Piper, “Piping” – Edinburgh, Scotland

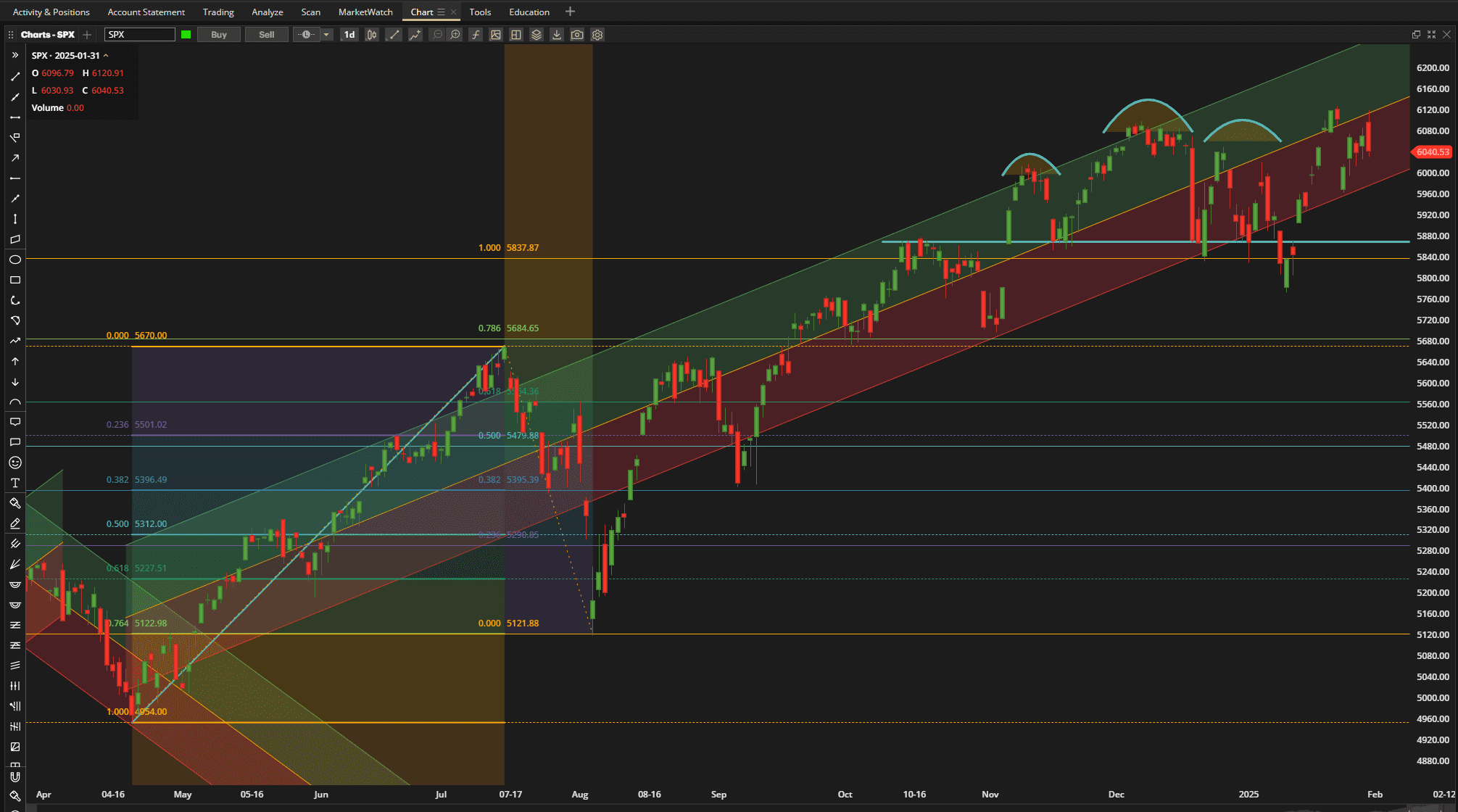

DeepSeek attempted to take US Equities (specifically tech stocks) to the Deep Six on Monday – but markets recovered mid week only to show weakness again on Friday:

Overall, the SPX (S&P 500 Index) was down ~1% over last Friday’s close. However, we remain in a sideways consolidation zone well within the dominant uptrend channel that started last April.

