Wheeler – Oregon Coast

Back in the 1970s I learned of Gerald Appel and his Moving Average Convergence Divergence (MACD) technical indicator. Appel published and sold a pamphlet explaining the MACD model and how to calculate it on a Texas Instrument calculator. This was a time just before personal computers became available so we relied on calculators for “complex” calculations. Some of you will remember the days of programmable calculators. At the time I was tracking no-load mutual funds using Exponential Moving Averages (EMAs). EMAs were easier to calculate than simple moving averages as one did not need to remove the oldest data point. Furthermore, EMAs place more emphasis on recent data vs. old data points so they are faster reacting to price changes.

Appel used various EMA combinations, but the default setting today is to use a 12-day and 26-day combination with a 9-day EMA of the MACD. Stockcharts now makes all the calculations for the end user so there is no need to manually go through all the calculations.

Stockchart Graphs: Save this link so you have an easy time finding an appropriate Stockchart graph for any ticker of interest. A little later I will go over some of the positives and negatives of using this technical indicator.

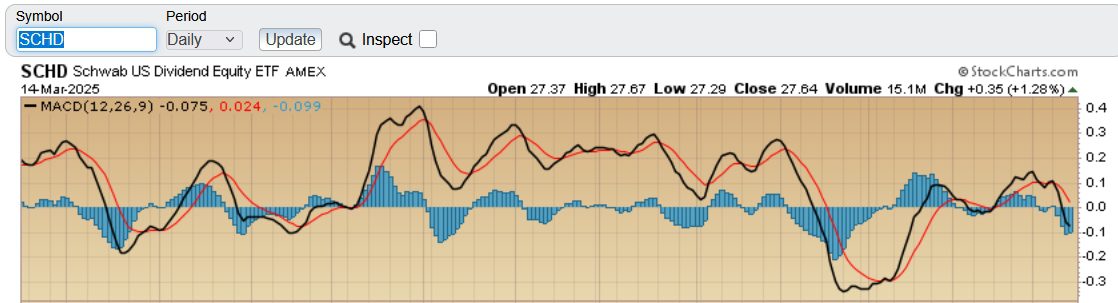

MACD: Below is the MACD plot for SCHD, one ETF used with ITA portfolios. The black or dark line is a calculation of the 26-day EMA minus the 12-day EMA. The red line is a 9-day EMA of the MACD graph. Again, Stockcharts does all the grunt work for the end user.

The argument goes like this. When the black line moves from below to above the red line we purchase shares in the security and when the black line moves from above to below the red line we sell all shares of the security. The current MACD recommendation for SCHD is to remain in cash and wait for a positive signal.

As with most technical indicators there are at least three fundamental negatives to the MACD.

- Moving in and out of the market creates taxable events. Most, if not all technical indicators, do not add sufficient returns to overcome the tax burden.

- Moving in and out of the market frequently results in what is known as a security whipsaw.

- In any give year there tend to be ten significant up days in the market. When using a technical indicator such as the MACD it is very easy to miss all or a major port of the upward move.

How might one use the MACD to our advantage? Assume one is accumulating cash in a portfolio. We have several choices as to how to use available cash.

- Invest immediately in the security most under the target percentage.

- Dollar-cost-average on a regular schedule which is not significantly different from #1.

- Use the MACD as a trigger as to when to move back into the market. This move or decision is a “first cousin” to the “Buy-Hold-Sell” recommendations one finds within the Kipling spreadsheet.

For example, both the MACD shown below and the BHS recommendation within the Kipling spreadsheet are telling us to wait before adding more shares of SCHD to any portfolios. This also happens to be the recommendation for most U.S. Equity securities.

In this first MACD graph of SCHD we see where the black line is below the red line. Therefore we remain on the sidelines when it comes to investing in more shares of SCHD.

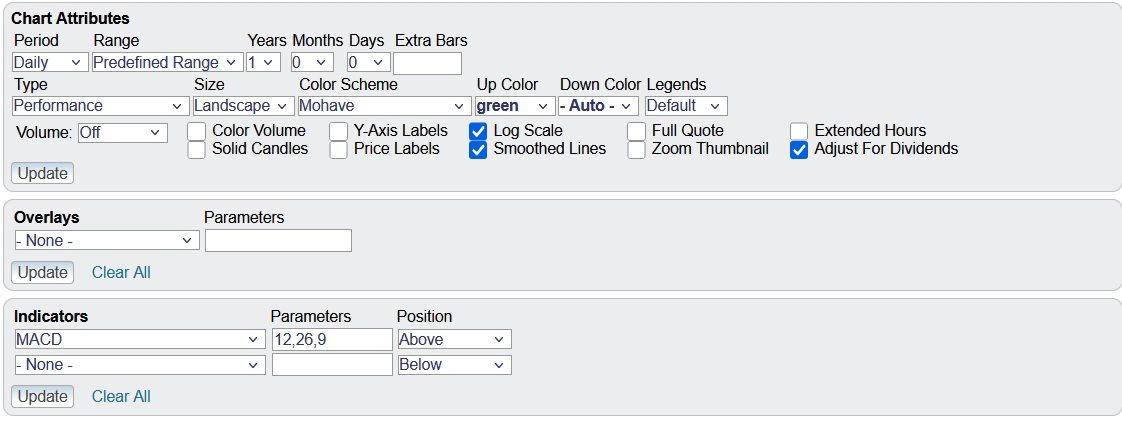

Graphs Settings: I was not able to capture both the graph and settings in one screenshot so I am breaking them into two parts. If you wish a little more clarity in the relationship between the black and red lines, change the date from one year to three months or less to as to expand the Stockcharts graph.

Note the default parameters are 12, 26, and 9 as explained above. One can find details on the Internet as to how to make the calculations. I let Stockcharts do the heavy lifting of these calculations.

If you have been following recent blog posts you are aware that I am repositioning many ETFs in order to further simplify the asset allocations of ITA portfolios.

Market projections are frequent incorrect so I pay little attention to them. I have similar reservations regarding technical indicators, although I find them fascinating. I hear projections that 2025 will be a volatile year, but 2026 and 2027 will be see a strong bull market. It is unlikely we will hear a review of these projections at the end of 2027.

Recommendation: Save as much as you can as early as you can and dollar-cost-average into a few broad based ETFs such as VOO. Trying to finesse the market will most likely end up as a major disappointment.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I updated the Stockcharts graph to better reflect the screenshots found in the blog post.

Lowell

Hi Lowell,

Thanks for MACH info. I use Stock charts daily but hadn’t pay much attention to the MACH. However, since I don’t have a subscription, it is loaded with annoying Ads. Are you aware of a way to get rid of ads without a subscription?

Bob

Bob,

No, I don’t know a workaround ads. I mainly use Stockcharts for the BPI data. MACD is a possible source for entering back into the market if one happens to be out of the market or if there is a new infusion of cash to be invested.

Lowell

Bob/Lowell,

I you are Schwab or Fidelity clients, you can choose MACD as a Study on Schwab (or Thinkorswim) charts or an “Indicator” on Fidelity charts. They also have good descriptions of the tecnical indicator. As an aside, it is often used together with RSI (Relative Strength Index).

~jim

Jim,

I am a Schwab client. If you click on the chart link I referenced in the above blog you will see the RSI graph at the bottom of the Stockchart.

I’ll check out the Thinkorswim graphs on Schwab. Thanks for the tip.

Lowell

Jim,

Thanks. I do use the Fidelity charts and will add the MACD.

Bob