

Per usual, I adjusted the SD Multiplier to 1.16 so the Stop Loss for VTI is limited to 8.0%. The Maximum Portfolio Risk is a rather low 3.6% as the available cash will be invested in BIL. Note that SPY, VTI, VOO, and ESGV are all Hold recommendations. Since the Sector BPI model is not showing any sectors as oversold, we use BIL as an “off ramp” vehicle to hold cash until either sectors or one or more of the equity ETFs show up as a Buy.

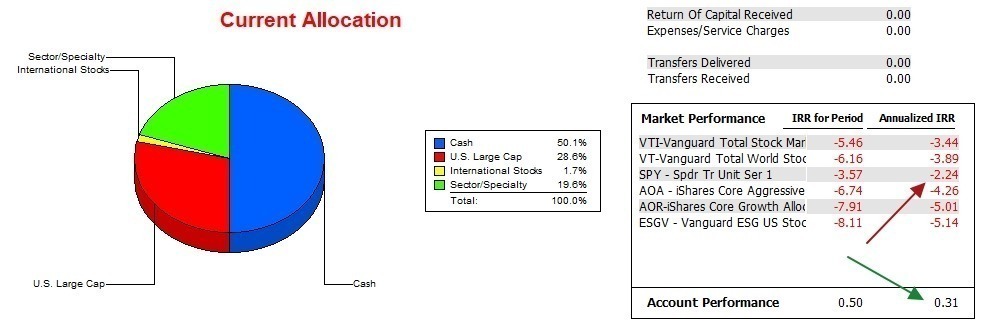

Millikan Performance Data

Since the last update the Millikan gained a fraction of a percent on the SPY benchmark. This is somewhat of a surprise considering the 50% holding in cash. The cash percentage will decline as shares of BIL are purchased. Limit orders are in place and I will be setting more orders when this blog is finished.

The following data begins on 12/31/2021 so we are working on the 19th month.

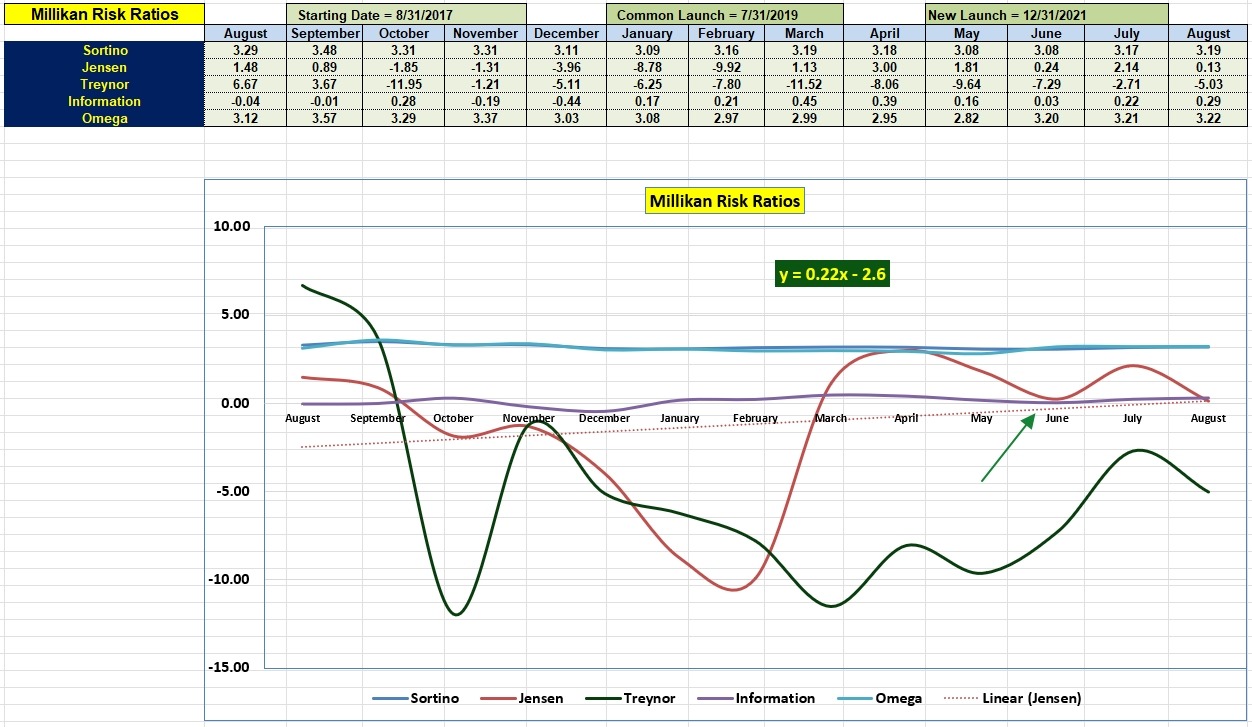

Millikan Risk Ratios

While the Jensen Performance Index is holding on to a small positive percentage, the slope (0.22) of the Jensen is still positive. The Information Ratio improved over the last few months, but is well below the high point reached last spring.

Millikan Sector BPI Update: 20 July 2023

Tweaking Sector BPI Plus Model: 20 May 2023

The ITA blog is free to all who register as a Guest. Pass this information on to friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.