Overall, the SPX (S&P 500 Index) was down ~1% over last Friday’s close. However, we remain in a sideways consolidation zone well within the dominant uptrend channel that started last April.

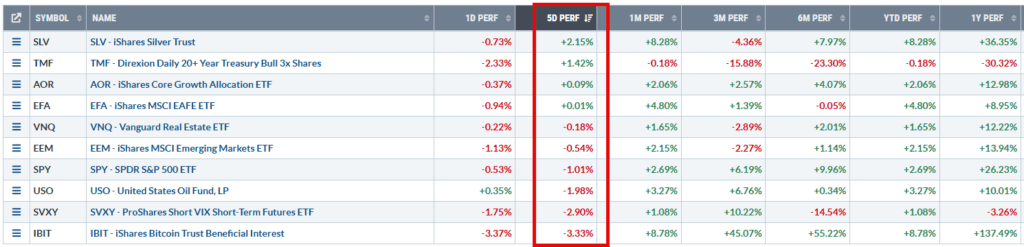

In terms of performance relative to other major asset classes:

US Equities came out in the middle of the pack with Silver (SLV) leading the way and Crypto (IBIT) being the biggest loser. Volatility increased significantly throughout the week (hence the negative performance of the inverse volatility fund SLVY).

US Equities came out in the middle of the pack with Silver (SLV) leading the way and Crypto (IBIT) being the biggest loser. Volatility increased significantly throughout the week (hence the negative performance of the inverse volatility fund SLVY).

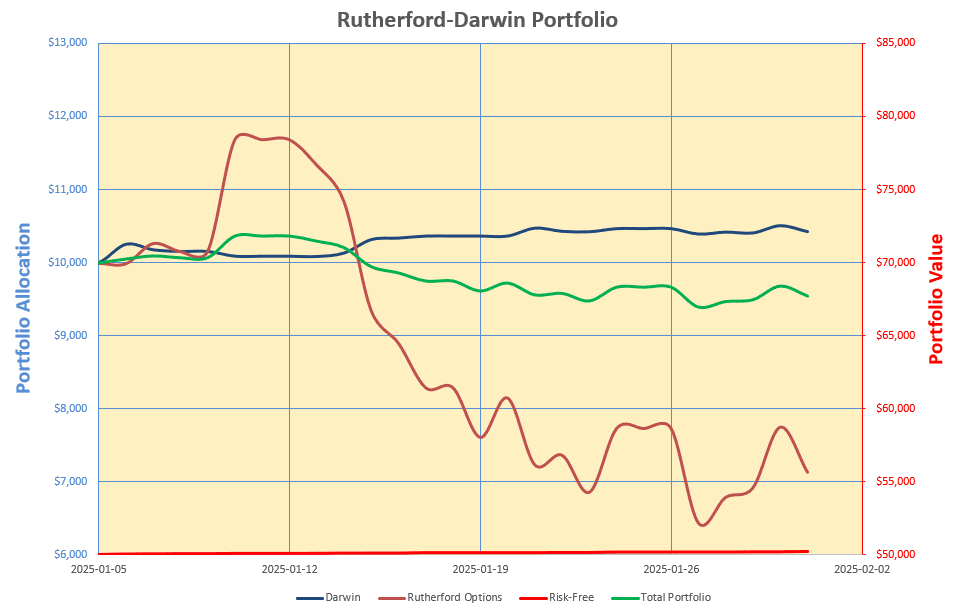

So, we’ll take a look at the impact of all this action on the performance of the Rutherford-Darwin Portfolio.

