St Johns Bridge

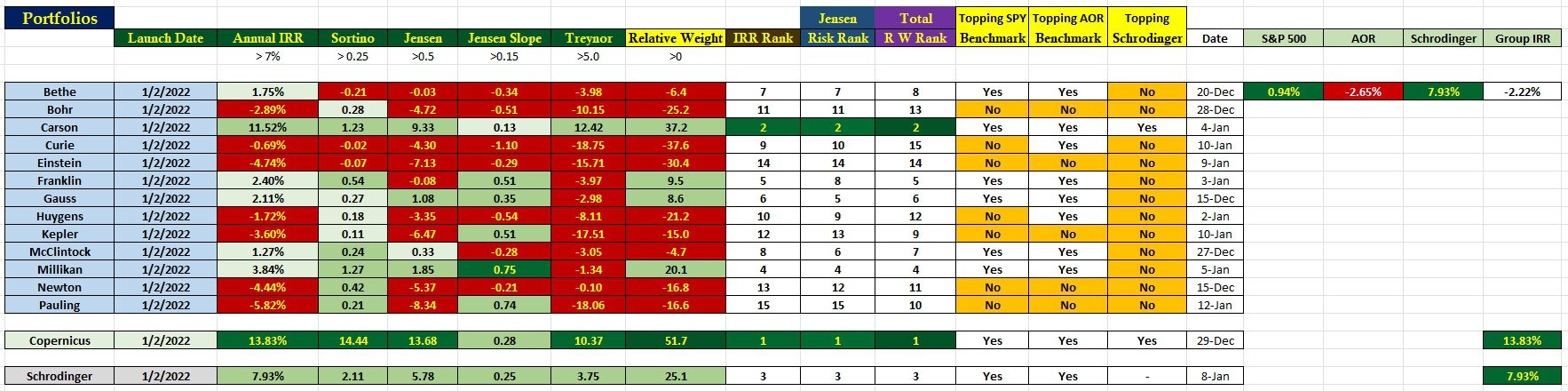

Below is 24.5 months of date for the ITA portfolios I track. This list does not include the portfolios managed and reported on by Hedgehunter. The Annual IRR column of data is accurate as of 1/12/2024 while the remainder of the data is current as of the Date column. I have a few more portfolios to bring out of the December 2023 period. That will happen before the end of January.

Relative Portfolio Performance

As a group the Sector BPI portfolios have an annualized IRR of -2.22%. While this is the IRR data for over two years, keep in mind that most of the Sector BPI portfolios have been using this investment model for only a few months.

The top portfolio is the Copernicus or the second easiest to manage. All one does with the Copernicus is save and invest in U.S. Equities such as VTI, VOO, SPY and/or ESGV. Schrodinger also ranks high and it is the easiest to manage as Schwab computers do all the work. With the Schrodinger, all one needs to do is save.

Only two portfolios outperform the Schrodinger while eight of the 15 do better than the SPY benchmark which is essentially the S&P 500. Ten of the 15 are outperforming the AOR benchmark.

The only drawbacks to the Copernicus and Schrodinger is that they provide no downside protection whereas all the Sector BPI are built to provide this protection in severe bear markets. All these portfolios are very well diversified. In addition, I highly recommend investors also use different portfolio investing models for further diversification.

If there are questions related to any of the other columns of information, post your comment or question in the space provided below.

I post this data approximately every two months.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.