Obviously, the $50,000 “risk-free” investment in BIL (Treasury Bills) wasn’t impacted and has generated $179 “income” over the first month since inception. Dividends will be paid next week that will be offset by a drop in price of BIL.

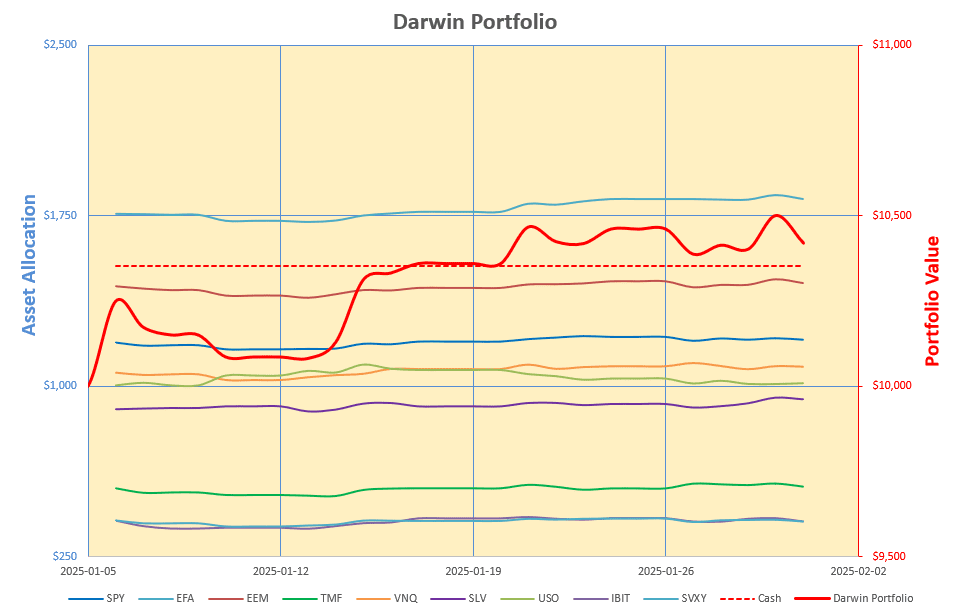

The $10,000 “Buy-And-Hold” portion of the portfolio looks like this:

with only modest movement and a small loss (<0.4%) on the week, although (annualized) volatility has increased to 10.5% (although this number is not too reliable after only one month of operation).

with only modest movement and a small loss (<0.4%) on the week, although (annualized) volatility has increased to 10.5% (although this number is not too reliable after only one month of operation).

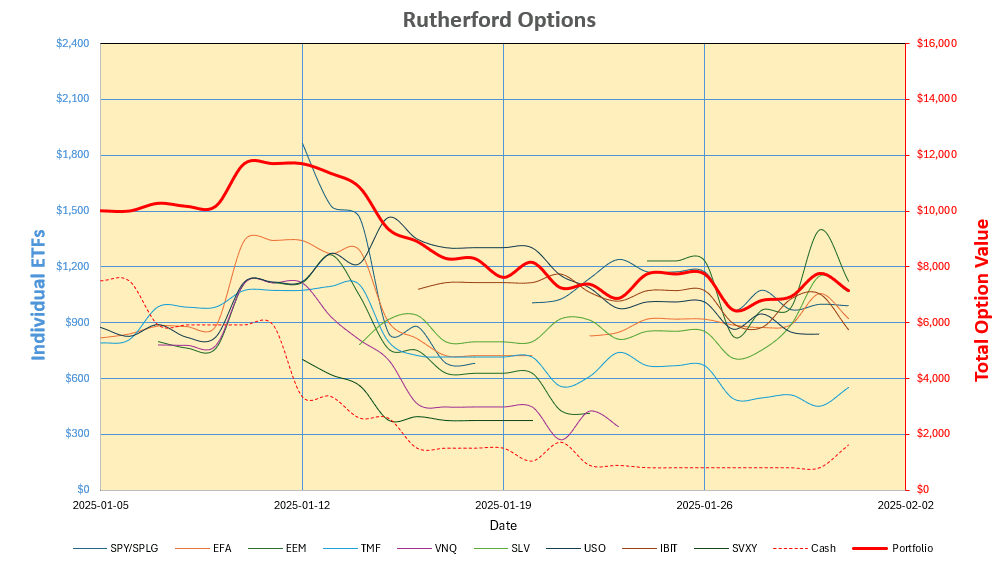

The Options portion of the portfolio had a predictable rougher ride:

although still managing to hold losses to 7.7% (0.85% total portfolio value) despite the ~10:1 leverage. (Annualized) Volatility in this portion of the portfolio is now at a scary ~122% (although, again, not a particularly reliable number after only 1 month of data).

although still managing to hold losses to 7.7% (0.85% total portfolio value) despite the ~10:1 leverage. (Annualized) Volatility in this portion of the portfolio is now at a scary ~122% (although, again, not a particularly reliable number after only 1 month of data).

Putting it all together the total picture looks like this:

with the total portfolio showing a respectable 14.6% volatility – although with negative returns to date.

with the total portfolio showing a respectable 14.6% volatility – although with negative returns to date.

As we have seen (and would expect) the Option portion of the portfolio has the highest volatility (and potential risk/reward) and I shall be refining my “rules” for managing this portion of the portfolio going forward now that I have established that this can be managed within the $10,000 allocation limits. I started out by allocating (nearly) all available funds to ensure this could be done within the funding limits. Now I need to be more selective in choosing the assets that I feel may move more than others and will “trend” rather than “consolidate” for significant lengths of time (> 1 month). My initial purchases were made with ~45 days to expiration and these are now down to ~21 days. At this point (i.e. after ~1 month) I would like to either:

a) Roll the Options out another month in time if I am still Bullish (with Calls) or Bearish (with Puts) on the underlying. If possible I will also move the strikes up/down appropriately to take money off the table and/or reduce risk; or

b) Close the position if I am “neutral” on the direction of the future movements.

On Friday, I closed my bullish position in USO (Oil) – i.e. sold my Call Options – as I am now “neutral” on Oil. This started out as the best performer for a couple of weeks (generating the peak in the brown line in above screenshot) but has pulled back significantly since Trump’s inauguration and is now back to where we started. Longer term, I am still bullish but will look for confirmation of a bounce from here before re-entering.

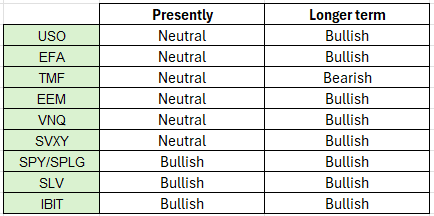

Here are my current “opinions” on potential behavior now and going forward:

I am focussing primarily on Weekly charts for my decisions but may choose daily charts to “time” entries. My longer term views are based on Monthly charts (and may be a little slow to react to changes in the investment environment).

I am focussing primarily on Weekly charts for my decisions but may choose daily charts to “time” entries. My longer term views are based on Monthly charts (and may be a little slow to react to changes in the investment environment).

At the moment I am reasonably comfortable with positions in SPY/SPLG, SLV and IBIT (despite a disappointing start) that are consistent over all time frames. EFA, EEM, USO and VNQ are all close to moving towards my longer term views with positive indicators in 2 time frames (but not the third). TMF is “iffy” and SVXY I will probably only go long (Buy Calls) as/if volatility settles down – it is difficult for an “investor” – i.e. someone checking charts/data less frequently than weekly – to catch “volatility spikes” and take advantage.

BTW – I am presently looking at AI (DeepSeek 🙂 ) to see if I can find a way to use it to make decisions. I am a long way from getting to that point – but it’s potentially an interesting tool to use in some way – not necessarily directly – to help make investment decisions.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question